Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need all the answers with explanation or the calculations MINI CASE Shrewsbury Herbal Products, Ltd. Shrewsbury Herbal Products, located in Central England close to

i need all the answers with explanation or the calculations

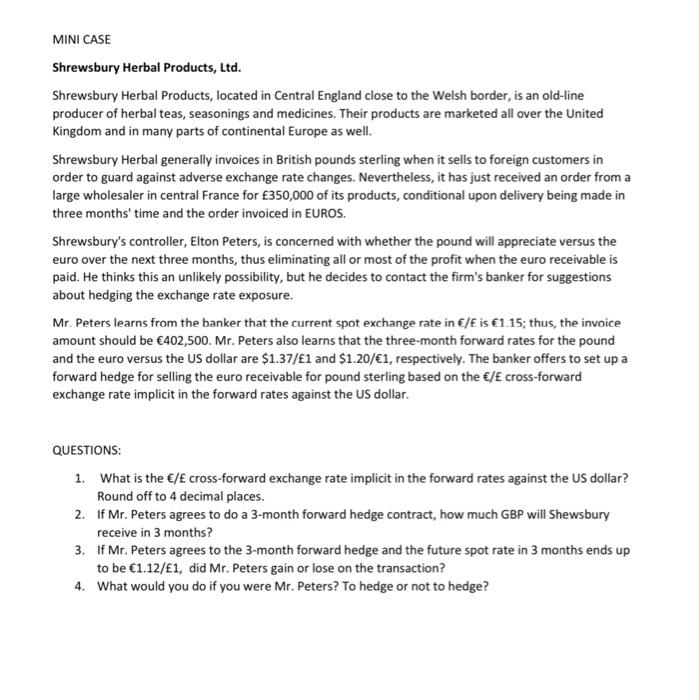

MINI CASE Shrewsbury Herbal Products, Ltd. Shrewsbury Herbal Products, located in Central England close to the Welsh border, is an old-line producer of herbal teas, seasonings and medicines. Their products are marketed all over the United Kingdom and in many parts of continental Europe as well. Shrewsbury Herbal generally invoices in British pounds sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for 350,000 of its products, conditional upon delivery being made in three months' time and the order invoiced in EUROS. Shrewsbury's controller, Elton Peters, is concerned with whether the pound will appreciate versus the euro over the next three months, thus eliminating all or most of the profit when the euro receivable is paid. He thinks this an unlikely possibility, but he decides to contact the firm's banker for suggestions about hedging the exchange rate exposure. Mr. Peters learns from the banker that the current spot exchange rate in / is 1.15; thus, the invoice amount should be 402,500. Mr. Peters also learns that the three-month forward rates for the pound and the euro versus the US dollar are $1.37/1 and $1.20/1, respectively. The banker offers to set up a forward hedge for selling the euro receivable for pound sterling based on the / cross-forward exchange rate implicit in the forward rates against the US dollar. QUESTIONS: 1. What is the / cross-forward exchange rate implicit in the forward rates against the US dollar? Round off to 4 decimal places. 2. If Mr. Peters agrees to do a 3-month forward hedge contract, how much GBP will Shewsbury receive in 3 months? 3. If Mr. Peters agrees to the 3-month forward hedge and the future spot rate in 3 months ends up to be 1.12/1, did Mr. Peters gain or lose on the transaction? 4. What would you do if you were Mr. Peters? To hedge or not to hedge Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started