Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need all these questions answered. Please answer all parts Required Information [The following Information applles to the questions displayed below.] Laker Company reported the

I need all these questions answered.

Please answer all parts

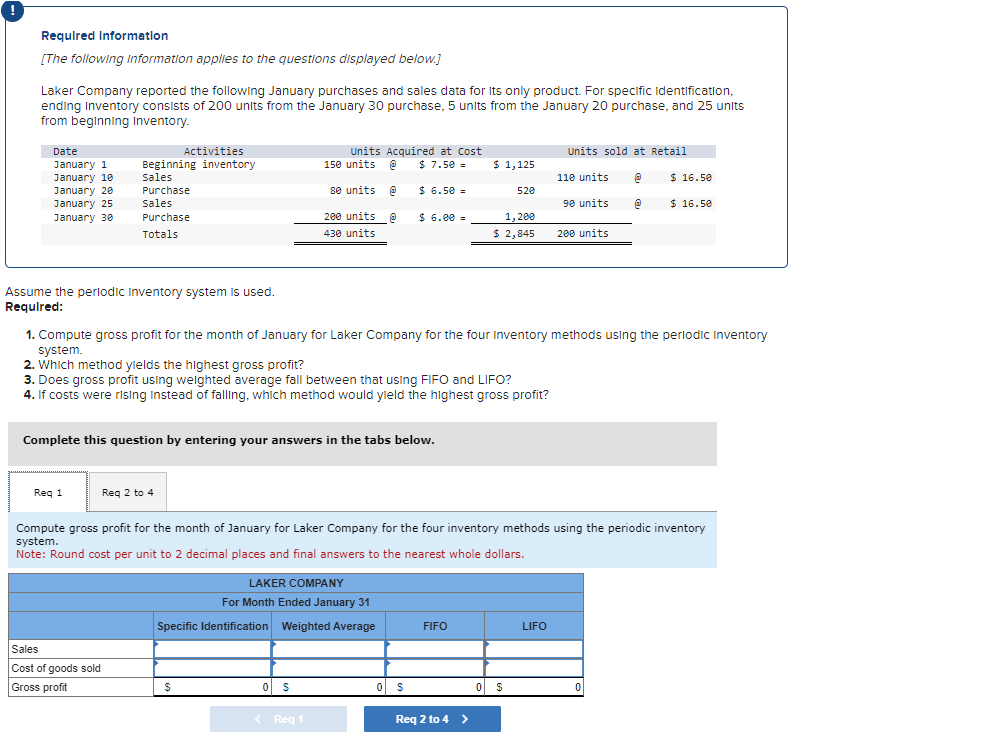

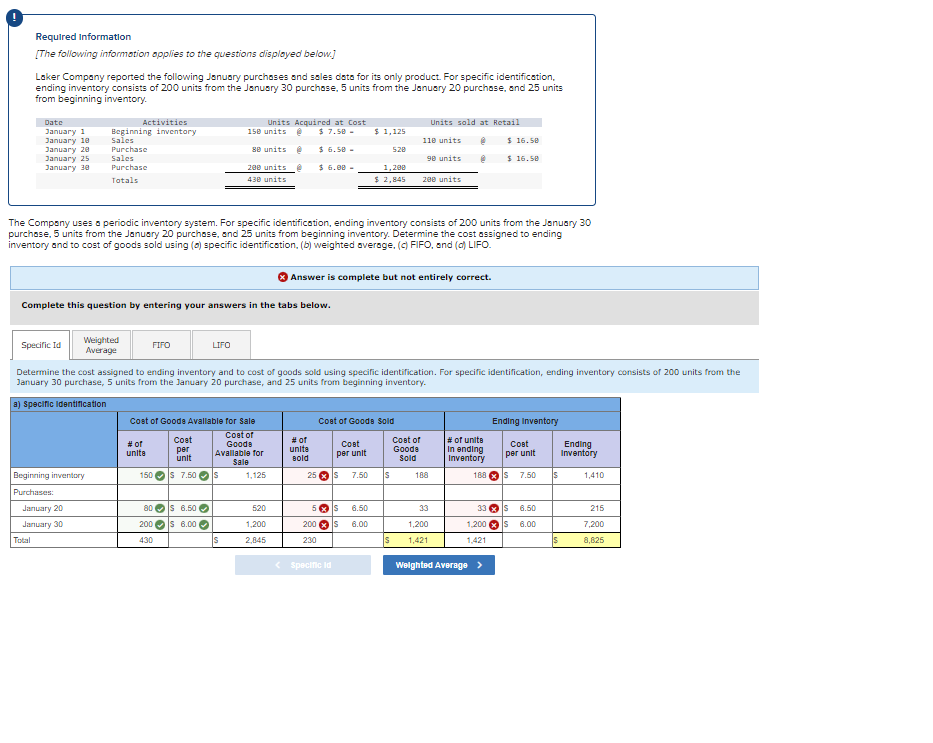

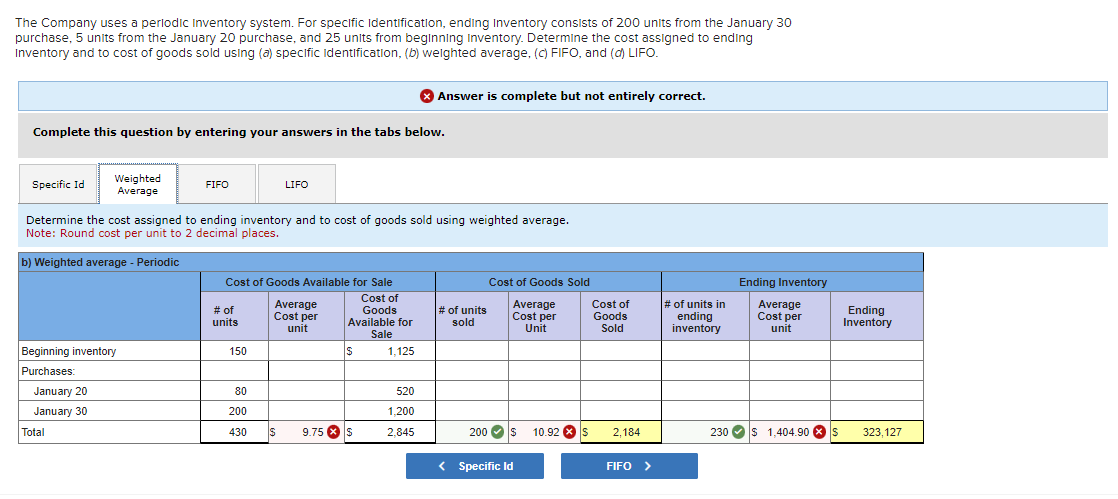

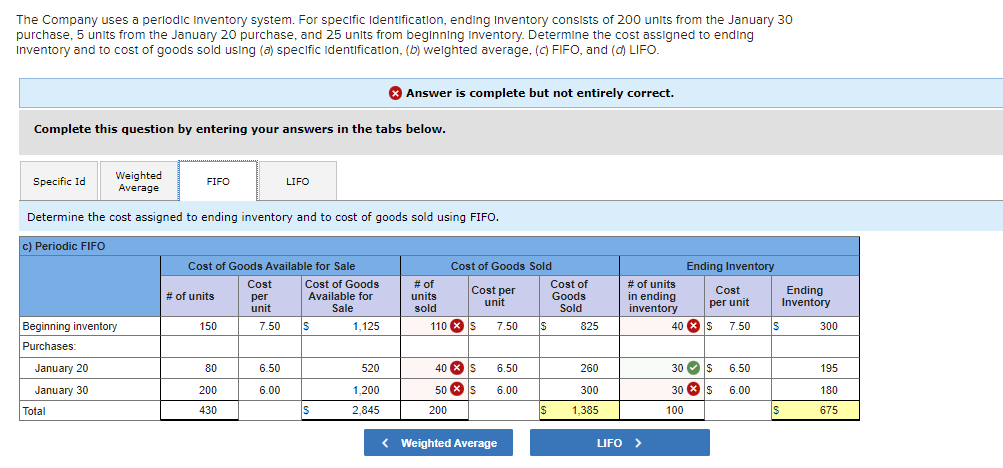

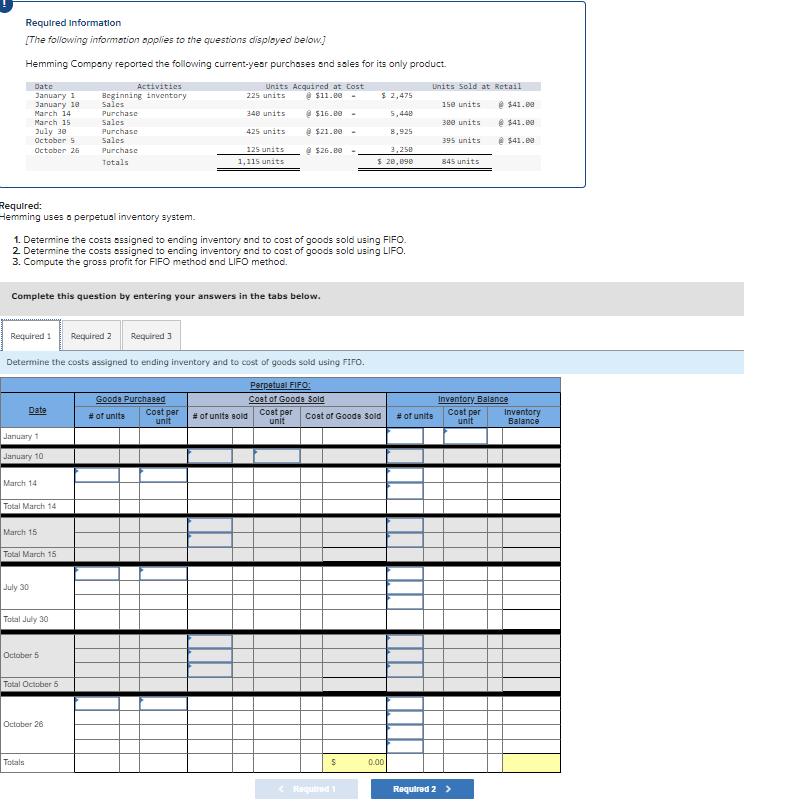

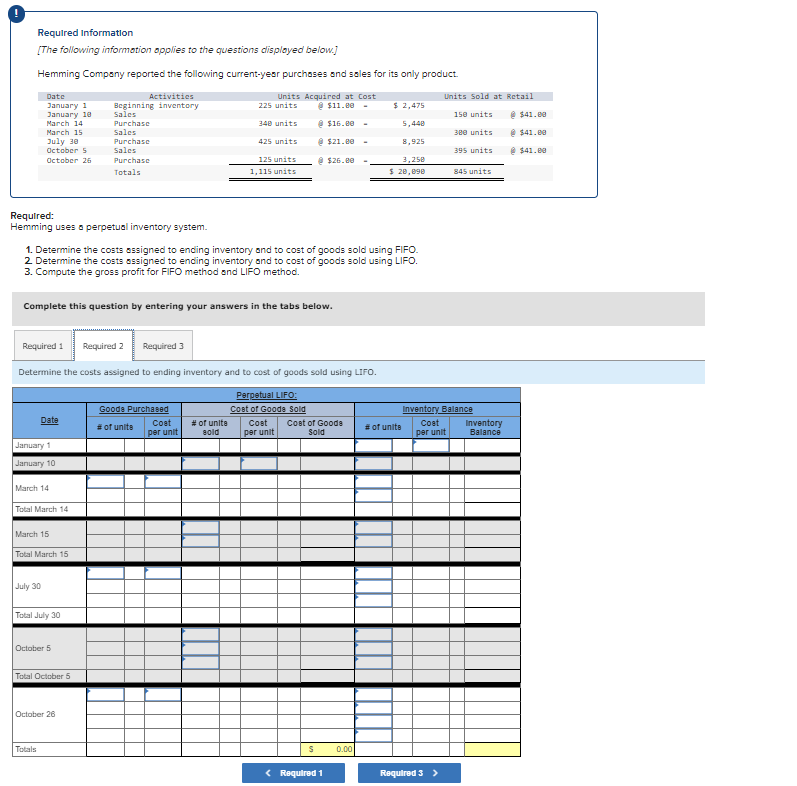

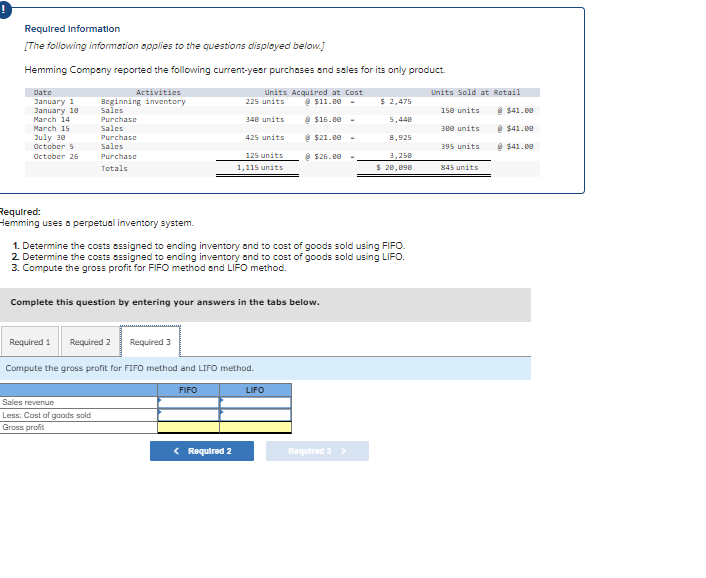

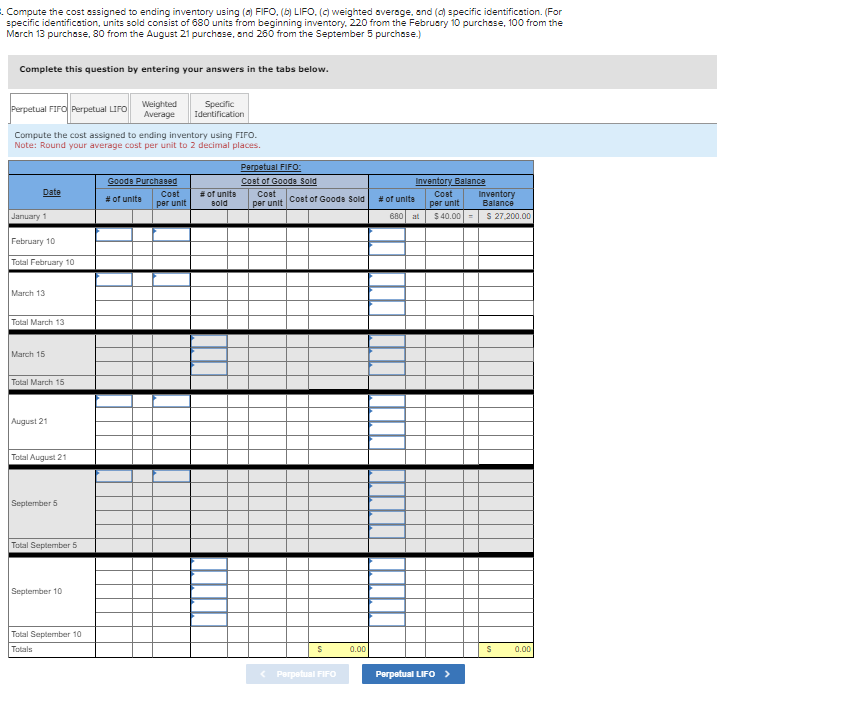

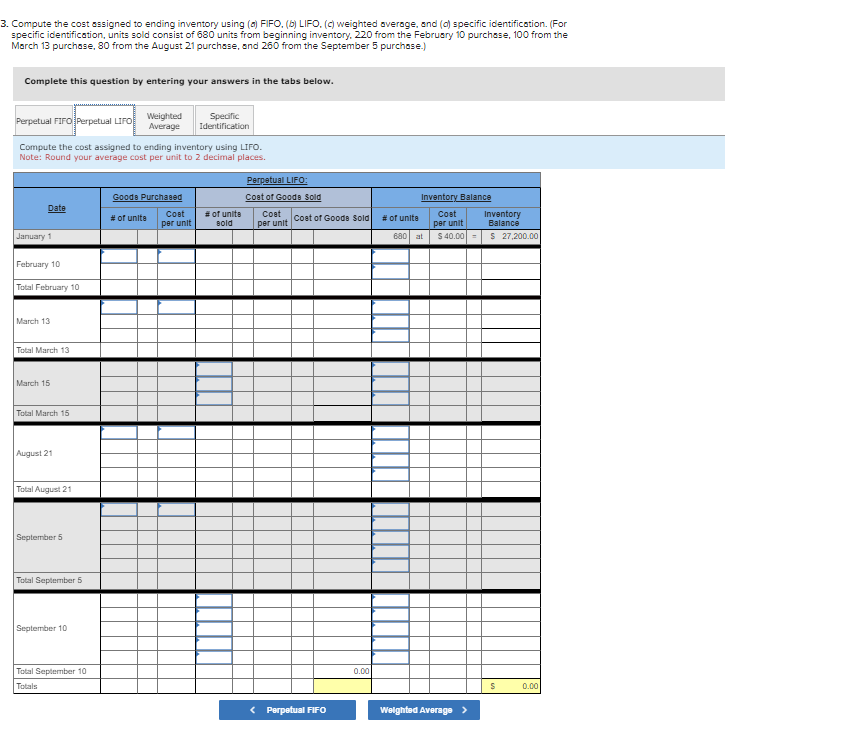

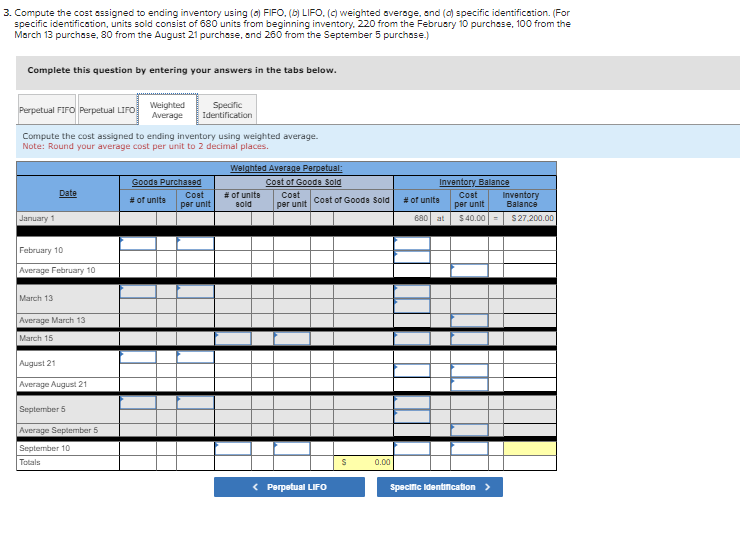

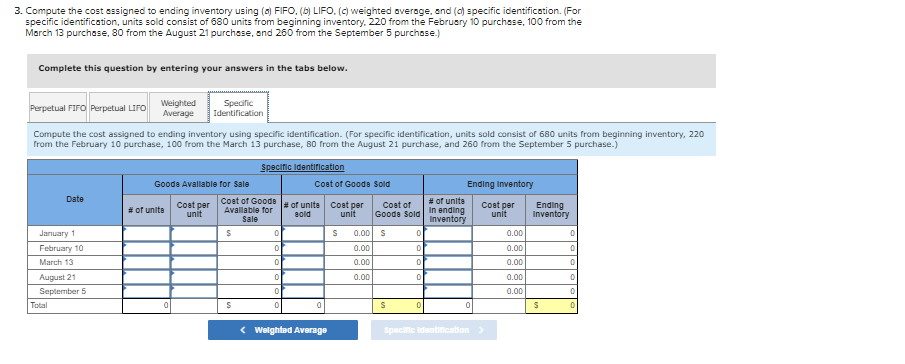

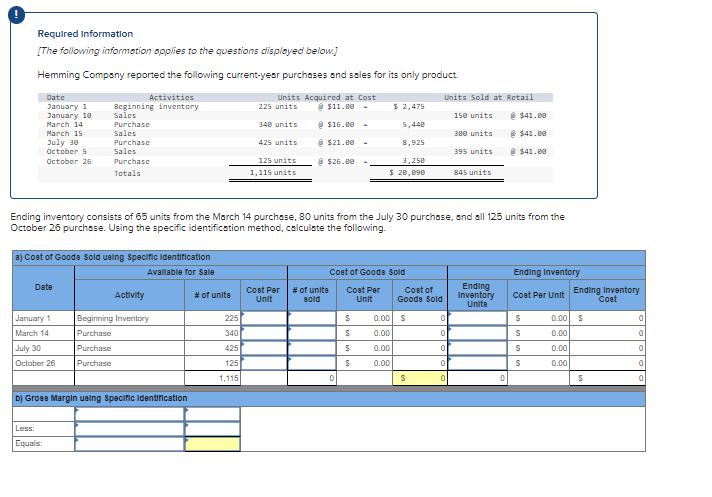

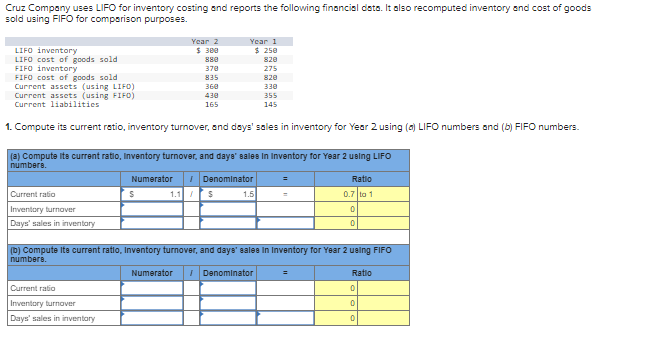

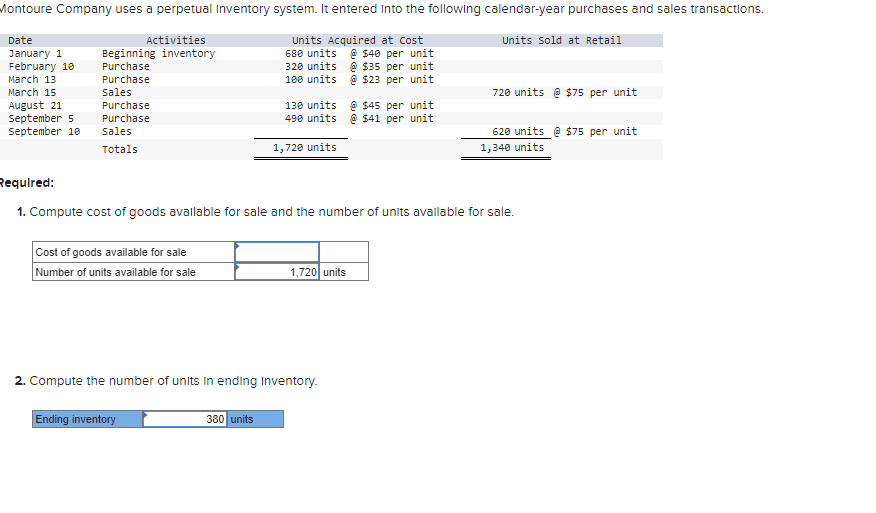

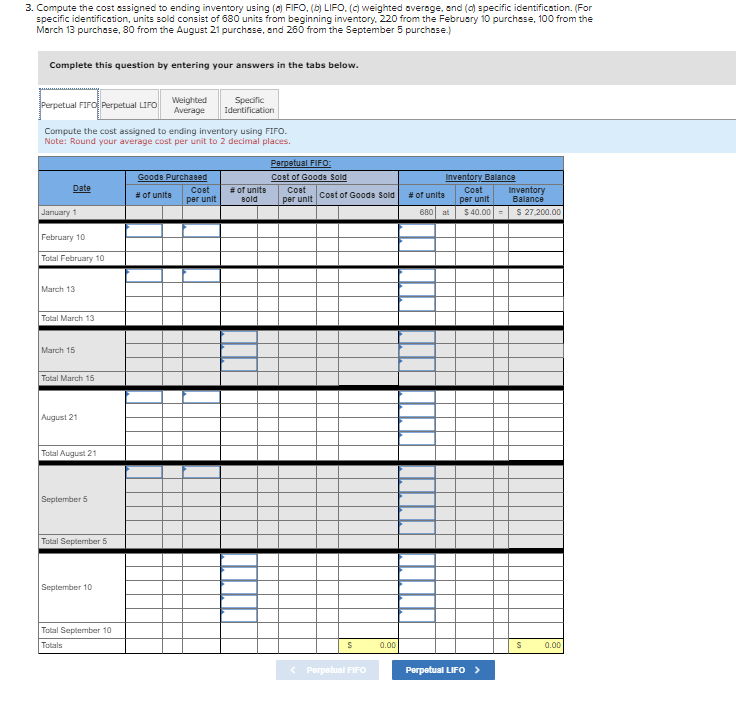

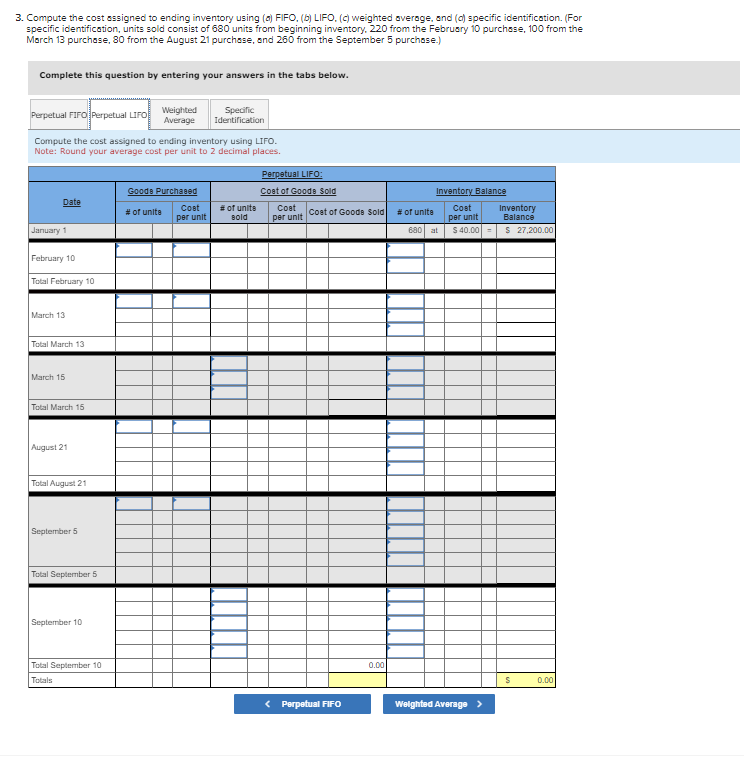

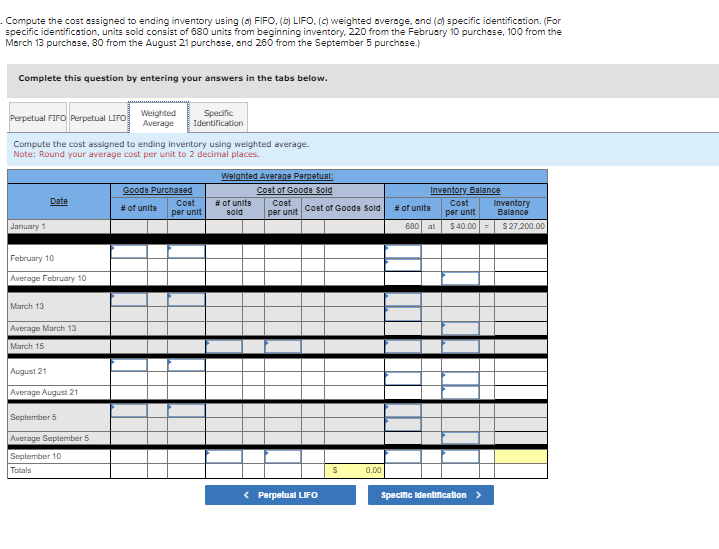

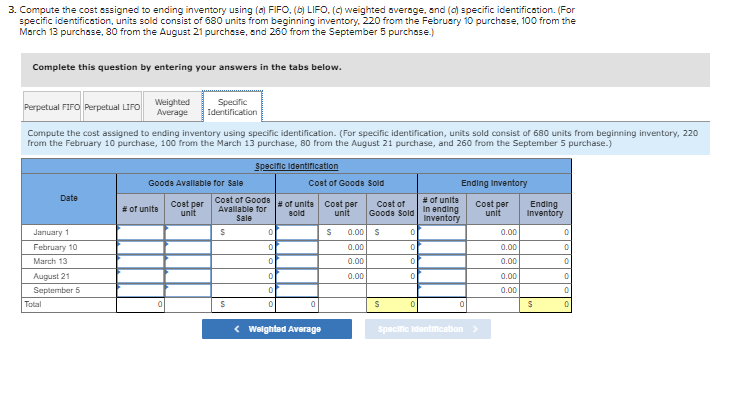

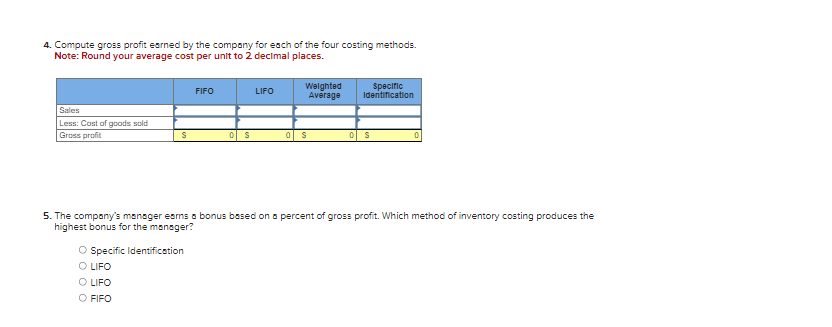

Required Information [The following Information applles to the questions displayed below.] Laker Company reported the following January purchases and sales data for Its only product. For specific Identlfication, ending Inventory consists of 200 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning Inventory. Assume the perlodic Inventory system is used. Requlred: 1. Compute gross profit for the month of January for Laker Company for the four Inventory methods using the perlodic Inventor system. 2. Which method ylelds the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yleld the highest gross profit? Complete this question by entering your answers in the tabs below. Compute gross profit for the month of January for Laker Company for the four inventory methods using the periodic inventory system. Note: Round cost per unit to 2 decimal places and final answers to the nearest whole dollars. Required information [The following informotion opplies to the questions disployed below.] Laker Company reported the following January purchoses and sales dato for its only product. For specific identification. ending inventory consists of 200 units from the Janusry 30 purchose, 5 units from the Janusry 20 purchose, and 25 units from beginning inventory. The Compony uses o periodic inventory system. For specific identificotion, ending inventory consists of 200 units from the January 30 ourchose, 5 units from the Janusry 20 purchose, and 25 units from beginning inventory. Determine the cost assigned to ending nventory and to cost of goods sold using (b) specific identification, (b) weighted overoge, (c) FIFO, and (c) LIFO. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. The Company uses a perlodic Inventory system. For specific Identification, ending Inventory consists of 200 units from the January 30 purchase, 5 unlts from the January 20 purchase, and 25 units from beginning Inventory. Determine the cost assigned to ending Inventory and to cost of goods sold using (a) specific Identification, (b) weighted average, (c) FIFO, and (d) LIFO. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. Note: Round cost per unit to 2 decimal places. The Company uses a perlodic Inventory system. For specific Identification, ending Inventory consists of 200 units from the January 30 burchase, 5 units from the January 20 purchase, and 25 units from beginning Inventory. Determine the cost assigned to ending nventory and to cost of goods sold using (a) specific Identlfication, (b) weighted average, (c) FIFO, and (d) LIFO. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Required Information [The following informotion opplies to the questions clisployed below.] Hemming Compony reported the following current-yesr purchoses and seles for its only product. Required: Hemming uses o perpetual inventory system. 1. Determine the costs assigned to encing inventory and to cost of goods sold using FIFO. 2 Determine the costs ossigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Determine the costs assigned to ending inventory and to cost of goods sold using Fifo. Required Information [The following informotion opplies to the questions disployed below.] Hemming Compeny reported the following current-yesr purchoses and sales for its only product. Required: Hemming uses a perpetual inventory system. 1. Determine the costs sssigned to ending inventory and to cost of goods sold using FIFO. 2 Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Determine the costs assigned to ending inventory and to cost of goods sold using LIFo. Required Information [The following informotion opplies to the questions clisployed below.] Hemming Compony reported the following current-yesr purchoses and sales for its only product. Required: Hemming uses o perpetual inventory system. 1. Determine the costs sssigned to ending inventory and to cost of goods sold using FIFO. 2 Determine the costs ossigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Compute the gross profit for FIFO method and LIFO method. Compute the cost sssigned to ending inventory using (o) FIFO, (b) LIFO, (c) weighted overoge, snd (c) specific identificotion. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the February 10 purchsse, 100 from the Morch 13 purchsse, 80 from the August 21 purchsse, and 260 from the September 5 purchose.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using FIFO. Note: Round your average cost per unit to 2 decimal places. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted overoge, and (c) specific identificotion. (For specific identificstion, units sold consist of 680 units from beginning inventory, 220 from the Februsry 10 purchsse, 100 from the March 13 purchsse, 80 from the August 21 purchsse, and 260 from the September 5 purchose.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using LIFO. Note: Round your average cost per unit to 2 decimal places. Compute the cost sssigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted overoge, snd (c) specific identificotion. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the Februsry 10 purch s se, 100 from the March 13 purchase, 80 from the August 21 purchase, and 260 from the September 5 purchase.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using weighted average. Note: Round your average cost per unit to 2 decimal places. Compute the cost assigned to ending inventory using (o) FIFO, (b) LIFO, (c) weighted overoge, and (c) specific identification. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the February 10 purchsse, 100 from the Morch 13 purchase, 80 from the August 21 purchsse, and 260 from the September 5 purchose.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using specific identification. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the February 10 purchase, 100 from the March 13 purchase, 80 from the August 21 purchase, and 260 from the September 5 purchase.) Required Information [The following informotion opplies to the questions clisployed below.] Hemming Compony reported the following current-yesr purchoses and sales for its only product. nding inventory consists of 65 units from the March 14 purchsse, 80 units from the July 30 purchase, snd all 125 units from the ctober 26 purchsse. Using the specific identification method, calculste the following. Cruz Company uses LIFO for inventory costing and reports the following financisl doto. It also recomputed inventory and cost of goods sold using FIFO for comperison purposes. 1. Compute its current ratio, inventory turnover, and dsys' soles in inventory for Year 2 using (a) LIFO numbers ond (b) FIFO numbers. 1. Compute cost of goods avallable for sale and the number of units avallable for sale. 2. Compute the number of units in ending Inventory. Compute the cost sssigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted overoge, snd (c) specific identification. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the Februsry 10 purchsse, 100 from the March 13 purchsse, 80 from the August 21 purchsse, and 260 from the September 5 purchuse.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using FIFO. Compute the cost sssigned to ending inventory using (o) FIFO, (b) LIFO, (c) weighted overoge, and (c) specific identificotion. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the February 10 purchsse, 100 from the Morch 13 purchsse, 80 from the August 21 purchsse, and 260 from the September 5 purchose.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using LIFO. Compute the cost sssigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted overoge, snd (c) specific identification. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the February 10 purchsse, 100 from the March 13 purchase, 80 from the August 21 purchsse, and 260 from the September 5 purchsse.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using weighted average. Note: Round your average cost per unit to 2 decimal places. Compute the cost sssigned to ending inventory using (o) FIFO, (b) LIFO, (c) weighted overoge, and (c) specific identificotion. (For specific identification, units sold consist of 680 units from beginning inventory, 220 from the February 10 purchsse, 100 from the Morch 13 purchsse, 80 from the August 21 purchsse, and 260 from the September 5 purchose.) Complete this question by entering your answers in the tabs below. Compute the cost assigned to ending inventory using specific identification. (For specific identification, units sold consist of 680 units from from the February 10 purchase, 100 from the March 13 purchase, 80 from the August 21 purchase, and 260 from the September 5 purch 4. Compute gross profit earned by the compony for esch of the four costing methods. Note: Round your average cost per unit to 2 decimal places. 5. The compony's mensger esrns o bonus bosed on o percent of gross profit. Which method of inventory costing produces the highest bonus for the manoger? Specific Identificotion LIFO LIFO FIFOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started