Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need answer 14,15,16,17 i need answer all please 14. At January 1, 2020, Who is this Company had a credit balance of P420,000 in

i need answer 14,15,16,17 i need answer all please

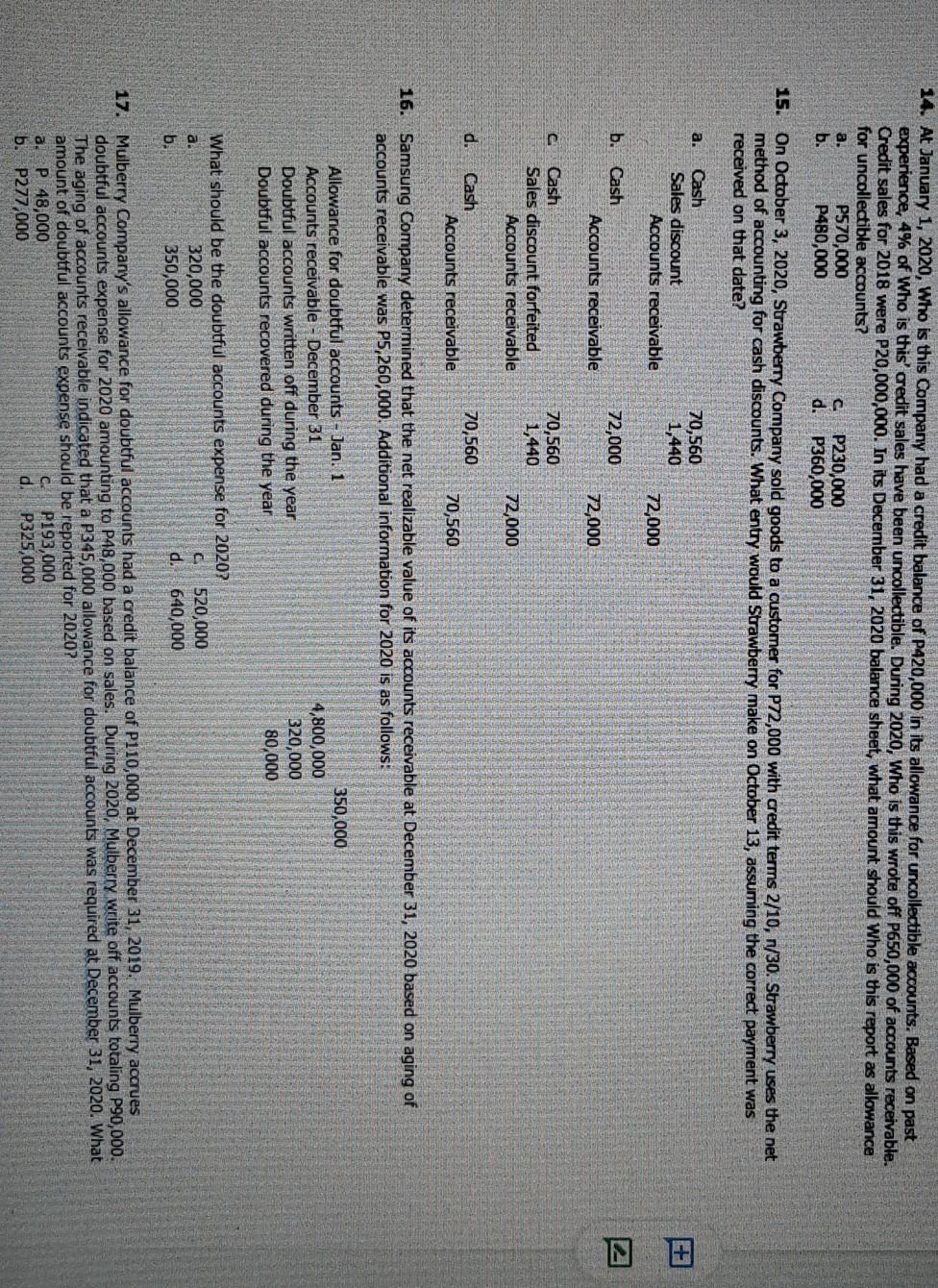

14. At January 1, 2020, Who is this Company had a credit balance of P420,000 in its allowance for uncollectible accounts. Based on past experience, 4% of Who is this' credit sales have been uncollectible. During 2020, Who is this wrote off P650,000 of accounts receivable. Credit sales for 2018 were P20,000,000. In its December 31, 2020 balance sheet, what amount should who is this report as allowance for uncollectible accounts? a. P570,000 P230,000 b. P480,000 d. P360,000 15. On October 3, 2020, Strawberry Company sold goods to a customer for P72,000 with credit terms 2/10, n/30. Strawberry uses the net method of accounting for cash discounts. What entry would Strawberry make on October 13, assuming the correct payment was received on that date? a. Cash Sales discount Accounts receivable 70,560 1,440 72,000 Cash 72,000 Accounts receivable 72,000 Cash Sales discount forfeited Accounts receivable 70,560 1,440 72,000 d. 70,560 Cash Accounts receivable 70,560 16. Samsung Company determined that the net realizable value of its accounts receivable at December 31, 2020 based on aging of accounts receivable was P5,260,000. Additional information for 2020 is as follows: Allowance for doubtful accounts - Jan. 1 Accounts receivable - December 31 Doubtful accounts written off during the year Doubtful accounts recovered during the year 350,000 4,800,000 320,000 80,000 What should be the doubtful accounts expense for 2020? a. 320,000 520,000 b. 350,000 d. 640,000 17. Mulberry Company's allowance for doubtful accounts had a credit balance of P110,000 at December 31, 2019. Mulberry accrues doubtful accounts expense for 2020 amounting to P48,000 based on sales. During 2020, Mulberry write off accounts totaling P90,000. The aging of accounts receivable indicated that a P345,000 allowance for doubtful accounts was required at December 31, 2020. What amount of doubtful accounts expense should be reported for 2020? a. P. 48,000 c. P193,000 b. P277,000 d. P325,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started