I need Answer As soon as possible Please. Thank you

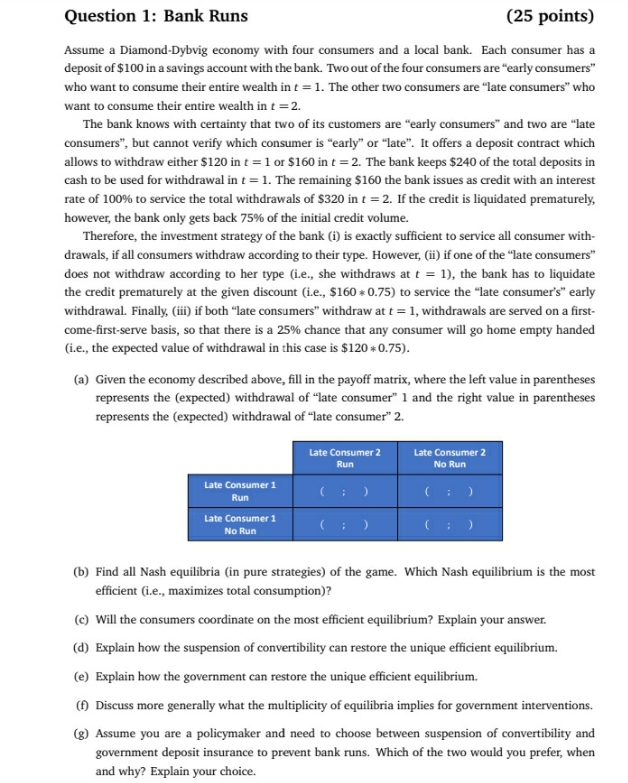

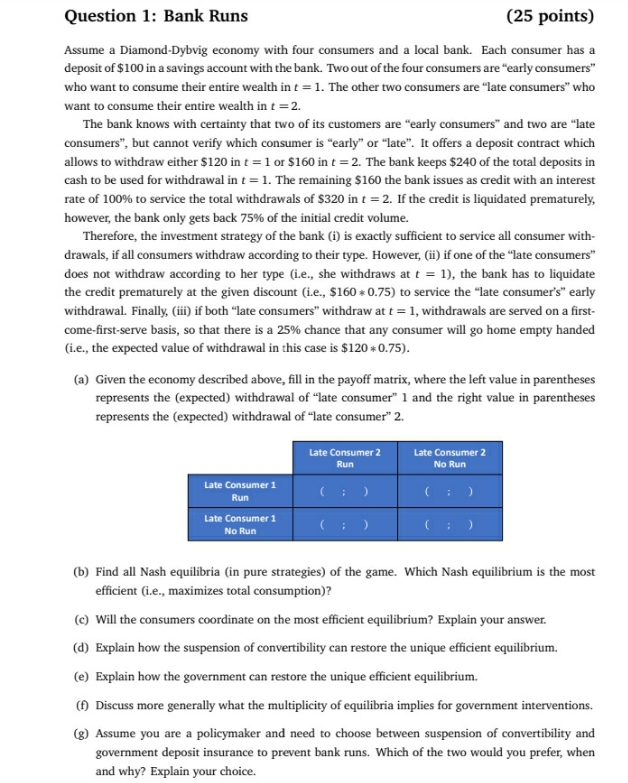

Question 1: Bank Runs (25 points) Assume a Diamond-Dybvig economy with four consumers and a local bank. Each consumer has a deposit of $100 in a savings account with the bank. Two out of the four consumers are "early consumers" who want to consume their entire wealth in t = 1. The other two consumers are "late consumers" who want to consume their entire wealth in t = 2. The bank knows with certainty that two of its customers are "early consumers" and two are "late consumers", but cannot verify which consumer is "early" or "late". It offers a deposit contract which allows to withdraw either $120 in t = 1 or $160 in t = 2. The bank keeps $240 of the total deposits in cash to be used for withdrawal in t = 1. The remaining $160 the bank issues as credit with an interest rate of 100% to service the total withdrawals of $320 in t = 2. If the credit is liquidated prematurely, however, the bank only gets back 75% of the initial credit volume. Therefore, the investment strategy of the bank (i) is exactly sufficient to service all consumer with- drawals, if all consumers withdraw according to their type. However, (ii) if one of the "late consumers" does not withdraw according to her type (i.e., she withdraws at t = 1), the bank has to liquidate the credit prematurely at the given discount (i.e., $160*0.75) to service the "late consumer's" early withdrawal. Finally, (iii) if both "late consumers" withdraw at t = 1, withdrawals are served on a first- come-first-serve basis, so that there is a 25% chance that any consumer will go home empty handed (i.e., the expected value of withdrawal in this case is $120 *0.75). (a) Given the economy described above, fill in the payoff matrix, where the left value in parentheses represents the (expected) withdrawal of "late consumer" 1 and the right value in parentheses represents the (expected) withdrawal of "late consumer" 2. Late Consumer 2 Late Consumer 2 Run No Run Late Consumer 1 Run Late Consumer 1 No Run ( : ( : ) (b) Find all Nash equilibria (in pure strategies) of the game. Which Nash equilibrium is the most efficient (i.e., maximizes total consumption)? (c) Will the consumers coordinate on the most efficient equilibrium? Explain your answer. (d) Explain how the suspension of convertibility can restore the unique efficient equilibrium. (e) Explain how the government can restore the unique efficient equilibrium. (f) Discuss more generally what the multiplicity of equilibria implies for government interventions. (g) Assume you are a policymaker and need to choose between suspension of convertibility and government deposit insurance to prevent bank runs. Which of the two would you prefer, when and why? Explain your choice