I need Answer as soon as possible. Thank you

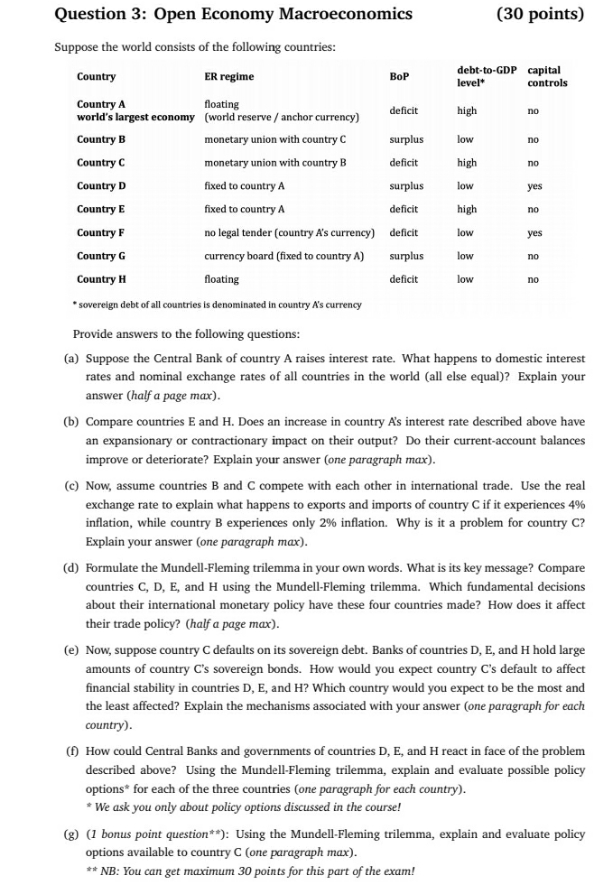

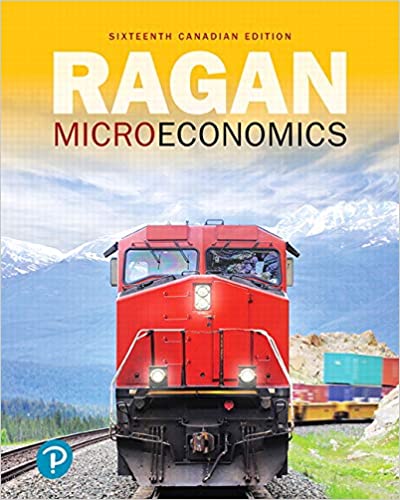

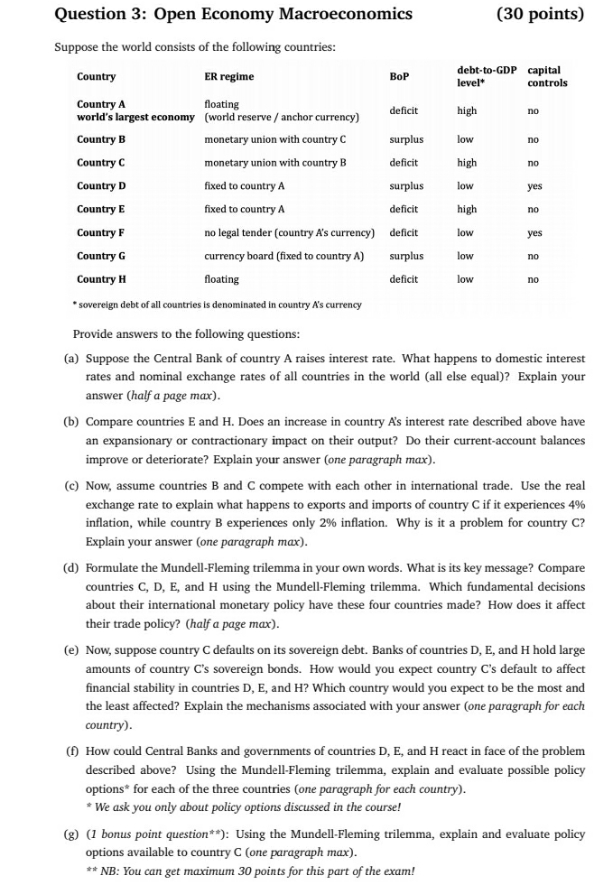

Question 3: Open Economy Macroeconomics (30 points) Suppose the world consists of the following countries: BoP debt-to-GDP capital Country ER regime level controls Country A floating deficit high no world's largest economy (world reserve / anchor currency) Country B monetary union with country C surplus low no Country C monetary union with country B deficit high no Country D fixed to country A surplus low yes Country E fixed to country A deficit high no Country F no legal tender (country A's currency) deficit low yes Country G currency board (fixed to country A] surplus low no Country H floating deficit low Do sovereign debt of all countries is denominated in country A's currency Provide answers to the following questions: (a) Suppose the Central Bank of country A raises interest rate. What happens to domestic interest rates and nominal exchange rates of all countries in the world (all else equal)? Explain your answer (half a page max). (b) Compare countries E and H. Does an increase in country A's interest rate described above have an expansionary or contractionary impact on their output? Do their current-account balances improve or deteriorate? Explain your answer (one paragraph max). (c) Now, assume countries B and C compete with each other in international trade. Use the real exchange rate to explain what happens to exports and imports of country C if it experiences 4% inflation, while country B experiences only 2% inflation. Why is it a problem for country C? Explain your answer (one paragraph max). (d) Formulate the Mundell-Fleming trilemma in your own words. What is its key message? Compare countries C, D, E, and H using the Mundell-Fleming trilemma. Which fundamental decisions about their international monetary policy have these four countries made? How does it affect their trade policy? (half a page max). (e) Now, suppose country C defaults on its sovereign debt. Banks of countries D, E, and H hold large amounts of country C's sovereign bonds. How would you expect country C's default to affect financial stability in countries D, E, and H? Which country would you expect to be the most and the least affected? Explain the mechanisms associated with your answer (one paragraph for each country). (f) How could Central Banks and governments of countries D, E, and H react in face of the problem described above? Using the Mundell-Fleming trilemma, explain and evaluate possible policy options* for each of the three countries (one paragraph for each country). * We ask you only about policy options discussed in the course! (g) (1 bonus point question* *): Using the Mundell-Fleming trilemma, explain and evaluate policy options available to country C (one paragraph max). *NB: You can get maximum 30 points for this part of the exam