Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need answer asap If we consider the effect of taxes, then the degree of operating leverage can be written as: DOL=1+[FC(1TC)TCD]/OCF Consider a project

i need answer asap

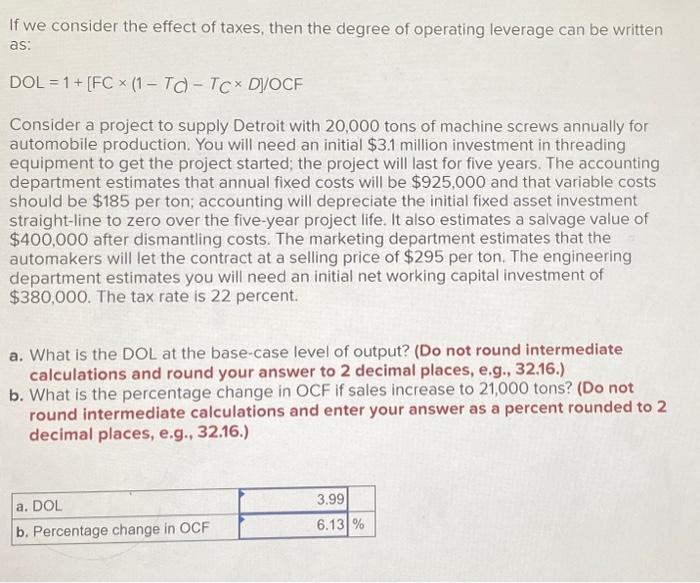

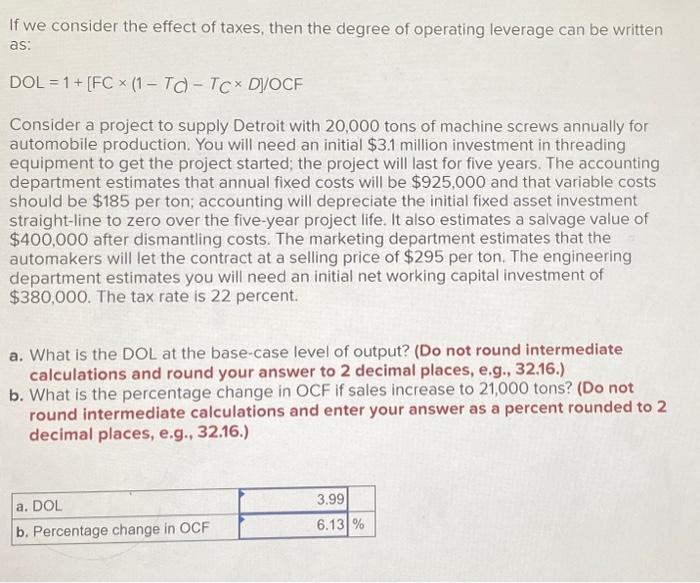

If we consider the effect of taxes, then the degree of operating leverage can be written as: DOL=1+[FC(1TC)TCD]/OCF Consider a project to supply Detroit with 20,000 tons of machine screws annually for automobile production. You will need an initial $3.1 million investment in threading equipment to get the project started; the project will last for five years. The accounting department estimates that annual fixed costs will be $925,000 and that variable costs should be $185 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the five-year project life. It also estimates a salvage value of $400,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $295 per ton. The engineering department estimates you will need an initial net working capital investment of $380,000. The tax rate is 22 percent. a. What is the DOL at the base-case level of output? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the percentage change in OCF if sales increase to 21,000 tons? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started