i need answer for

1&2&3

Auditing question

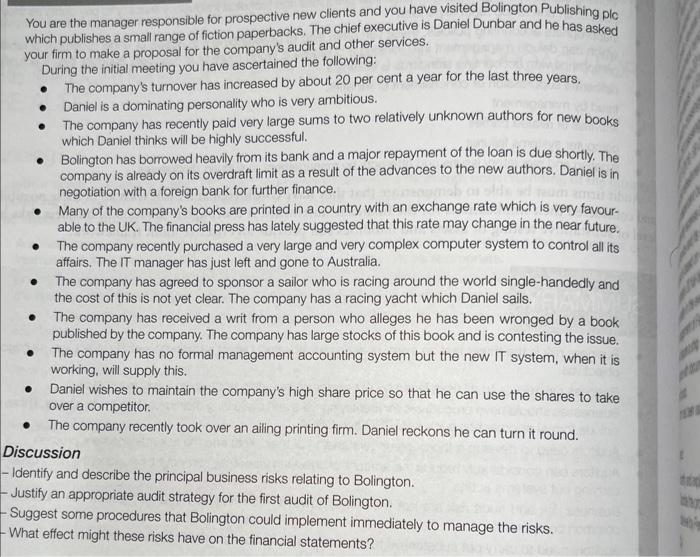

You are the manager responsible for prospective new cle chief executive is Daniel Dunbar and he has asked which publishes a small range of fiction paperbacks. The chief executive is Dat your firm to make a proposal for the company's audit and other ser During the initial meeting you have ascertained the following: - Daniel is a dominating personality who is very ambitious. - The company has recently paid very large sums to two relatively unknown authors for new books which Daniel thinks will be highly successful. - Bolington has borrowed heavily from its bank and a major repayment of the loan is due shortly. The company is already on its overdraft limit as a result of the advances to the new authors. Daniel is in negotiation with a foreign bank for further finance. - Many of the company's books are printed in a country with an exchange rate which is very favourable to the UK. The financial press has lately suggested that this rate may change in the near future. - The company recently purchased a very large and very complex computer system to control all its affairs. The IT manager has just left and gone to Australia. - The company has agreed to sponsor a sailor who is racing around the world single-handedly and the cost of this is not yet clear. The company has a racing yacht which Daniel sails. - The company has received a writ from a person who alleges he has been wronged by a book published by the company. The company has large stocks of this book and is contesting the issue. - The company has no formal management accounting system but the new IT system, when it is working, will supply this. - Daniel wishes to maintain the company's high share price so that he can use the shares to take over a competitor. - The company recently took over an ailing printing firm. Daniel reckons he can turn it round. Discussion - Identify and describe the principal business risks relating to Bolington. - Justify an appropriate audit strategy for the first audit of Bolington. - Suggest some procedures that Bolington could implement immediately to manage the risks. -What effect might these risks have on the financial statements