i need answer for 5. 6. 7.

5, 6, 7

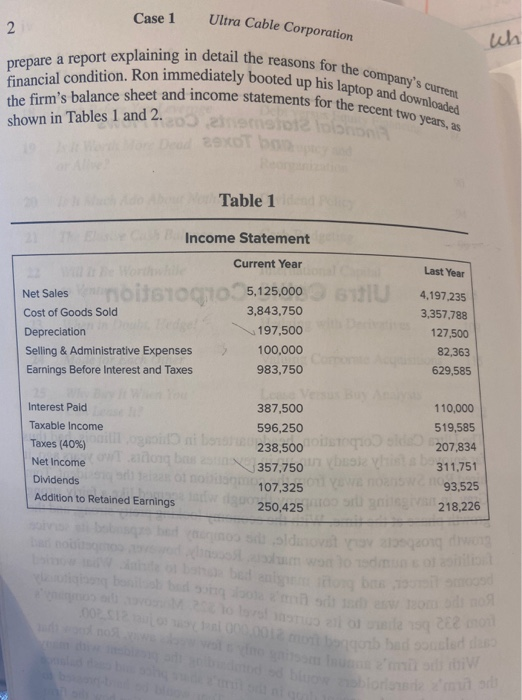

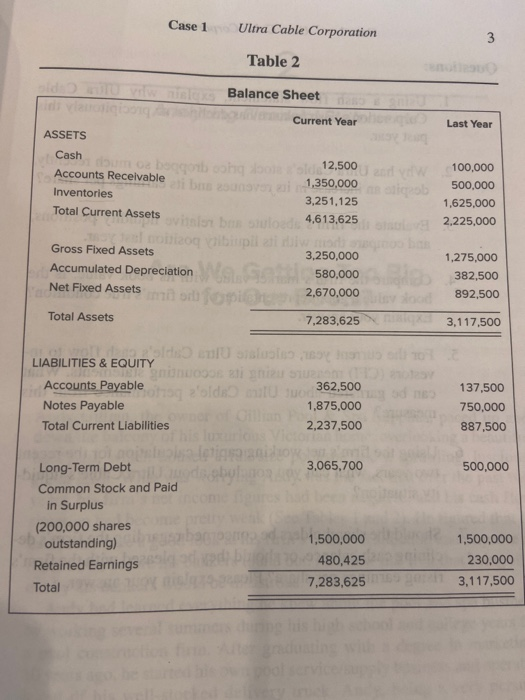

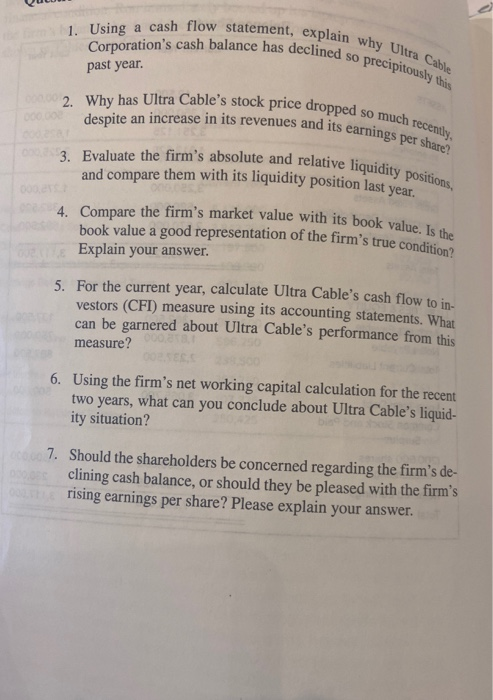

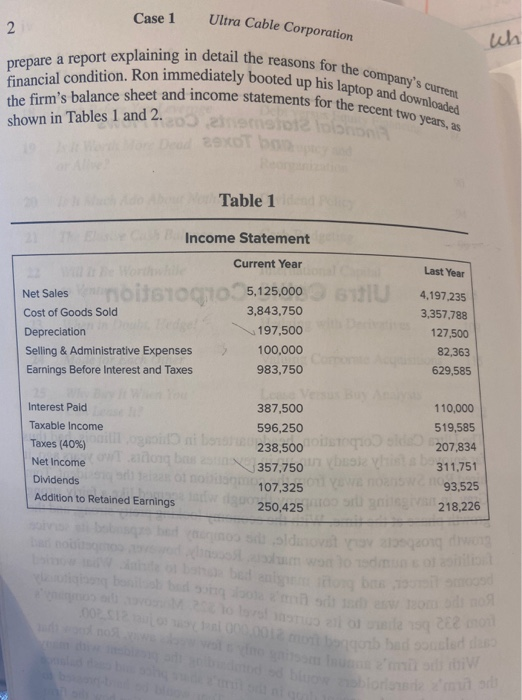

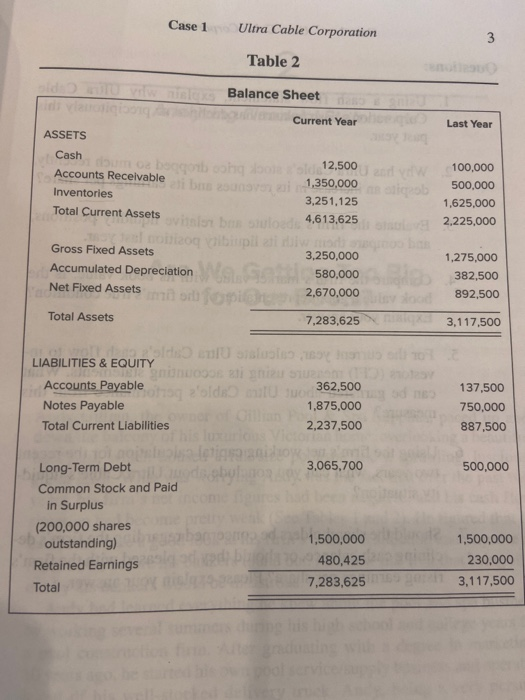

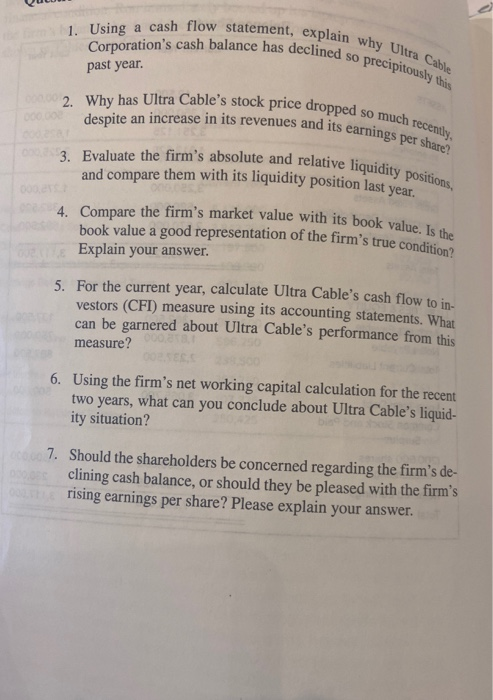

Financial Statements, Cash Flows and Taxes Ultra Cable Corporation The Ultra Cable Corporation, headquartered in Chicago, Illinois, had thus far enjoyed a fairly steady run-up in revenues and profits. Two years ago, it hired Ron Swenson away from the competition to assist the president, Tom Gray, in navigating the company through what seemed like a fairly strong growth phase at the time. With the economy looking pretty strong, and the growth prospects very favorable, the company had expanded its service facilities to a number of new markets. Recently, however, competition had become fiercer, and profit margins had started to shrink. What worried Ron the most was that the firm's stock price had declined precipitously from $35 per share to its current level of $25. Moreover, the company's cash balance had dropped from $100,000 last year to just $12,500. With the firm's annual meeting only a few weeks away, Ron knew that the firm's shareholders would be bombarding the president with many questions about the recent drop in the firm's share price and cash balance and would demand some explanations. Tom would be hard-pressed to come up with feasible responses and suggestions regarding how the firm would be gearing itself to alleviate its liquidity problems. Ron knew that the firm's management had planned on raising some short- term debt fairly soon to fund its working capital. Therefore, he expected that it would not be long before his boss, Tom, would come knocking on his door asking him that million-dollar question: "Where have all the dollars gone?" Later that day his phone rang, and just as he had feared Tom asked Ron to 1 Dagon bad onclude blorist Ultra Cable Corporation 2 Wh prepare a report explaining in detail the reasons for the company's current the firm's balance sheet and income statements for the recent two years, as financial condition. Ron immediately booted up his laptop and downloaded Case 1 shown in Tables 1 and 2. not long Dead 2800T band Table 1 Income Statement Current Year Last Year Net Sales Cost of Goods Sold Depreciation Selling & Administrative Expenses Earnings Before Interest and Taxes 3,843,750 197,500 100,000 983,750 4,197 235 3,357.788 127,500 82,363 629,585 110,000 Interest Paid Taxable income 387,500 596,250 Taxes (40%) no 238,500 sto od 207 357,750 buah Net Income Dividends Addition to retained Earnings 519,585 207.834 311,751 93,525 218,226 107,325 250,425 Case 1 Ultra Cable Corporation 3 Table 2 Balance Sheet Current Year Last Year ASSETS 12,500 100,000 500.000 1,625,000 2,225,000 Cash bobobet Accounts Receivable Inventories bo zunareza 1,350,000 natico 3,251,125 Total Current Assets oviti brinulo 4,613,625 oblog bitspila Hold Gross Fixed Assets 3,250,000 Accumulated Depreciation 580,000 Net Fixed Assets on 2,670,000 Total Assets 7,283,625 1,275,000 382,500 892,500 3,117,500 O sisu LIABILITIES & EQUITY Accounts Payable 362,500 1992'de mul suod Notes Payable 1,875,000 Total Current Liabilities 2,237,500 Furlon 137,500 750,000 887,500 3,065,700 500,000 bol Long-Term Debt Common Stock and Paid in Surplus (200,000 shares outstanding) Retained Earnings Total 1,500,000 480,425 7,283,625 1,500,000 230,000 3,117,500 1. Using a cash flow statement, explain why Ultra Cable Corporation's cash balance has declined so 2. Why has Ultra Cable's stock price dropped so much recently, despite an increase in its revenues and its earnings per share? 3. Evaluate the firm's absolute and relative liquidity positions, and compare them with its liquidity position last year. 4. Compare the firm's market value with its book value. Is the book value a good representation of the firm's true condition? past year. precipitously this Explain your answer. 5. For the current year, calculate Ultra Cable's cash flow to in- vestors (CFI) measure using its accounting statements. What can be garnered about Ultra Cable's performance from this measure? 6. Using the firm's net working capital calculation for the recent two years, what can you conclude about Ultra Cable's liquid- ity situation? 7. Should the shareholders be concerned regarding the firm's de- clining cash balance, or should they be pleased with the firm's rising earnings per share? Please explain your