i need answer for PART B

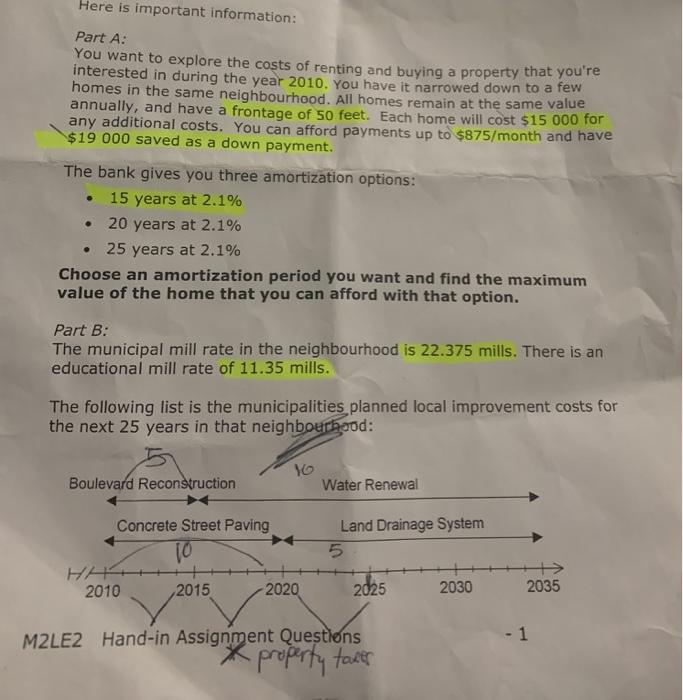

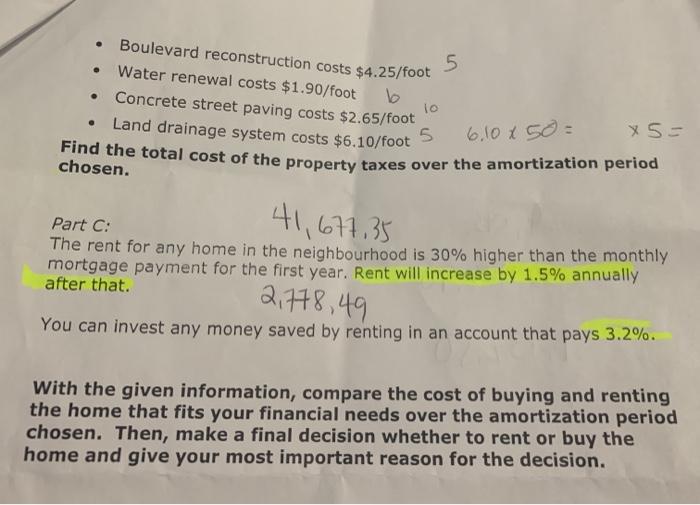

Here is important information: Part A: You want to explore the costs of renting and buying a property that you're interested in during the year 2010. You have it narrowed down to a few homes in the same neighbourhood. All homes remain at the same value annually, and have a frontage of 50 feet. Each home will cost $15 000 for any additional costs. You can afford payments up to $875/month and have $19 000 saved as a down payment. The bank gives you three amortization options: 15 years at 2.1% 20 years at 2.1% 25 years at 2.1% Choose an amortization period you want and find the maximum value of the home that you can afford with that option. . Part B: The municipal mill rate in the neighbourhood is 22.375 mills. There is an educational mill rate of 11.35 mills. The following list is the municipalities planned local improvement costs for the next 25 years in that neighbourhood: Boulevard Reconstruction Yo Water Renewal Concrete Street Paving Land Drainage System 5 10 HA 2010 2015 2020 2025 2030 2035 M2LE2 Hand-in Assignment Questions - 1 property taler . 5. . . lo 5 6.10x50= x5= Boulevard reconstruction costs $4.25/foot Water renewal costs $1.90/foot Concrete street paving costs $2.65/foot Land drainage system costs $6.10/foot Find the total cost of the property taxes over the amortization period chosen. 41,677,35 Part C: The rent for any home in the neighbourhood is 30% higher than the monthly mortgage payment for the first year. Rent will increase by 1.5% annually after that. You can invest any money saved by renting in an account that pays 3.2%. 2,778,49 With the given information, compare the cost of buying and renting the home that fits your financial needs over the amortization period chosen. Then, make a final decision whether to rent or buy the home and give your most important reason for the decision. Here is important information: Part A: You want to explore the costs of renting and buying a property that you're interested in during the year 2010. You have it narrowed down to a few homes in the same neighbourhood. All homes remain at the same value annually, and have a frontage of 50 feet. Each home will cost $15 000 for any additional costs. You can afford payments up to $875/month and have $19 000 saved as a down payment. The bank gives you three amortization options: 15 years at 2.1% 20 years at 2.1% 25 years at 2.1% Choose an amortization period you want and find the maximum value of the home that you can afford with that option. . Part B: The municipal mill rate in the neighbourhood is 22.375 mills. There is an educational mill rate of 11.35 mills. The following list is the municipalities planned local improvement costs for the next 25 years in that neighbourhood: Boulevard Reconstruction Yo Water Renewal Concrete Street Paving Land Drainage System 5 10 HA 2010 2015 2020 2025 2030 2035 M2LE2 Hand-in Assignment Questions - 1 property taler . 5. . . lo 5 6.10x50= x5= Boulevard reconstruction costs $4.25/foot Water renewal costs $1.90/foot Concrete street paving costs $2.65/foot Land drainage system costs $6.10/foot Find the total cost of the property taxes over the amortization period chosen. 41,677,35 Part C: The rent for any home in the neighbourhood is 30% higher than the monthly mortgage payment for the first year. Rent will increase by 1.5% annually after that. You can invest any money saved by renting in an account that pays 3.2%. 2,778,49 With the given information, compare the cost of buying and renting the home that fits your financial needs over the amortization period chosen. Then, make a final decision whether to rent or buy the home and give your most important reason for the decision