I NEED ANSWER FOR PART TWO QUESTION 1 AND TWO I HAVE ANSWERS FOR QUESTION ONE

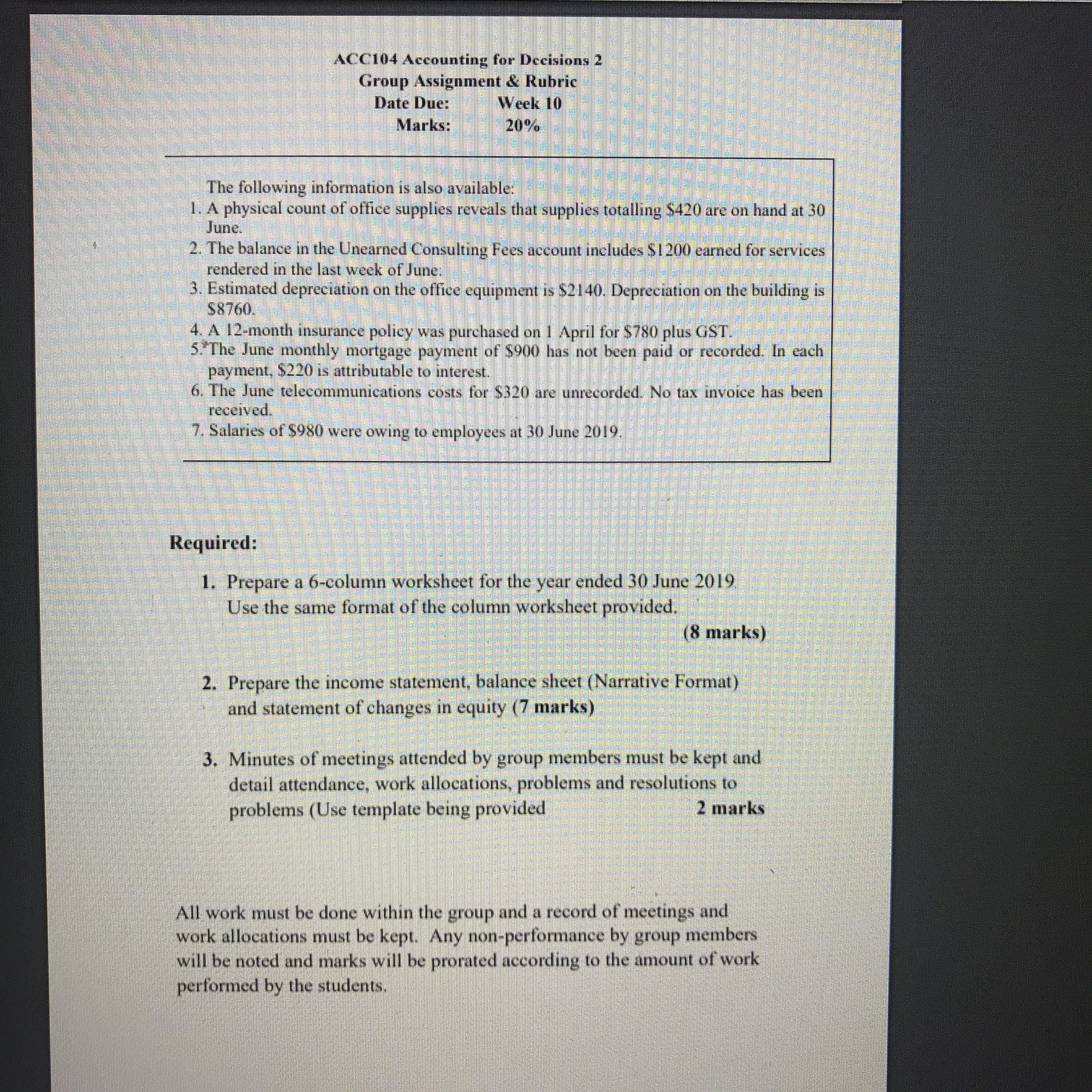

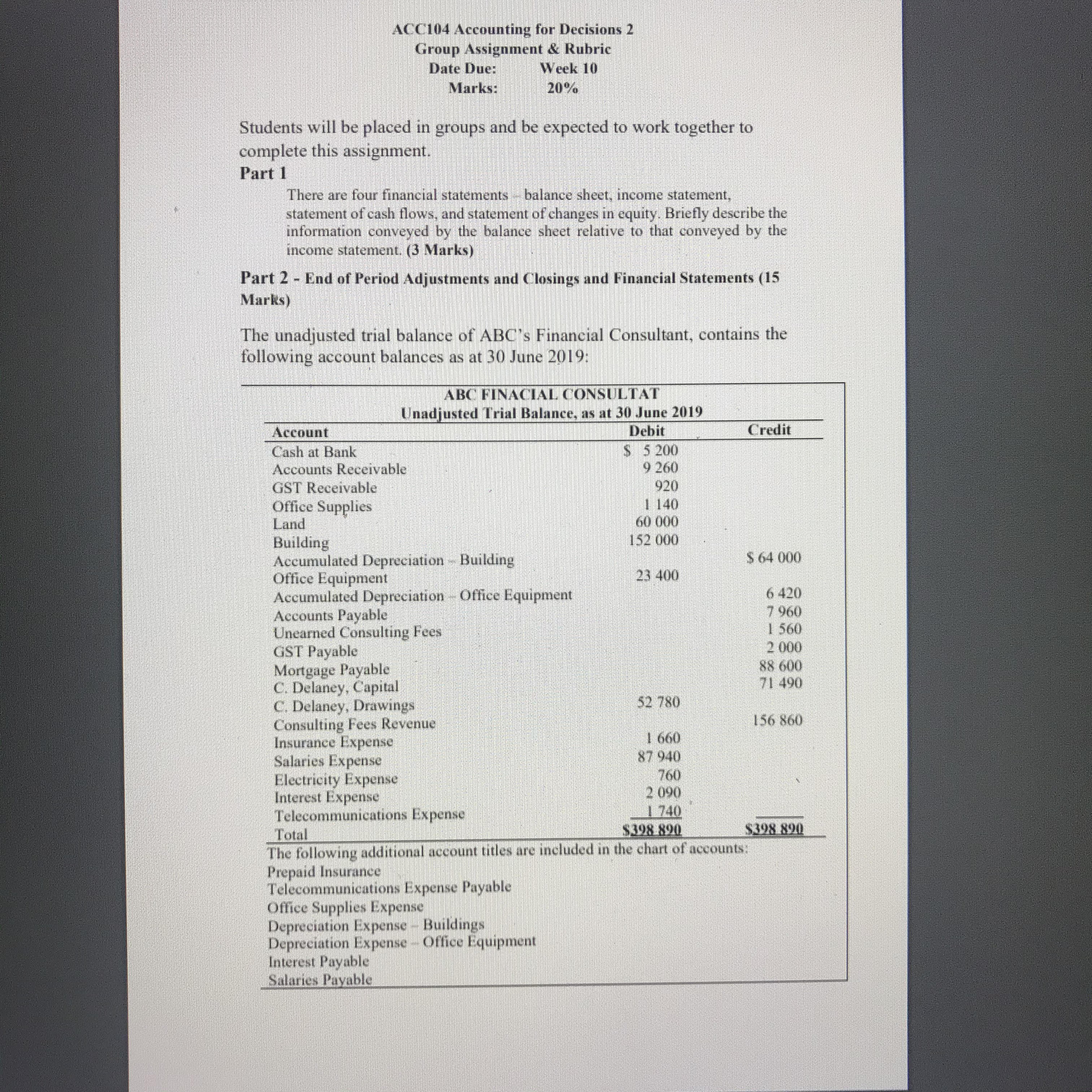

ACC104 Accounting for Decisions 2 Group Assignment & Rubric Date Due: Week 10 Marks: 20% The following information is also available: 1. A physical count of office supplies reveals that supplies totalling $420 are on hand at 30 June. 2. The balance in the Unearned Consulting Fees account includes $ 1 200 earned for services rendered in the last week of June: 3. Estimated depreciation on the office equipment is $2140. Depreciation on the building is $8760. 4. A 12-month insurance policy was purchased on 1 April for $780 plus GST. 5. The June monthly mortgage payment of $900 has not been paid or recorded. In each payment, $220 is attributable to interest. . The June telecommunications costs for $320 are unrecorded. No tax invoice has been received. . Salaries of $980 were owing to employees at 30 June 2019. Required: 1. Prepare a 6-column worksheet for the year ended 30 June 2019 Use the same format of the column worksheet provided. (8 marks) 2. Prepare the income statement, balance sheet (Narrative Format) and statement of changes in equity (7 marks) 3. Minutes of meetings attended by group members must be kept and detail attendance, work allocations, problems and resolutions to problems (Use template being provided 2 marks All work must be done within the group and a record of meetings and work allocations must be kept. Any non-performance by group members will be noted and marks will be prorated according to the amount of work performed by the students.ACC104 Accounting for Decisions 2 Group Assignment & Rubric Date Due: Week 10 Marks: 20% Students will be placed in groups and be expected to work together to complete this assignment. Part 1 There are four financial statements - balance sheet, income statement, statement of cash flows, and statement of changes in equity. Briefly describe the information conveyed by the balance sheet relative to that conveyed by the income statement. (3 Marks) Part 2 - End of Period Adjustments and Closings and Financial Statements (15 Marks) The unadjusted trial balance of ABC's Financial Consultant, contains the following account balances as at 30 June 2019: ABC FINACIAL CONSULTAT Unadjusted Trial Balance, as at 30 June 2019 Account Debit Credit Cash at Bank $ 5 200 Accounts Receivable 9 260 GST Receivable 920 Office Supplies 1 140 Land 60 000 Building 152 000 Accumulated Depreciation - Building $ 64 000 Office Equipment 23 400 Accumulated Depreciation - Office Equipment 6 420 Accounts Payable 960 Unearned Consulting Fees 1 560 GST Payable 2 000 Mortgage Payable 88 600 C. Delaney, Capital 71 490 C. Delaney, Drawings 52 780 Consulting Fees Revenue 156 860 Insurance Expense 1 660 Salaries Expense 87 940 Electricity Expense 760 Interest Expense 2 090 Telecommunications Expense 1 740 Total $398 890 $398 890 The following additional account titles are included in the chart of accounts Prepaid Insurance Telecommunications Expense Payable Office Supplies Expense Depreciation Expense -Buildings Depreciation Expense Office Equipment Interest Payable Salaries Payable