Question

I need answer of question 6 Roger Mills, the Vice President of Finance of Global Resources, was concerned about the fact that Global Resources used

I need answer of question 6

Roger Mills, the Vice President of Finance of Global Resources, was concerned about the fact that Global Resources used one discount rate to evaluate all projects. Currently that rate was 10 percent. He knew certain projects were riskier than others, and he felt they should carry a higher discount rate (hurdle rate) than more conservative projects.

The firm had just hired Jennifer Morrison, an MBA from the Desautels School at McGill University (at a starting salary of 150,000 a year). Roger felt with her education and training, she should be able to provide some meaningful suggestions.

Jennifer said, There are several ways to account for risk in the capital budgeting process, but the most widely used method by the Top 500 companies in Canada is the risk-adjusted discount rate approach. You set up different risk categories in the corporate capital budgeting manual and specify an appropriate discount rate for each.

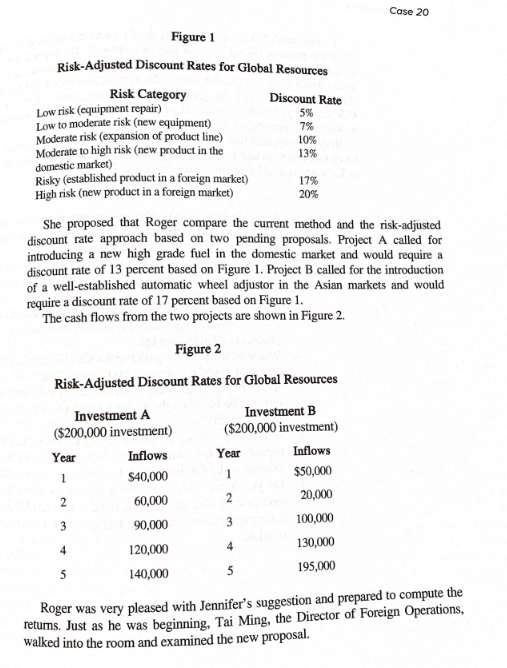

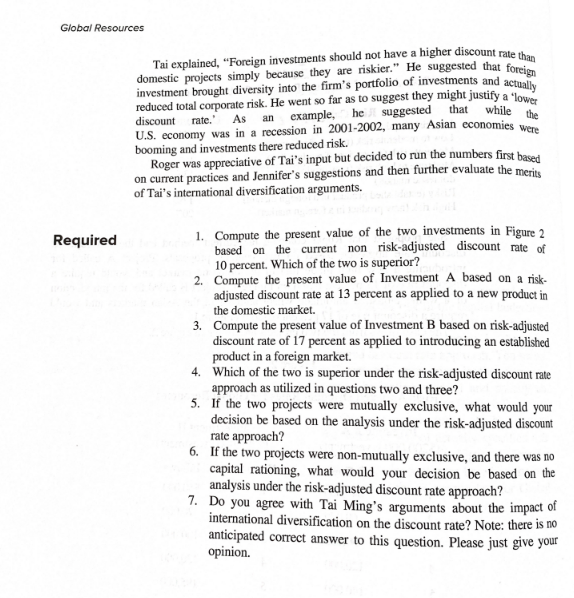

One of the case studies she had used at the Desautels School actually specified risk categories as shown in Figure 1. Jennifer also added discount rates based on the risk level that might be appropriate for Global Resources.

If the two projects were non-mutually exclusive, and there was no capital rationing, what would your decision be based on the analysis under the risk-adjusted discount rate approach?

Case 20 10% 13% Figure 1 Risk-Adjusted Discount Rates for Global Resources Risk Category Discount Rate Low risk (equipment repair) 5% Low to moderate risk (new equipment) 7% Moderate risk (expansion of product line) Moderate to high risk (new product in the domestic market) Risky (established product in a foreign market) 17% High risk (new product in a foreign market) 20% She proposed that Roger compare the current method and the risk-adjusted discount rate approach based on two pending proposals. Project A called for introducing a new high grade fuel in the domestic market and would require a discount rate of 13 percent based on Figure 1. Project B called for the introduction of a well-established automatic wheel adjustor in the Asian markets and would require a discount rate of 17 percent based on Figure 1. The cash flows from the two projects are shown in Figure 2. Figure 2 a Risk-Adjusted Discount Rates for Global Resources Investment A Investment B ($200,000 investment) ($200,000 investment) Year Inflows Year Inflows 1 $40,000 1 $50,000 2 60,000 2 20,000 3 90,000 3 100,000 4 120,000 4 130,000 5 140,000 5 195,000 Roger was very pleased with Jennifer's suggestion and prepared to compute the returns. Just as he was beginning, Tai Ming, the Director of Foreign Operations, walked into the room and examined the new proposal. Global Resources Tai explained, Foreign investments should not have a higher discount rate thay investment brought diversity into the firm's portfolio of investments and actually domestic projects simply because they are riskier:" He suggested that foreign reduced total corporate risk. He went so far as to suggest they might justify a "lower discount rate. As an example, he suggested that while the U.S. economy was in a recession in 2001-2002, many Asian economies were booming and investments there reduced risk. Roger was appreciative of Tai's input but decided to run the numbers first based on current practices and Jennifer's suggestions and then further evaluate the merits of Tai's international diversification arguments. Required 1. Compute the present value of the two investments in Figure 2 based on the current non risk-adjusted discount rate of 10 percent. Which of the two is superior? 2. Compute the present value of Investment A based on a risk- adjusted discount rate at 13 percent as applied to a new product in the domestic market. 3. Compute the present value of Investment B based on risk-adjusted discount rate of 17 percent as applied to introducing an established product in a foreign market. 4. Which of the two is superior under the risk-adjusted discount rate approach as utilized in questions two and three? 5. If the two projects were mutually exclusive, what would your decision be based on the analysis under the risk-adjusted discount rate approach? 6. If the two projects were non-mutually exclusive, and there was no capital rationing, what would your decision be based on the analysis under the risk-adjusted discount rate approach? 7. Do you agree with Tai Ming's arguments about the impact of international diversification on the discount rate? Note: there is no anticipated correct answer to this question. Please just give your opinion. Case 20 10% 13% Figure 1 Risk-Adjusted Discount Rates for Global Resources Risk Category Discount Rate Low risk (equipment repair) 5% Low to moderate risk (new equipment) 7% Moderate risk (expansion of product line) Moderate to high risk (new product in the domestic market) Risky (established product in a foreign market) 17% High risk (new product in a foreign market) 20% She proposed that Roger compare the current method and the risk-adjusted discount rate approach based on two pending proposals. Project A called for introducing a new high grade fuel in the domestic market and would require a discount rate of 13 percent based on Figure 1. Project B called for the introduction of a well-established automatic wheel adjustor in the Asian markets and would require a discount rate of 17 percent based on Figure 1. The cash flows from the two projects are shown in Figure 2. Figure 2 a Risk-Adjusted Discount Rates for Global Resources Investment A Investment B ($200,000 investment) ($200,000 investment) Year Inflows Year Inflows 1 $40,000 1 $50,000 2 60,000 2 20,000 3 90,000 3 100,000 4 120,000 4 130,000 5 140,000 5 195,000 Roger was very pleased with Jennifer's suggestion and prepared to compute the returns. Just as he was beginning, Tai Ming, the Director of Foreign Operations, walked into the room and examined the new proposal. Global Resources Tai explained, Foreign investments should not have a higher discount rate thay investment brought diversity into the firm's portfolio of investments and actually domestic projects simply because they are riskier:" He suggested that foreign reduced total corporate risk. He went so far as to suggest they might justify a "lower discount rate. As an example, he suggested that while the U.S. economy was in a recession in 2001-2002, many Asian economies were booming and investments there reduced risk. Roger was appreciative of Tai's input but decided to run the numbers first based on current practices and Jennifer's suggestions and then further evaluate the merits of Tai's international diversification arguments. Required 1. Compute the present value of the two investments in Figure 2 based on the current non risk-adjusted discount rate of 10 percent. Which of the two is superior? 2. Compute the present value of Investment A based on a risk- adjusted discount rate at 13 percent as applied to a new product in the domestic market. 3. Compute the present value of Investment B based on risk-adjusted discount rate of 17 percent as applied to introducing an established product in a foreign market. 4. Which of the two is superior under the risk-adjusted discount rate approach as utilized in questions two and three? 5. If the two projects were mutually exclusive, what would your decision be based on the analysis under the risk-adjusted discount rate approach? 6. If the two projects were non-mutually exclusive, and there was no capital rationing, what would your decision be based on the analysis under the risk-adjusted discount rate approach? 7. Do you agree with Tai Ming's arguments about the impact of international diversification on the discount rate? Note: there is no anticipated correct answer to this question. Please just give your opinionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started