Answered step by step

Verified Expert Solution

Question

1 Approved Answer

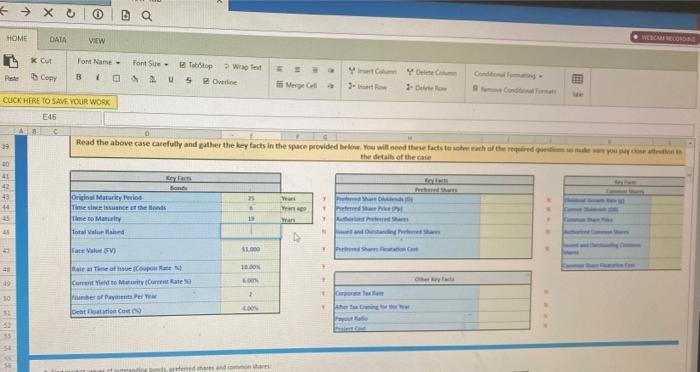

i need answers please 1.234] and do not enter the percent sign. CUCK HERE TO SAVE YOUR WORK E46 B N. 57 68 70 73

i need answers please

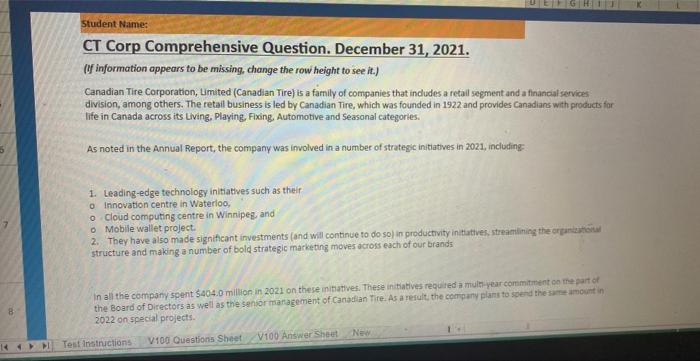

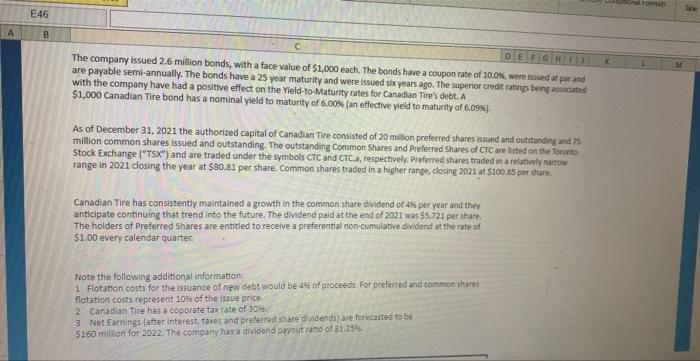

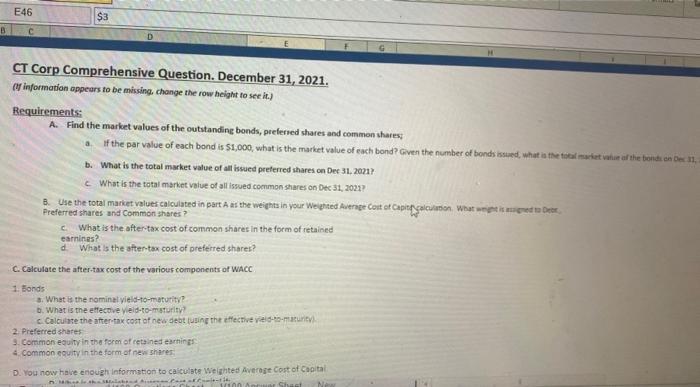

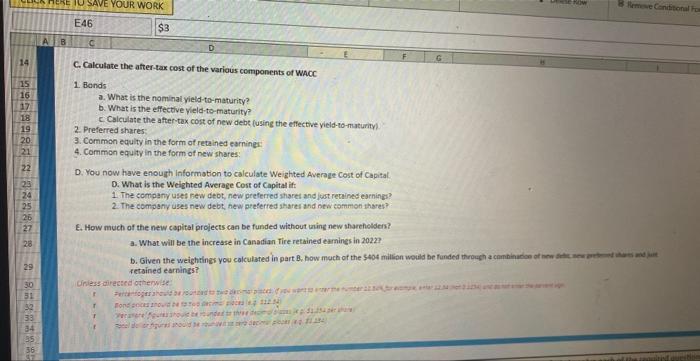

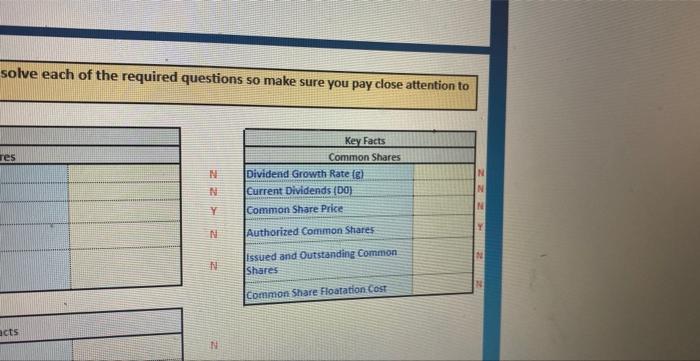

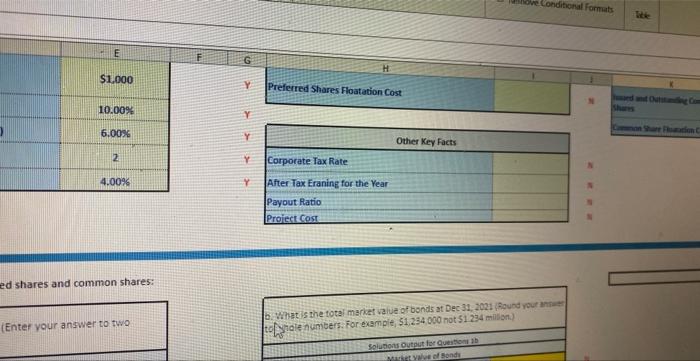

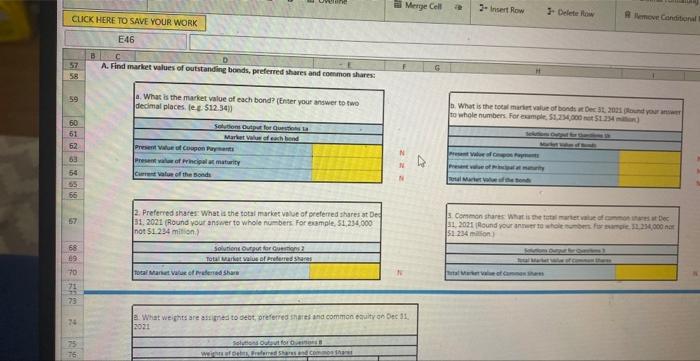

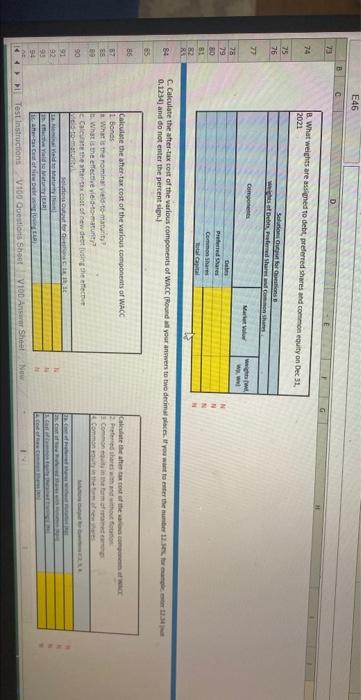

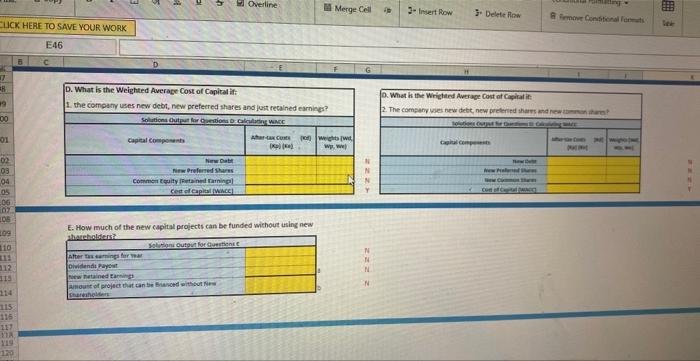

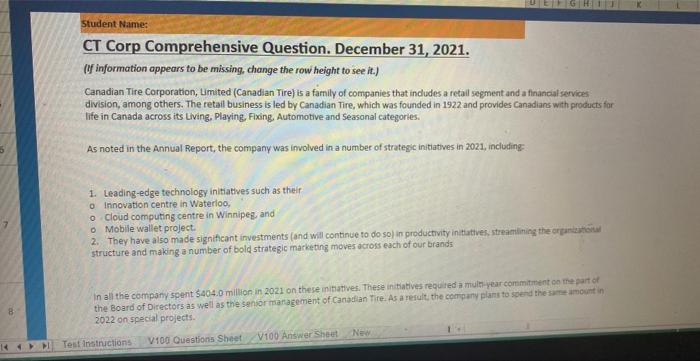

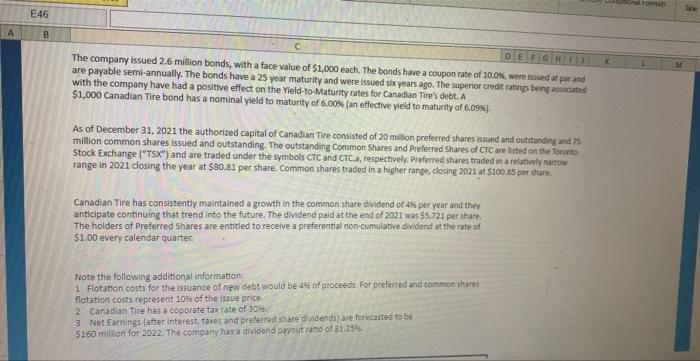

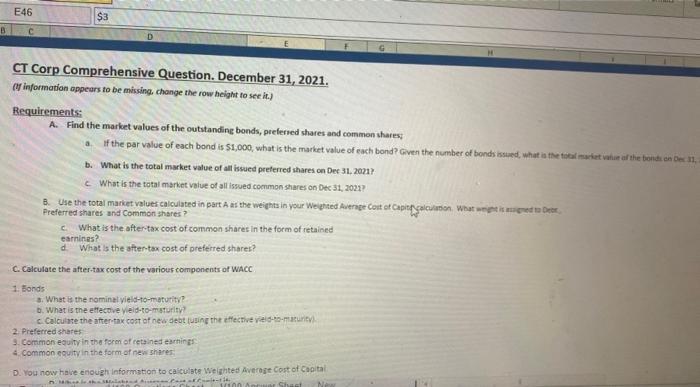

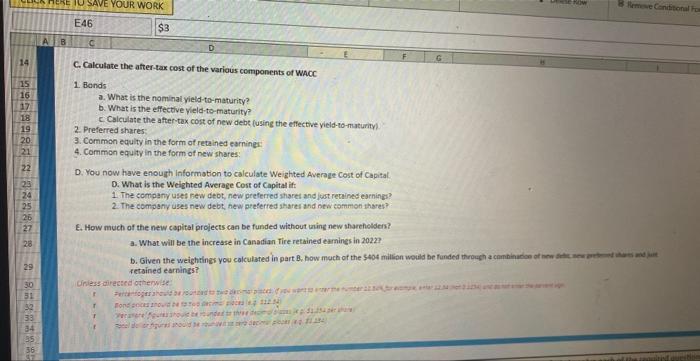

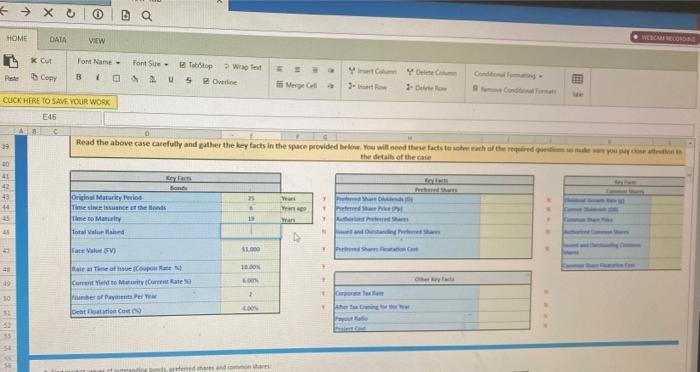

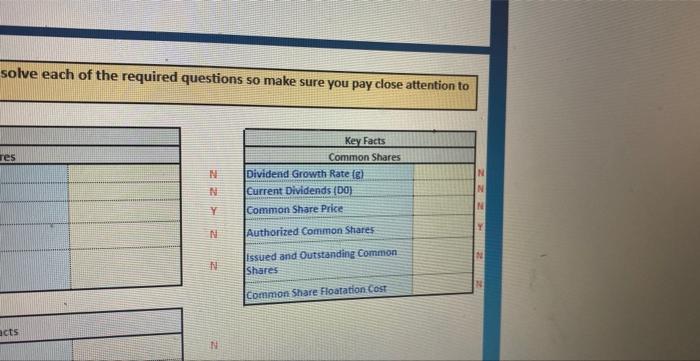

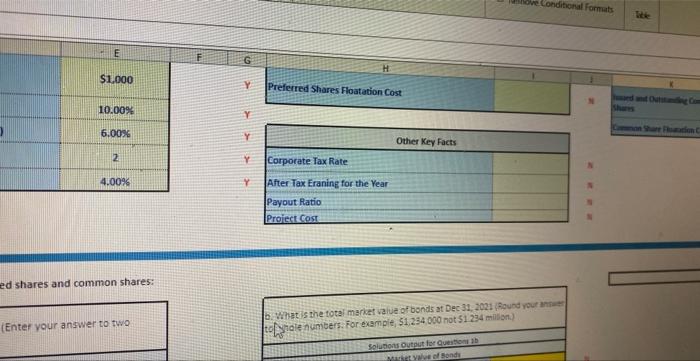

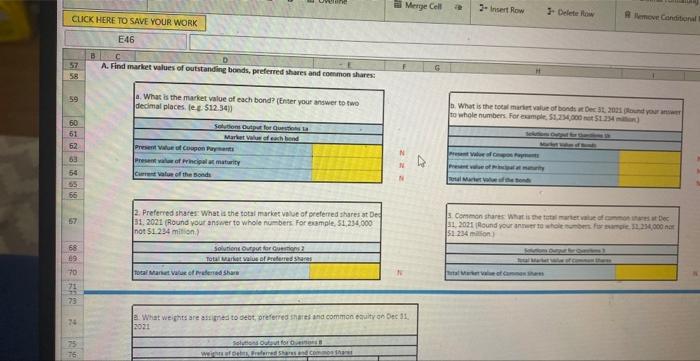

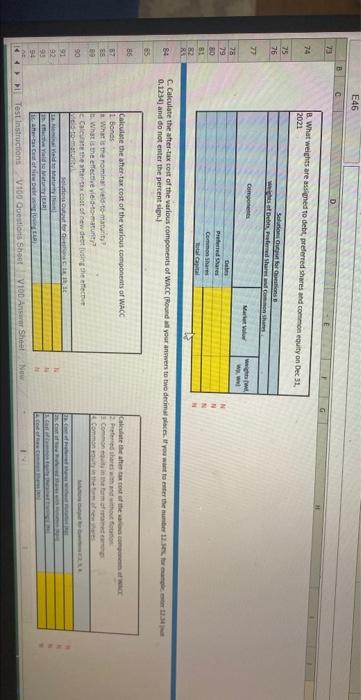

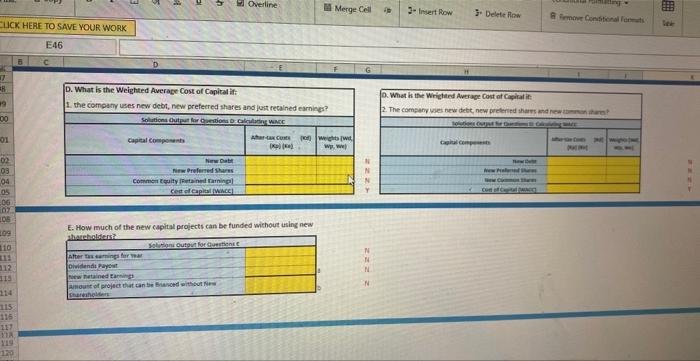

1.234] and do not enter the percent sign. CUCK HERE TO SAVE YOUR WORK E46 B N. 57 68 70 73 2. What weights are asr bres to dect, preferied ghares and common equity on oec 11 . 76 51.234 mation! C. Calculate the after-tax cost of the various components of WACC 1. Bands a. What is the nominal yield-to-maturity? b. What is the effective vield-to-maturity? c. Calculate the after-tax cost of new debe (using the effective vield-to-maturity) 2. Preferred shares: 3. Common equity in the form of retained earning: 4. Common equity in the form of new shares: D. You now have enough information to calculate Weighted Average cost of Capital. D. What is the Weighted Average Cost of Capital if: 1 The company uses rew debt, new preferred shares and jost renined earnings? 2. The company uses new debt, hew preferred sharer and new common thares? E. How much of the new capital projects can be funded without uring new thareholden? a. What will be the increase in Canadian Tire retained earnines in 20227 retained earnings? Ciniess directed ctherwise The company issued 2.6 million bonds, with a face value of $1,000 each. The bonds have a coupon rate of 10.0%, were issued at pur and are payable semi-annually. The bonds have a 25 year maturity and were issued six years ago. The superior credit ratings being associated with the company have had a positive effect on the Yield-to-Maturity rates for Canadian Tire's debt. A $1,000 Canadian Tire bond has a nominal yield to maturity of 6.00% (an effective vield to maturity of 6.09% ). As of December 31, 2021 the authorized capital of Canadian Tire consisted of 20 million preferred shares issued and outsanding und 75 million common shares issued and outstanding. The outstanding Common Shares and Preferred Shares of CrC are listed on the forchta Stock Exchange ("TSX") and are traded under the symbols CTC and CTC.a, respectively. Preferred shares traded in a rebatively nartow range in 2021 closing the year at $80.81 per share, Common shares traded in a higher range, closing 2021 at $100.85 per share. Canadian Tire has consistently maintained a growth in the common share dividend of 45 per year and they anticipate continuing that trend into the future. The dividend paid at the end of 2021 was 55 .721 per share. The holders of Preferred Shares are entitled to recelve a preferential non-cumulathe dividend at the rate of $1.00 every calendar quarter. Note the following additional information: 1 Flotation costs for the issuance of new debt would be 4% of proceeds. For prelerred and common shares flotation costs represent 10% of the issue price. 2 Canadian Tire has a coporate tax cate of 30%. 3 Net Earnings lafter interest, taxes and prefered share dividends) are forecauted to be. $160 milion for 2022 . The company has a dividend parvout rato of 31 .2516. solve each of the required questions so make sure you pay close attention to E. How much of the new capital projects can be funded wichout using new CT Corp Comprehensive Question. December 31, 2021. (If information appears to be missing, change the row height to see it.) Canadian Tire Corporation, Limited (Canadian Tire) is a family of companies that indudes a retail segment and a financial services division, among others. The retail business is led by Canadian Tire, which was founded in 1922 and provides Canadians with products for life in Canada across its Living, Playing, Fixing, Automotive and Seasonal categories. As noted in the Annual Report, the company was imvolved in a number of strategic initiatives in 2021, including: 1. Leading-edge technology initiatives such as theif - Innovation centre in Waterioo, - Cloud computing centre in Winnipeg, and - Mobile wallet project. 2. They have also made significant investments (and will continue to do so) in productivity inituttives, streamlining the orgarteviousu structure and making a number of bold strategic marketing moves across each of our brands In ali the company sperit $404.0 million in 2021 on these initatwes. These in thatives requited a multh year commitnent co the part of the Board of Directors as well as the senior maragement of Canadian Tire. As a refult, the company plans to spend the same arociant in 2022 on special projects. (I) information appears to be missing, change the row beight to sece ir.) Requirements: A. Find the market values of the outstanding bonds, peferned shares and common shares: b. What is the total market value of all issued preferred shares cen Dec 31. 2021? C. What is the total market value of all issued cocnmon shares on Dec 31, 2021? Preferred shares and Common shares? c. What is the after-tax cost of common shares in the form of retained earnines? d. What is the after-tax cost of preferred shares? C. Calculate the after-tax cost of the various components of WACC 1. Bonds 3. What is the nominal yield-to-moturity? b. What is the elfacolve veld-ro-muturity c. Calculate the atter-mx cost of nes debt fusing the effective vield-ro-muzurity). 2. Preferred shates 3. Common equity in the foron of retained earnin is 4 Common equity in the form of new shares: D. You now have enough informstion to caiculate Weighted Average Cost of Cagital ed shares and common shares: Enter vour answer to two

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started