I need answers to Both questions. If you answer, answer both.

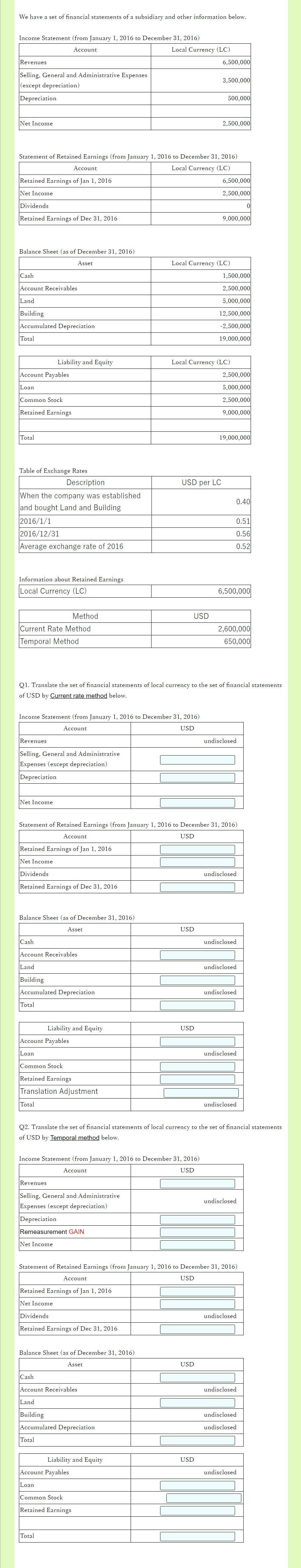

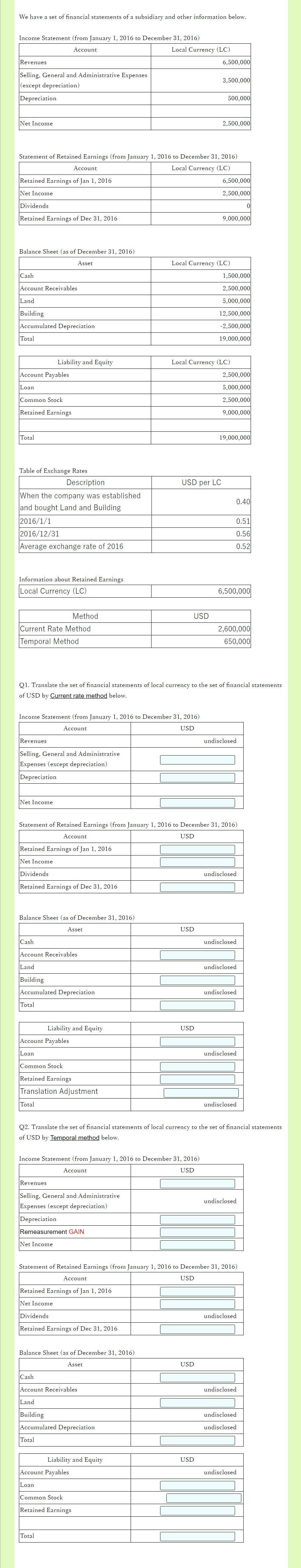

We have a set of financial statements of a subsidiary and other information below. Income Statement (from January 1, 2016 to December 31, 2016) Account Local Currency (LC) Revenues 6,500,000 3,500,000 Selling, General and Administrative Expenses (except depreciation) Depreciation 500,000 Net Income 2,500,000 2016 to December 31, 2016) Statement of Retained Earnings (from January Account Local Currency (LC) Retained Earnings of Jan 1, 2016 6,500,000 Net Income 2,500,000 Dividends Retained Earnings of Dec 31, 2016 9,000,000 Balance Sheet (as of December 31, 2016) Asset Local Currency (LC) Cash 1,500,000 Account Receivables 2,500,000 Land 5,000,000 12,500,000 Building Accumulated Depreciation -2,500,000 Total 19,000,000 Liability and Equity Local Currency (LC) 2,500,000 Account Payables Loan 5,000,000 Common Stock 2,500,000 Retained Earnings 9,000,000 Total 19,000,000 Table of Exchange Rates Description USD per LC 0.40 When the company was established and bought Land and Building 2016/1/1 2016/12/31 Average exchange rate of 2016 0.51 0.561 0.52 Information about Retained Earnings Local Currency (LC) 6,500,000 Method USD Current Rate Method 2,600,000 650,000 Temporal Method Q1. Translate the set of financial statements of local currency to the set of financial statements of USD by Current rate method below. Income Statement (from January 1, 2016 to December 31, 2016) Account USD Revenues undisclosed Selling, General and Administrative Expenses (except depreciation) Depreciation Net Income Statement of Retained Earnings (from January 2016 to December 31, 2016) Account USD Retained Earnings of Jan 1, 2016 Net Income Dividends undisclosed Retained Earnings of Dec 31, 2016 Balance Sheet (as of December 31, 2016) Asset USD Cash undisclosed Account Receivables Land undisclosed Building Accumulated Depreciation undisclosed Total Liability and Equity USD Account Payables Loan undisclosed Common Stock Retained Earnings Translation Adjustment Total undisclosed Q2. Translate the set of financial statements of local currency to the set of financial statements of USD by Temporal method below. Income Statement (from January 1, 2016 to December 31, 2016) Account USD Revenues Selling, General and Administrative Expenses (except depreciation) undisclosed Depreciation Remeasurement GAIN Net Income Statement of Retained Earnings (from January 1, 2016 to December 31, 2016) Account USD Retained Earnings of Jan 1, 2016 Net Income Dividends undisclosed Retained Earnings of Dec 31, 2016 Balance Sheet (as of December 31, 2016) Asset USD Cash Account Receivables undisclosed Land undisclosed Building Accumulated Depreciation undisclosed Total USD Liability and Equity Account Payables undisclosed Loan Common Stock Retained Earnings Total We have a set of financial statements of a subsidiary and other information below. Income Statement (from January 1, 2016 to December 31, 2016) Account Local Currency (LC) Revenues 6,500,000 3,500,000 Selling, General and Administrative Expenses (except depreciation) Depreciation 500,000 Net Income 2,500,000 2016 to December 31, 2016) Statement of Retained Earnings (from January Account Local Currency (LC) Retained Earnings of Jan 1, 2016 6,500,000 Net Income 2,500,000 Dividends Retained Earnings of Dec 31, 2016 9,000,000 Balance Sheet (as of December 31, 2016) Asset Local Currency (LC) Cash 1,500,000 Account Receivables 2,500,000 Land 5,000,000 12,500,000 Building Accumulated Depreciation -2,500,000 Total 19,000,000 Liability and Equity Local Currency (LC) 2,500,000 Account Payables Loan 5,000,000 Common Stock 2,500,000 Retained Earnings 9,000,000 Total 19,000,000 Table of Exchange Rates Description USD per LC 0.40 When the company was established and bought Land and Building 2016/1/1 2016/12/31 Average exchange rate of 2016 0.51 0.561 0.52 Information about Retained Earnings Local Currency (LC) 6,500,000 Method USD Current Rate Method 2,600,000 650,000 Temporal Method Q1. Translate the set of financial statements of local currency to the set of financial statements of USD by Current rate method below. Income Statement (from January 1, 2016 to December 31, 2016) Account USD Revenues undisclosed Selling, General and Administrative Expenses (except depreciation) Depreciation Net Income Statement of Retained Earnings (from January 2016 to December 31, 2016) Account USD Retained Earnings of Jan 1, 2016 Net Income Dividends undisclosed Retained Earnings of Dec 31, 2016 Balance Sheet (as of December 31, 2016) Asset USD Cash undisclosed Account Receivables Land undisclosed Building Accumulated Depreciation undisclosed Total Liability and Equity USD Account Payables Loan undisclosed Common Stock Retained Earnings Translation Adjustment Total undisclosed Q2. Translate the set of financial statements of local currency to the set of financial statements of USD by Temporal method below. Income Statement (from January 1, 2016 to December 31, 2016) Account USD Revenues Selling, General and Administrative Expenses (except depreciation) undisclosed Depreciation Remeasurement GAIN Net Income Statement of Retained Earnings (from January 1, 2016 to December 31, 2016) Account USD Retained Earnings of Jan 1, 2016 Net Income Dividends undisclosed Retained Earnings of Dec 31, 2016 Balance Sheet (as of December 31, 2016) Asset USD Cash Account Receivables undisclosed Land undisclosed Building Accumulated Depreciation undisclosed Total USD Liability and Equity Account Payables undisclosed Loan Common Stock Retained Earnings Total