I need assistance in filling out financial statements based on the transactions recorded

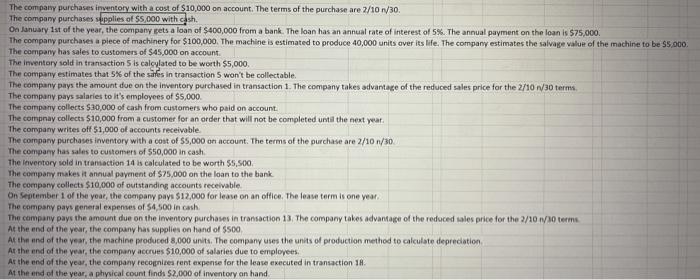

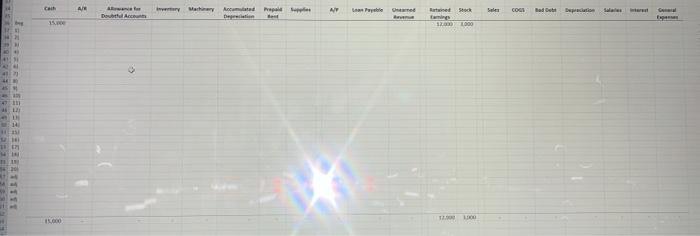

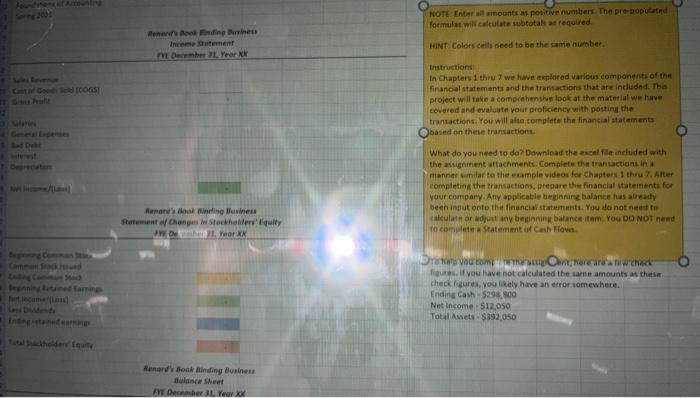

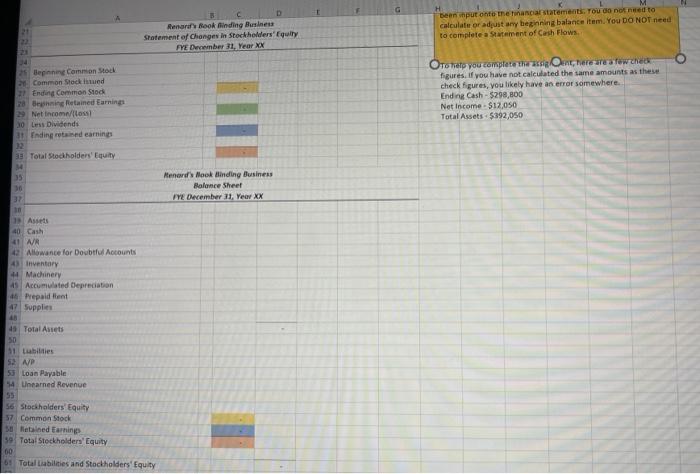

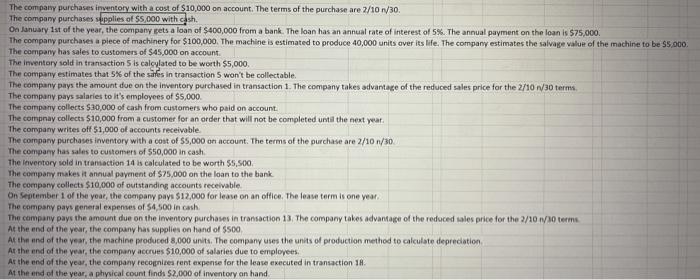

The company purchases inventory with a cost of $10,000 on account. The terms of the purchase are 2/10/30 The company purchases supplies of $5,000 with cash. On January 1st of the year, the company gets a loan of $400,000 from a bank. The loan has an annual rate of interest of 5%. The annual payment on the loan is $75,000 The company purchases a piece of machinery for $100,000. The machine is estimated to produce 40,000 units over its life. The company estimates the salvage value of the machine to be $5.000 The company has sales to customers of $45,000 on account The inventory sold in transaction 5 is calcylated to be worth $5,000 The company estimates that 5% of the sales in transaction 5 won't be collectable. The company pays the amount due on the inventory purchased in transaction 1. The company takes advantage of the reduced sales price for the 2/10 1/30 terms. The company pays salaries to it's employees of $5,000 The company collects $30,000 of cash from customers who paid on account The compnay collects $10,000 from a customer for an order that will not be completed until the next year. The company writes off $1,000 of accounts receivable The company purchases inventory with a cost of $5,000 on account. The terms of the purchase are 2/10 1/30 The company has sales to customers of $50,000 in cash, The Inventory sold in transaction 14 is calculated to be worth $5.500 The company makes it annual payment of $75,000 on the loan to the bank The company collects $10,000 of outstanding accounts receivable On Septembar 1 of the year, the company pays $12,000 for lease on an office. The lease term is one year The company pays general expenses of $4,500 in cash The company pays the amount due on the Inventory purchases in transaction 13 The company takes advantage of the reduced sales price for the 2/10 1/30 terme At the end of the year, the company has supplies on hand of $500 At the end of the year, the machine produced 8,000 units. The company uses the units of production method to calculate depreciation At the end of the year, the company accrues $10,000 of salaries due to employees At the end of the year, the company recognizes rent expense for the lease executed in transaction 18 At the end of the year, a physical count finds $2,000 of inventory on hand A y Machinery Acced hapas AY Stock COG hadde Doll Acce When 12.000000 TE 14 NOTE Entramounts positive numbers. The pre populated formules will calculate subtotal as required, Income utement De Year XK HINT Colors cell need to be the same number GOS Instructions In Chapter 1 thru we have explored various components of the financal statements and the transactions that are included. This project will take a comprehensive look at the material we have covered and evaluate your proficiency with posting the transactions. You will alta complete the financial statements based on these transactions What do you need to do? Download the excelle included with the assignment attachments Complete the transactions in manner milar to the example videos for Chapters I thru 7. Alter completing the transactions, prepare the financial statements for your company. Any applicable beginning balance has already been ingut onto the financial statement. You do not need to calculator adjust any beginning balance item You DO NOT need to complete a Statement of Cash Flow Runon ning Business Barente Changes Stockholders' Equity JYOR. Year XX Do you hane, Marrus whack figures if you have not calculated the same amounts as these checkgre, you likely have an error somewhere Ending Cash-$298.00 Net Income 512,050 Total Assets $392 050 Renard Boak Binding Business F December 31 Year KX H Renan Rook finding Business Statement of Changes in Stockholders' Equity FYE Dmber 31, Year XX been put onto the tancarstatements. Tou do not need to calculate or adjust any heginning balance item. You DO NOT need to complete a Statement of Cash Flows 2 Beinn Common Stock Common Stocked 27 Ending Common Stock 20 Behin Retained Earnings 29 Net Incomalossi 30 Less Dividends 3 Ending retsed earnings Os at you complete the entre tower figures. If you have not calculated the same amounts as these check figures, you likely have an error somewhere Ending Cash - $298,800 Net Income - $12,050 Total Assets $392,050 38 Total Stockholders' Equity 33 30 37 Menards Mook dinding Business Balance Sheet FYE December 11. Yeay XX Assets 40 Cash 41 NA 42 Allowance for Doubtful Accounts 4) Inventory 44 Machinery 45 Accumulated Depreciation 46 Prepaid fent 47 Supplies 45 Total Assets 50 1 tbilities 52 N/P 53 Loan Payable 14 Unearned Revenue 55 56 Stockholders' Equity 37 Common Stock 38 Retained Earning 59 Total Stockholders' Equity 00 61 Total Liabilities and Stockholders' Equity