Answered step by step

Verified Expert Solution

Question

1 Approved Answer

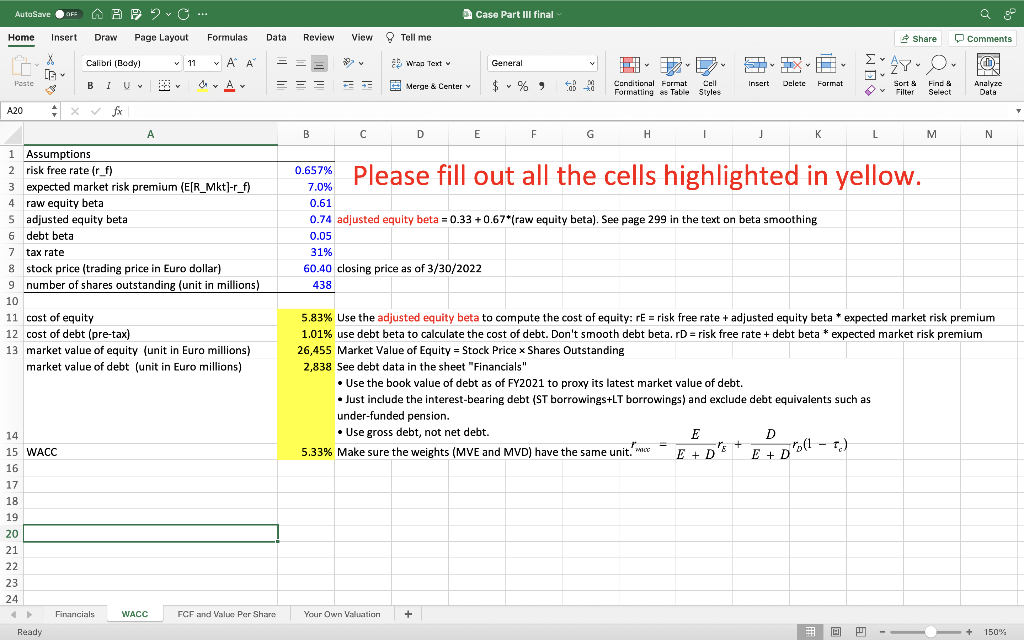

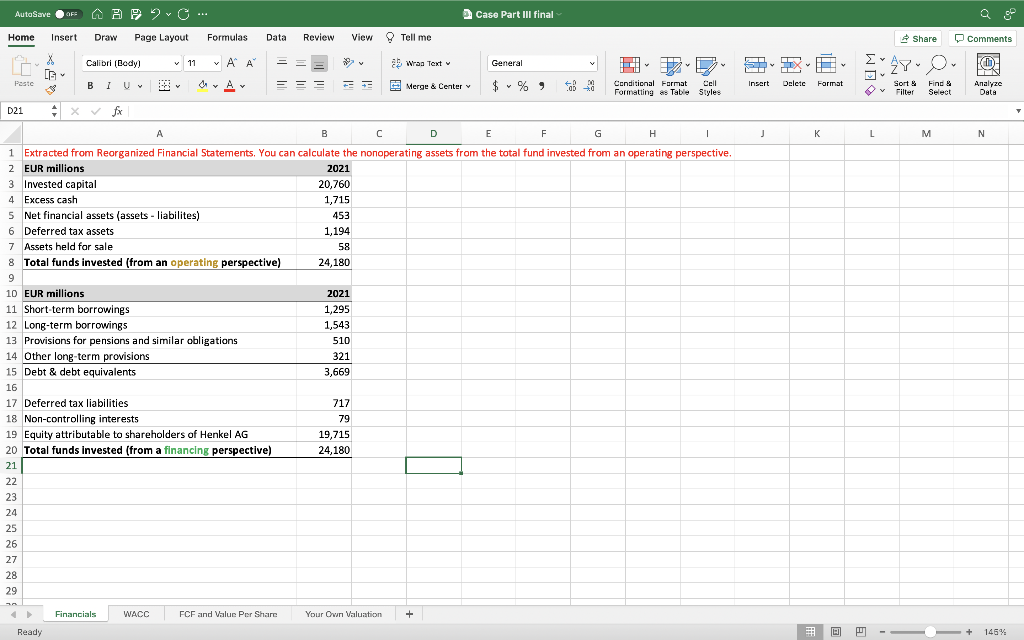

I need assistance verifying if my market value of debt in cell b13 is correct. I wasn't sure if i should've subtracted other long term

I need assistance verifying if my market value of debt in cell b13 is correct. I wasn't sure if i should've subtracted other long term provisions (cell b14 on financials spreadsheet).

AutoSave AAP 2O... OF Case Part III final Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibri (body) v 11 ~ Al A a Wraa Text y General X [G SI V () Paste BIU dA = = - - Merge & Center $ % , Insert Delete Format Y Conditional Format Cell Formatting as Table Styles Sort & Filter Fine Select Analyze Data A20 x x A B C D E F F G H H 1 j K L M N 0.657% Please fill out all the cells highlighted in yellow. 1 Assumptions 2 risk free rate (rf) 3 expected market risk premium (E[R_Mkt)-r_f) 4 raw equity beta 5 adjusted equity beta 6 debt beta 7 tax rate 8 stock price (trading price in Euro dollar) 9 number of shares outstanding (unit in millions) 10 11 cost of equity 12 cost of debt (pre-tax) 13 market value of equity (unit in Euro millions) market value of debt (unit in Euro millions) % 0.61 0.74 adjusted equity beta = 0.33 +0.67*(raw equity beta). See page 299 in the text on beta smoothing 0.05 31% 60.40 closing price as of 3/30/2022 438 5.83% Use the adjusted equity beta to compute the cost of equity: rE = risk free rate + adjusted equity beta * expected market risk premium 1.01% use debt beta to calculate the cost of debt. Don't smooth debt beta. rD = risk free rate + debt beta * expected market risk premium 26,455 Market Value of Equity - Stock Price x Shares Outstanding 2,838 See debt data in the sheet "Financials" Use the book value of debt as of FY2021 to proxy its latest market value of debt. . Just include the interest-bearing debt (ST borrowings+LT borrowings) and exclude debt equivalents such as under-funded pension. Use gross debt, not net debt. E E D 5.33% Make sure the weights (MVE and MVD) have the same unit. - + TS E + D'S o(1 - 1) E + D D' + 14 15 WACC 16 17 18 19 20 21 22 23 24 Financials Ready WACC FCF and Value Per Share Your Own Valuation + S: + 150% AutoSave AAP ... OF Case Part III final Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments SR V () Insert Format Delete Sort & Y Find & Select Filter Analyze Date V K L M N 20,760 X Calibri (Body) v 11 v P A a Wraa Text General LE Paste B 1 BIU A = = - - Merge & Center $ % ) Conditional Format Cell Formatting as Table Styles D21 + x fx A B D E F. H 1 1 Extracted from Reorganized Financial Statements. You can calculate the nonoperating assets from the total fund invested from an operating perspective. 2 EUR millions 2021 3 Invested capital 4 Excess cash 1,715 5 Net financial assets (assets - liabilites) 453 6 Deferred tax assets 1,194 7 Assets held for sale 58 8 Total funds invested (from an operating perspective) 24,180 9 10 EUR millions 2021 11 Short-term borrowings 1,295 12 Long-term borrowings 1,543 13 Provisions for pensions and similar obligations 510 14 Other long-term provisions 321 15 Debt & debt equivalents 3,669 16 17 Deferred tax liabilities 717 18 Non-controlling interests 79 19 Equity attributable to shareholders of Henkel AG 19,715 20 Total funds invested (from a financing perspective) 24,180 21 22 22 23 24 25 26 27 28 29 Financials WACC FCF and Value Per Share Your Own Valuation + Ready S: + 145% AutoSave AAP 2O... OF Case Part III final Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibri (body) v 11 ~ Al A a Wraa Text y General X [G SI V () Paste BIU dA = = - - Merge & Center $ % , Insert Delete Format Y Conditional Format Cell Formatting as Table Styles Sort & Filter Fine Select Analyze Data A20 x x A B C D E F F G H H 1 j K L M N 0.657% Please fill out all the cells highlighted in yellow. 1 Assumptions 2 risk free rate (rf) 3 expected market risk premium (E[R_Mkt)-r_f) 4 raw equity beta 5 adjusted equity beta 6 debt beta 7 tax rate 8 stock price (trading price in Euro dollar) 9 number of shares outstanding (unit in millions) 10 11 cost of equity 12 cost of debt (pre-tax) 13 market value of equity (unit in Euro millions) market value of debt (unit in Euro millions) % 0.61 0.74 adjusted equity beta = 0.33 +0.67*(raw equity beta). See page 299 in the text on beta smoothing 0.05 31% 60.40 closing price as of 3/30/2022 438 5.83% Use the adjusted equity beta to compute the cost of equity: rE = risk free rate + adjusted equity beta * expected market risk premium 1.01% use debt beta to calculate the cost of debt. Don't smooth debt beta. rD = risk free rate + debt beta * expected market risk premium 26,455 Market Value of Equity - Stock Price x Shares Outstanding 2,838 See debt data in the sheet "Financials" Use the book value of debt as of FY2021 to proxy its latest market value of debt. . Just include the interest-bearing debt (ST borrowings+LT borrowings) and exclude debt equivalents such as under-funded pension. Use gross debt, not net debt. E E D 5.33% Make sure the weights (MVE and MVD) have the same unit. - + TS E + D'S o(1 - 1) E + D D' + 14 15 WACC 16 17 18 19 20 21 22 23 24 Financials Ready WACC FCF and Value Per Share Your Own Valuation + S: + 150% AutoSave AAP ... OF Case Part III final Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments SR V () Insert Format Delete Sort & Y Find & Select Filter Analyze Date V K L M N 20,760 X Calibri (Body) v 11 v P A a Wraa Text General LE Paste B 1 BIU A = = - - Merge & Center $ % ) Conditional Format Cell Formatting as Table Styles D21 + x fx A B D E F. H 1 1 Extracted from Reorganized Financial Statements. You can calculate the nonoperating assets from the total fund invested from an operating perspective. 2 EUR millions 2021 3 Invested capital 4 Excess cash 1,715 5 Net financial assets (assets - liabilites) 453 6 Deferred tax assets 1,194 7 Assets held for sale 58 8 Total funds invested (from an operating perspective) 24,180 9 10 EUR millions 2021 11 Short-term borrowings 1,295 12 Long-term borrowings 1,543 13 Provisions for pensions and similar obligations 510 14 Other long-term provisions 321 15 Debt & debt equivalents 3,669 16 17 Deferred tax liabilities 717 18 Non-controlling interests 79 19 Equity attributable to shareholders of Henkel AG 19,715 20 Total funds invested (from a financing perspective) 24,180 21 22 22 23 24 25 26 27 28 29 Financials WACC FCF and Value Per Share Your Own Valuation + Ready S: + 145%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started