Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need calculations too! THANK YOU SO MUCH!!!!!! Be wrap Text Copy ? ??||? ?| |++] Merge & Center. | $ ? % ..0l+oo Conditional

I need calculations too! THANK YOU SO MUCH!!!!!!

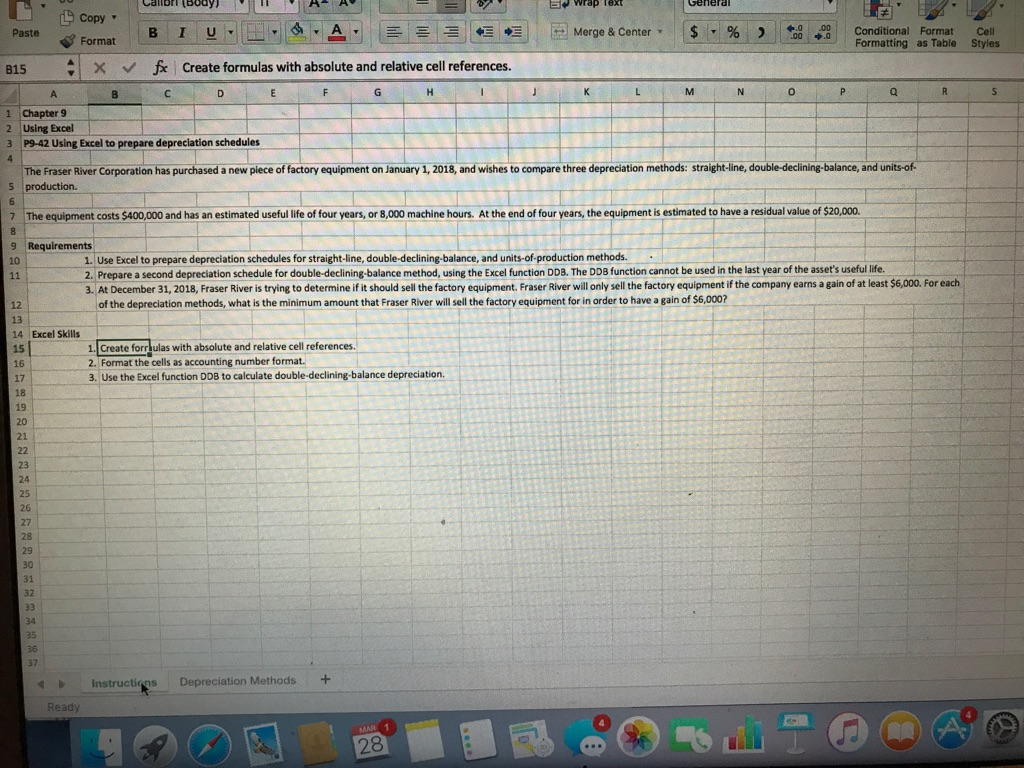

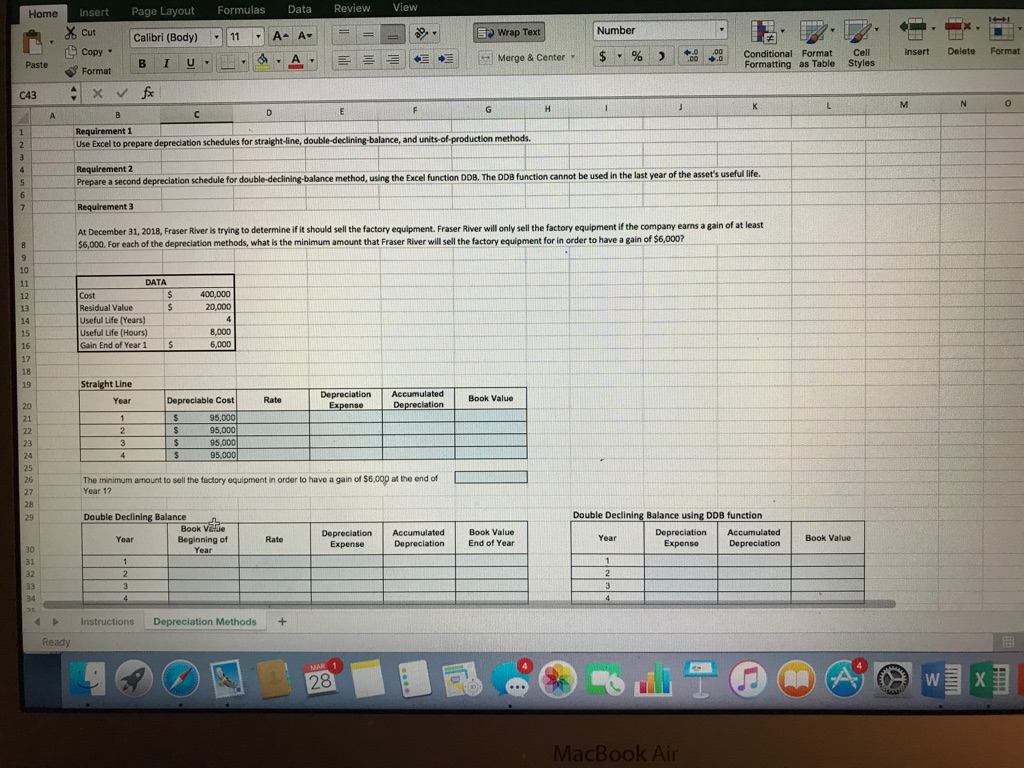

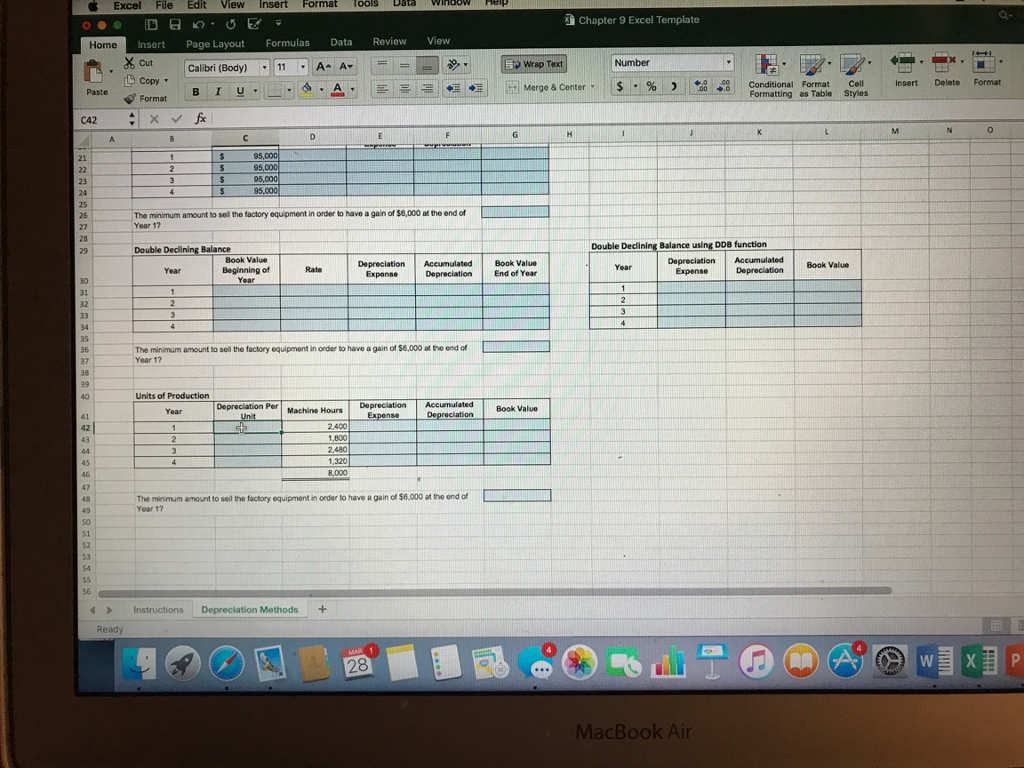

Be wrap Text Copy ? ??||? ?| |++] Merge & Center. | $ ? % ..0l+oo Conditional Format Cell Formatting as Table Styles Paste , Format B I UE B15 : 1 v/ fx i Create formulas with absolute and relative cell references. 1 Chapter 9 2 Using Excel P9-42 Using Excel to prepare depreciation schedules The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three depreciation methods: straight-line, double-declining-balance, and 7 The equipment costs $400,000 and has an estimated useful life of four years, or 8,000 machine hours. At the end of four years, the equipment is estimated to have a residual value of $20,000 9 Requirements 1. Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. 2. Prepare a second depreciation schedule for double-declining -balance method, using the Excel function DD8. The DD8 function cannot be used in the last year of the asset's useful life At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000? 12 Excel Skills 15 1. Create forr ulas with absolute and relative cell references 2. Format the cells as accounting number format. 3. Use the Excel function DD8 to calculate double-declining balance depreciation. 17 19 21 23 Instructions Depreciation Methods + ReadyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started