Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need Cash Flow statement for this. Please I have only 2 hours to do this. Please do it correctly BACKGROUND INFORMATION ZANAHORIA is a

I need Cash Flow statement for this. Please I have only 2 hours to do this. Please do it correctly

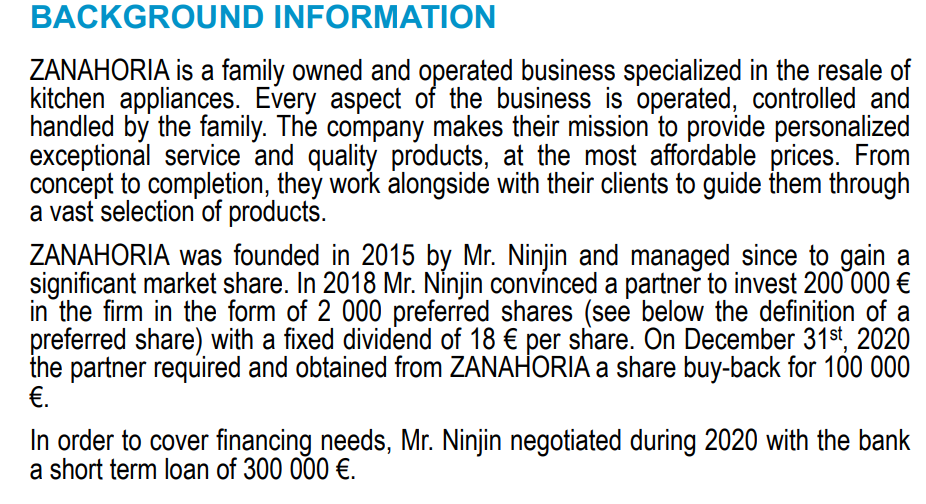

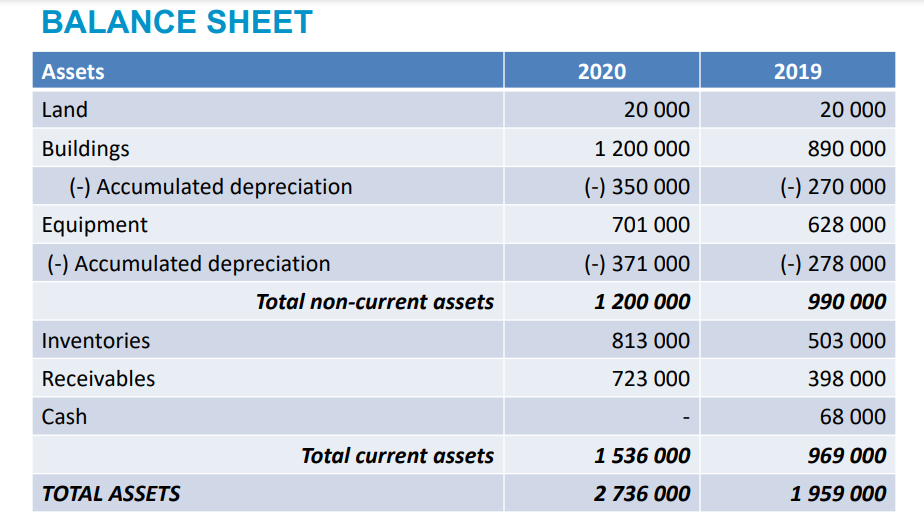

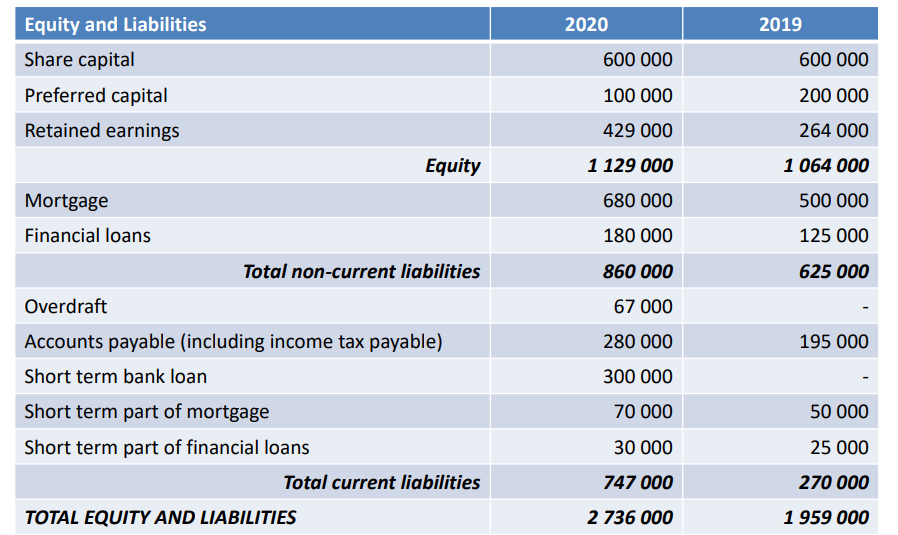

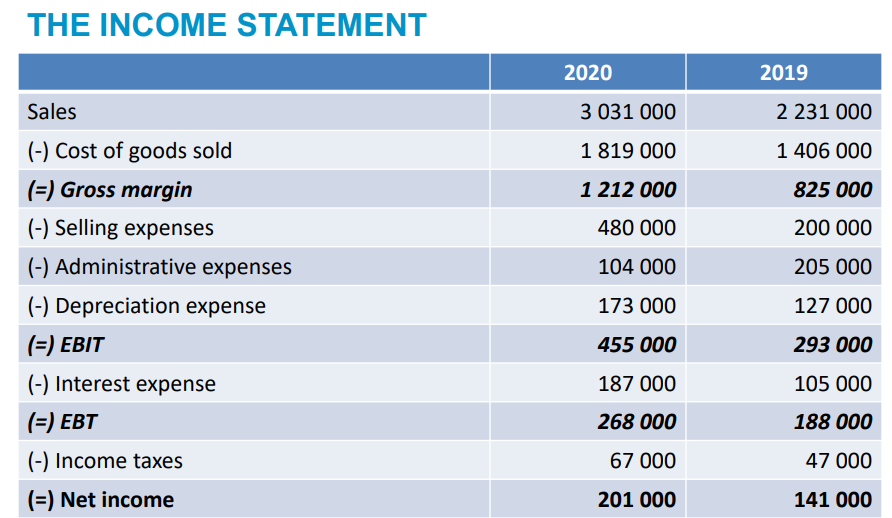

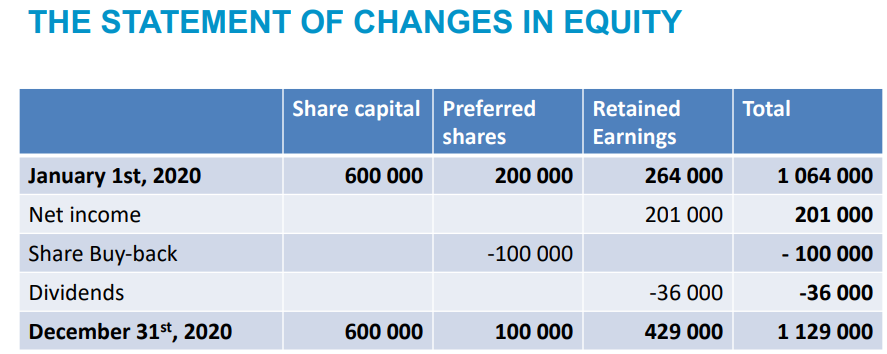

BACKGROUND INFORMATION ZANAHORIA is a family owned and operated business specialized in the resale of kitchen appliances. Every aspect of the business is operated, controlled and handled by the family. The company makes their mission to provide personalized exceptional service and quality products, at the most affordable prices. From concept to completion, they work alongside with their clients to guide them through a vast selection of products. ZANAHORIA was founded in 2015 by Mr. Ninjin and managed since to gain a significant market share. In 2018 Mr. Nnjin convinced a partner to invest 200 000 in the firm in the form of 2 000 preferred shares (see below the definition of a preferred share) with a fixed dividend of 18 per share. On December 31st , 2020 the partner required and obtained from ZANAHORIA a share buy-back for 100 000 . In order to cover financing needs, Mr. Ninjin negotiated during 2020 with the bank a short term loan of 300 000 . BALANCE SHEET Assets 2020 2019 Land 20 000 20 000 1 200 000 890 000 (-) 350 000 Buildings (-) Accumulated depreciation Equipment (-) Accumulated depreciation Total non-current assets (-) 270 000 628 000 701 000 (-) 371 000 (-) 278 000 1 200 000 990 000 Inventories 813 000 503 000 Receivables 723 000 398 000 Cash 68 000 Total current assets 1 536 000 969 000 TOTAL ASSETS 2 736 000 1 959 000 2019 2020 600 000 100 000 600 000 200 000 264 000 429 000 1 129 000 1 064 000 500 000 680 000 180 000 125 000 Equity and Liabilities Share capital Preferred capital Retained earnings Equity Mortgage Financial loans Total non-current liabilities Overdraft Accounts payable (including income tax payable) Short term bank loan Short term part of mortgage Short term part of financial loans Total current liabilities 625 000 860 000 67 000 280 000 195 000 300 000 70 000 50 000 30 000 25 000 747 000 270 000 TOTAL EQUITY AND LIABILITIES 2 736 000 1 959 000 THE INCOME STATEMENT 2020 2019 Sales 3 031 000 2 231 000 1 819 000 1 406 000 1 212 000 825 000 480 000 200 000 104 000 205 000 127 000 (-) Cost of goods sold (=) Gross margin (-) Selling expenses (-) Administrative expenses (-) Depreciation expense =) EBIT (-) Interest expense (=) EBT (-) Income taxes (=) Net income 173 000 455 000 293 000 187 000 105 000 268 000 188 000 67 000 47 000 201 000 141 000 THE STATEMENT OF CHANGES IN EQUITY Total Share capital Preferred shares Retained Earnings January 1st, 2020 600 000 200 000 264 000 1 064 000 Net income 201 000 201 000 Share Buy-back -100 000 - 100 000 Dividends -36 000 -36 000 December 31st, 2020 600 000 100 000 429 000 1 129 000 REQUIRED Mr. Ninjin is very surprised by the situation of his company. He thought everything was on track as sales and profit had steadily progressed these past years. He had bought new storage space and had also invested in new equipment to optimize administrative tasks, something which had resulted in administrative expenses decreasing very substantially. What could have gone wrong and resulted in the company being out of cash at the end of 2020? Your task is to help Mr Ninjin make sense of the situation and suggest some solutions to improve the cash balance of the company. To this end you will carry out: - An analysis of cash-flows for the year 2020. To this end you will prepare the appropriate cash-flow statement with the help of the information provided in the income statements, balance sheets for the years 2019 and 2020 and of the additional information provided in the next slides

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started