Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need correct and fast QUESTION 1 The directors of Jump Plc has just developed two new products A and B and is now considering

i need correct and fast

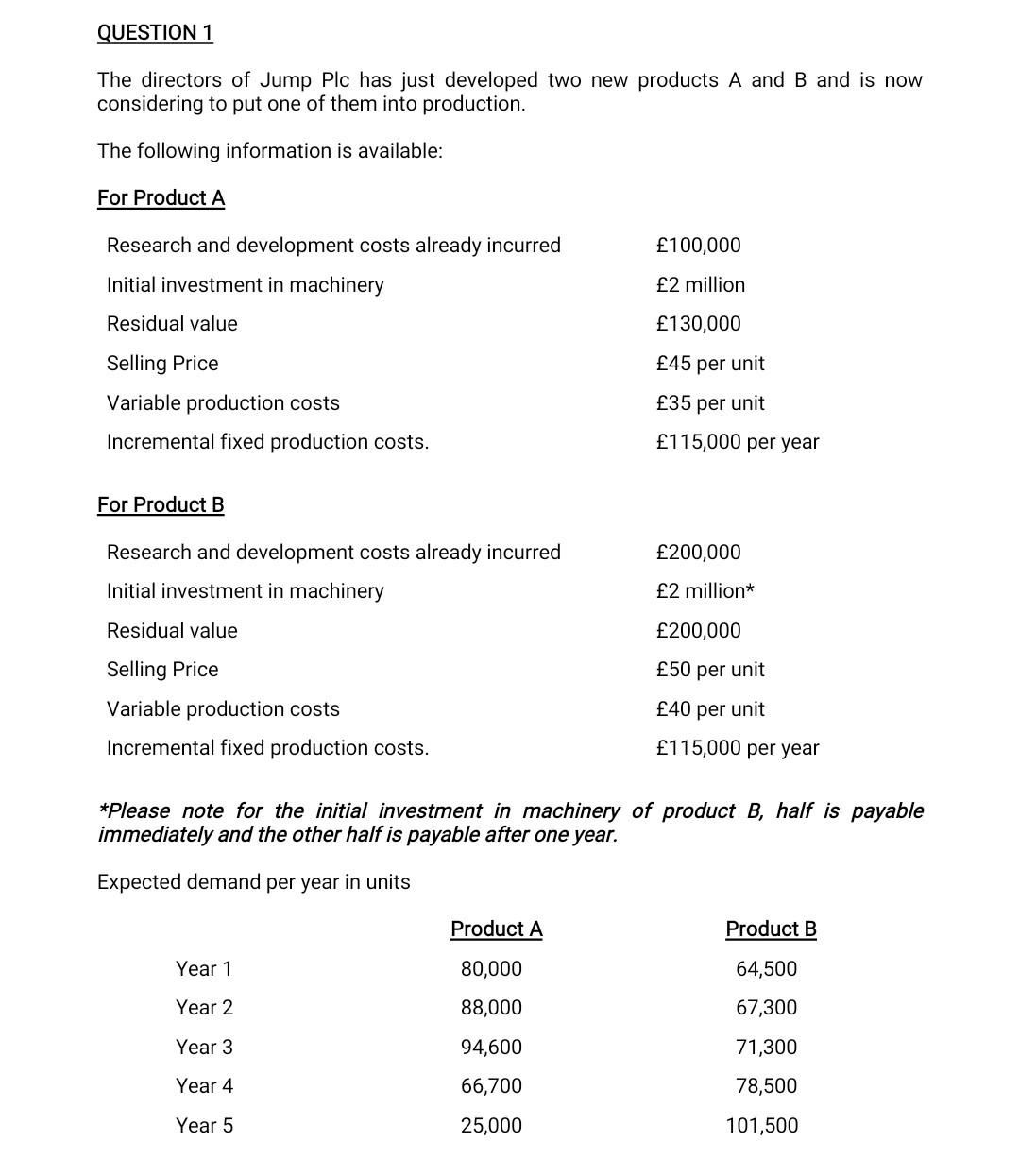

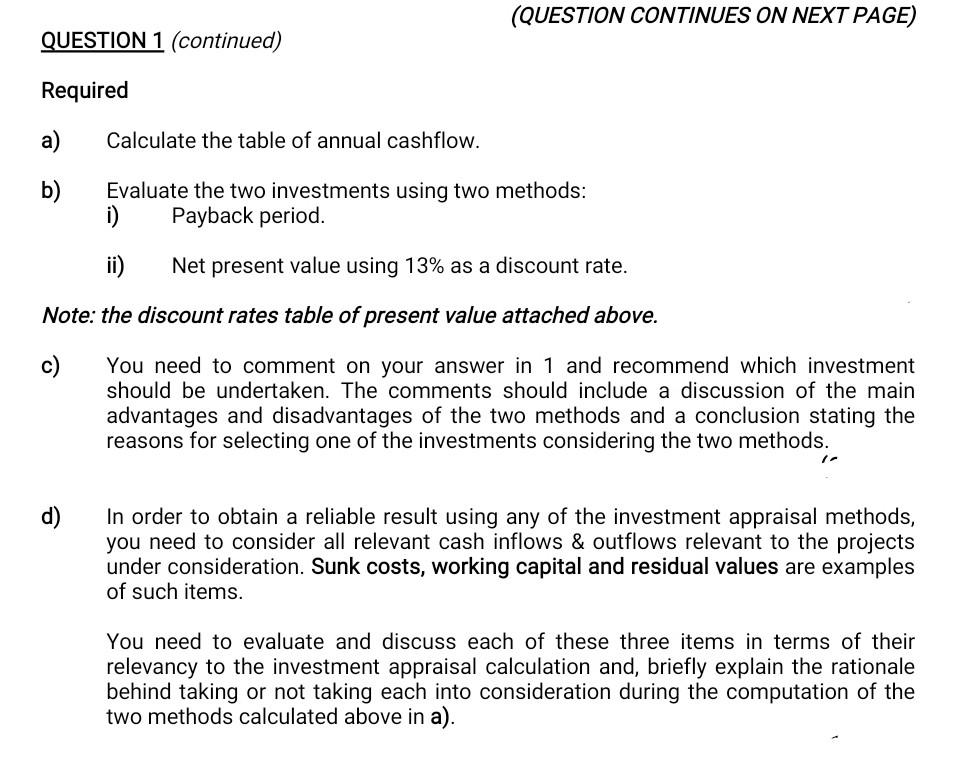

QUESTION 1 The directors of Jump Plc has just developed two new products A and B and is now considering to put one of them into production. The following information is available: For Product A Research and development costs already incurred 100,000 Initial investment in machinery 2 million. Residual value 130,000 Selling Price 45 per unit Variable production costs 35 per unit Incremental fixed production costs. 115,000 per year For Product B Research and development costs already incurred 200,000 Initial investment in machinery 2 million* Residual value 200,000 Selling Price 50 per unit Variable production costs 40 per unit Incremental fixed production costs. 115,000 per year *Please note for the initial investment in machinery of product B, half is payable immediately and the other half is payable after one year. Expected demand per year in units Product A Product B Year 1 80,000 64,500 Year 2 88,000 67,300 Year 3 94,600 71,300 Year 4 66,700 78,500 Year 5 25,000 101,500 (QUESTION CONTINUES ON NEXT PAGE) QUESTION 1 (continued) Required a) Calculate the table of annual cashflow. b) Evaluate the two investments using two methods: Payback period. ii) Net present value using 13% as a discount rate. Note: the discount rates table of present value attached above. c) You need to comment on your answer in 1 and recommend which investment should be undertaken. The comments should include a discussion of the main advantages and disadvantages of the two methods and a conclusion stating the reasons for selecting one of the investments considering the two methods. In order to obtain a reliable result using any of the investment appraisal methods, you need to consider all relevant cash inflows & outflows relevant to the projects under consideration. Sunk costs, working capital and residual values are examples of such items. You need to evaluate and discuss each of these three items in terms of their relevancy to the investment appraisal calculation and, briefly explain the rationale behind taking or not taking each into consideration during the computation of the two methods calculated above in a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started