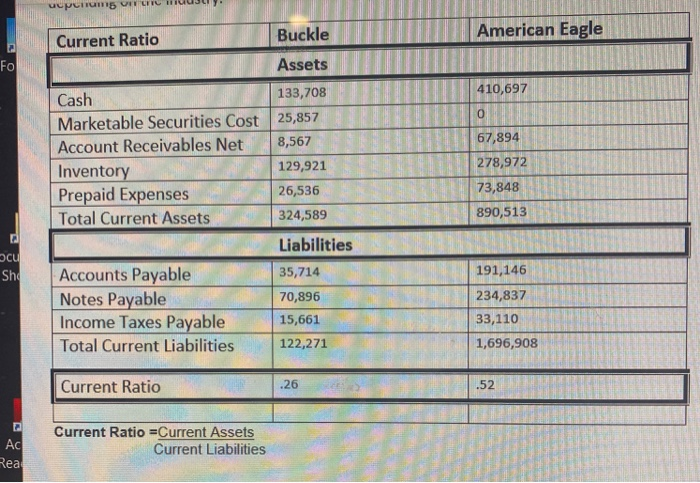

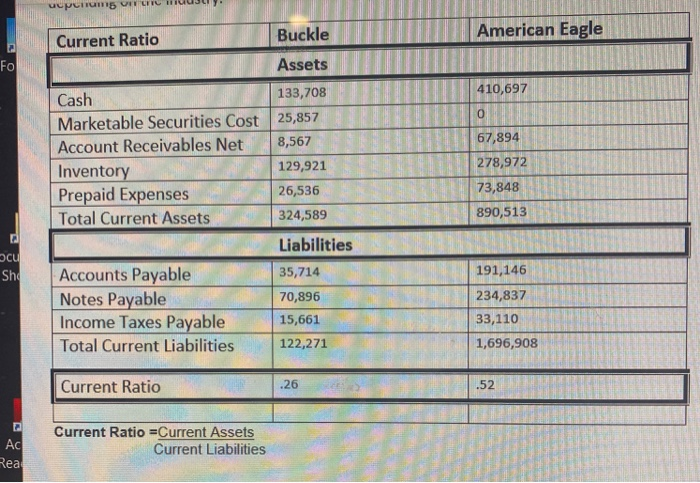

I need current Ratio and quick Ratio for these two companies.

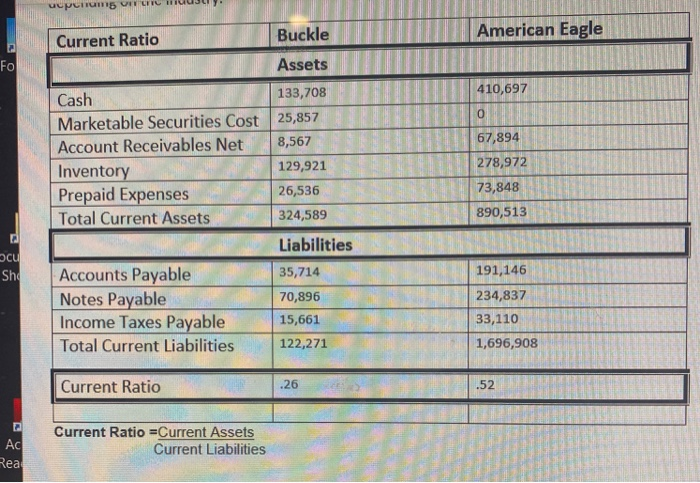

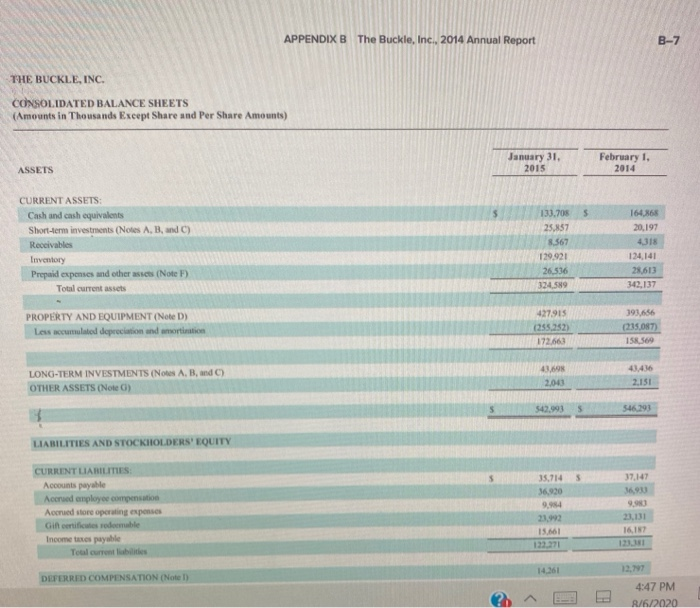

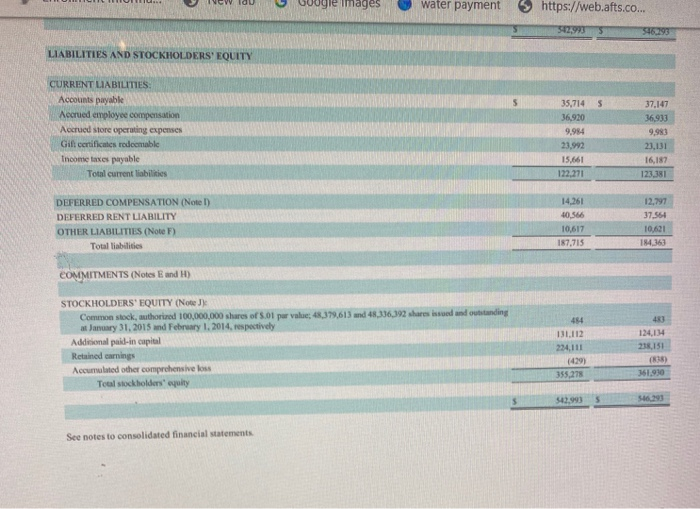

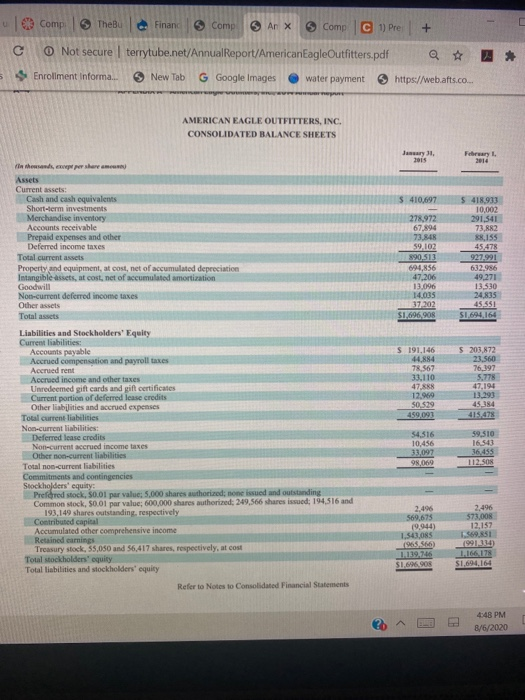

upclub cic Buckle Current Ratio American Eagle FO Assets 410,697 0 67,894 278,972 73,848 890,513 Cash 133,708 Marketable Securities Cost 25,857 Account Receivables Net 8,567 Inventory 129,921 Prepaid Expenses 26,536 Total Current Assets 324,589 Liabilities Accounts Payable 35,714 Notes Payable 70,896 Income Taxes Payable 15,661 Total Current Liabilities 122,271 cu Sho 191,146 234,837 33,110 1,696,908 Current Ratio .26 .52 Ac Rea Current Ratio =Current Assets Current Liabilities APPENDIX B The Buckle, Inc., 2014 Annual Report B-7 THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands Except Share and Per Share Amounts) January 31, February 1, 2014 ASSETS 2015 S CURRENT ASSETS: Cash and cash equivalents Short-term investments (Notes A, B, and C) Receivables Inventory Prepaid expenses and other asics (Note F) Total current assets 133.705 25,857 8.567 129,921 26,536 32459 164.868 20,197 4318 124,141 28,613 342,137 PROPERTY AND EQUIPMENT (Note D) Les accumulated depreciation and mortistin 427.915 (255.252) 172.663 393.456 (235,087) 158.569 LONG-TERM INVESTMENTS (Notes A, B, and C) OTHER ASSETS (Note ) 43,693 2,043 43:436 2.151 5 542.993 S 546.293 LIABILITIES AND STOCKHOLDERS' EQUITY 5 35.714 36,930 37.147 16 944 CURRENT LIABILITIES: Accounts payable Accred employee compensation Accrued store operating expenses Gift certificates redeemable Income taxes payable Toulourbilities 21.992 15.661 16.187 14.361 DEFERRED COMPENSATION (Note 1) 4:47 PM R/6/2020 TOU ogle images water payment https://web.afts.co. 542993 546,293 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Accounts payable Accrued employee compensation Accrued store operating expenses Gift certificates redeemable Income taxes payable Total current liabilities 35,714 5 36,920 9,984 21.992 15.661 122,271 37.147 36,933 9,983 23,131 16,187 123.381 DEFERRED COMPENSATION (Note 1) DEFERRED RENT LIABILITY OTHER LIABILITIES (Note F) Total liabilities 14.261 40,566 10,617 157,715 12,797 37.564 10,621 184363 COMMITMENTS (Notes E und H) STOCKHOLDERS' EQUITY (Note: Common stock, authorized 100,000,000 shares of 5.01 par value, 48.379.613 and 48,336,392 shares issued and outstanding at January 31, 2015 and February 1, 2014, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total stockholders' equity 484 131.112 224,111 (429) 355.278 43 124, 114 238,151 (818) 361,930 5 542.990 5 546290 See notes to consolidated financial statements Comp TheB Finand 5 Comp 5 An X > Comp C1) Pre + O Not secure terrytube.net/Annual Report/American EagleOutfitters.pdf + Enrollment informa... New Tab G Google Images water payment > https://web.afts.co... AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED BALANCE SHEETS January 31, February 1, 2014 $ 410,097 278,972 67.894 73.848 59.102 890.513 694,856 47,206 13.096 14.035 37 202 $1,696,908 5418,933 10,002 291,541 73,882 88,155 45.478 927-991 632.986 49,271 13,530 24,835 45,551 51.694,164 in the sands, pershare am) Assets Current assets Cash and cash equivalents Short-term investments Merchandise inventory Accounts receivable Prepaid expenses and other Deferred income taxes Total current assets Property and equipment, at cost, net of accumulated depreciation Intangible assets, at cost, net of accumulated amortization Goodwill Non-current deferred income taxes Other assets Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued compensation and payroll taxes Accrued rent Accrued income and other taxes Unredeemed gift cards and gift certificates Current portion of deferred lease credits Other liabilities and accrued expenses Total current liabilities Non-current liabilities: Deferred lease credit Non-current accrued income taxes Other non-current liabilities Total non-current liabilities Commitments and contingencies Stockholders' equity Preferred stock, 50.01 per value: 5.000 shares authorized: none issued and outstanding Common stock, 50.01 par value; 600,000 shares authorized: 249,566 shares issued: 194,516 and 193,149 shares outstanding, respectively Contributed capital Accumulated other comprehensive income Retained earnings Treasury stock. 55,050 and 56,417 shares, respectively, at cost Total stockholders' equity Total liabilities and stockholders' equity Refer to Notes to Consolidated Financial Statements S 191,146 44.884 78 567 33.110 47.888 12.969 50529 459,093 $ 203,872 23.560 76,197 5,778 47,194 13.293 45384 41547 54.516 59,510 16,543 10,456 31.097 98,000 112.50 2,495 569.675 (9.944) 1.54308 2,496 573.003 12,157 1.569.851 16 17 $1,694,16 S1608 4:48 PM B/6/2020