Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need detailed workings for this question please. A company invests $2,000,000 into a fund. The annual rate of interest earned on this fund is

I need detailed workings for this question please.

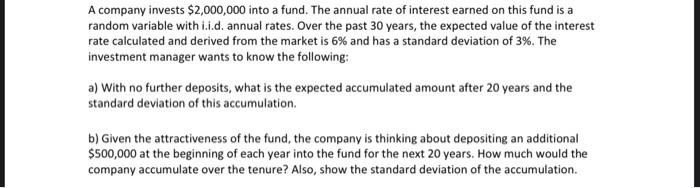

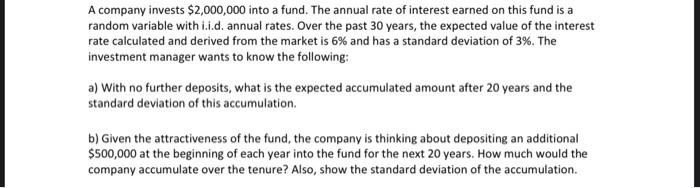

A company invests $2,000,000 into a fund. The annual rate of interest earned on this fund is a random variable with i.i.d. annual rates. Over the past 30 years, the expected value of the interest rate calculated and derived from the market is 6% and has a standard deviation of 3%. The investment manager wants to know the following: a) With no further deposits, what is the expected accumulated amount after 20 years and the standard deviation of this accumulation b) Given the attractiveness of the fund, the company is thinking about depositing an additional $500,000 at the beginning of each year into the fund for the next 20 years. How much would the company accumulate over the tenure? Also, show the standard deviation of the accumulation. A company invests $2,000,000 into a fund. The annual rate of interest earned on this fund is a random variable with i.i.d. annual rates. Over the past 30 years, the expected value of the interest rate calculated and derived from the market is 6% and has a standard deviation of 3%. The investment manager wants to know the following: a) With no further deposits, what is the expected accumulated amount after 20 years and the standard deviation of this accumulation b) Given the attractiveness of the fund, the company is thinking about depositing an additional $500,000 at the beginning of each year into the fund for the next 20 years. How much would the company accumulate over the tenure? Also, show the standard deviation of the accumulation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started