Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need E7-4B and E7-5B Exercises: Set B E7-1B Hewitt Company produces golf dises which it normally sells to retailers for $7 each. The cost

I need E7-4B and E7-5B

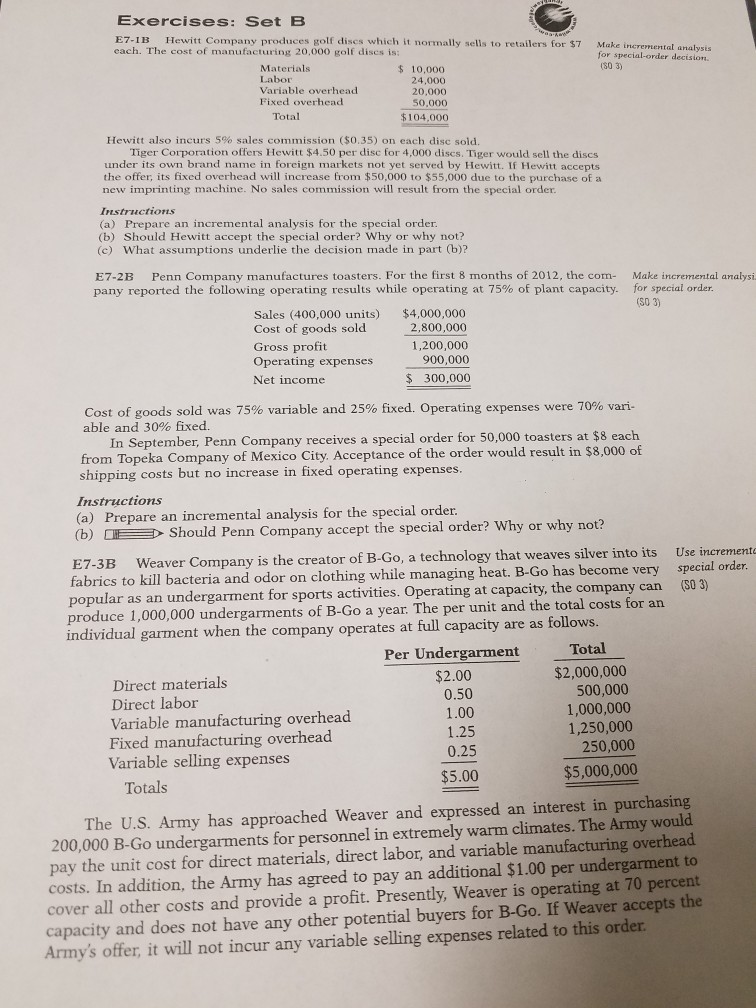

Exercises: Set B E7-1B Hewitt Company produces golf dises which it normally sells to retailers for $7 each. The cost of manufacturing 20,000 golf discs is: Make incremental analysis for special-order decision. $ 10,000 24,000 Variable overhead Fixed overhead 50,000 $104,000 Total Hewitt also incurs 5% sales commission ($0.35) on each disc sold. Tiger Corporation offers Hewitt $4.50 per disc for 4,000 discs. Tiger would sell the discs under its own brand name in foreign markets not yet served by Hewitt. If Hewitt accepts the offer, its fixed overhead will increase from $50,000 to $55,000 due to the purchase of a new imprinting machine. No sales commission will result from the special order. Instructions (a) Prepare an incremental analysis for the special order (b) Should Hewitt accept the special order? Why or why not? (c) What assumptions underlie the decision made in part (b)? Penn Company manufactures toasters. For the first 8 months of 2012, the com- Make incremental analys E7-2B pany reported the following operating results while operating at 75% of plant capacity for special order. (S0 Sales (400,000 units) Cost of goods sold Gross profit Operating expenses Net income $4,000,000 2,800,000 1,200,000 900,000 300,000 Cost of goods sold was 75% variable and 25% fixed. Operating expenses were 70% van able and 30% fixed. In September, Penn Company receives a special order for 50,000 toasters at $8 each a Company of Mexico City. Acceptance of the order would result in $8,000 of operating expenses from Topek shipping costs but no increase in fixed Instructions (a) Prepare an incremental analysis for the special order. (b) Should Penn Company accept the special order? Why or why not? E7-3B Weaver Company is the creator of B.Go, a technology that weaves siver into its Use i special order (S0 3) fabrics to kill bacteria and odor on clothing while managing heat. B-Go has become very popular as an undergarment for sports activities. Operating at capacity, the company can produce 1,000,000 undergarments of B-Go a year: The per unit and the total costs for an individual garment when the company operates at full capacity are as follows. Total Per Undergarment Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses $2,000,000 500,000 1,000,000 1,250,000 250,000 0.50 $5.00 $5,000,000 Totals The U.S. Army has approached Weaver and expressed an interest in purchasing 200,000 B-Go undergarments for personnel in extremely warm climates. The Army would pay the unit cost for direct materials, direct labor, and variable manufacturing overhead costs. In addition, the Army has agreed to pay an additional $1.00 per undergarment to cover all other costs and provide a profit. Presently, Weaver is operating at 70 percent capacity and does not have any other potential buyers for B-Go. If Weaver accepts the Army's offer, it will not incur any variable selling expenses related to this order Exercises: Set B E7-1B Hewitt Company produces golf dises which it normally sells to retailers for $7 each. The cost of manufacturing 20,000 golf discs is: Make incremental analysis for special-order decision. $ 10,000 24,000 Variable overhead Fixed overhead 50,000 $104,000 Total Hewitt also incurs 5% sales commission ($0.35) on each disc sold. Tiger Corporation offers Hewitt $4.50 per disc for 4,000 discs. Tiger would sell the discs under its own brand name in foreign markets not yet served by Hewitt. If Hewitt accepts the offer, its fixed overhead will increase from $50,000 to $55,000 due to the purchase of a new imprinting machine. No sales commission will result from the special order. Instructions (a) Prepare an incremental analysis for the special order (b) Should Hewitt accept the special order? Why or why not? (c) What assumptions underlie the decision made in part (b)? Penn Company manufactures toasters. For the first 8 months of 2012, the com- Make incremental analys E7-2B pany reported the following operating results while operating at 75% of plant capacity for special order. (S0 Sales (400,000 units) Cost of goods sold Gross profit Operating expenses Net income $4,000,000 2,800,000 1,200,000 900,000 300,000 Cost of goods sold was 75% variable and 25% fixed. Operating expenses were 70% van able and 30% fixed. In September, Penn Company receives a special order for 50,000 toasters at $8 each a Company of Mexico City. Acceptance of the order would result in $8,000 of operating expenses from Topek shipping costs but no increase in fixed Instructions (a) Prepare an incremental analysis for the special order. (b) Should Penn Company accept the special order? Why or why not? E7-3B Weaver Company is the creator of B.Go, a technology that weaves siver into its Use i special order (S0 3) fabrics to kill bacteria and odor on clothing while managing heat. B-Go has become very popular as an undergarment for sports activities. Operating at capacity, the company can produce 1,000,000 undergarments of B-Go a year: The per unit and the total costs for an individual garment when the company operates at full capacity are as follows. Total Per Undergarment Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses $2,000,000 500,000 1,000,000 1,250,000 250,000 0.50 $5.00 $5,000,000 Totals The U.S. Army has approached Weaver and expressed an interest in purchasing 200,000 B-Go undergarments for personnel in extremely warm climates. The Army would pay the unit cost for direct materials, direct labor, and variable manufacturing overhead costs. In addition, the Army has agreed to pay an additional $1.00 per undergarment to cover all other costs and provide a profit. Presently, Weaver is operating at 70 percent capacity and does not have any other potential buyers for B-Go. If Weaver accepts the Army's offer, it will not incur any variable selling expenses related to this orderStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started