I need entries and answers for all steps 1-10 ASAP!! All need info is included. Thank you endlessly in advance!

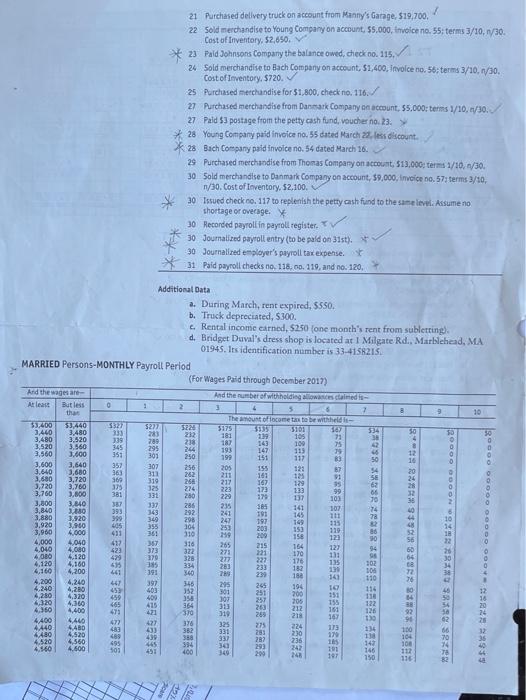

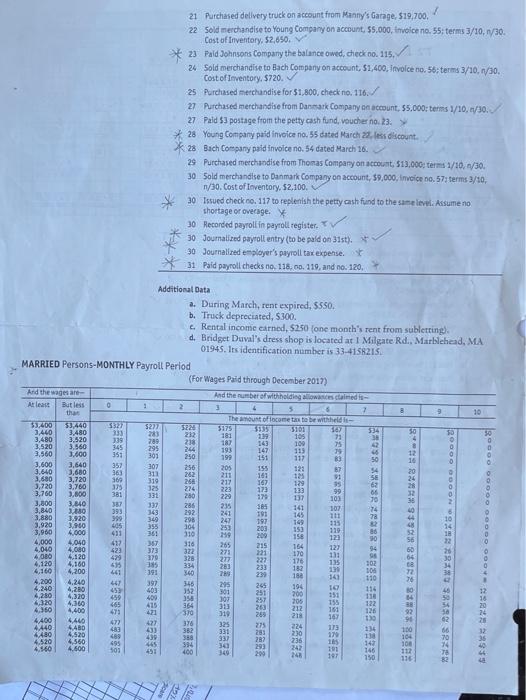

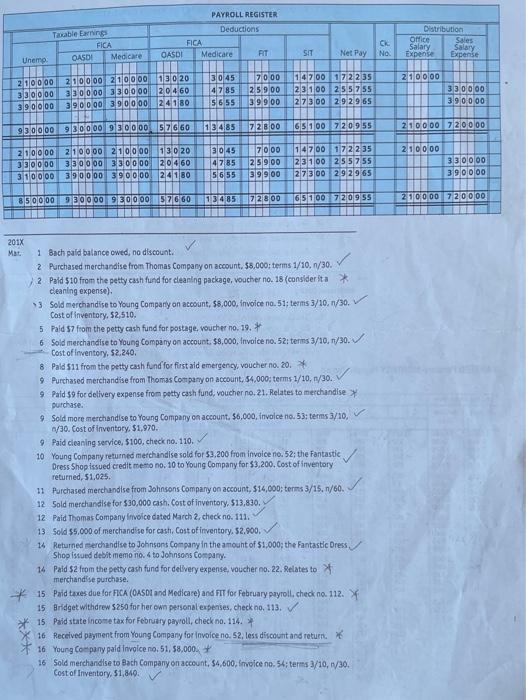

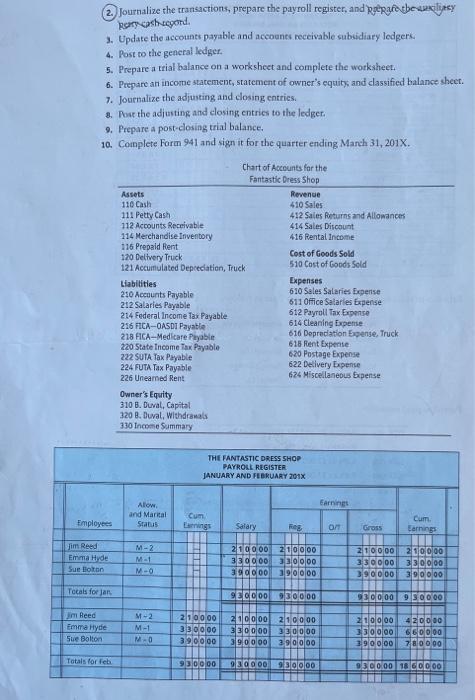

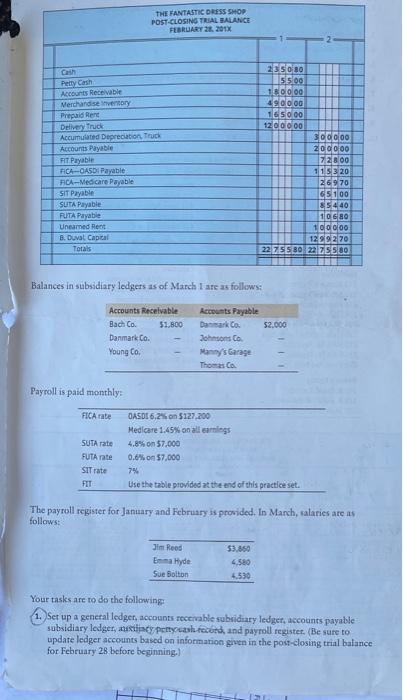

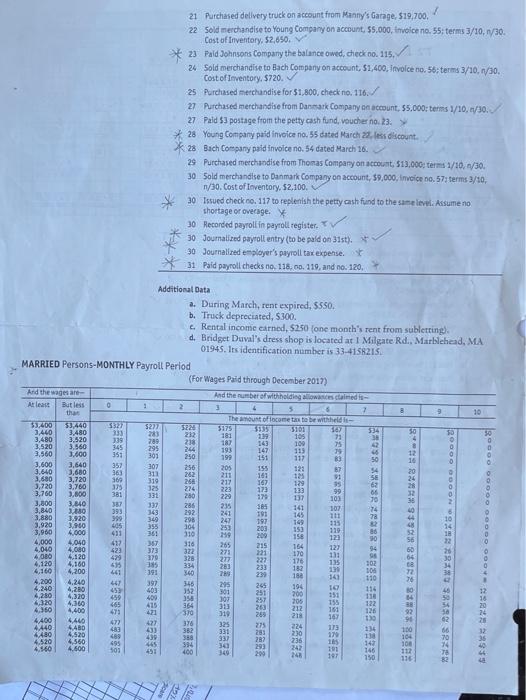

7 21 Purchased delivery truck on account from Manny's Garage $19,700, 22 Sold merchandise to Young Company on account, 55.000, invoice no. 55: terms 3/10,30 Cost of Inventory, $2,650. V * 23 Pald Johnsons Company the balance owed, check no. 115. 24 Sold merchandise to Bach Company on account. 51,400, Invoice no. 56: terms 3/10, 1/30 Cost of Inventory, 5720. 25 Purchased merchandise for $1,800, check no. 116./ 27 Purchased merchandise from Dark Company on account, 55,000: terms 1/10, 1/30. 27 Pald $ postage from the petty cash fund, voucher no 23. 28 Young Company paid invoice no. 55 dated March 27. less discount 28 Bach Company paid invoice no. 54 dated March 16. 29 Purchased merchandise from Thomas Company on account, 513,000; terms 1/10, 1/30. 30 Sold merchandise to Danmark Company on account, 59,000, invece no. 57 terms 3/10, 30. Cost of Teventory 2.100 30 Issued check no. 117 to replenish the petty cash fund to the same level Assume no shortage or overage. Y 30 Recorded payroll in payroll register. 30 Journalized payroll entry (to be paid on 31st). (a 30 Journalined employer's payroll tax expense. * 1 Paid paroll becks 10 18.0.19 and no. 120 Additional Data a. During March, rent expired, 5550. b. Truck deprecated, 5.300. Rental income earned, $250 (one month's rent from sublering). d. Bridget Duval's dress shop is located at 1 Milgate Rd., Marblehead, MA 01945. Its identification number is 33-4158215 MARRIED Persons-MONTHLY Payroll Period ( (For Wages Paid through December 2017) And the wagen- And the number of withholding was taimed Butless that 2 3 7 8 9 10 $3,400 3,440 3323 3.33 339 345 351 1480 38 283 289 295 301 218 250 10 3,520 3.560 3.600 3.640 3,680 3,720 3,760 357 363 369 30 307 311 319 54 SE 381 53,440 3.480 3.520 3.560 3.000 3,640 3,680 3,720 3.780 2.800 1446 30 3.920 STCO 4,040 4.080 4.120 4.160 4.200 70 2.800 337 343 74 78 256 262 26 274 280 286 292 298 104 310 316 322 328 334 3,840 3,880 3.920 3,960 4.000 4,040 adb 355 337 393 999 A. 411 437 423 429 6 441 The amount of income tax to be withheld- 5175 5101 181 21 105 71 182 143 109 193 147 119 199 151 117 205 155 123 -- 211 161 125 217 167 129 35 223 173 233 99 229 170 137 103 235 141 107 241 191 145 111 197 149 135 25 203 151 119 158 12 265 215 164 129 273 21 170 277 227 176 11: 135 233 182 75 239 182 14 245 194 251 200 100 205 155 333 26 212 161 319 269 218 167 325 113 331 281 2010 170 337 282 236 34 242 101 209 197 30 56 367 373 370 335 391 54 1 Song soodsgh oooooooooooco 4120 4,160 110 47 115 30 4.240 4,280 4,320 4.360 4,400 459 465 397 403 409 413 421 4 4.240 4,280 4,320 4,400 4440 , 4.520 4.560 546 352 34 364 370 122 126 ) AD 4,520 4,560 4.600 477 43 489 493 101 427 4 439 44 453 376 382 388 394 134 130 100 104 100 146 750 116 PAYROLL REGISTER Deductions Taxable Ewing FICA Unemo QADI Medicare Office FICA QASDI Medicare Distribution Sales Salary Expense Expense CK Net Pay No sal RT SIT 210000 2 100 00 3,300.00 39 00 00 210000 200000 13 0 20 33 0000 3 30000 20460 390 000 390000 24180 30 45 4785 5655 7000 2.5 900 39 900 147 00 17 2235 2 3 100 25 5 755 27 300 29 29 65 330 000 390 000 930 000 9.30 000 9300.00 BZG 60 13485 728 00 65 100 720 9 55 210000 720000 2100.00 210000 21 00 00 21 00 00 130 20 330000 33 0000 330000 20 460 310000 390000 390000! 24180 30 45 47.85 56 55 7 000 2/5 900 39900 14700 172235 2 3 100 2.5 57 55 27 300 292965 330 000 390000 - 8 500 00 930000 90000576 13485 72800 65100 7 20/955 210000 720 000 2018 Mat 1 Bach paid balance owed, no discount 2 Purchased merchandise from Thomas Company on account, 88,000; terms 1/10, 1/30. 2 Paid $10 from the petty cash fund for cleaning package, voucher no. 18 (consider ita* deaning expense) 3 Sold merchandise to Young Comparly on account, $8,000, invoice no. 51; terms 3/10, 1/30, Cost of inventory 52,510. 5 Paid 57 from the petty cash fund for. postage, voucher no. 19. 6 Sold merchandise to Young Company on account. 58,000, Invoice no. 52: terms 3/10, 1/30. Cost of inventory, 52.240, 8 Pald 511 from the petty cash fund for first aid emergency, voucher no. 20. 9 Purchased merchandise from Thomas Company on account, 54.000; terms 1/10,n/30. 9 Pald S9 for delivery expense from petty cash fund, voucher no. 21. Relates to merchandise purchase. 9 Sold more merchandise to Young Company on account. $6,000. Involce no. 53: terms 3/10, /30. Cost of inventory $1.970. 9 Paid cleaning service, 5100, check no. 110. 10 Young Company returned merchandise sold for $3,200 from invoice no. 52: the Fantastic Dress Shop issued credit me no. 10 to Young Company for $3,200. Cost of inventory returned, 51,025. 11 Purchased merchandise from Johnsons Company on account, $14,000; terms 3/15, 1/60 12 Sold merchandise for $30,000 cash. Cost of inventory, 513,830. 12 Paid Thomas Company Invoice dated March 2. check no. 111. 13 Sold $5,000 of merchandise for cash. Cost of inventory, 52.900. 14 Returned merchandise to Johnson Company in the amount of 51.000; the Fantastic Dress Shop issued debit memo no. 4 to Johnsons Company. 14 Paid $2 from the petty cash fund for delivery expense voucher no. 22. Relates to merchandise purchase * 15 Poid taxes due for FICA (OASot and Medicare) and FIT for February payroll, check no. 112. * 15 Bridget withdrew S250 for her own personal expenses, check no. 113. 15 Paid state income tax for February payroll, check no. 114. * 16 Received payment from Young Company for Invoice no. 52, less discount and return. 16 Young Company paid invoice no. 51, 58,000 + 16 Sold merchandise to Bach Company on account, 54,600, Invoice no. 54; terms 3/10,30. Cost of Inventory, 51,840 2. Journalize the transactions, prepare the payroll register, and operafotbewakility Rashegord. 3. Update the accounts payable and accounts receivable subsidiary ledgers 4. Post to the general ledger 5. Prepare a trial balance on a worksheet and complete the worksheet. 6. Prepare an income statement, statement of owner's equity, and classified balance sheet. 7. Journalize the adjusting and closing entries. 3. Pose the adjusting and closing entries to the ledger 9. Prepare a post-closing trial balance, 10. Complete Form 941 and sign it for the quarter ending March 31, 2017. Chart of Accounts for the Fantastic Dress Shop Assets 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Merchandise Inventory 116 Prepaid Rent 120 Delivery Truck 121 Accumulated Depreciation, Truck Revenue 410 Sales 412 Sales Returns and Allowances 414 Sales Discount 416 Rental Income Cost of Goods Sold 510 Cost of Goods Sold Liabilities 210 Accounts Payable 212 Salaries Payable 214 Federal Income Tax Payable 236 FICA-OASDT Payable 218 FICA-Medicare Payable 220 State Income Tax Payable 222 SUTA Tax Payable 224 FUTA Tax Payable 226 Uneamed Rent Expenses 610 Sales Salaries Expertse 611 Office Salaries Expense 612 Payroll Tax Expense 614 Cleaning Expense 616 Depreciation Expense, Truck 618 Rent Experte 620 Postage Expense 622 Delivery Expense 624 Miscellaneous Sipense Owner's Equity 310 B. Duval, Capital 320 8. Duval, Withdrawals 330 Income Summary THE FANTASTIC DRESS SHOP PAYROLL REGISTER JANUARY AND FEBRUARY 2018 Earnings Allow and Marital Status Employees Cum Earnings Salary Reg OM Cum Earnings Gross Jim Reed Emma Hyde Sue Boon M-2 M-1 MO 210000 200000 330 000 33 0000 390000 390000 210000 330 000 390000 200000 3,30 000 390000 Tecals for an SEC000 930000 530000 9.50000 im Reed M-2 Emma Hyde M-1 210000 330 000 3.900.00 210000 330 000 390 000 210000 33 00 390000 210 000 330 000 390000 420 000 600.00 7 al 0 0 Sue Bolton M0 Totals for Feb 930000 9/30000 950000 1000000 THE FANTASTIC DRESS SHOP POST-CLOSING TRIAL BALANCE FEBRUARY 2017 Petty Cash Accounts Receivable Merchandise vor Prepaid Rent Delivery truck Accumulated Deprecation. Truck Accounts Payable FIT Payable FICA OASI Payable RC-Medicare Payable SIT Payable SUTA Payable RUTA Payable Uneamed Hent B. Duval Capital Totals 255080 55.00 100g 49 dolog 1650.00 120 00 00 300000 200 000 72800 1153 20 269 70 65109 85440 106 80 10 000 12.99 270 22 ZEE 80 22 ZEEBO Balances in subsidiary ledgers as of March are as follows: Accounts Receivable Accounts Payable Bach Co. 51.800 52.000 Danmark Co. Johnson Co. Young Co Manny's Garage Thomas Payroll is paid monthly FICA rate OASI 6,2% on $127,200 Medicare 1.45% on all earnings SUTA rate 4.8% on 57.000 0.6kon 57.000 FUTA te SIT rate 7% FIT Use the table provided at the end of this practice set. The payroll register for January and February is provided. In March, talaries are us follows: Jim Reed 53.850 En Hyde 4580 Sue Bolton 4.530 Your tasks are to do the following 4. Set up a general ledger, accounts receivable subsidiary ledger, accounts payable subsidiary ledger, usiljacy pettywash teed, and payroll register. (Be sure to update ledger accounts based on information given in the post-closing trial balance for February 28 before beginning.) 7 21 Purchased delivery truck on account from Manny's Garage $19,700, 22 Sold merchandise to Young Company on account, 55.000, invoice no. 55: terms 3/10,30 Cost of Inventory, $2,650. V * 23 Pald Johnsons Company the balance owed, check no. 115. 24 Sold merchandise to Bach Company on account. 51,400, Invoice no. 56: terms 3/10, 1/30 Cost of Inventory, 5720. 25 Purchased merchandise for $1,800, check no. 116./ 27 Purchased merchandise from Dark Company on account, 55,000: terms 1/10, 1/30. 27 Pald $ postage from the petty cash fund, voucher no 23. 28 Young Company paid invoice no. 55 dated March 27. less discount 28 Bach Company paid invoice no. 54 dated March 16. 29 Purchased merchandise from Thomas Company on account, 513,000; terms 1/10, 1/30. 30 Sold merchandise to Danmark Company on account, 59,000, invece no. 57 terms 3/10, 30. Cost of Teventory 2.100 30 Issued check no. 117 to replenish the petty cash fund to the same level Assume no shortage or overage. Y 30 Recorded payroll in payroll register. 30 Journalized payroll entry (to be paid on 31st). (a 30 Journalined employer's payroll tax expense. * 1 Paid paroll becks 10 18.0.19 and no. 120 Additional Data a. During March, rent expired, 5550. b. Truck deprecated, 5.300. Rental income earned, $250 (one month's rent from sublering). d. Bridget Duval's dress shop is located at 1 Milgate Rd., Marblehead, MA 01945. Its identification number is 33-4158215 MARRIED Persons-MONTHLY Payroll Period ( (For Wages Paid through December 2017) And the wagen- And the number of withholding was taimed Butless that 2 3 7 8 9 10 $3,400 3,440 3323 3.33 339 345 351 1480 38 283 289 295 301 218 250 10 3,520 3.560 3.600 3.640 3,680 3,720 3,760 357 363 369 30 307 311 319 54 SE 381 53,440 3.480 3.520 3.560 3.000 3,640 3,680 3,720 3.780 2.800 1446 30 3.920 STCO 4,040 4.080 4.120 4.160 4.200 70 2.800 337 343 74 78 256 262 26 274 280 286 292 298 104 310 316 322 328 334 3,840 3,880 3.920 3,960 4.000 4,040 adb 355 337 393 999 A. 411 437 423 429 6 441 The amount of income tax to be withheld- 5175 5101 181 21 105 71 182 143 109 193 147 119 199 151 117 205 155 123 -- 211 161 125 217 167 129 35 223 173 233 99 229 170 137 103 235 141 107 241 191 145 111 197 149 135 25 203 151 119 158 12 265 215 164 129 273 21 170 277 227 176 11: 135 233 182 75 239 182 14 245 194 251 200 100 205 155 333 26 212 161 319 269 218 167 325 113 331 281 2010 170 337 282 236 34 242 101 209 197 30 56 367 373 370 335 391 54 1 Song soodsgh oooooooooooco 4120 4,160 110 47 115 30 4.240 4,280 4,320 4.360 4,400 459 465 397 403 409 413 421 4 4.240 4,280 4,320 4,400 4440 , 4.520 4.560 546 352 34 364 370 122 126 ) AD 4,520 4,560 4.600 477 43 489 493 101 427 4 439 44 453 376 382 388 394 134 130 100 104 100 146 750 116 PAYROLL REGISTER Deductions Taxable Ewing FICA Unemo QADI Medicare Office FICA QASDI Medicare Distribution Sales Salary Expense Expense CK Net Pay No sal RT SIT 210000 2 100 00 3,300.00 39 00 00 210000 200000 13 0 20 33 0000 3 30000 20460 390 000 390000 24180 30 45 4785 5655 7000 2.5 900 39 900 147 00 17 2235 2 3 100 25 5 755 27 300 29 29 65 330 000 390 000 930 000 9.30 000 9300.00 BZG 60 13485 728 00 65 100 720 9 55 210000 720000 2100.00 210000 21 00 00 21 00 00 130 20 330000 33 0000 330000 20 460 310000 390000 390000! 24180 30 45 47.85 56 55 7 000 2/5 900 39900 14700 172235 2 3 100 2.5 57 55 27 300 292965 330 000 390000 - 8 500 00 930000 90000576 13485 72800 65100 7 20/955 210000 720 000 2018 Mat 1 Bach paid balance owed, no discount 2 Purchased merchandise from Thomas Company on account, 88,000; terms 1/10, 1/30. 2 Paid $10 from the petty cash fund for cleaning package, voucher no. 18 (consider ita* deaning expense) 3 Sold merchandise to Young Comparly on account, $8,000, invoice no. 51; terms 3/10, 1/30, Cost of inventory 52,510. 5 Paid 57 from the petty cash fund for. postage, voucher no. 19. 6 Sold merchandise to Young Company on account. 58,000, Invoice no. 52: terms 3/10, 1/30. Cost of inventory, 52.240, 8 Pald 511 from the petty cash fund for first aid emergency, voucher no. 20. 9 Purchased merchandise from Thomas Company on account, 54.000; terms 1/10,n/30. 9 Pald S9 for delivery expense from petty cash fund, voucher no. 21. Relates to merchandise purchase. 9 Sold more merchandise to Young Company on account. $6,000. Involce no. 53: terms 3/10, /30. Cost of inventory $1.970. 9 Paid cleaning service, 5100, check no. 110. 10 Young Company returned merchandise sold for $3,200 from invoice no. 52: the Fantastic Dress Shop issued credit me no. 10 to Young Company for $3,200. Cost of inventory returned, 51,025. 11 Purchased merchandise from Johnsons Company on account, $14,000; terms 3/15, 1/60 12 Sold merchandise for $30,000 cash. Cost of inventory, 513,830. 12 Paid Thomas Company Invoice dated March 2. check no. 111. 13 Sold $5,000 of merchandise for cash. Cost of inventory, 52.900. 14 Returned merchandise to Johnson Company in the amount of 51.000; the Fantastic Dress Shop issued debit memo no. 4 to Johnsons Company. 14 Paid $2 from the petty cash fund for delivery expense voucher no. 22. Relates to merchandise purchase * 15 Poid taxes due for FICA (OASot and Medicare) and FIT for February payroll, check no. 112. * 15 Bridget withdrew S250 for her own personal expenses, check no. 113. 15 Paid state income tax for February payroll, check no. 114. * 16 Received payment from Young Company for Invoice no. 52, less discount and return. 16 Young Company paid invoice no. 51, 58,000 + 16 Sold merchandise to Bach Company on account, 54,600, Invoice no. 54; terms 3/10,30. Cost of Inventory, 51,840 2. Journalize the transactions, prepare the payroll register, and operafotbewakility Rashegord. 3. Update the accounts payable and accounts receivable subsidiary ledgers 4. Post to the general ledger 5. Prepare a trial balance on a worksheet and complete the worksheet. 6. Prepare an income statement, statement of owner's equity, and classified balance sheet. 7. Journalize the adjusting and closing entries. 3. Pose the adjusting and closing entries to the ledger 9. Prepare a post-closing trial balance, 10. Complete Form 941 and sign it for the quarter ending March 31, 2017. Chart of Accounts for the Fantastic Dress Shop Assets 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Merchandise Inventory 116 Prepaid Rent 120 Delivery Truck 121 Accumulated Depreciation, Truck Revenue 410 Sales 412 Sales Returns and Allowances 414 Sales Discount 416 Rental Income Cost of Goods Sold 510 Cost of Goods Sold Liabilities 210 Accounts Payable 212 Salaries Payable 214 Federal Income Tax Payable 236 FICA-OASDT Payable 218 FICA-Medicare Payable 220 State Income Tax Payable 222 SUTA Tax Payable 224 FUTA Tax Payable 226 Uneamed Rent Expenses 610 Sales Salaries Expertse 611 Office Salaries Expense 612 Payroll Tax Expense 614 Cleaning Expense 616 Depreciation Expense, Truck 618 Rent Experte 620 Postage Expense 622 Delivery Expense 624 Miscellaneous Sipense Owner's Equity 310 B. Duval, Capital 320 8. Duval, Withdrawals 330 Income Summary THE FANTASTIC DRESS SHOP PAYROLL REGISTER JANUARY AND FEBRUARY 2018 Earnings Allow and Marital Status Employees Cum Earnings Salary Reg OM Cum Earnings Gross Jim Reed Emma Hyde Sue Boon M-2 M-1 MO 210000 200000 330 000 33 0000 390000 390000 210000 330 000 390000 200000 3,30 000 390000 Tecals for an SEC000 930000 530000 9.50000 im Reed M-2 Emma Hyde M-1 210000 330 000 3.900.00 210000 330 000 390 000 210000 33 00 390000 210 000 330 000 390000 420 000 600.00 7 al 0 0 Sue Bolton M0 Totals for Feb 930000 9/30000 950000 1000000 THE FANTASTIC DRESS SHOP POST-CLOSING TRIAL BALANCE FEBRUARY 2017 Petty Cash Accounts Receivable Merchandise vor Prepaid Rent Delivery truck Accumulated Deprecation. Truck Accounts Payable FIT Payable FICA OASI Payable RC-Medicare Payable SIT Payable SUTA Payable RUTA Payable Uneamed Hent B. Duval Capital Totals 255080 55.00 100g 49 dolog 1650.00 120 00 00 300000 200 000 72800 1153 20 269 70 65109 85440 106 80 10 000 12.99 270 22 ZEE 80 22 ZEEBO Balances in subsidiary ledgers as of March are as follows: Accounts Receivable Accounts Payable Bach Co. 51.800 52.000 Danmark Co. Johnson Co. Young Co Manny's Garage Thomas Payroll is paid monthly FICA rate OASI 6,2% on $127,200 Medicare 1.45% on all earnings SUTA rate 4.8% on 57.000 0.6kon 57.000 FUTA te SIT rate 7% FIT Use the table provided at the end of this practice set. The payroll register for January and February is provided. In March, talaries are us follows: Jim Reed 53.850 En Hyde 4580 Sue Bolton 4.530 Your tasks are to do the following 4. Set up a general ledger, accounts receivable subsidiary ledger, accounts payable subsidiary ledger, usiljacy pettywash teed, and payroll register. (Be sure to update ledger accounts based on information given in the post-closing trial balance for February 28 before beginning.)