I need Exercises 11, 13, 14 and 17 (you must also interpret the ratios) worked out

Discussion Question: "Financial ratios are just numbers, they do not tell you what's really going on in an organisation." How would you respond to this statement? Please discuss.

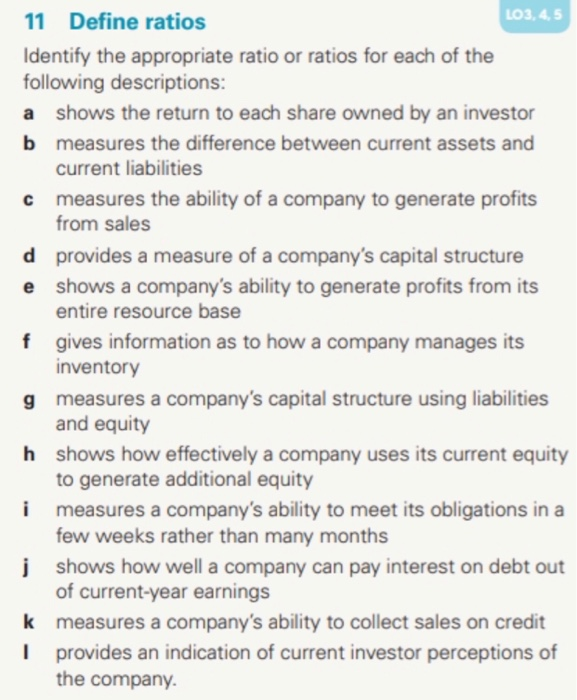

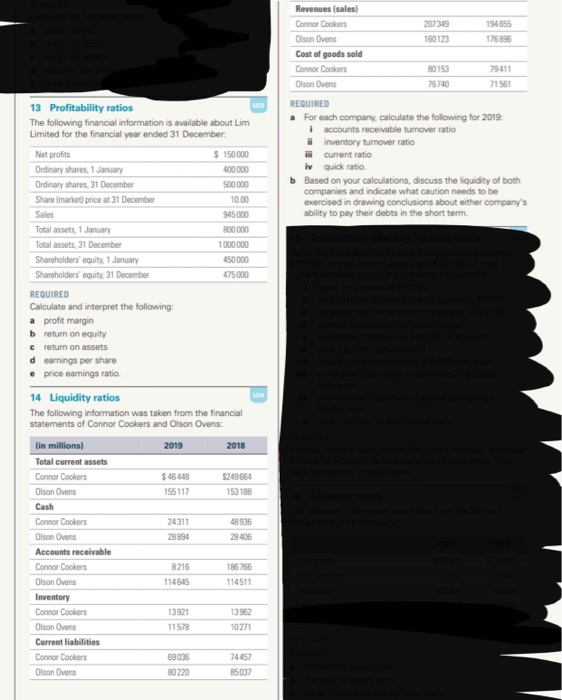

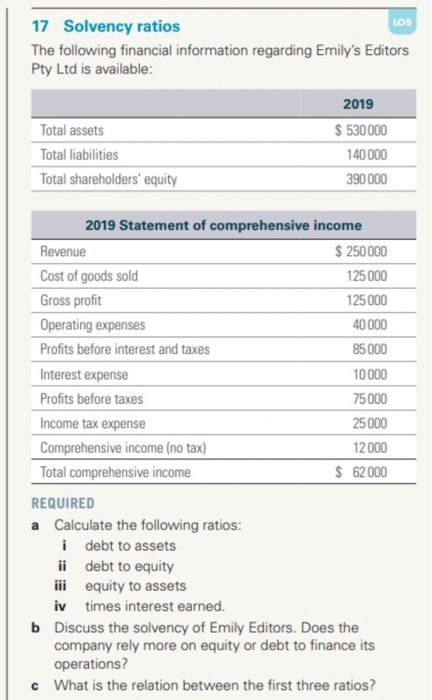

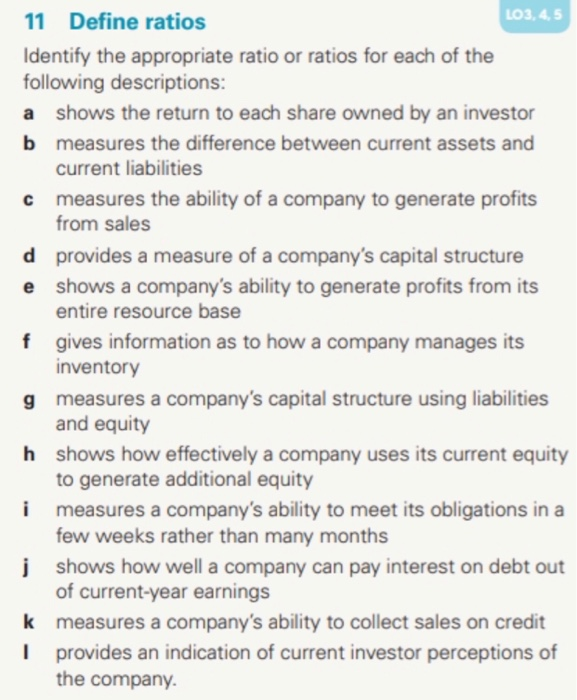

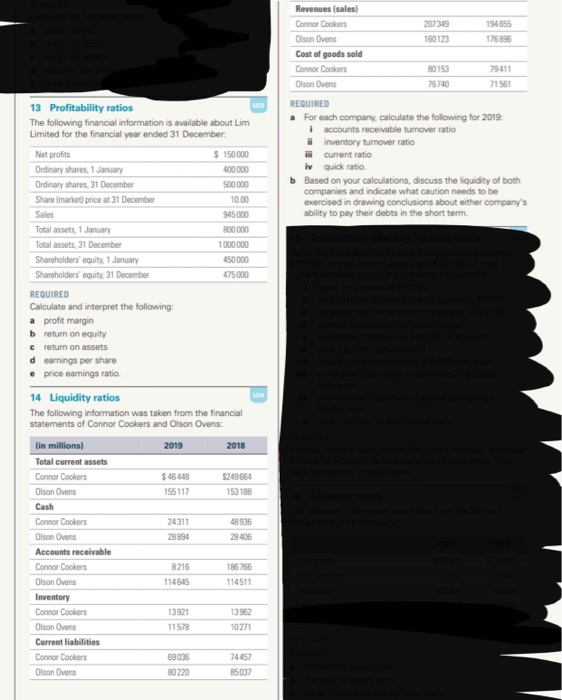

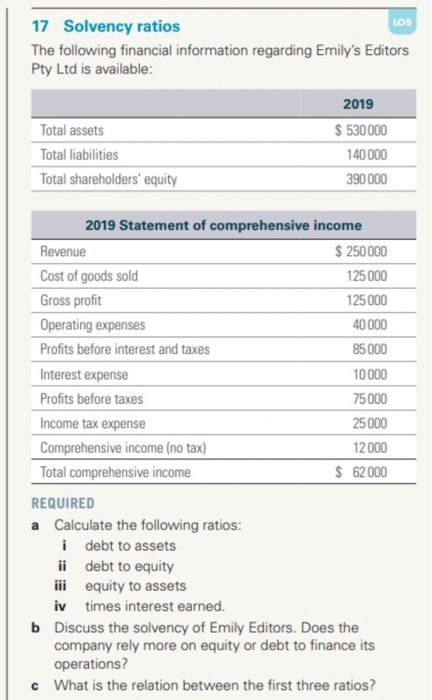

11 Define ratios LO3, 4,5 Identify the appropriate ratio or ratios for each of the following descriptions: a shows the return to each share owned by an investor b measures the difference between current assets and current liabilities measures the ability of a company to generate profits from sales d provides a measure of a company's capital structure e shows a company's ability to generate profits from its entire resource base f gives information as to how a company manages its inventory g measures a company's capital structure using liabilities and equity h shows how effectively a company uses its current equity to generate additional equity i measures a company's ability to meet its obligations in a few weeks rather than many months j shows how well a company can pay interest on debt out of current-year earnings k measures a company's ability to collect sales on credit I provides an indication of current investor perceptions of the company. BOB Revenues (sales) Connor Cookers 207349 194555 Olson Ovens 160123 175896 Cost of goods sold Connor Cookers 80153 Olson Ovens 75740 71561 REQUIRED a For each company, calculate the following for 2019 i accounts receivable turnover ratio inventory turnover ratio in current ratio iv quick ratio b Based on your calculations, discuss the liquidity of both companies and indicate what caution needs to be exercised in drawing conclusions about either company's ability to pay their debts in the short term. 13 Profitability ratios The following financial information is available about Lim Limited for the financial year ended 31 December Net profits $ 150 000 Ordinary shares, 1 January 400000 Ordinary shares, 31 December 500 000 Share (market price at 31 December 10.00 Sales 945000 Total assets, 1 January 800000 Total assets, 31 December 1 000 000 Shareholders' equity, 1 January 450000 Shareholders' equity, 31 December 475000 REQUIRED Calculate and interpret the following: a profit margin b return on equity c return on assets d earnings per share e price earnings ratio 14 Liquidity ratios The following information was taken from the financial statements of Connor Cookers and Olson Ovens: BD 2019 2018 $ 4644 155117 $249664 153 188 24311 28894 48936 28406 (in millions) Total current assets Connor Cookers Olson Ovens Cash Connor Cookers Olson Ovens Accounts receivable Connor Cookers Olson Ovens Inventory Connor Cookers Olson Ovens Current liabilities Connor Cookers Olson Ovens 8216 186766 114511 114545 13921 11578 13962 10271 59036 B0220 74457 85037 LOS 17 Solvency ratios The following financial information regarding Emily's Editors Pty Ltd is available: Total assets Total liabilities Total shareholders' equity 2019 $ 530 000 140 000 390 000 2019 Statement of comprehensive income Revenue $ 250000 Cost of goods sold 125000 Gross profit 125 000 Operating expenses 40000 Profits before interest and taxes 85000 Interest expense 10000 Profits before taxes 75 000 Income tax expense 25000 Comprehensive income (no tax) 12000 Total comprehensive income $ 62000 REQUIRED a Calculate the following ratios: i debt to assets ii debt to equity iii equity to assets iv times interest earned. b Discuss the solvency of Emily Editors. Does the company rely more on equity or debt to finance its operations? c What is the relation between the first three ratios