i need explanatiom on excel ASAP

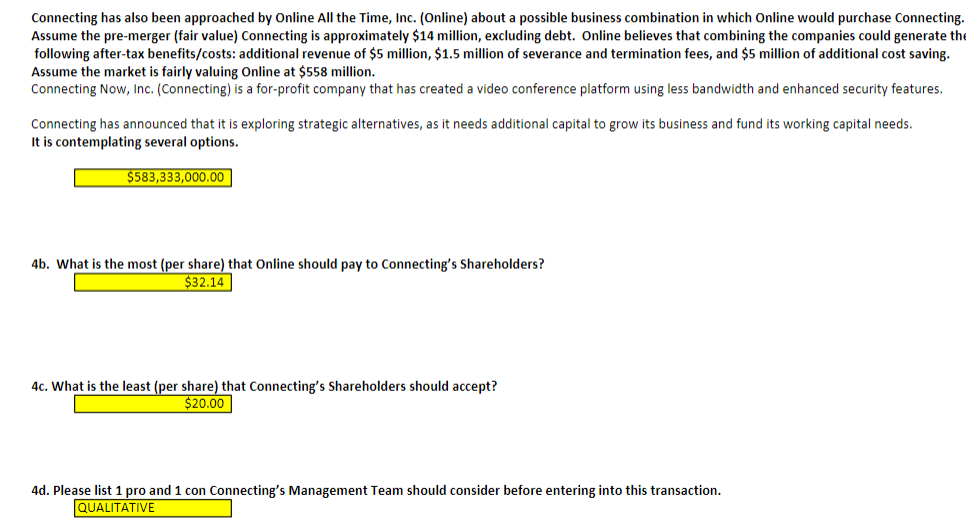

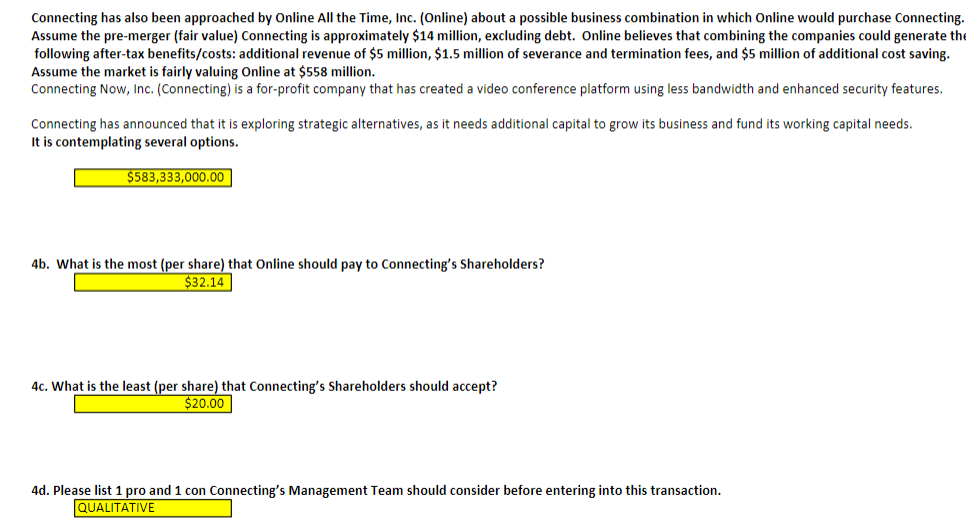

Connecting has also been approached by Online All the Time, Inc. (Online) about a possible business combination in which Online would purchase Connecting. Assume the pre-merger (fair value) Connecting is approximately $14 million, excluding debt. Online believes that combining the companies could generate the following after-tax benefits/costs: additional revenue of $5 million, $1.5 million of severance and termination fees, and $5 million of additional cost saving. Assume the market is fairly valuing Online at $558 million. Connecting Now, Inc. (Connecting) is a for-profit company that has created a video conference platform using less bandwidth and enhanced security features. Connecting has announced that it is exploring strategic alternatives, as it needs additional capital to grow its business and fund its working capital needs. It is contemplating several options. $583,333,000.00 4b. What is the most (per share) that Online should pay to Connecting's Shareholders? $32.14 4c. What is the least (per share) that connecting's Shareholders should accept? $20.00 4d. Please list 1 pro and 1 con Connecting's Management Team should consider before entering into this transaction. QUALITATIVE Connecting has also been approached by Online All the Time, Inc. (Online) about a possible business combination in which Online would purchase Connecting. Assume the pre-merger (fair value) Connecting is approximately $14 million, excluding debt. Online believes that combining the companies could generate the following after-tax benefits/costs: additional revenue of $5 million, $1.5 million of severance and termination fees, and $5 million of additional cost saving. Assume the market is fairly valuing Online at $558 million. Connecting Now, Inc. (Connecting) is a for-profit company that has created a video conference platform using less bandwidth and enhanced security features. Connecting has announced that it is exploring strategic alternatives, as it needs additional capital to grow its business and fund its working capital needs. It is contemplating several options. $583,333,000.00 4b. What is the most (per share) that Online should pay to Connecting's Shareholders? $32.14 4c. What is the least (per share) that connecting's Shareholders should accept? $20.00 4d. Please list 1 pro and 1 con Connecting's Management Team should consider before entering into this transaction. QUALITATIVE