Answered step by step

Verified Expert Solution

Question

1 Approved Answer

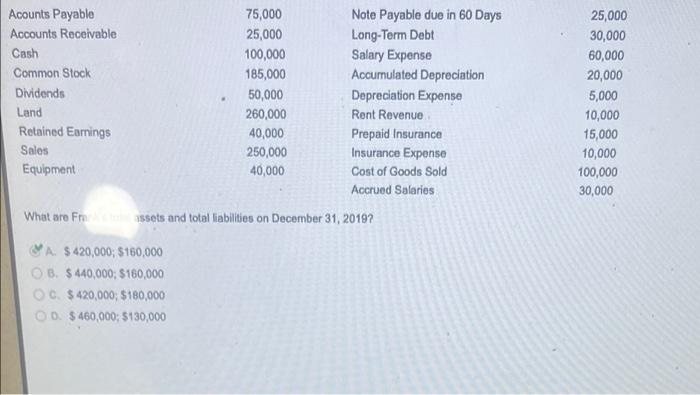

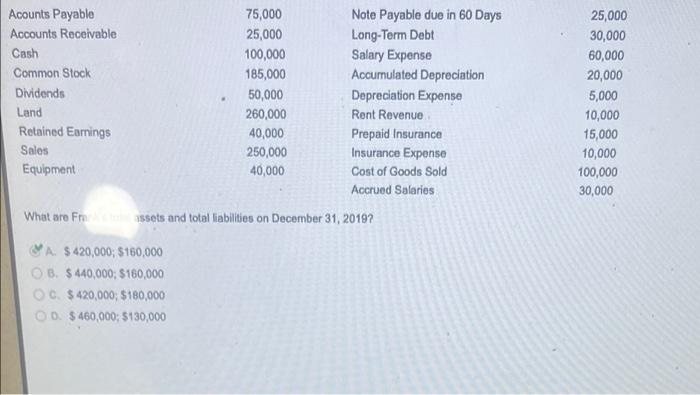

I need explanation for both questions Acounts Payablo 75,000 Note Payable due in 60 Days Accounts Receivable 25,000 Long-Term Debt Cash 100,000 Salary Expense Common

I need explanation for both questions

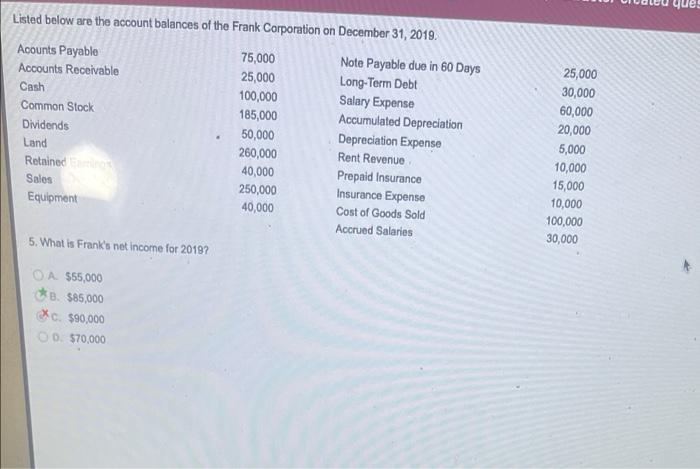

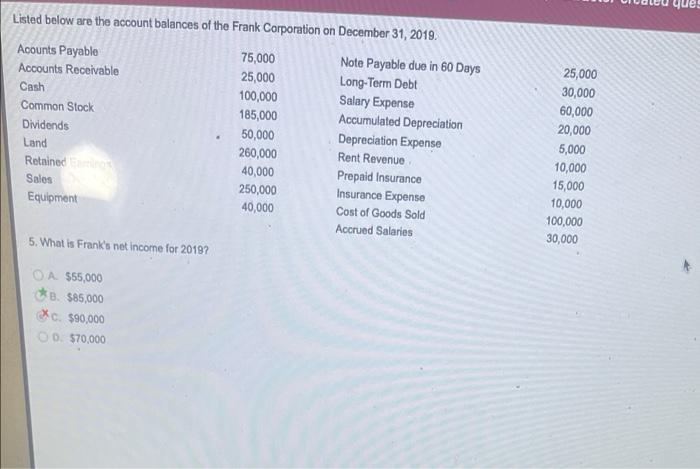

Acounts Payablo 75,000 Note Payable due in 60 Days Accounts Receivable 25,000 Long-Term Debt Cash 100,000 Salary Expense Common Stock 185,000 Accumulated Depreciation Dividends 50,000 Depreciation Expense Land 260,000 Rent Revenue Retained Earnings 40,000 Prepaid Insurance Sales 250,000 Insurance Expense Equipment 40,000 Cost of Goods Sold Accrued Salaries What are massets and total liabilities on December 31, 2019? 25,000 30,000 60,000 20,000 5,000 10,000 15,000 10,000 100,000 30,000 A. $ 420,000; 5160,000 OB. $ 440,000; $160,000 OC. $420,000; $180,000 OD. $ 460,000; 5130,000 ques Listed below are the account balances of the Frank Corporation on December 31, 2019. Acounts Payable 75,000 Note Payable due in 60 Days Accounts Receivable 25,000 Long-Term Debt Cash 100,000 Salary Expense Common Stock 185,000 Accumulated Depreciation Dividends 50,000 Depreciation Expense Land 260,000 Rent Revenue Retained 40,000 Prepaid Insurance Sales 250,000 Insurance Expense Equipment 40,000 Cost of Goods Sold Accrued Salaries 25,000 30,000 60,000 20,000 5,000 10,000 15,000 10,000 100,000 30,000 5. What is Frank's net income for 2018? A555,000 33. $85,000 c. $90,000 0 570,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started