Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need full answer 20) Gardner Corporation purchased a truck at the beginning of 2010 for $75,000. The truck is estimated to have a salvage

i need full answer

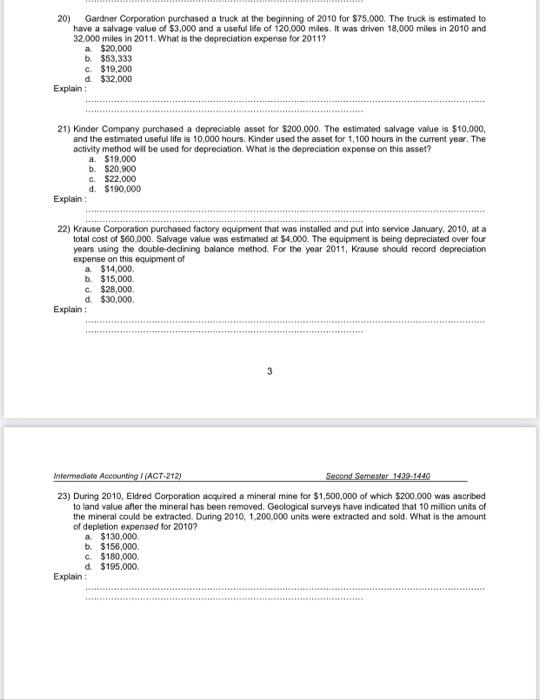

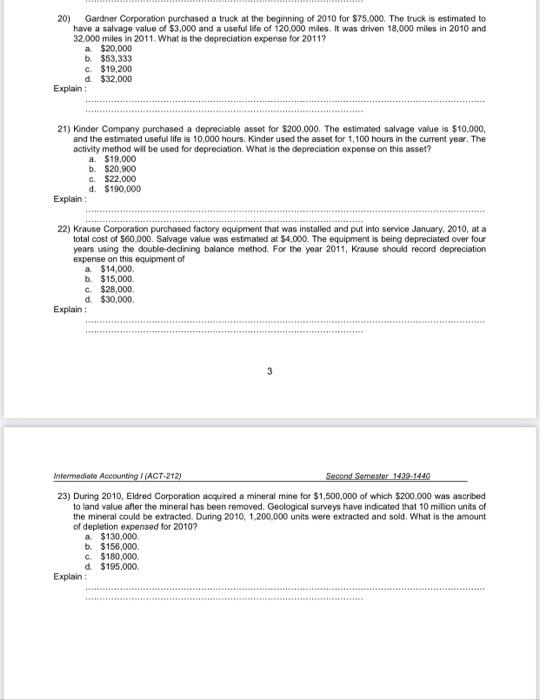

20) Gardner Corporation purchased a truck at the beginning of 2010 for $75,000. The truck is estimated to have a salvage value of $3,000 and a useful life of 120,000 miles. It was driven 18,000 miles in 2010 and 32,000 miles in 2011. What is the depreciation expense for 2011? a $20,000 b. $53,333 c. $19,200 d. $32,000 Explain: 21) Kinder Company purchased a depreciable asset for $200,000. The estimated salvage value is $10,000, and the estimated useful life is 10,000 hours. Kinder used the asset for 1,100 hours in the current year. The activity method will be used for depreciation. What is the depreciation expense on this asset? a. $19,000 b. $20,900 c. $22,000 d. $190,000 Explain: 22) Krause Corporation purchased factory equipment that was installed and put into service January, 2010, at a total cost of $60,000. Salvage value was estimated at $4,000. The equipment is being depreciated over four years using the double-declining balance method. For the year 2011, Krause should record depreciation expense on this equipment of a $14,000. b. $15,000. c. $28,000. d. $30,000. ********** www. *********** 3 Intermediate Accounting I (ACT-212) Second Semester 1439-1440 23) During 2010, Eldred Corporation acquired a mineral mine for $1,500,000 of which $200.000 was ascribed to land value after the mineral has been removed. Geological surveys have indicated that 10 million units of the mineral could be extracted. During 2010, 1,200,000 units were extracted and sold. What is the amount of depletion expensed for 2010? a $130,000. b. $156,000. c. $180,000. d. $195,000. Explain: Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started