Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need good help with this and pls i don't want a wrong answer as always beacuse i am really looking for help, also no

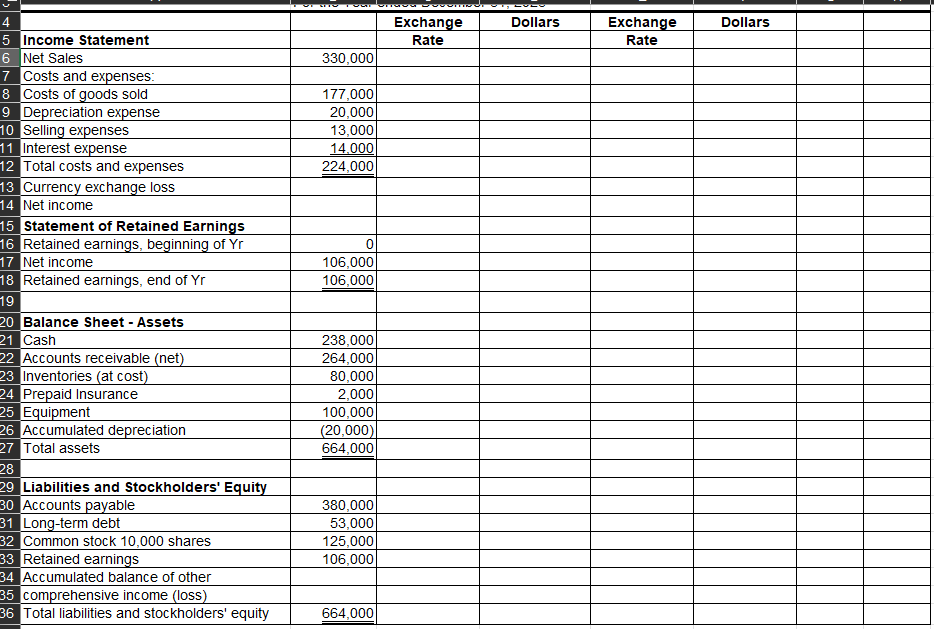

i need good help with this and pls i don't want a wrong answer as always beacuse i am really looking for help, also no handwriting for the answer, Financial statements of Leblanc Corporation, a foreign subsidiary of the DeWitt Corporation a US company are shown below at and for the year ended December

Please remeasure this subsidiary, and figure out the gain or loss on remeasurement.

Translate the subsidiary and figure out the gain or loss for translation.

Assumptions:

The parent company Clay organized the subsidiary on December

Exchange rates for the LCU were as follows:

December $

Current exchange Spot: December

Weighted Average Average of period

Inventory was acquired evenly throughout the year and sales were made evenly throughout the year.

Fixed assets were acquired by the subsidiary on December and common stock was issued.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started