Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need handwritten calculations You are considering investing in a new business which requires an initial investment of $250,000 in a waste disposal truck. The

I need handwritten calculations

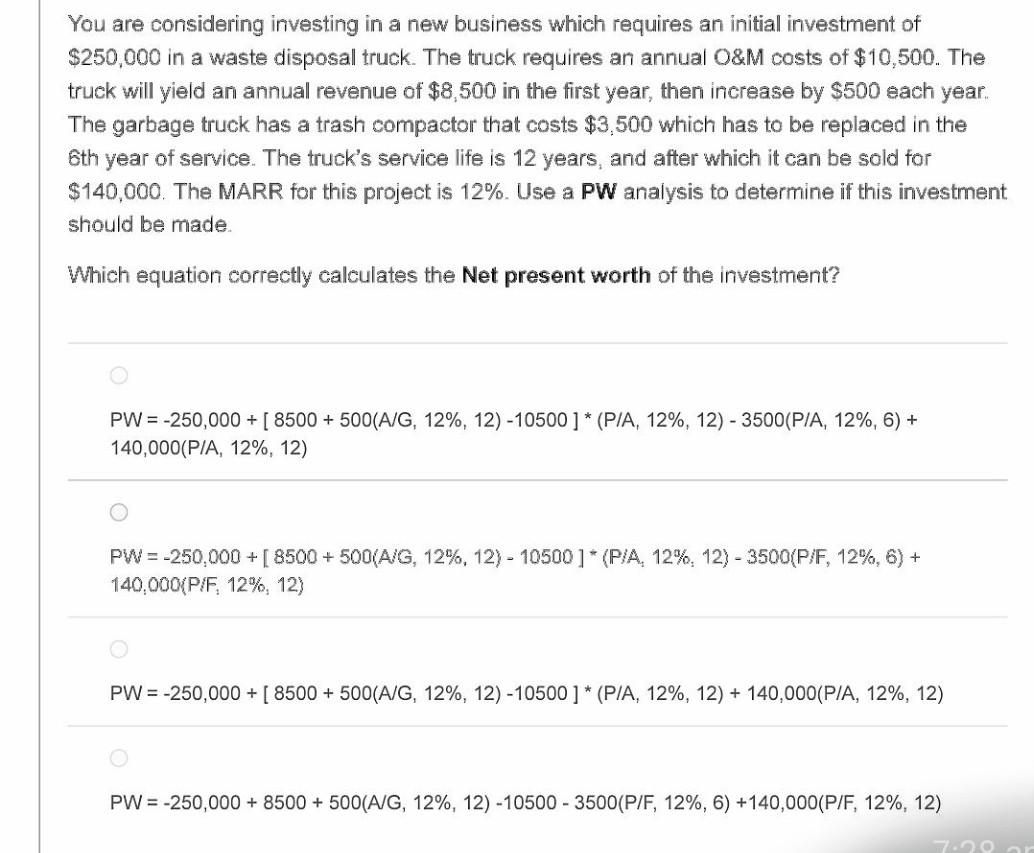

You are considering investing in a new business which requires an initial investment of $250,000 in a waste disposal truck. The truck requires an annual O&M costs of $10,500. The truck will yield an annual revenue of $8,500 in the first year, then increase by $500 each year. The garbage truck has a trash compactor that costs $3,500 which has to be replaced in the 6th year of service. The truck's service life is 12 years, and after which it can be sold for $140,000. The MARR for this project is 12%. Use a PW analysis to determine if this investment should be made. Which equation correctly calculates the Net present worth of the investment? PW = -250,000+ [ 8500 + 500(AIG, 12%, 12) - 10500 ] * (PIA, 12%, 12) - 3500(PIA, 12%, 6) + 140,000(PIA, 12%, 12) PW = -250,000 + [ 8500 + 500(AIG, 12%, 12) - 10500]* (PIA, 12%, 12) - 3500(P/F, 12%, 6) + 140,000(PIF, 12%, 12) PW= -250,000+ [ 8500 + 500(AIG, 12%, 12) - 10500 ] * (P/A, 12%, 12) + 140,000(PIA, 12%, 12) PW = -250,000 + 8500 + 500(A/G, 12%, 12) - 10500 - 3500(P/F, 12%, 6) +140,000(P/F, 12%, 12)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started