Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**I need handwritten solution NOT EXCEL solution for thumbs up. ** Do not copy paste other solutions on Chegg Question #1 (30 Points): A construction

**I need handwritten solution NOT EXCEL solution for thumbs up.

** Do not copy paste other solutions on Chegg

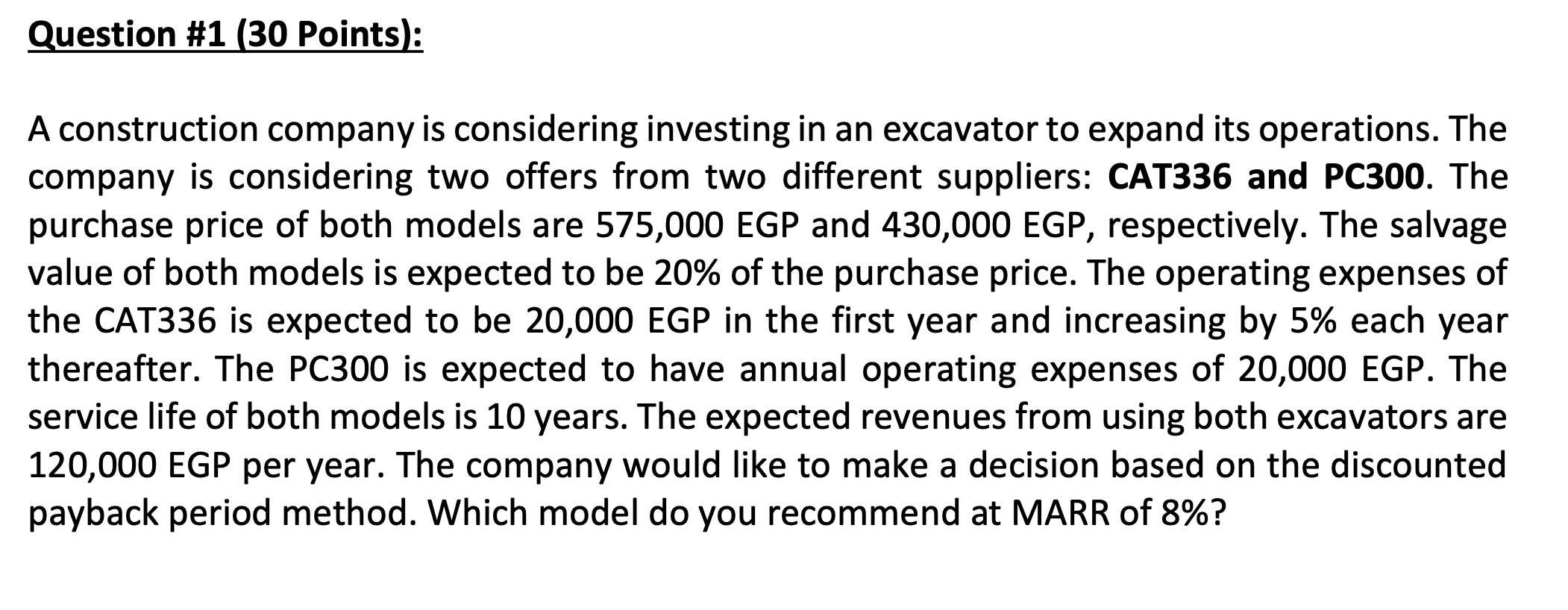

Question #1 (30 Points): A construction company is considering investing in an excavator to expand its operations. The company is considering two offers from two different suppliers: CAT336 and PC300. The purchase price of both models are 575,000 EGP and 430,000 EGP, respectively. The salvage value of both models is expected to be 20% of the purchase price. The operating expenses of the CAT336 is expected to be 20,000 EGP in the first year and increasing by 5% each year thereafter. The PC300 is expected to have annual operating expenses of 20,000 EGP. The service life of both models is 10 years. The expected revenues from using both excavators are 120,000 EGP per year. The company would like to make a decision based on the discounted payback period method. Which model do you recommend at MARR of 8%? Question #1 (30 Points): A construction company is considering investing in an excavator to expand its operations. The company is considering two offers from two different suppliers: CAT336 and PC300. The purchase price of both models are 575,000 EGP and 430,000 EGP, respectively. The salvage value of both models is expected to be 20% of the purchase price. The operating expenses of the CAT336 is expected to be 20,000 EGP in the first year and increasing by 5% each year thereafter. The PC300 is expected to have annual operating expenses of 20,000 EGP. The service life of both models is 10 years. The expected revenues from using both excavators are 120,000 EGP per year. The company would like to make a decision based on the discounted payback period method. Which model do you recommend at MARR of 8%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started