Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need helo with V,V,VII thank you! 2. In the United States, payroll taxes are levied to fund the Social Security Insurance and Medicare Insurance

I need helo with V,V,VII thank you!

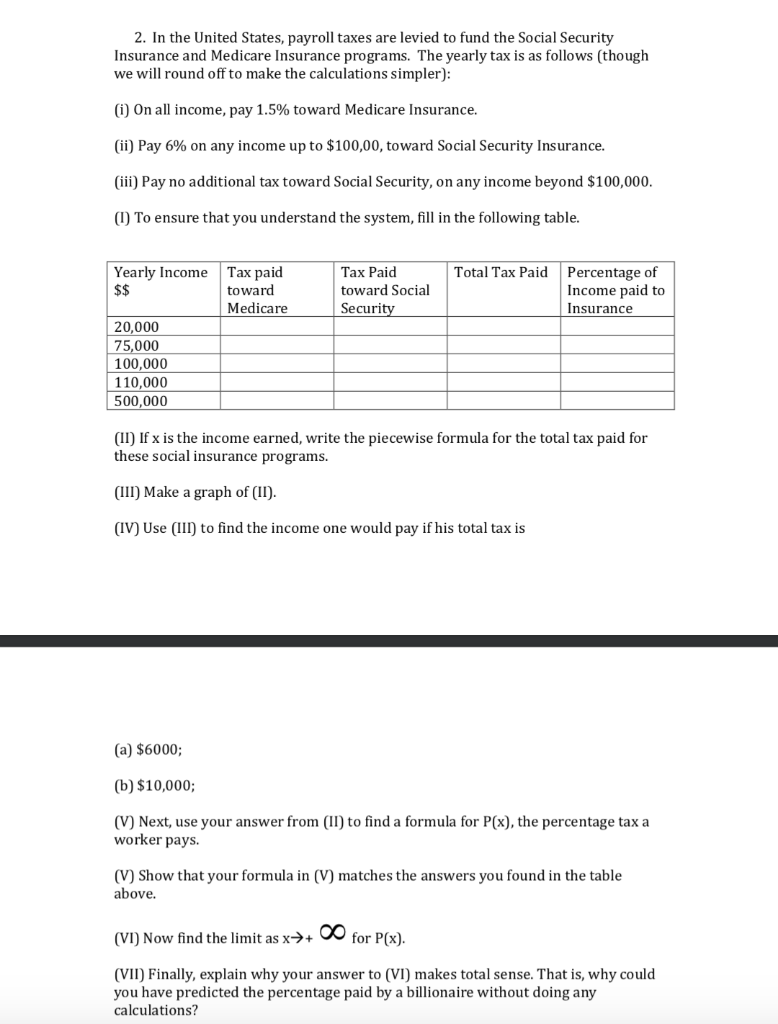

2. In the United States, payroll taxes are levied to fund the Social Security Insurance and Medicare Insurance programs. The yearly tax is as follows though we will round off to make the calculations simpler): (i) On all income, pay 1.5% toward Medicare Insurance. (ii) Pay 6% on any income up to $100,00, toward Social Security Insurance. (iii) Pay no additional tax toward Social Security, on any income beyond $100,000. (1) To ensure that you understand the system, fill in the following table. Tax Paid toward Social Security Total Tax Paid Percentage of Income paid to Insurance Yearly Income Tax paid $$ toward Medicare 20,000 75,000 100,000 110,000 500,000 (II) If x is the income earned, write the piecewise formula for the total tax paid for these social insurance programs. (III) Make a graph of (II). (IV) Use (III) to find the income one would pay if his total tax is (a) $6000; (b) $10,000; (V) Next, use your answer from (II) to find a formula for P(x), the percentage tax a worker pays. (V) Show that your formula in (V) matches the answers you found in the table above. (VI) Now find the limit as x + for P(x). (VII) Finally, explain why your answer to (VI) makes total sense. That is, why could you have predicted the percentage paid by a billionaire without doing any calculations? 2. In the United States, payroll taxes are levied to fund the Social Security Insurance and Medicare Insurance programs. The yearly tax is as follows though we will round off to make the calculations simpler): (i) On all income, pay 1.5% toward Medicare Insurance. (ii) Pay 6% on any income up to $100,00, toward Social Security Insurance. (iii) Pay no additional tax toward Social Security, on any income beyond $100,000. (1) To ensure that you understand the system, fill in the following table. Tax Paid toward Social Security Total Tax Paid Percentage of Income paid to Insurance Yearly Income Tax paid $$ toward Medicare 20,000 75,000 100,000 110,000 500,000 (II) If x is the income earned, write the piecewise formula for the total tax paid for these social insurance programs. (III) Make a graph of (II). (IV) Use (III) to find the income one would pay if his total tax is (a) $6000; (b) $10,000; (V) Next, use your answer from (II) to find a formula for P(x), the percentage tax a worker pays. (V) Show that your formula in (V) matches the answers you found in the table above. (VI) Now find the limit as x + for P(x). (VII) Finally, explain why your answer to (VI) makes total sense. That is, why could you have predicted the percentage paid by a billionaire without doing any calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started