Answered step by step

Verified Expert Solution

Question

1 Approved Answer

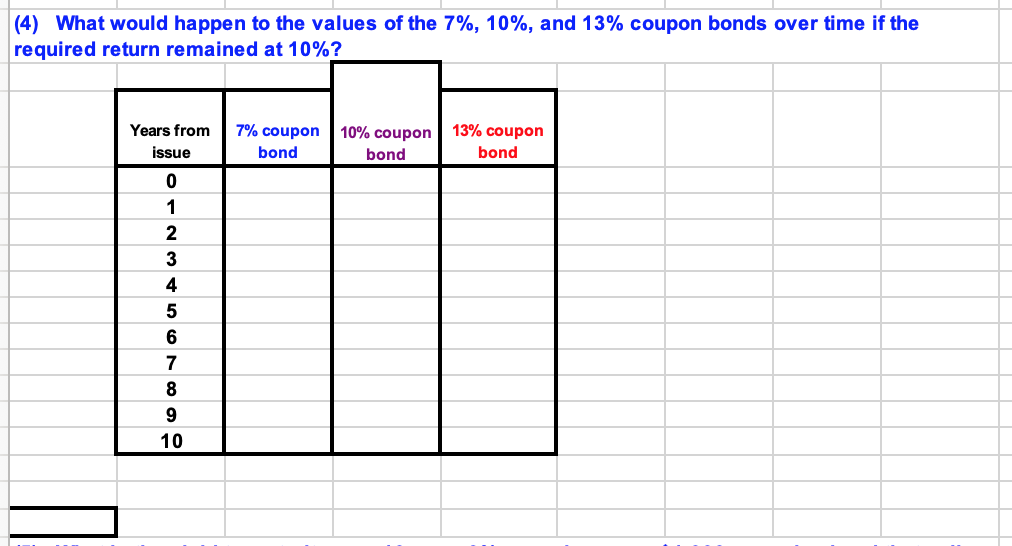

i need help answering question # 4 ONLY. this is the question: ( 4 ) What would happen to the values of the 7 %

i need help answering question # ONLY. this is the question: What would happen to the values of the and coupon bonds over time if the required return remained at see attached a picture of this question so that you can see what needs to be answered

in case you need more info to solve, here were the preceeding questions with their corresponding answers:

What is the value of a year, $ par value bond with a annual coupon if its required return is answer: $

What is the value of a coupon bond that is otherwise identical to the bond described in Would we now have a discount or a premium bond? answer: $

What is the value of a coupon bond with these characteristics? Would we now have a discount or a premium bond? answer: $ What would happen to the values of the and coupon bonds over time if the

required return remained at

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started