I need help answering questions 10-14.

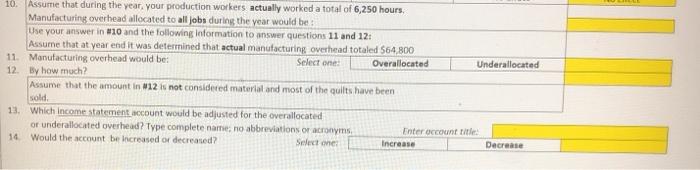

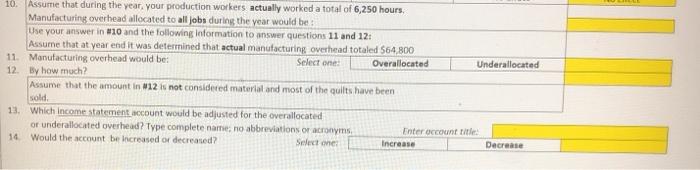

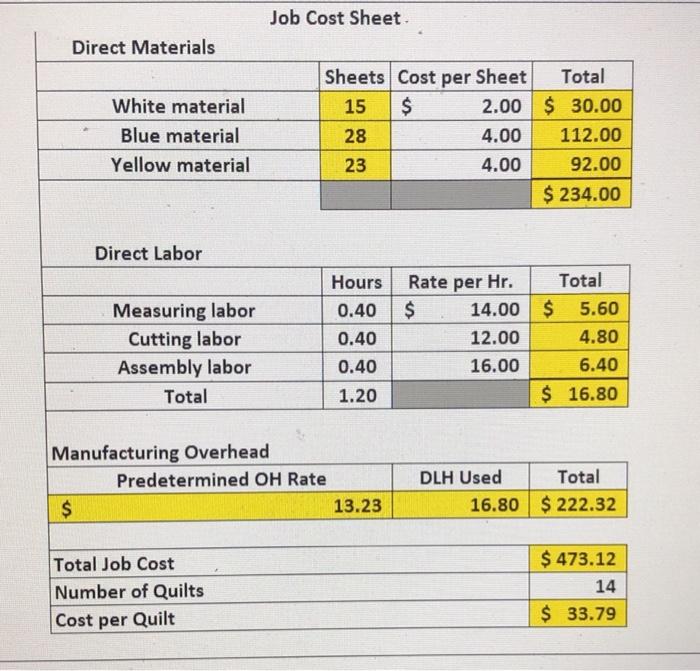

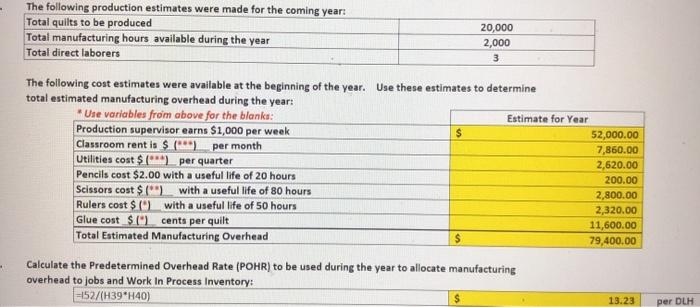

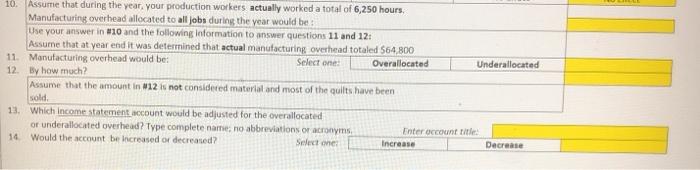

10. Assume that during the year your production workers actually worked a total of 6,250 hours. Manufacturing overhead allocated to all jobs during the vear would be Use your answer in 10 and the following information to answer questions 11 and 12: Assume that at year end it was determined that actual manufacturing overhead totaled $64.800 11. Manufacturing overhead would be Select one Overallocated Underallocated 12. By how much? Assume that the amount in #12 is not considered material and most of the quilts have been sold, 13. Which income statement account would be adjusted for the overallocated or underallocated overhead? Type complete nameno abbreviations or acronyms Enter account title 14 Would the account be increased or decreased? Select one Increase Decrease Job Cost Sheet Direct Materials White material Blue material Yellow material Sheets Cost per Sheet Total 15 $ 2.00 $ 30.00 4.00 112.00 23 4.00 92.00 $ 234.00 28 Direct Labor Measuring labor Cutting labor Assembly labor Total Hours 0.40 0.40 0.40 1.20 Rate per Hr. Total $ 14.00 $ 5.60 12.00 4.80 16.00 6.40 $ 16.80 Manufacturing Overhead Predetermined OH Rate $ 13.23 DLH Used Total 16.80 $ 222.32 Total Job Cost Number of Quilts Cost per Quilt $ 473.12 14 $ 33.79 The following production estimates were made for the coming year: Total quilts to be produced 20,000 Total manufacturing hours available during the year 2,000 Total direct laborers 3 The following cost estimates were available at the beginning of the year. Use these estimates to determine total estimated manufacturing overhead during the year: * Use variables from above for the blanks: Estimate for Year Production supervisor earns $1,000 per week $ 52,000.00 Classroom rent is $ (***) per month 7,860.00 Utilities cost $("").per quarter 2,620.00 Pencils cost $2.00 with a useful life of 20 hours 200.00 Scissors cost $(") with a useful life of 80 hours 2,800.00 Rulers cost $(") with a useful life of 50 hours 2,320.00 Glue cost $("cents per quilt 11,600.00 Total Estimated Manufacturing Overhead 79,400.00 Calculate the predetermined Overhead Rate (POHR) to be used during the year to allocate manufacturing overhead to jobs and Work In Process Inventory: =152/(H39*H40) 13.23 per DLH