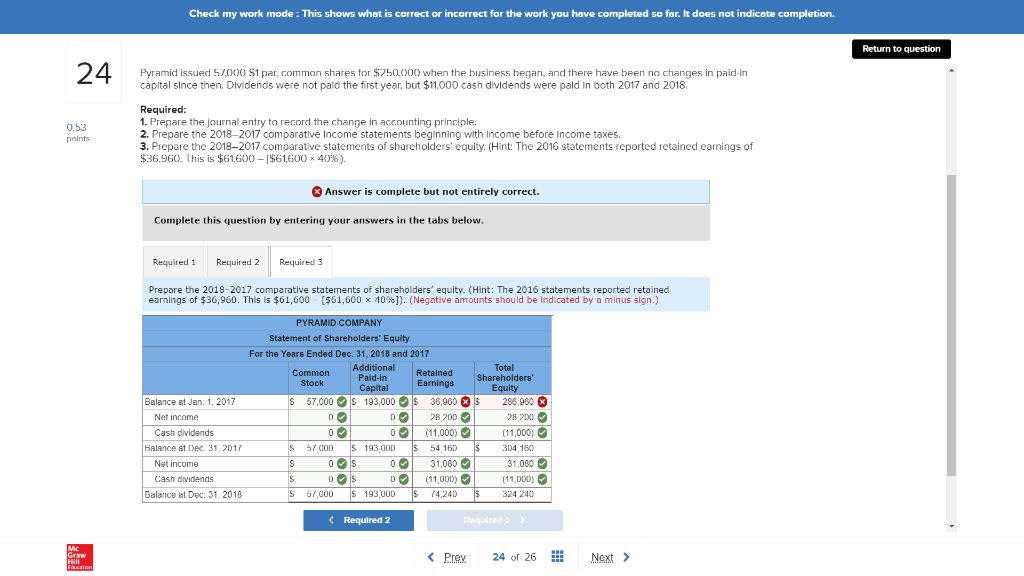

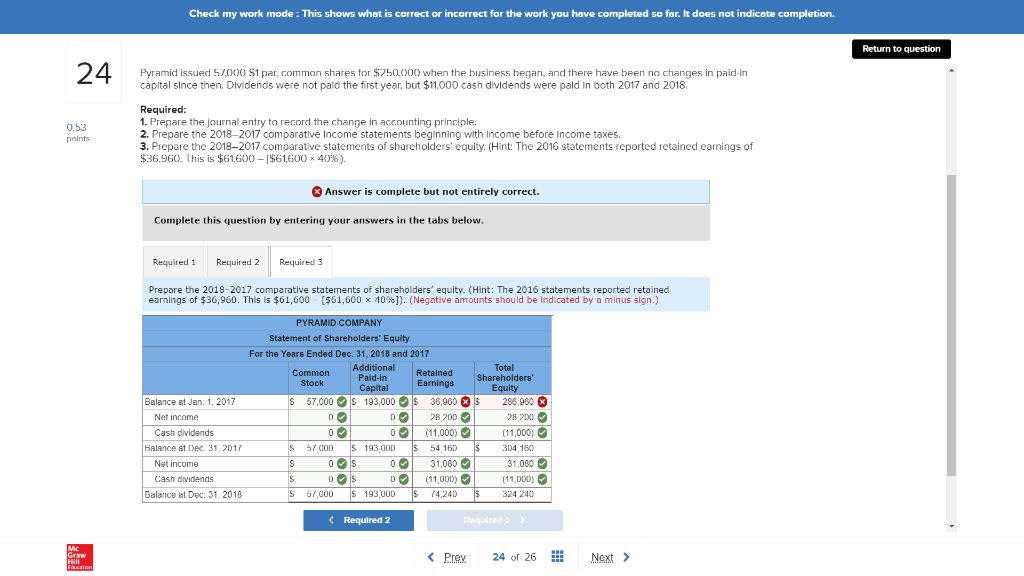

I need help answering the last question, the part with the retained earnings.

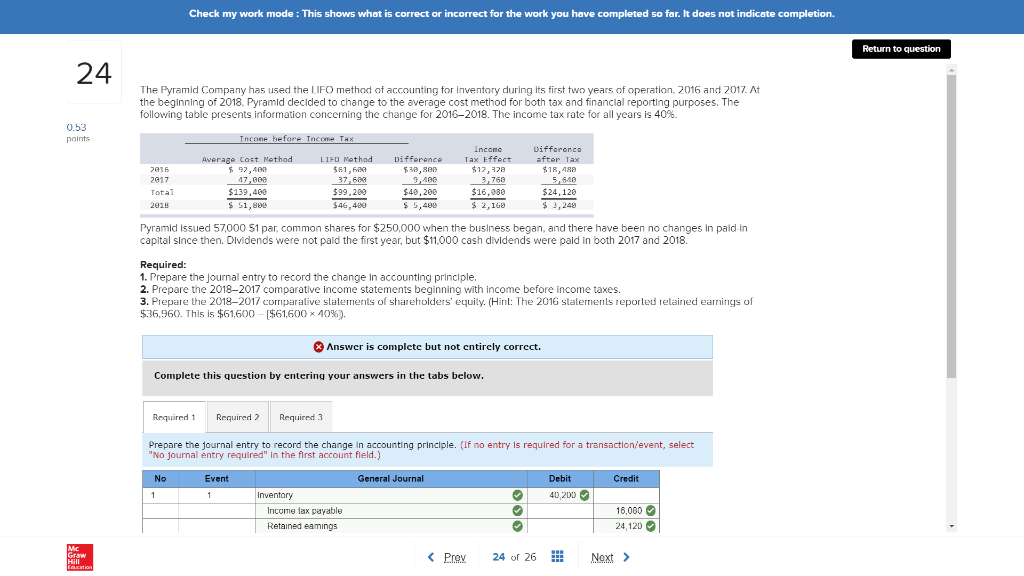

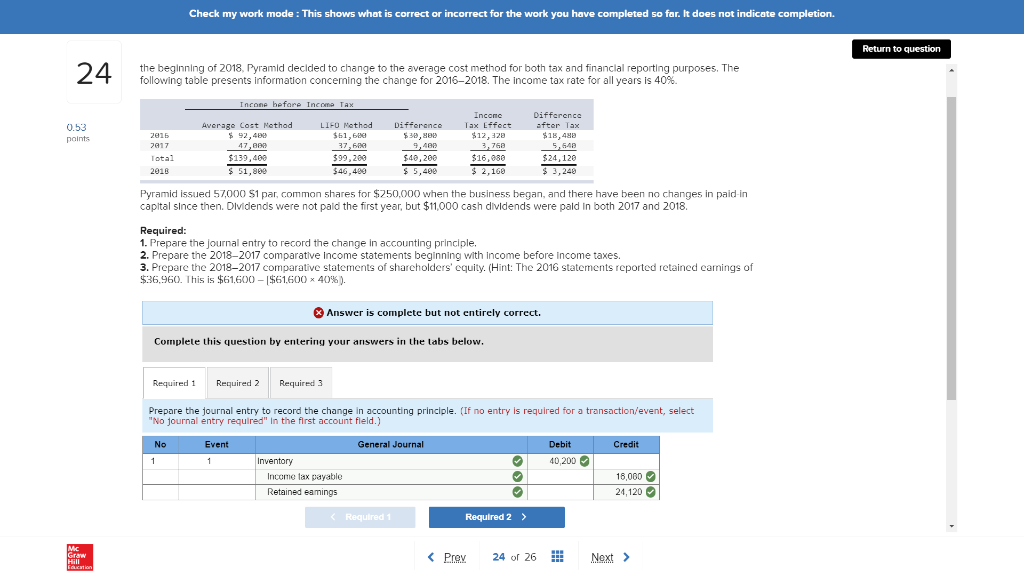

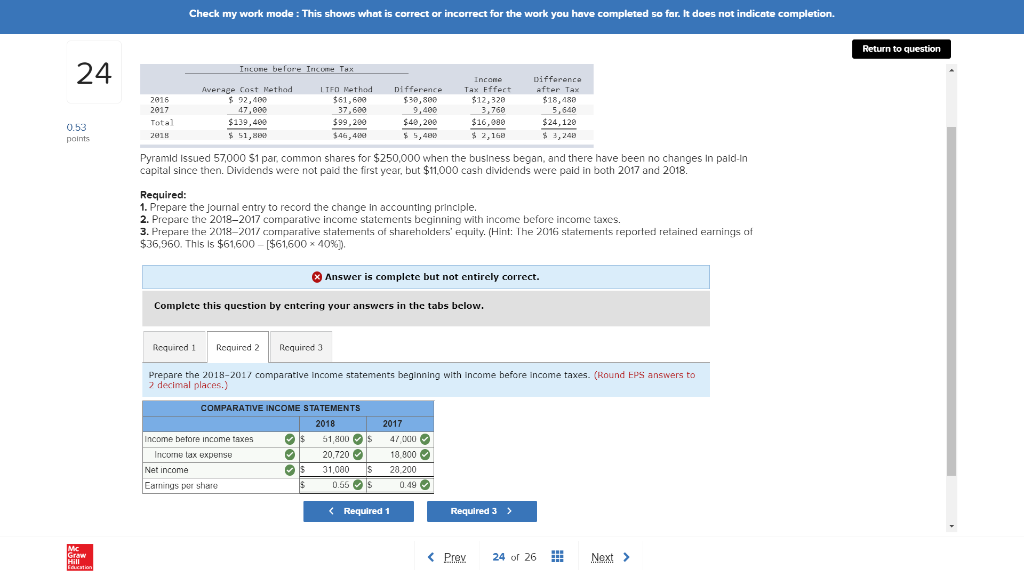

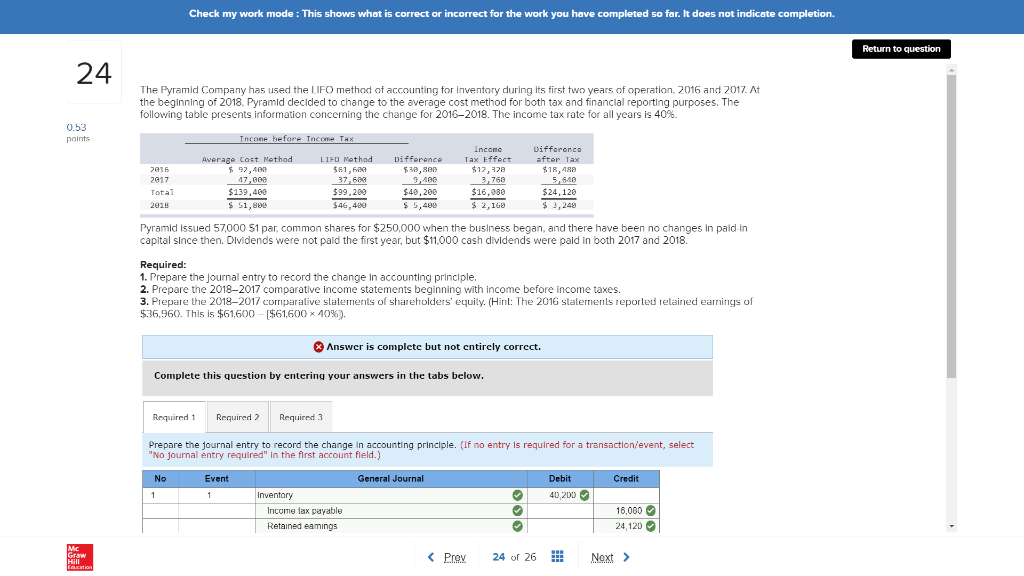

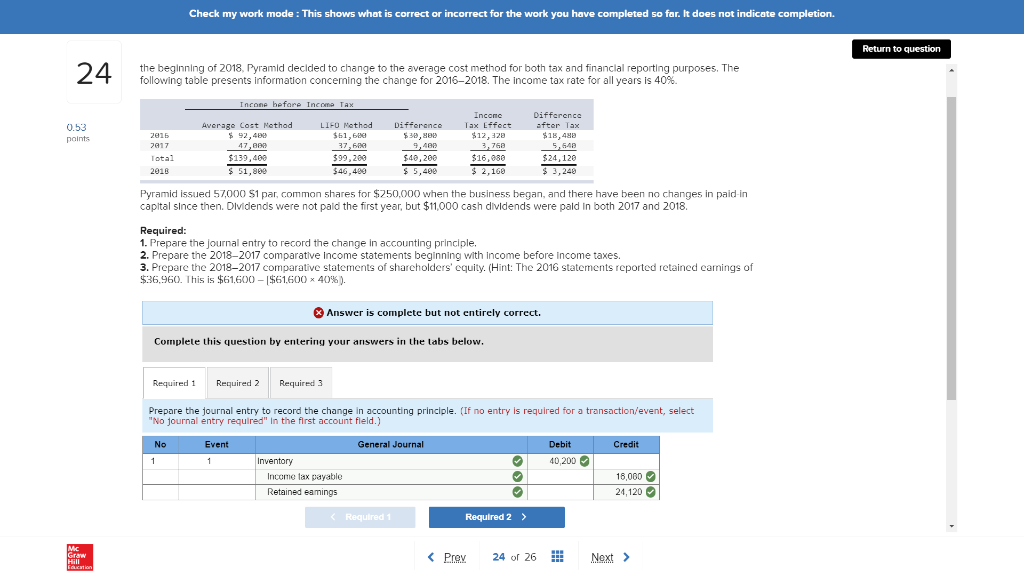

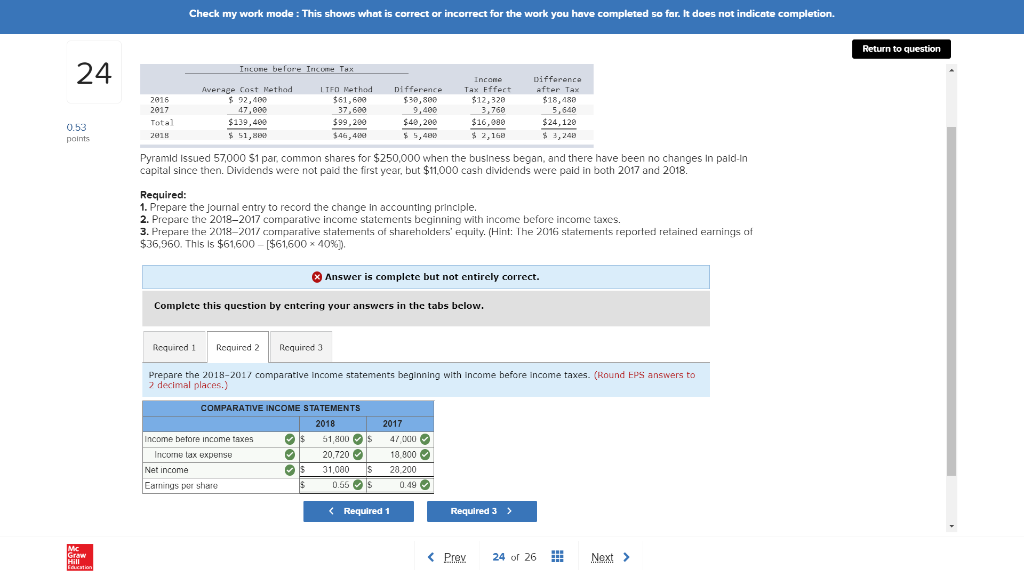

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question The Pyramid Company has used the LIFO method of accounting for inventory during its first two years of operation, 2016 and 2017. At the beginning of 2018, Pyramld declded to change to the average cost method for both tax and financial reporting purposes. The following table presents information concerning the change for 2016-2018. The income tax rate for all years is 40%. Tncone before Tncome Tax Incanc ax Effo Diffarence aftor Tax Averago Cost Nothad Wothad Difforence 38,800 97,480 2017 $99,280 546,480 $16,080 2,168 $24,120 1, 248 Total $139,400 $48,208 281 Pyramld Issued 57000 $1 par, common shares for $250,000 when the business began, and there have been no changes In pald-In capital since then. Dividends were not paid the first year, but $11,000 cash dividends were paid in both 2017 and 2018 Required: 1. Prepare the Journal entry to record the change In accounting princlple 2. Prepare the 2018-2017 comparative income statements beginning with income before income taxes. 3. Prepare the 2018-2017 comparalive slalemenls of shareholders' equily. (Hinl: The 2016 slalenents reporled relained eaings ol $36.960. This is $61.600 [$61,600 x 40%). &Answer is complctc but not entirely correct. Complete this question by entering your answers in the tabs below Required Required Reqired 3 Prepare the journal entry to record the change In accounting principle. (If no entry Is required for a transaction/event, select "No journal entry required" in the first account fleld.) No Event General Journal Debit Credit Inventory 40 200 Income tax payable Retained eamings 6,080 24,120 PreY 24 26 Next> Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question the beginning of 2018, Pyramid declded to change to the average cost method for both tax and financlal reporting purposes. The following table presents information conceming the change for 2016-2018. The income tax rate for all years is 40%. Incone hefare Incomo Tax Inconc Difference 18,488 24,120 3,248 Average Cost Nethod LIFO Nothad Differance Tax Lffect ftor Tax 0.53 points 61,69 $99,200 546,480 12, 328 3,768 92,480 ,488 $40,200 lotal 2018 $ 51,809 $ 2,168 Pyramid issued 57000 $1 par, common shares for $250,000 when the business began, and there have been no changes in paid-in capltal since then. Dividends were not pald the first year, but $11,000 cash dividends were pald In both 2017 and 2018 Required: 1. Prepare the journal entry to record the change in accounting principle. 2. Prepare the 2018-2017 comparative Income statements beginning with income before income taxes. 3. Prepare the 2018-2017 comparative statements of sharcholders' cquity. (Hint: The 2016 statements reported retained canings of 536.960. I his is $61.600-($61600 x 40%). Answer is complete but not entirely correct. Complete this question by entering your answers in the labs below Required Required 2Required 3 Prepare the journal entry to record the change in accounting principle. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld.) No Event General Journal Debit Credit Inventory 40,200 Income lax payable Retained eamings 16,060 24,120 Required 1 Required 2 > 24 or 26 Next> Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Pyramid issued 57,000 SI par, common shares for $.50.00 when the business began, and there have been no changes in paid-in capltal since then. Dvidends were not pald the first year, but $11,000 cash divldends were pald In both 2017 and 2018. Required: 1. Prepare the journal entry to record the change in accounting principle. 2. Prepare the 2018-2017 comparative Income statements beginning with Income before Income taxes. 3. Prepare the 2018-2017 comparative statements of shareholders' equity. (Hint: The 2016 statements reported retained eamings of $36.960. I his is $61600-($61600 x 40%). 0.53 points Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs belovw Required 1 Required 2Required 3 Prepare the 2018-2017 comparative statements of shareholders' equity. (Hint: The 2016 statements reported retained earnings of $36,960. This is $61,600 [$61,600 x 40%]). (Negative amounts should be indicated by a minus sign.) PYRAMID COMPANY Statement of Shareholders' Equity For the Years Ended Dec. 31, 2018 and 2017 AdditionalRetainedShareholders 57,000 193,000 s 36,960 286,980 (11,000) 31,080 Total Paid-in Stock Balance et J n. 1, 2017 Net income Cash dividends 00| (11,000) 54.16D Balance at Dec 31 2017 93,000 304.1 031,080 D(11000)(1,000y Net income Cash dvidends 11,000) 4.24D Balance at Dec. 31, 2018 r,0oo 193,000 324 240 Required 2 PreY 24 or 26 Next>