Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help answering theses question(Type out answers) All the information you need are in the pictures so you will need to read them! This

i need help answering theses question(Type out answers) All the information you need are in the pictures so you will need to read them! This is my 3rd time submitting this question where yall are saying there no information (YOU NEED TO READ!)

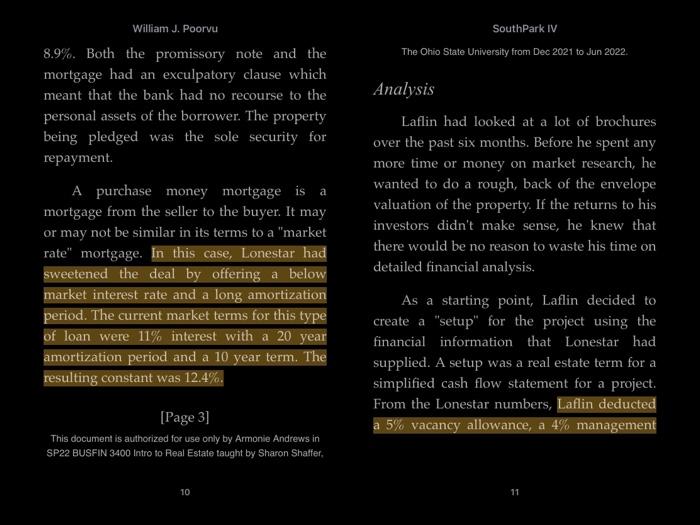

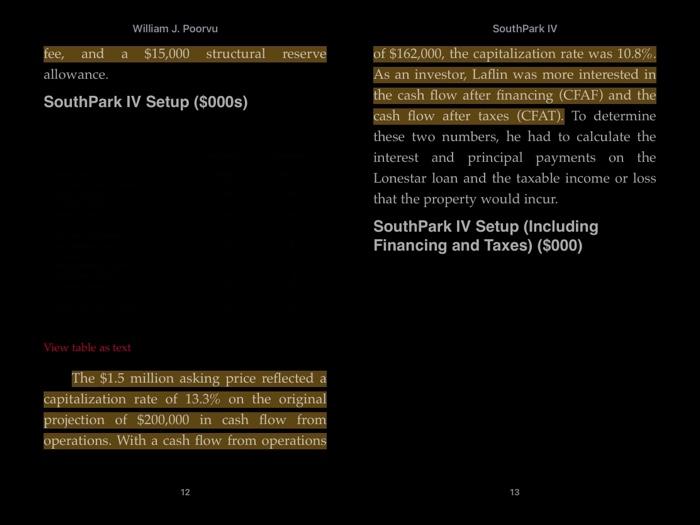

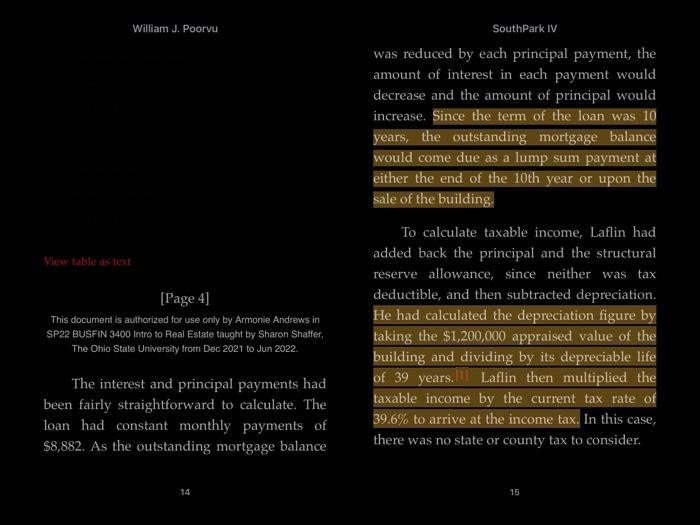

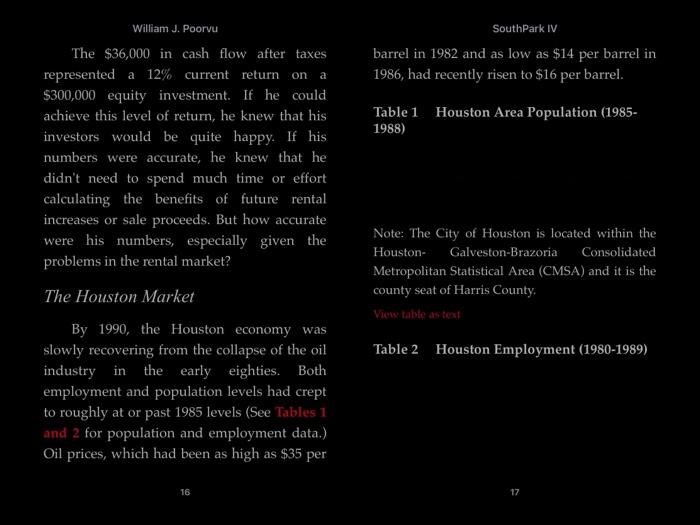

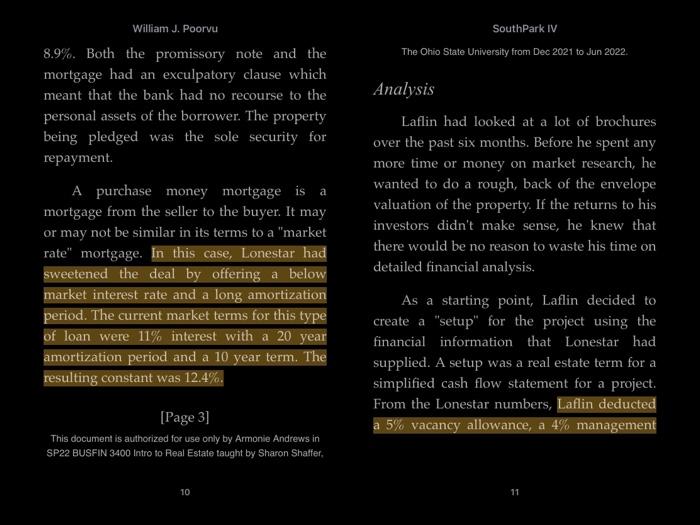

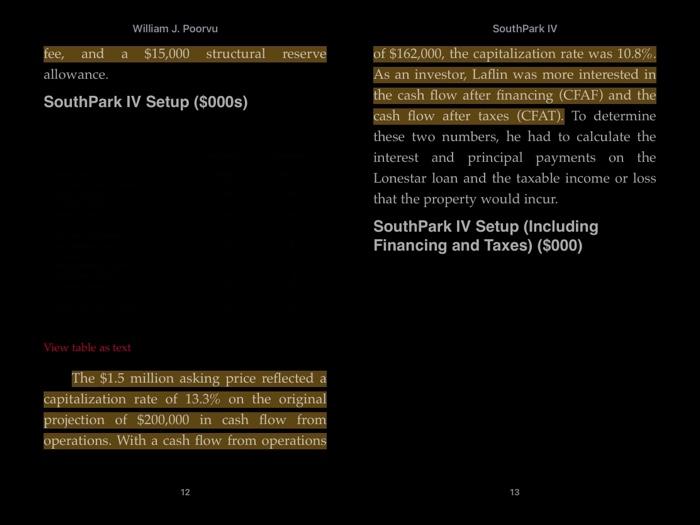

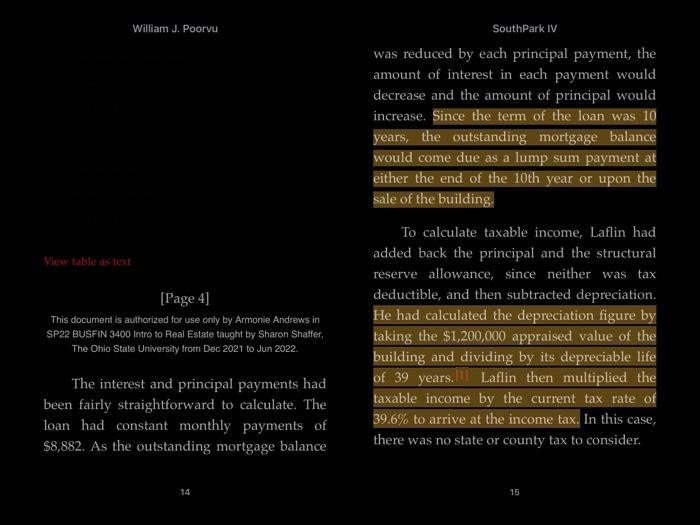

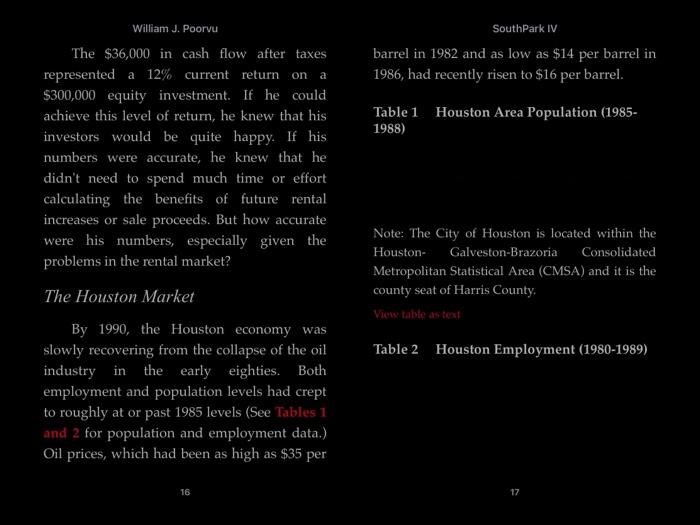

SouthPark IV George Laflin was intrigued by the packet of papers that lay in front of him. The papers comprised a brochure that Lonestar Savings & Loan had put together in an effort to sell the SouthPark IV Distribution Center in Houston, Texas. South Park IV was an 80,000 square foot Office / Warehouse facility located on the south side of Houston. Lonestar was asking $1.5 million for the property. It was January of 1990 and the Houston real estate market was beginning to show a few signs of recovering from a decade long slump. Laflin had recently raised $450,000 to invest in troubled properties and he wondered whether South Park IV would make a good investment George Laflin Laflin had been born and raised in 3 William J. Poorvu Houston. After graduating from Rice University with a degree in electrical engineering, he had accepted a job with a large computer manufacturer in Houston. During the past ten years, he had seen both explosive growth and rapid declines in real estate values. Now, at the age of 32, he wanted to invest in real estate and hopefully build equity through appreciation. He had convinced eight friends to join him in committing $50,000 each to buy one or two troubled properties within the greater Houston area. Laflin had decided to initially focus on office/warehouse properties due to their relatively small size and their strong historical performance During his initial discussions with his friends, Laflin had expressed his hope that the properties would achieve both a reasonable South Park IV current return and substantial appreciation. Laflin would take 10% of the deal for putting it together and acting as an asset manager. He would hire a professional property management firm to manage any properties that were purchased. South Park IV Built in 1980, the SouthPark IV Distribution Center was located in the 100 acre South Park Industrial Center. The building had 185 foot bay depths and 22 foot clear ceilings. Approximately 15% of the space was finished as office space (see Exhibit 1 for a floor plan). The exterior walls were simple concrete panels. Loading docks were located in the front of the building and access to rail service was available from the back of the building. There was parking for 80 cars. William J. Poorvu [Page 2] This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 South Park IV leases were due to expire on June 30, 1990 (see Exhibit 2 for a summary of the lease terms). The leases were net of common expenses, taxes, and insurance. Lonestar paid these expenses and then was reimbursed by each tenant on a per square foot basis. These payments were shown on the income statement as expense reimbursement. In general, the building was considered to be in excellent condition. The one exception was the roof which needed to be repaired. Lonestar had recently received an estimate of $50,000 to repair the roof. As part of the sales book, Lonestar had provided a summary of SouthPark IV's operating results as of October 1989. Lonestar's numbers projected that SouthPark IV would have $252,000 in total income, $52,000 in total expenses, and $200,000 in cash flow from operations for 1989. All four tenants had indicated to Lonestar that they would be willing to extend their leases for five years but only at the current market base rental rate of $2.00 per square foot. If Laflin purchased the property and extended the leases, he would incur no additional costs. If he brought in new tenants, however, he would most likely incur a tenant improvement expense of $2.50 per square foot and a leasing expense, on a five year lease, of 15% of the first year's rent. The tenant The building was fully leased to four tenants. The leases ranged in size from 12,000 square feet to 30,000 square feet. All four William J. Poorvu improvement expense represented a negotiated amount that an owner often gave to a new tenant to customize the tenant's space. The land under SouthPark IV had recently been appraised at $300,000 and the building at $1,200,000. In arriving at his result, the appraiser had used three methods to calculate the property value: cost, income, and market data. Under the cost approach, the appraiser had applied current construction costs to the appropriate square footages within the building (see Exhibit 3). For the income approach, he had set up a ten year discounted cash flow (see Exhibit ). Finally, the market data approach used recent comparable sales to arrive at a value (see Exhibit 5). South Park IV Lonestar had foreclosed on the property when the original developer had been forced into bankruptcy by the failure of another project. When no one else had bid at the foreclosure auction, Lonestar had bid in at its mortgage amount in order to protect its position. Federal regulators were pushing the bank to dispose of its real estate holdings. Lonestar had responded by aggressively marketing its properties and by offering attractive financing terms. Financing Lonestar was offering a $1,200,000 loan secured by a purchase money first mortgage on the property with a 10 year term, 30 year amortization period and an 8% interest rate. (See Exhibit 6 for the interest and principal payments associated with this loan.) The mortgage payment constant for this loan was William J. Poorvu South Park IV The Ohio State University from Dec 2021 to Jun 2022. a 8.9%. Both the promissory note and the mortgage had an exculpatory clause which meant that the bank had no recourse to the personal assets of the borrower. The property being pledged was the sole security for repayment A purchase money mortgage is a mortgage from the seller to the buyer. It may or may not be similar in its terms to a "market rate" mortgage. In this case, Lonestar had sweetened the deal by offering a below market interest rate and a long amortization period. The current market terms for this type of loan were 11% interest with a 20 year amortization period and a 10 year term. The resulting constant was 12.4%. Analysis Laflin had looked at a lot of brochures over the past six months. Before he spent any more time or money on market research, he wanted to do a rough, back of the envelope valuation of the property. If the returns to his investors didn't make sense, he knew that there would be no reason to waste his time on detailed financial analysis. As a starting point, Laflin decided to create a "setup" for the project using the financial information that Lonestar had supplied. A setup was a real estate term for a simplified cash flow statement for a project. From the Lonestar numbers, Laflin deducted a 5% vacancy allowance, a 4% management [Page 3 This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, 10 11 William J. Poorvu fee, and a $15,000 structural reserve allowance. SouthPark IV Setup ($000s) South Park IV of $162,000, the capitalization rate was 10.8%. As an investor, Laflin was more interested in the cash flow after financing (CFAF) and the cash flow after taxes (CFAT). To determine these two numbers, he had to calculate the interest and principal payments on the Lonestar loan and the taxable income or loss that the property would incur. South Park IV Setup (Including Financing and Taxes) ($000) View table as test The $1.5 million asking price reflected a capitalization rate of 13.3% on the original projection of $200,000 in cash flow from operations. With a cash flow from operations 12 13 William J. Poorvu South Park IV was reduced by each principal payment, the amount of interest in each payment would decrease and the amount of principal would increase. Since the term of the loan was 10 years, the outstanding mortgage balance would come due as a lump sum payment at either the end of the 10th year or upon the sale of the building To calculate taxable income, Laflin had added back the principal and the structural reserve allowance, since neither was tax deductible, and then subtracted depreciation. He had calculated the depreciation figure by taking the $1,200,000 appraised value of the building and dividing by its depreciable life of 39 years. Laflin then multiplied the taxable income by the current tax rate of 39.6% to arrive at the income tax. In this case, there was no state or county tax to consider. View table as text [Page 4 This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 The interest and principal payments had been fairly straightforward to calculate. The loan had constant monthly payments of $8,882. As the outstanding mortgage balance 14 15 William J. Poorvu South Park IV barrel in 1982 and as low as $14 per barrel in 1986, had recently risen to $16 per barrel. Table 1 Houston Area Population (1985- 1988) The $36,000 in cash flow after taxes represented a 12% current return on a $300,000 equity investment. If he could achieve this level of return, he knew that his investors would be quite happy. If his numbers were accurate, he knew that he didn't need to spend much time or effort calculating the benefits of future rental increases or sale proceeds. But how accurate were his numbers, especially given the problems in the rental market? Note: The City of Houston is located within the Houston- Galveston-Brazoria Consolidated Metropolitan Statistical Area (CMSA) and it is the county seat of Harris County, View table as text Table 2 Houston Employment (1980-1989) The Houston Market By 1990, the Houston economy was slowly recovering from the collapse of the oil industry in the early eighties. Both employment and population levels had crept to roughly at or past 1985 levels (See Tables 1 and 2 for population and employment data.) Oil prices, which had been as high as $35 per 16 17 William J. Poorvu Source: Texas Employment Commission View table as tent South Park IV the market with deeply discounted properties. Houston, with almost 210 million square feet of industrial space, was the 9th largest industrial market in the U.S. Between 1981 and 1985 approximately 35,000,000 square feet of industrial space was added. From 1986-1989, there has been no speculative construction in the area. A limited amount of build-to-suit construction had taken place during this period (See Table 3 for Houston industrial occupancy data). [Page 5 This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 Table 3 Houston Industrial Occupancy Data (000s) The outlook for the real estate industry in Houston was not clear. Economic growth would generate fresh demand for space, although almost every category of real estate had a tremendous supply of vacant space. There was also a concern that the collapse of the Savings & Loan industry in Texas might further depress prices and rents by flooding a 18 19 William J. Poorvu South Park IV View table as test Within the submarket in which SouthPark IV was located, there were nine buildings that were considered to be competitive to South Park IV. Occupancy and rental rate information, based on their current tenants, are shown below in Table 4. View table as text Most of these leases, however, were written many years ago at higher rents. At the current market rental rate of $2.00 per square foot, Laflin realized that he would not obtain Lonestar's projected rents. Obviously, the returns would be lower. Table 4 Competitor Occupancy & Rental Rates October, 1989 But Laflin had been following the local real estate market closely. He felt that the local economy was gaining strength and that a resurgence in economic activity would cause a rise in rental rates and real estate values. He also felt that the near collapse of the Savings 20 21 William J. Poorvu & Loan industry in Texas presented a unique opportunity to invest in troubled real estate properties at a substantial discount Somehow he would have to incorporate both current market rates and potential future rates in his analysis. If he didn't, he felt that someone else would outbid him for the property. [Page 6] This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 SouthPark IV also believed that he would be able to sell the property at a 10% cap rate. To complete his analysis, Laflin had to calculate the net cash flow from a sale. To do this, he would take the net selling price and subtract the net book value in order to get the gain on sale. He would then calculate the tax liability by multiplying the gain on sale by the 28% tax rate. This would allow him to calculate the net cash from sale by taking the net selling price and subtracting the mortgage balance and the tax liability. Net book value was defined as the purchase price plus capital improvements minus accumulated depreciation. He assumed that the cost of selling the project would be 5% of the gross sales price. Laflin wondered if the asking price itself too high. Even with future rental If the partnership invested in SouthPark IV, Laflin assumed that the partnership would hold the property for five years. Over this period, he believed that both income and expenses for office/warehouse properties in Houston would grow at a 3% annual rate. He was 22 23 South Park IV were at best After all, the numbers projections. William J. Poorvu increases and future sale proceeds included, it was difficult to make the numbers work. The fixed mortgage payments could lead to either positive or negative leverage depending on the actual rental rate that he achieved. If he could negotiate a lower sales price with Lonestar, he might be able to improve the returns to his investors. Of course, he also knew that Lonestar would not lend the partnership more than 80% of the purchase price. It was time for Laflin to do some calculations: a revised income statement, a five year projection, and, using the back of the envelope approach, an analysis of the impact of a lower purchase price. Only then could he see if South Park IV was the right investment for his group. There were opportunities in Houston but he also had to consider the risks. 24 25 Data Given in Case Setup Year 1 Depreciation South Park IV Setup ($000s) Original Lonestar Projections 1990 Revised Laflin Projections 1990 $200 52 $200 52 $2.50 average 252 252 -13 Base rent (80,000 s.1) Expense reimbursement Gross Income Vacancy (5%) Net income General expenses Real estate taxes Insurance Management fee (4%) Structural reserve Total expenses Cash flow from operations 252 -12 -30 - 10 239 -12 -30 -10 -10 - 15 -77 -52 200 162 South Park IV Setup (Including Financing and Taxes) ($000) Cash flow from operations Interest Principal Cash flow after financing + Principal + Structural Reserve - Depreciation Taxable income Income Tax (39.6%) Cash flow after taxes 162 -96 -101 56 10 15 -31 50 -20 36 Data Given in Case Setup Year 1 Depreciation Setup at $2 per sf Initial Setup: Year 1 (Based on $1.5 million purchase price) 1.500 1,200 Percent (Year 1 Return) 10.8% Return on Asset (ROA) or cap rate 8.8% Mortgage Constant SouthPark IV Setup (Including Financing and Taxes) (5000) Invested Capital Cash flow from operations Interest Principal Cash flow after financing + Principal + Structural Reserve Depreciation Taxable income Income Tax (39.6%) Cash flow after taxes 300 Revised Laflin Income 1990 1621 -96 -10 56 10 15 -31 50 -20 36 18.7% pretax Return on Equity (ROE) 300 12.0% after tax Return on Equity (ROE) Data Given in Case Setup Year 1 Depreciation Calculation for Annual Depreciation Purchase price Land value Depreciable base 1,500,000 -300,000 1,200,000 39 years ** this was given in footnote on page 4 Depreciable life Annual depreciation 30,769.231 Data Given in Case Setup Year 1 Depreciation Setup at $2 per sf South Park IV Setup (5000s) Original Lonestar Projections 1990 Revised Laflin Projections 1990 ($2.50/81) Income at S2/s1 $200 52 252 $200 52 252 -13 239 -12 -30 S160 52 $212 -10.6 5201 252 Base rent (80,000 sf) Expense reimbursement Gross Income Vacancy (5%) Net income General expenses Real estate taxes Insurance Management fee (4%) Structural reserve Total expenses Cash flow from operations -12 -12 -30 -30 -10 -10 -10 -10 -15 -8.056 -15 -75.056 S126 -77 -52 200 162 Returns 10.8% 8.8% Revised Returns 8,4% ROA or cap rate 8,8% mortgage constant South Park IV Setup (Including Financing and Taxes) (5000) Investment Income Cash flow from operations 1500 Interest 1200 Principal Cash flow after financing 300 + Principal Structural Reserve Depreciation Taxable income Revised Income S126 .96 -10 20.344 10 15 -31 14.344 162 -96 - 10 56 10 15 -311 50 18.7% 6.8% pretax ROE Income Tax (39.6%) -20 -5.68 Cash flow after taxes 300 36 12.0% 14.664 4.9% after tax ROE SouthPark IV George Laflin was intrigued by the packet of papers that lay in front of him. The papers comprised a brochure that Lonestar Savings & Loan had put together in an effort to sell the SouthPark IV Distribution Center in Houston, Texas. South Park IV was an 80,000 square foot Office / Warehouse facility located on the south side of Houston. Lonestar was asking $1.5 million for the property. It was January of 1990 and the Houston real estate market was beginning to show a few signs of recovering from a decade long slump. Laflin had recently raised $450,000 to invest in troubled properties and he wondered whether South Park IV would make a good investment George Laflin Laflin had been born and raised in 3 William J. Poorvu Houston. After graduating from Rice University with a degree in electrical engineering, he had accepted a job with a large computer manufacturer in Houston. During the past ten years, he had seen both explosive growth and rapid declines in real estate values. Now, at the age of 32, he wanted to invest in real estate and hopefully build equity through appreciation. He had convinced eight friends to join him in committing $50,000 each to buy one or two troubled properties within the greater Houston area. Laflin had decided to initially focus on office/warehouse properties due to their relatively small size and their strong historical performance During his initial discussions with his friends, Laflin had expressed his hope that the properties would achieve both a reasonable South Park IV current return and substantial appreciation. Laflin would take 10% of the deal for putting it together and acting as an asset manager. He would hire a professional property management firm to manage any properties that were purchased. South Park IV Built in 1980, the SouthPark IV Distribution Center was located in the 100 acre South Park Industrial Center. The building had 185 foot bay depths and 22 foot clear ceilings. Approximately 15% of the space was finished as office space (see Exhibit 1 for a floor plan). The exterior walls were simple concrete panels. Loading docks were located in the front of the building and access to rail service was available from the back of the building. There was parking for 80 cars. William J. Poorvu [Page 2] This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 South Park IV leases were due to expire on June 30, 1990 (see Exhibit 2 for a summary of the lease terms). The leases were net of common expenses, taxes, and insurance. Lonestar paid these expenses and then was reimbursed by each tenant on a per square foot basis. These payments were shown on the income statement as expense reimbursement. In general, the building was considered to be in excellent condition. The one exception was the roof which needed to be repaired. Lonestar had recently received an estimate of $50,000 to repair the roof. As part of the sales book, Lonestar had provided a summary of SouthPark IV's operating results as of October 1989. Lonestar's numbers projected that SouthPark IV would have $252,000 in total income, $52,000 in total expenses, and $200,000 in cash flow from operations for 1989. All four tenants had indicated to Lonestar that they would be willing to extend their leases for five years but only at the current market base rental rate of $2.00 per square foot. If Laflin purchased the property and extended the leases, he would incur no additional costs. If he brought in new tenants, however, he would most likely incur a tenant improvement expense of $2.50 per square foot and a leasing expense, on a five year lease, of 15% of the first year's rent. The tenant The building was fully leased to four tenants. The leases ranged in size from 12,000 square feet to 30,000 square feet. All four William J. Poorvu improvement expense represented a negotiated amount that an owner often gave to a new tenant to customize the tenant's space. The land under SouthPark IV had recently been appraised at $300,000 and the building at $1,200,000. In arriving at his result, the appraiser had used three methods to calculate the property value: cost, income, and market data. Under the cost approach, the appraiser had applied current construction costs to the appropriate square footages within the building (see Exhibit 3). For the income approach, he had set up a ten year discounted cash flow (see Exhibit ). Finally, the market data approach used recent comparable sales to arrive at a value (see Exhibit 5). South Park IV Lonestar had foreclosed on the property when the original developer had been forced into bankruptcy by the failure of another project. When no one else had bid at the foreclosure auction, Lonestar had bid in at its mortgage amount in order to protect its position. Federal regulators were pushing the bank to dispose of its real estate holdings. Lonestar had responded by aggressively marketing its properties and by offering attractive financing terms. Financing Lonestar was offering a $1,200,000 loan secured by a purchase money first mortgage on the property with a 10 year term, 30 year amortization period and an 8% interest rate. (See Exhibit 6 for the interest and principal payments associated with this loan.) The mortgage payment constant for this loan was William J. Poorvu South Park IV The Ohio State University from Dec 2021 to Jun 2022. a 8.9%. Both the promissory note and the mortgage had an exculpatory clause which meant that the bank had no recourse to the personal assets of the borrower. The property being pledged was the sole security for repayment A purchase money mortgage is a mortgage from the seller to the buyer. It may or may not be similar in its terms to a "market rate" mortgage. In this case, Lonestar had sweetened the deal by offering a below market interest rate and a long amortization period. The current market terms for this type of loan were 11% interest with a 20 year amortization period and a 10 year term. The resulting constant was 12.4%. Analysis Laflin had looked at a lot of brochures over the past six months. Before he spent any more time or money on market research, he wanted to do a rough, back of the envelope valuation of the property. If the returns to his investors didn't make sense, he knew that there would be no reason to waste his time on detailed financial analysis. As a starting point, Laflin decided to create a "setup" for the project using the financial information that Lonestar had supplied. A setup was a real estate term for a simplified cash flow statement for a project. From the Lonestar numbers, Laflin deducted a 5% vacancy allowance, a 4% management [Page 3 This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, 10 11 William J. Poorvu fee, and a $15,000 structural reserve allowance. SouthPark IV Setup ($000s) South Park IV of $162,000, the capitalization rate was 10.8%. As an investor, Laflin was more interested in the cash flow after financing (CFAF) and the cash flow after taxes (CFAT). To determine these two numbers, he had to calculate the interest and principal payments on the Lonestar loan and the taxable income or loss that the property would incur. South Park IV Setup (Including Financing and Taxes) ($000) View table as test The $1.5 million asking price reflected a capitalization rate of 13.3% on the original projection of $200,000 in cash flow from operations. With a cash flow from operations 12 13 William J. Poorvu South Park IV was reduced by each principal payment, the amount of interest in each payment would decrease and the amount of principal would increase. Since the term of the loan was 10 years, the outstanding mortgage balance would come due as a lump sum payment at either the end of the 10th year or upon the sale of the building To calculate taxable income, Laflin had added back the principal and the structural reserve allowance, since neither was tax deductible, and then subtracted depreciation. He had calculated the depreciation figure by taking the $1,200,000 appraised value of the building and dividing by its depreciable life of 39 years. Laflin then multiplied the taxable income by the current tax rate of 39.6% to arrive at the income tax. In this case, there was no state or county tax to consider. View table as text [Page 4 This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 The interest and principal payments had been fairly straightforward to calculate. The loan had constant monthly payments of $8,882. As the outstanding mortgage balance 14 15 William J. Poorvu South Park IV barrel in 1982 and as low as $14 per barrel in 1986, had recently risen to $16 per barrel. Table 1 Houston Area Population (1985- 1988) The $36,000 in cash flow after taxes represented a 12% current return on a $300,000 equity investment. If he could achieve this level of return, he knew that his investors would be quite happy. If his numbers were accurate, he knew that he didn't need to spend much time or effort calculating the benefits of future rental increases or sale proceeds. But how accurate were his numbers, especially given the problems in the rental market? Note: The City of Houston is located within the Houston- Galveston-Brazoria Consolidated Metropolitan Statistical Area (CMSA) and it is the county seat of Harris County, View table as text Table 2 Houston Employment (1980-1989) The Houston Market By 1990, the Houston economy was slowly recovering from the collapse of the oil industry in the early eighties. Both employment and population levels had crept to roughly at or past 1985 levels (See Tables 1 and 2 for population and employment data.) Oil prices, which had been as high as $35 per 16 17 William J. Poorvu Source: Texas Employment Commission View table as tent South Park IV the market with deeply discounted properties. Houston, with almost 210 million square feet of industrial space, was the 9th largest industrial market in the U.S. Between 1981 and 1985 approximately 35,000,000 square feet of industrial space was added. From 1986-1989, there has been no speculative construction in the area. A limited amount of build-to-suit construction had taken place during this period (See Table 3 for Houston industrial occupancy data). [Page 5 This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 Table 3 Houston Industrial Occupancy Data (000s) The outlook for the real estate industry in Houston was not clear. Economic growth would generate fresh demand for space, although almost every category of real estate had a tremendous supply of vacant space. There was also a concern that the collapse of the Savings & Loan industry in Texas might further depress prices and rents by flooding a 18 19 William J. Poorvu South Park IV View table as test Within the submarket in which SouthPark IV was located, there were nine buildings that were considered to be competitive to South Park IV. Occupancy and rental rate information, based on their current tenants, are shown below in Table 4. View table as text Most of these leases, however, were written many years ago at higher rents. At the current market rental rate of $2.00 per square foot, Laflin realized that he would not obtain Lonestar's projected rents. Obviously, the returns would be lower. Table 4 Competitor Occupancy & Rental Rates October, 1989 But Laflin had been following the local real estate market closely. He felt that the local economy was gaining strength and that a resurgence in economic activity would cause a rise in rental rates and real estate values. He also felt that the near collapse of the Savings 20 21 William J. Poorvu & Loan industry in Texas presented a unique opportunity to invest in troubled real estate properties at a substantial discount Somehow he would have to incorporate both current market rates and potential future rates in his analysis. If he didn't, he felt that someone else would outbid him for the property. [Page 6] This document is authorized for use only by Armonie Andrews in SP22 BUSFIN 3400 Intro to Real Estate taught by Sharon Shaffer, The Ohio State University from Dec 2021 to Jun 2022 SouthPark IV also believed that he would be able to sell the property at a 10% cap rate. To complete his analysis, Laflin had to calculate the net cash flow from a sale. To do this, he would take the net selling price and subtract the net book value in order to get the gain on sale. He would then calculate the tax liability by multiplying the gain on sale by the 28% tax rate. This would allow him to calculate the net cash from sale by taking the net selling price and subtracting the mortgage balance and the tax liability. Net book value was defined as the purchase price plus capital improvements minus accumulated depreciation. He assumed that the cost of selling the project would be 5% of the gross sales price. Laflin wondered if the asking price itself too high. Even with future rental If the partnership invested in SouthPark IV, Laflin assumed that the partnership would hold the property for five years. Over this period, he believed that both income and expenses for office/warehouse properties in Houston would grow at a 3% annual rate. He was 22 23 South Park IV were at best After all, the numbers projections. William J. Poorvu increases and future sale proceeds included, it was difficult to make the numbers work. The fixed mortgage payments could lead to either positive or negative leverage depending on the actual rental rate that he achieved. If he could negotiate a lower sales price with Lonestar, he might be able to improve the returns to his investors. Of course, he also knew that Lonestar would not lend the partnership more than 80% of the purchase price. It was time for Laflin to do some calculations: a revised income statement, a five year projection, and, using the back of the envelope approach, an analysis of the impact of a lower purchase price. Only then could he see if South Park IV was the right investment for his group. There were opportunities in Houston but he also had to consider the risks. 24 25 Data Given in Case Setup Year 1 Depreciation South Park IV Setup ($000s) Original Lonestar Projections 1990 Revised Laflin Projections 1990 $200 52 $200 52 $2.50 average 252 252 -13 Base rent (80,000 s.1) Expense reimbursement Gross Income Vacancy (5%) Net income General expenses Real estate taxes Insurance Management fee (4%) Structural reserve Total expenses Cash flow from operations 252 -12 -30 - 10 239 -12 -30 -10 -10 - 15 -77 -52 200 162 South Park IV Setup (Including Financing and Taxes) ($000) Cash flow from operations Interest Principal Cash flow after financing + Principal + Structural Reserve - Depreciation Taxable income Income Tax (39.6%) Cash flow after taxes 162 -96 -101 56 10 15 -31 50 -20 36 Data Given in Case Setup Year 1 Depreciation Setup at $2 per sf Initial Setup: Year 1 (Based on $1.5 million purchase price) 1.500 1,200 Percent (Year 1 Return) 10.8% Return on Asset (ROA) or cap rate 8.8% Mortgage Constant SouthPark IV Setup (Including Financing and Taxes) (5000) Invested Capital Cash flow from operations Interest Principal Cash flow after financing + Principal + Structural Reserve Depreciation Taxable income Income Tax (39.6%) Cash flow after taxes 300 Revised Laflin Income 1990 1621 -96 -10 56 10 15 -31 50 -20 36 18.7% pretax Return on Equity (ROE) 300 12.0% after tax Return on Equity (ROE) Data Given in Case Setup Year 1 Depreciation Calculation for Annual Depreciation Purchase price Land value Depreciable base 1,500,000 -300,000 1,200,000 39 years ** this was given in footnote on page 4 Depreciable life Annual depreciation 30,769.231 Data Given in Case Setup Year 1 Depreciation Setup at $2 per sf South Park IV Setup (5000s) Original Lonestar Projections 1990 Revised Laflin Projections 1990 ($2.50/81) Income at S2/s1 $200 52 252 $200 52 252 -13 239 -12 -30 S160 52 $212 -10.6 5201 252 Base rent (80,000 sf) Expense reimbursement Gross Income Vacancy (5%) Net income General expenses Real estate taxes Insurance Management fee (4%) Structural reserve Total expenses Cash flow from operations -12 -12 -30 -30 -10 -10 -10 -10 -15 -8.056 -15 -75.056 S126 -77 -52 200 162 Returns 10.8% 8.8% Revised Returns 8,4% ROA or cap rate 8,8% mortgage constant South Park IV Setup (Including Financing and Taxes) (5000) Investment Income Cash flow from operations 1500 Interest 1200 Principal Cash flow after financing 300 + Principal Structural Reserve Depreciation Taxable income Revised Income S126 .96 -10 20.344 10 15 -31 14.344 162 -96 - 10 56 10 15 -311 50 18.7% 6.8% pretax ROE Income Tax (39.6%) -20 -5.68 Cash flow after taxes 300 36 12.0% 14.664 4.9% after tax ROE - Consider the following questions as you read the case:

- Is this a good property for Laflin to acquire? Why or why not?

- What price should Laflin offer for SouthPark IV? What conditions should he attach to his offer?

- How might Lonestar try to justify a higher price?

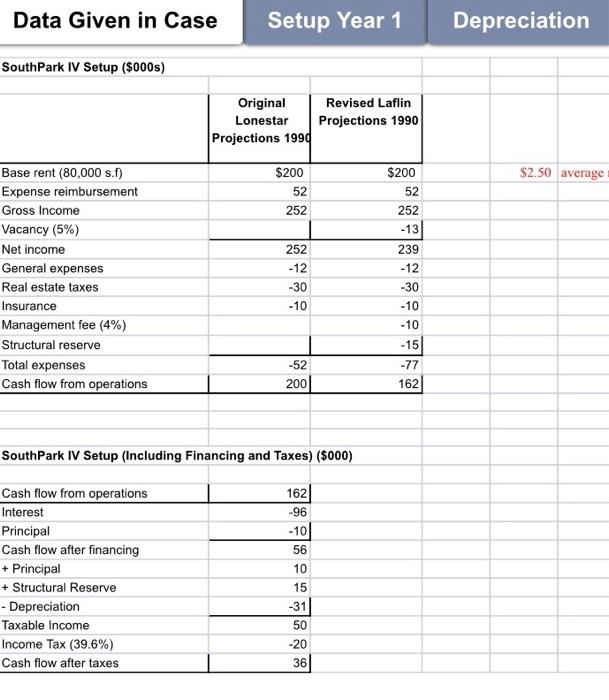

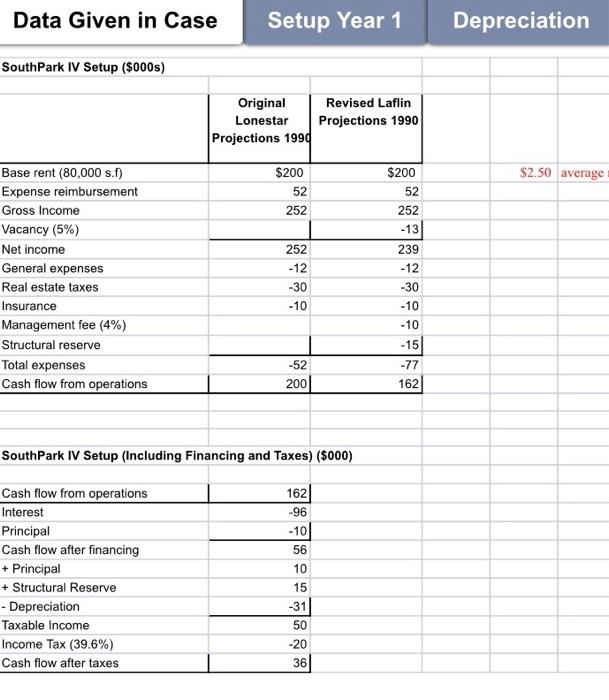

- What might SouthPark IV be worth in five years?

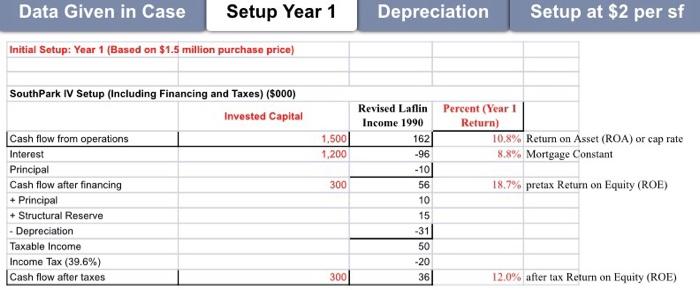

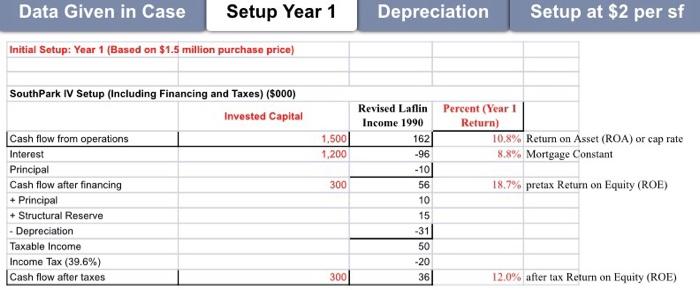

- Why are there wide variations in the valuation of real estate assets?

- Read SouthPark IV case study pictures below then answer questions:

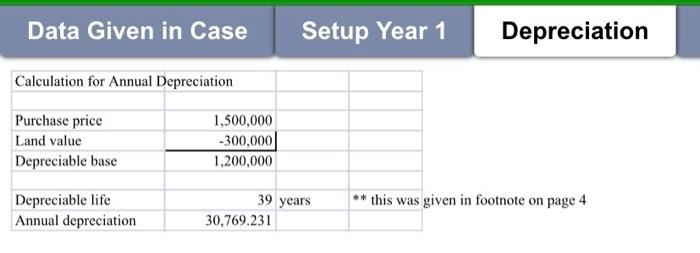

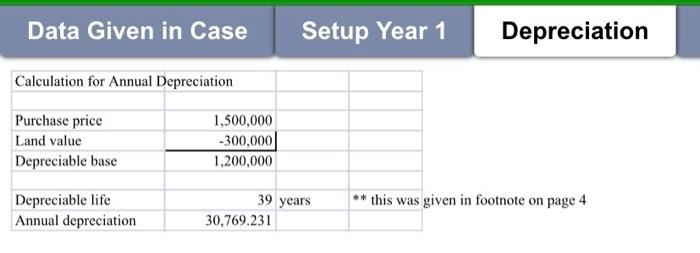

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

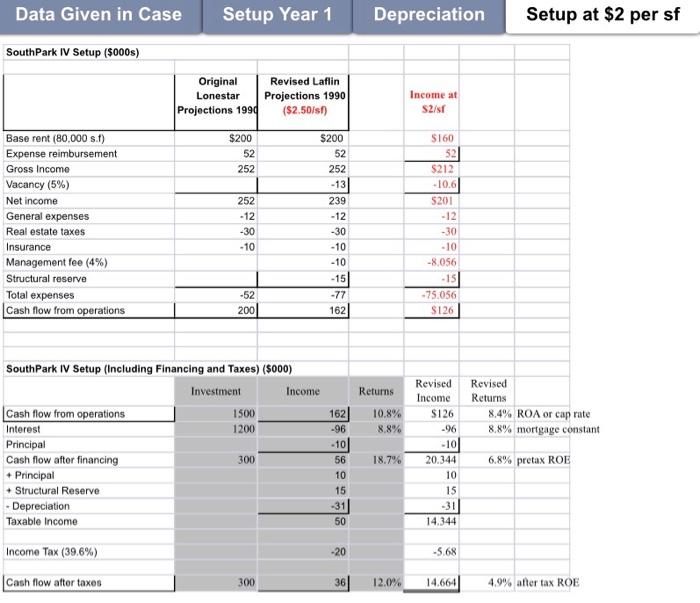

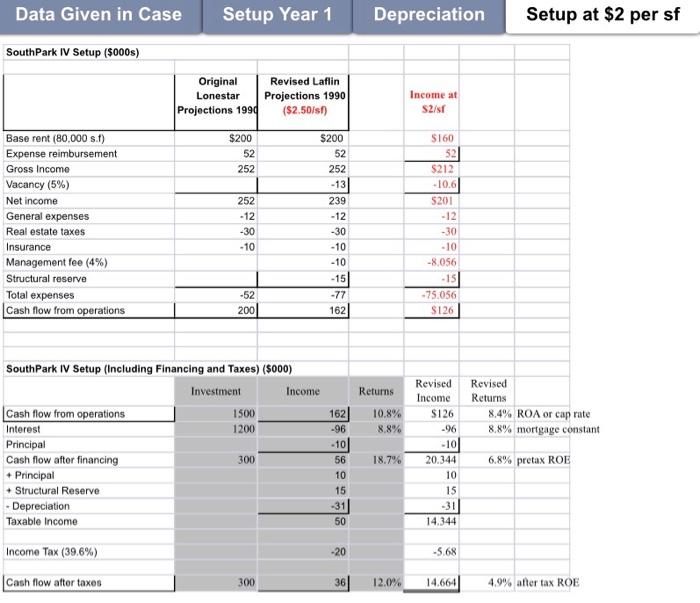

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started