Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help as soon as possible please Baxter Company's budget committee provides the following information: (Click the icon to view the information.) Read the

I need help as soon as possible please

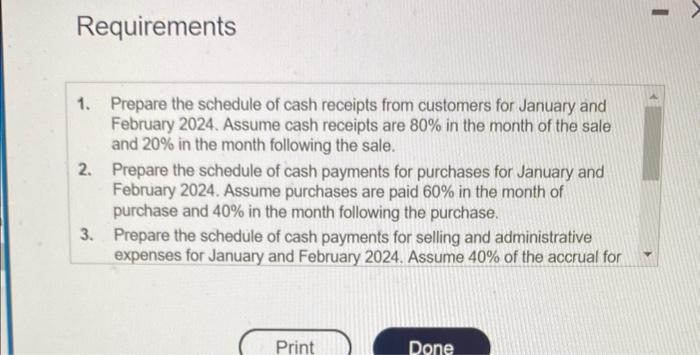

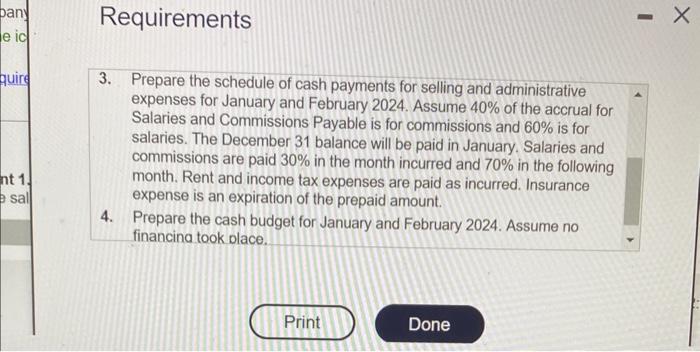

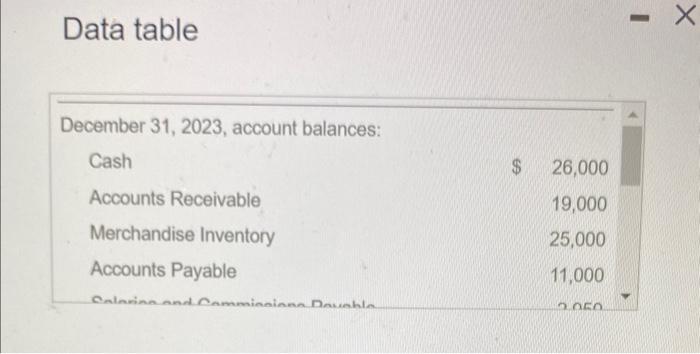

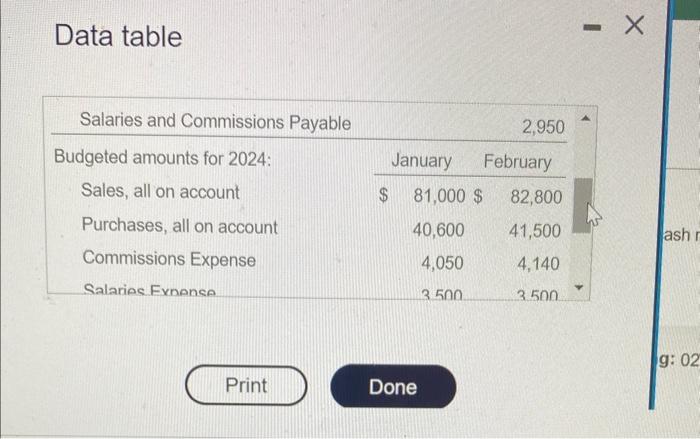

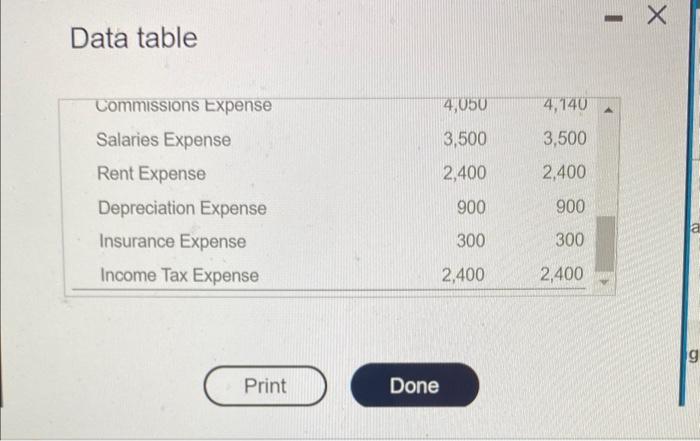

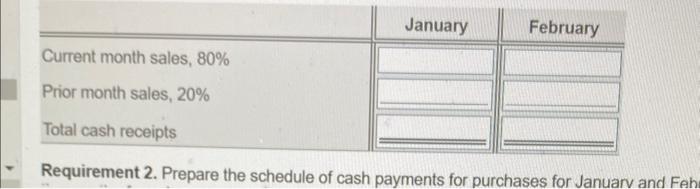

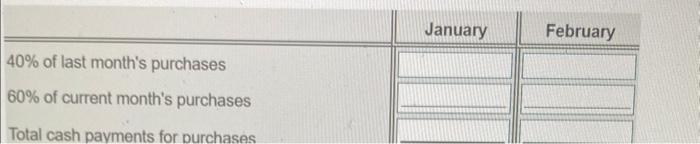

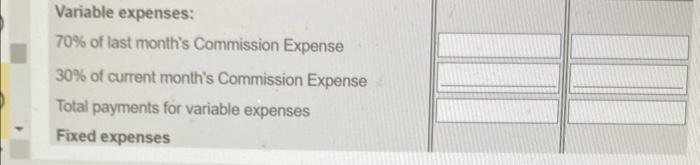

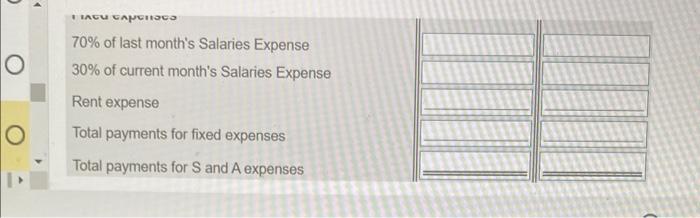

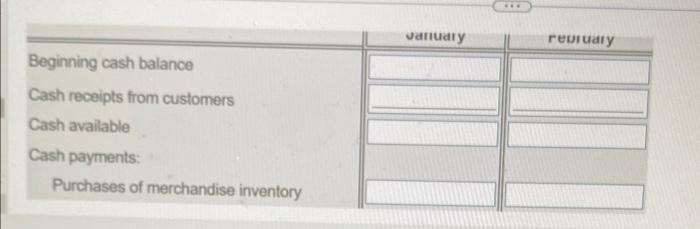

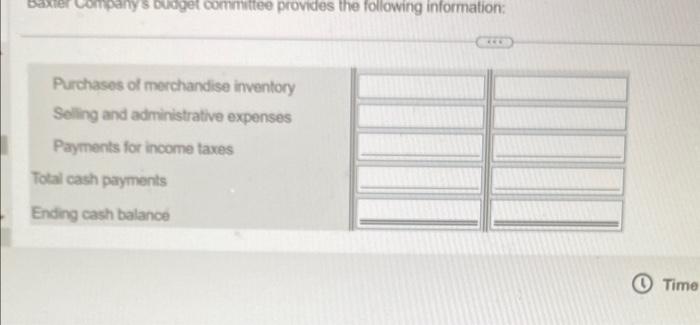

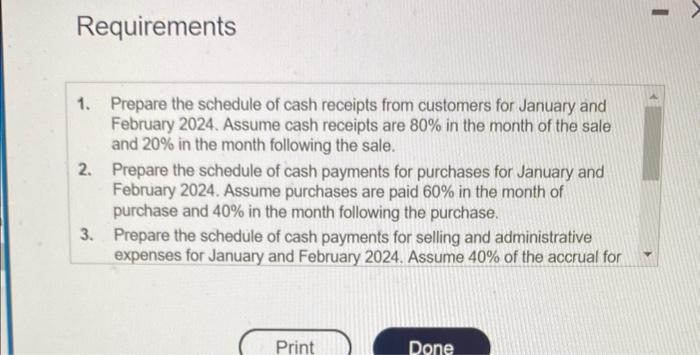

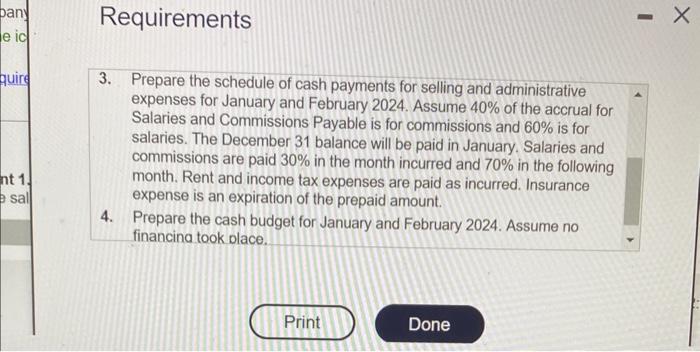

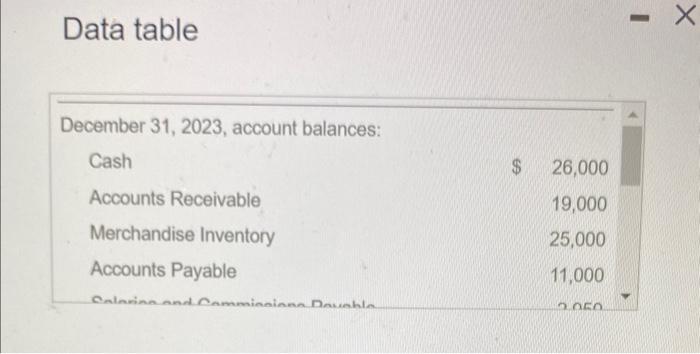

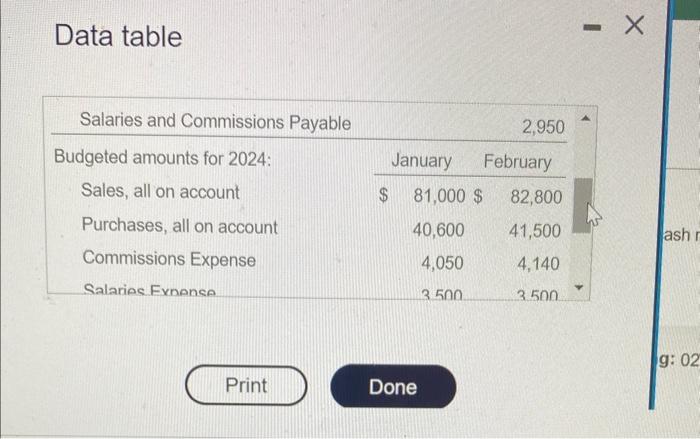

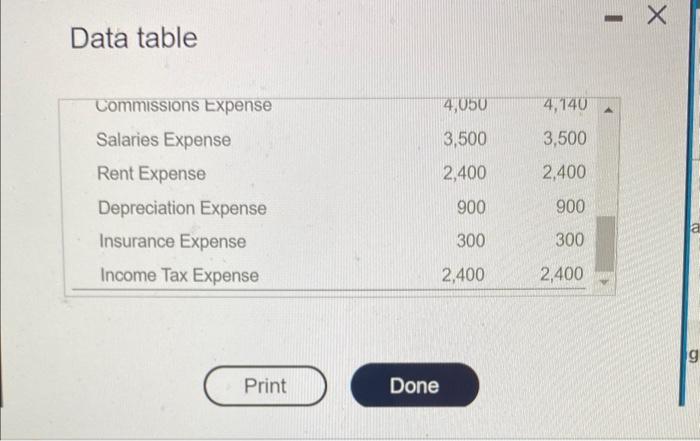

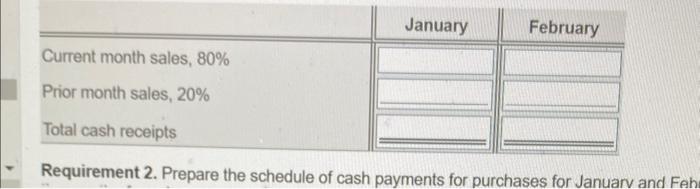

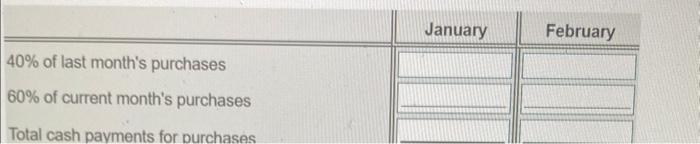

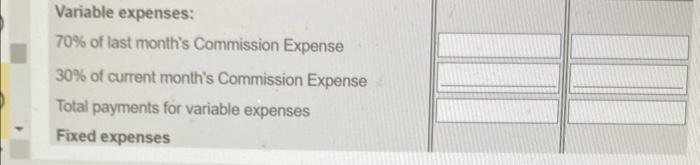

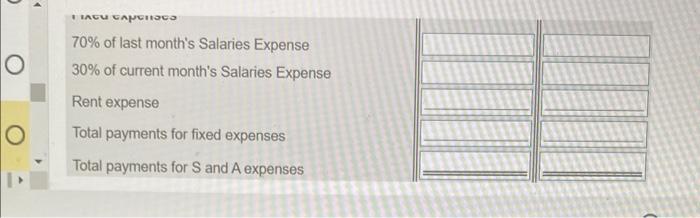

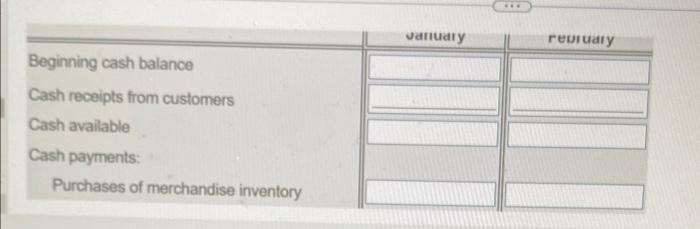

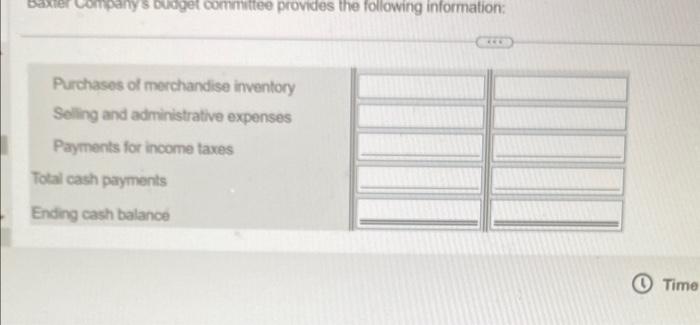

Baxter Company's budget committee provides the following information: (Click the icon to view the information.) Read the requirements. Requirement 1. Prepare the schedule of cash receipts from customers for January and February 2024. Assume cash receipts a month of the sale and 20% in the month following the sale. Requirements 1. Prepare the schedule of cash receipts from customers for January and February 2024. Assume cash receipts are 80% in the month of the sale and 20% in the month following the sale. 2. Prepare the schedule of cash payments for purchases for January and February 2024. Assume purchases are paid 60% in the month of purchase and 40% in the month following the purchase. 3. Prepare the schedule of cash payments for selling and administrative expenses for January and February 2024. Assume 40% of the accrual for Requirements 3. Prepare the schedule of cash payments for selling and administrative expenses for January and February 2024. Assume 40% of the accrual for Salaries and Commissions Payable is for commissions and 60% is for salaries. The December 31 balance will be paid in January. Salaries and commissions are paid 30% in the month incurred and 70% in the following month. Rent and income tax expenses are paid as incurred. Insurance expense is an expiration of the prepaid amount. 4. Prepare the cash budget for January and February 2024. Assume no Data table Data table Data table Requirement 2. Prepare the schedule of cash payments for purchases for Januarv and Feh \begin{tabular}{l|ll|l} \hline \hline 40% of last month's purchases & January & February \\ 60% of current month's purchases & & \\ Total cash payments for purchases & & \end{tabular} Variable expenses: 70% of last month's Commission Expense 30% of current month's Commission Expense Total payments for variable expenses Fixed expenses 70% of last month's Salaries Expense 30% of current month's Salaries Expense Rent expense Total payments for fixed expenses Total payments for S and A expenses Beginning cash balance Cash receipts from customers Cash available Cash payments: Purchases of merchandise inventory Purchases of merchandise inventory Seling and administrative expenses Payments for income taves Tobal cash payments Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started