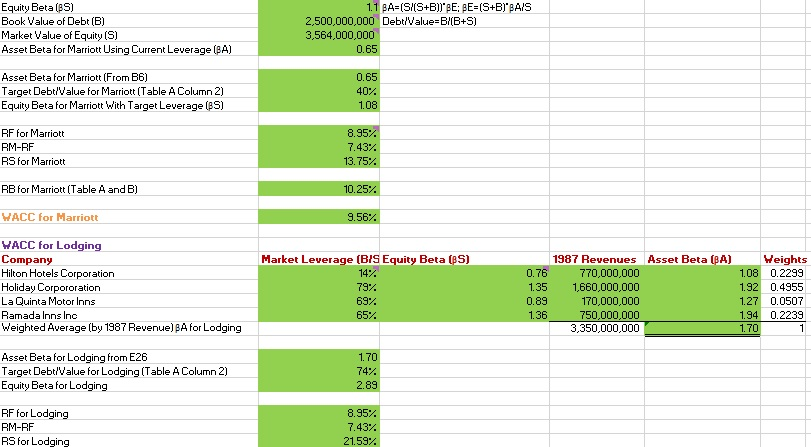

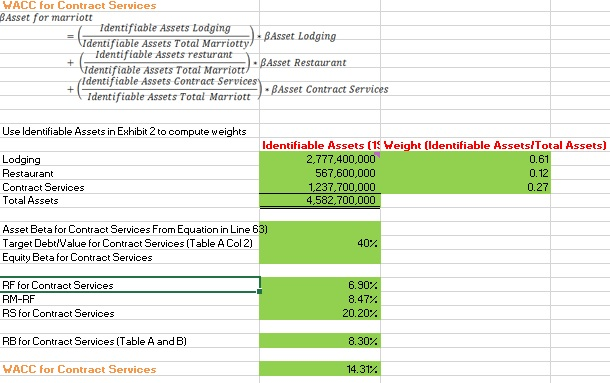

I need Help ASAP Please. I just need to find ASSET Beta for contract, and Equity Beta for Contract. Please see the pictures below. Thank you in advance.

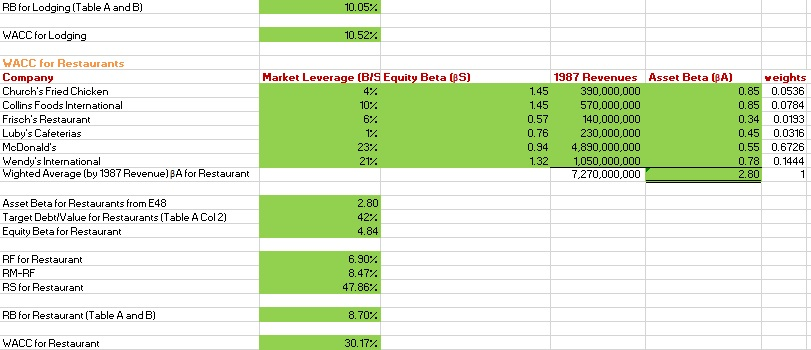

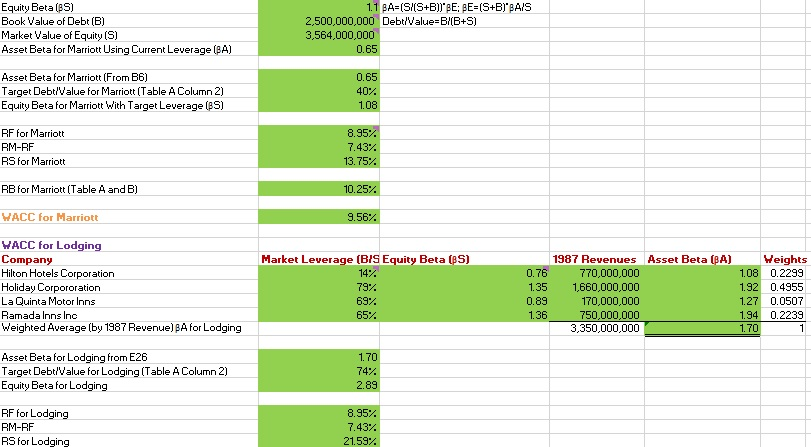

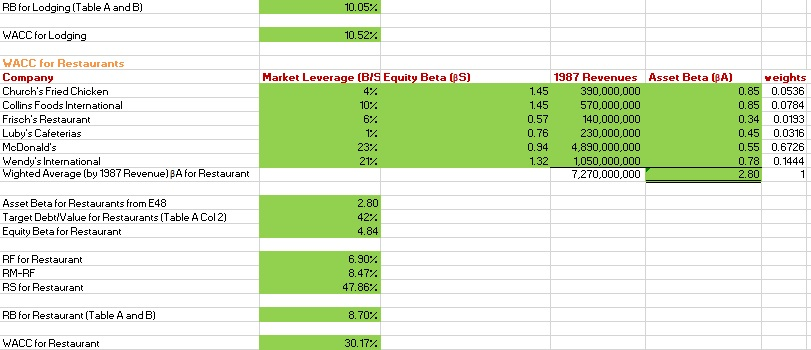

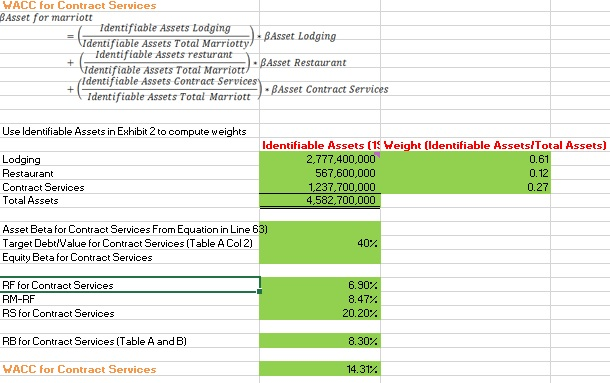

Equity Beta Book Value of Debt (B) Market Value of Equity (S) Asset Beta for Marriott Using Currnt Leverage (BA) 2,500,000,000 DebtValue BIB+5) 3,564,000,000 Asset Beta for Marriott (From B6) Target Debt/Value for Marriott (Table A Column 2) Equity Beta for Marrt with Target Leverage (BS) 40: RF for Marriott RM-RF RS for Marriott 95 7.43% RB for Marriott Table A and B) WACC for Marriott WACC for Lodging Company Hilton Hotels Corporation Holiday Corpororation La Quinta Motor Inns Ramada Inns Inc Weighted Average(by 1987 Revenue) BA for Lodging Market Leverage (BIS Equity Beta (BS] 14% 79% 1987 Revenues 0.76 770,000,000 1,660,000,000 170,000,000 750,000,000 3,350,000,000 Asset Beta (BA) Weights 0.2299 1.92 0.4955 1.27 0.0507 1.94 0.2239 1.35 0.89 1.70 Asset Beta for Lodging from E26 Target Debt/value for Lodging (Table A Column 2) Equity Beta for Lodging 74 RF for Lodging RM-RF RS for Lodging 95 7.43% 21.59% RB for Lodging (Table A and B WACC for Lodging WACC for Restaurants Company Church's Fried Chickern Collins Foods International Frisch's Restaurant Luby's Cafeterias McDonald's Wendy's International wighted Average (by 1987 Revenue)BA for Restaurant Market Leverage (BIS Equity Beta (BS] 1987 Revenues Asset Beta (A) 390,000,000 570,000,000 140,000,000 230,000,000 0.94 4,890,000,000 1,050,000,000 7,270,000,000 veights 0.0536 0.0784 0.34 0.0193 0.45 0.0316 0.6726 0.1444 1.45 0.57 0.76 23% 2.80 Asset Beta for Restaurants from E48 Target Debtl'Value for Restaurants (Table A Col 2) Equity Beta for Restaurant RF for Restaurant RM-RF RS for Restaurant 8.47% RB for Restaurant (Table A and B] WACC for Restaurant 17% WACC for Contract Services BAsset for marriott Identifiable Assets Lodgin Identifiable Assets Total Marriotty BAsset Lodging Identifiable Assets restur Identifiable Assets Total Marriott Identifiable Assets Contract Services Identifiable Assets Total Marriott Asset Restaurant BAsset Contract Services Use Identifiable Assets in Exhibit 2 to compute weights Identifiable Assets (1Weight (ldentifiable AssetslTotal Assets) Lodging Restaurant Contract Services Total Assets 2,777,400,0 0.61 567,600,000 1.237,700,000 4.582,700.000 Asset Beta for Contract Services From Equation in Line 6 Target Debt/value for Contract Services(Table A Col 2 Equity Beta tor Lontract Services 40: RF for Contract Services RM-RF RS for Contract Services 8.47% RB for Contract Services (Table A and B) WACC for Contract Services Equity Beta Book Value of Debt (B) Market Value of Equity (S) Asset Beta for Marriott Using Currnt Leverage (BA) 2,500,000,000 DebtValue BIB+5) 3,564,000,000 Asset Beta for Marriott (From B6) Target Debt/Value for Marriott (Table A Column 2) Equity Beta for Marrt with Target Leverage (BS) 40: RF for Marriott RM-RF RS for Marriott 95 7.43% RB for Marriott Table A and B) WACC for Marriott WACC for Lodging Company Hilton Hotels Corporation Holiday Corpororation La Quinta Motor Inns Ramada Inns Inc Weighted Average(by 1987 Revenue) BA for Lodging Market Leverage (BIS Equity Beta (BS] 14% 79% 1987 Revenues 0.76 770,000,000 1,660,000,000 170,000,000 750,000,000 3,350,000,000 Asset Beta (BA) Weights 0.2299 1.92 0.4955 1.27 0.0507 1.94 0.2239 1.35 0.89 1.70 Asset Beta for Lodging from E26 Target Debt/value for Lodging (Table A Column 2) Equity Beta for Lodging 74 RF for Lodging RM-RF RS for Lodging 95 7.43% 21.59% RB for Lodging (Table A and B WACC for Lodging WACC for Restaurants Company Church's Fried Chickern Collins Foods International Frisch's Restaurant Luby's Cafeterias McDonald's Wendy's International wighted Average (by 1987 Revenue)BA for Restaurant Market Leverage (BIS Equity Beta (BS] 1987 Revenues Asset Beta (A) 390,000,000 570,000,000 140,000,000 230,000,000 0.94 4,890,000,000 1,050,000,000 7,270,000,000 veights 0.0536 0.0784 0.34 0.0193 0.45 0.0316 0.6726 0.1444 1.45 0.57 0.76 23% 2.80 Asset Beta for Restaurants from E48 Target Debtl'Value for Restaurants (Table A Col 2) Equity Beta for Restaurant RF for Restaurant RM-RF RS for Restaurant 8.47% RB for Restaurant (Table A and B] WACC for Restaurant 17% WACC for Contract Services BAsset for marriott Identifiable Assets Lodgin Identifiable Assets Total Marriotty BAsset Lodging Identifiable Assets restur Identifiable Assets Total Marriott Identifiable Assets Contract Services Identifiable Assets Total Marriott Asset Restaurant BAsset Contract Services Use Identifiable Assets in Exhibit 2 to compute weights Identifiable Assets (1Weight (ldentifiable AssetslTotal Assets) Lodging Restaurant Contract Services Total Assets 2,777,400,0 0.61 567,600,000 1.237,700,000 4.582,700.000 Asset Beta for Contract Services From Equation in Line 6 Target Debt/value for Contract Services(Table A Col 2 Equity Beta tor Lontract Services 40: RF for Contract Services RM-RF RS for Contract Services 8.47% RB for Contract Services (Table A and B) WACC for Contract Services