i need help

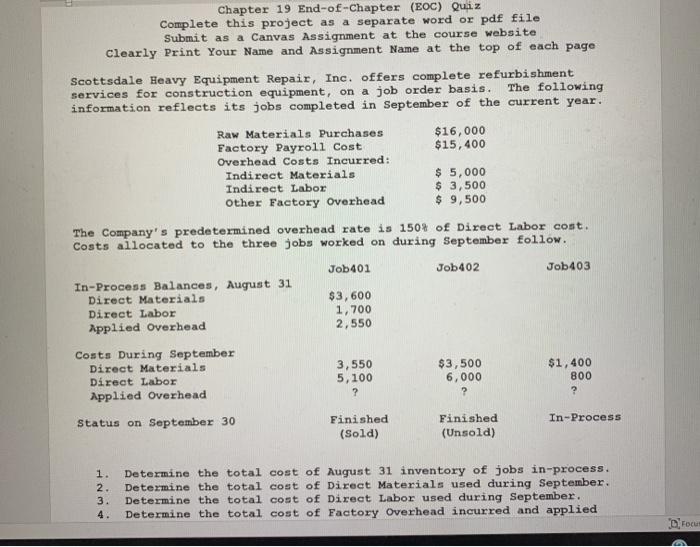

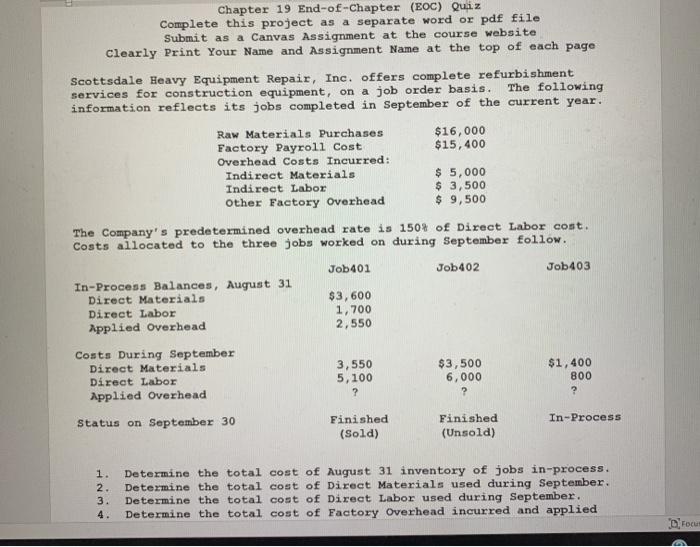

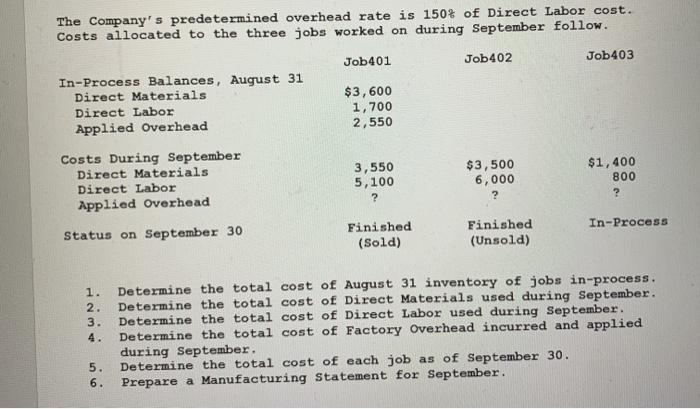

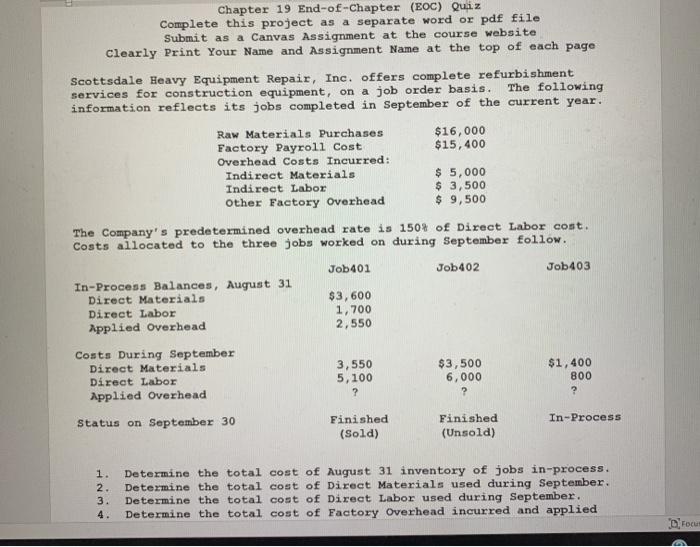

Chapter 19 End-of-Chapter (EOC) Quiz Complete this project as a separate word or pdf file Submit as a Canvas Assignment at the course website clearly Print Your Name and Assignment Name at the top of each page Scottsdale Heavy Equipment Repair, Inc. offers complete refurbishment services for construction equipment, on a job order basis. The following information reflects its jobs completed in September of the current year. Raw Materials Purchases $16,000 Factory Payroll Cost $15,400 Overhead Costs Incurred: Indirect Materials $ 5,000 Indirect Labor $ 3,500 Other Factory Overhead $ 9,500 The Company's predetermined overhead rate is 150% of Direct Labor cost. Costs allocated to the three jobs worked on during September follow. Job 401 Job 402 Job 403 In-Process Balances, August 31 Direct Materials $3,600 Direct Labor 1,700 Applied Overhead 2,550 Costs During September Direct Materials 3,550 $3,500 $1,400 Direct Labor 5,100 6,000 800 Applied Overhead ? ? ? Status on September 30 Finished Finished In-Process (Sold) (Unsold) 1. 2. 3. 4. Determine the total cost of August 31 inventory of jobs in-process. Determine the total cost of Direct Materials used during September. Determine the total cost of Direct Labor used during September. Determine the total cost of Factory Overhead incurred and applied Focus The Company's predetermined overhead rate is 150% of Direct Labor cost. Costs allocated to the three jobs worked on during September follow. Job 401 Job402 Job 403 $3,600 1,700 2,550 In-Process Balances, August 31 Direct Materials Direct Labor Applied Overhead Costs During September Direct Materials Direct Labor Applied Overhead Status on September 30 3,550 5,100 ? $3,500 6,000 ? $1,400 800 ? In-Process Finished (Sold) Finished (Unsold) 1. 2. 3. Determine the total cost of August 31 inventory of jobs in-process. Determine the total cost of Direct Materials used during September. Determine the total cost of Direct Labor used during September. Determine the total cost of Factory Overhead incurred and applied during September. Determine the total cost of each job as of September 30. Prepare a Manufacturing Statement for September. 5. 6