i need help

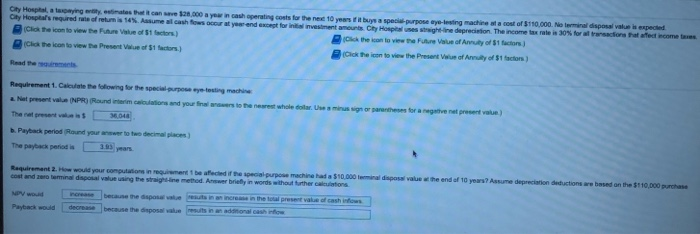

City Hosptal, a tapaying enty, eetimales that it can save $28,000 a year in cash operating costs for the next 10 years if it buys a special-purpose aye-lesting machine at a cost of $110,000. No terminal disposal value is expecled City Hosplal's required rate of return is 14%. Assume al cash fows occur at year-end except for inilial imvestment ameunts Cty Hosptal uses straighe-ine deprecietion. The income tax rale is 30% for al transacions hat affect income taes (Click the icon to view the Future Value of $1 factors) Clck the icon to view the FuAre Value of Annuly of $1 factors (Clck the icon to view the Present Value of $1 factors) (Clck the icon to view the Present Value of Annuty of $1 factors) Read the quirements Requirement 1. Calculate the following for the special purpose eye-testing machine a Nat present value (NPR) Round interim caloulations and your final ansers to the nearest whole doilar. Use a minus sign or panantheses for a negatve net present value) 36,044 The net present value is b. Payback period Round your answer to two decimal places) 3.99 years The payback period is Raquiremant 2. How would your computations in requiement 1 be afecied if the special-purpose machine had a $10,000 teminal disposal value a the end of 10 years? Assume depreciation deductions are based on the $110,000 purchase cost and zero terminal dsposal value using the straight-ine method. Anewr briefly in words without further calculations increase because the dsposal valueeuts in an increase in the total present value of cash infows MPV woud Payback would decrease because the disposal value results in an additional cash infow City Hosptal, a tapaying enty, estimales that it can save $28,000 a year in cash operating costs for the next 10 years if it buys a special-purpose aye-lesting machine at a cost of $110,000. No terminal disposal value is expecled City Hosplal's required rate of return is 14%. Assume al cash ows occur at year-end except for inilial imvestment ameunts Cty Hosplal uses straighe-ine deprecietion. The income tax rale is 30% for al transacions hat afect income taxes. (Click the icon to view the Future Value of $1 factors) Clck the icon to view the FuAre Value of Annuly of $1 factors (Cick the icon to view the Present Value of $1 factors) (Clck the icon to view the Present Value of Annuly of $1 factors) Read the ouiements Requirement 1. Calculate the following for the special-purpose eye-testing machine a Nat present value (NPR) Round interim caloulations and your final ansers to the nearest whole dolar. Use a minus sign or panantheses for a negathve net present value) 36,044 The net present value is b. Payback period Round your answer to two decimal places) 3.99 years The payback period is Raquiremant 2. How would your computations in requiement 1 be afecied if the special-purpose machine had a $10,000 teminal disposal value a the end of 10 years? Assume depreciation deductions are based on the $110,000 purchase cost and zero terminal dsposal value using the straight-ine method. Anewer briefly in words without further calculatons increase because the dsposal valueets in an increase in the total present value of cash infows NPV woud decrease Payback would because the disposal valueresults in an additional cash infiow City Hospital, a taxpaying entity, estimates that it can save $28,000 a year in cash operating costs for the next 10 years ift buys a special purpose aye-testing machine at a cost of $110,000. No terminal disposal value is expected City Hospital's required rate of returm is 14 % Assume all cash Nows occur at year-end except for initial imvestment amounts City Hosptal uses straighe-ine depreciation. The income tax rate is 30% for all transactions that afect income taxes. (Cick the icon to view the Future Value of $1 factors) eCick the icon to view the Fuhre Value of Anuty of $1 factors) Click the icon to view the Present Value of $1 factors) Cick the icon to view the Present Value of Annuity of $1 faclors) Read the reauirements Requirement 1. Calculate the following for the special purpose eye-testing machine Net present value (NPR) 0Round interim caloulations and your final anwers to the nearest whole dollar Use a minus sign or parentheses for a negative net present value.) 36,048 The net present value is b. Payback period (Round your answer to two decimal placees) 393 years The payback period is Requirement 2. How would your computations in requirement 1 be afected if the special-purpose machine had a $10,000 terminal disposal value at the end of 10 years? Assume depreciation deductions are based on the $110,000 purchase cost and zero terminal disposal value using the straight-ine method Answer briefly in words without further calculations increase because the disposal value resuts in an increase in the total present value of cash inflows NPV would decrease because the disposal value resuts in an additional cash infow Payback woud