Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help completing PART D. I have completed all previous parts and provided the correct answers in the screenshots below. Carla Vista Snowboarding Company,

I need help completing PART D. I have completed all previous parts and provided the correct answers in the screenshots below.

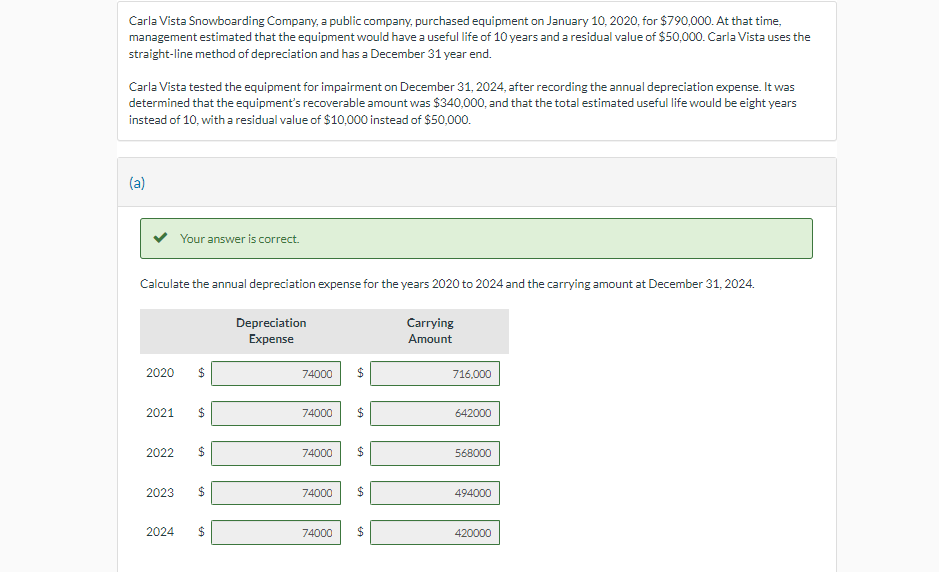

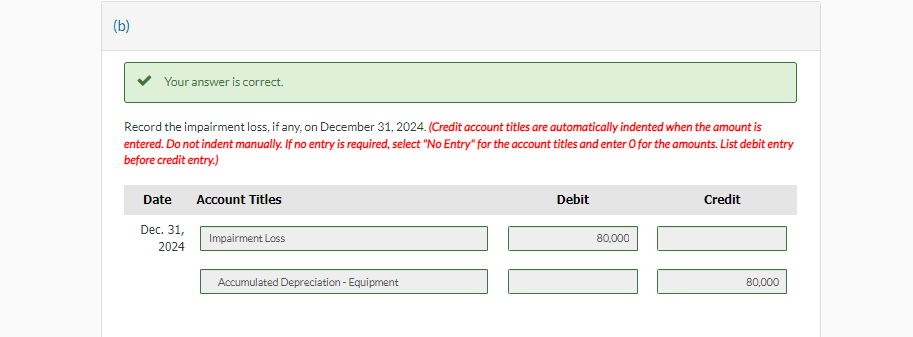

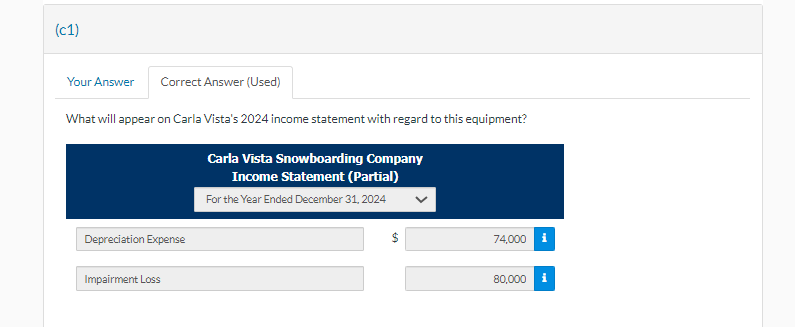

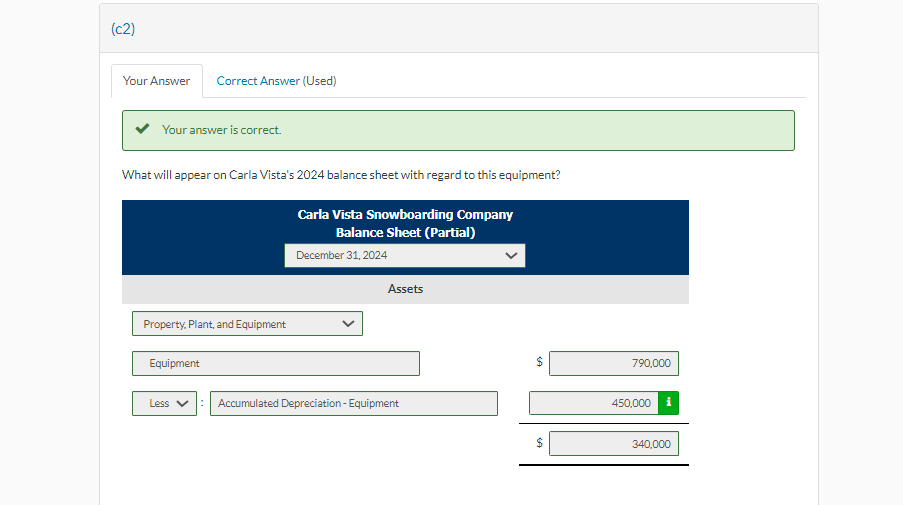

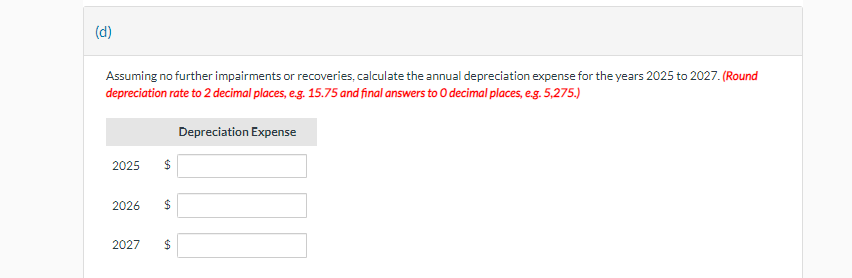

Carla Vista Snowboarding Company, a public company, purchased equipment on January 10,2020 , for $790,000. At that time, management estimated that the equipment would have a useful life of 10 years and a residual value of $50,000. Carla Vista uses the straight-line method of depreciation and has a December 31 year end. Carla Vista tested the equipment for impairment on December 31, 2024, after recording the annual depreciation expense. It was determined that the equipment's recoverable amount was $340,000, and that the total estimated useful life would be eight years instead of 10 , with a residual value of $10,000 instead of $50,000. (a) Your answer is correct. Calculate the annual depreciation expense for the years 2020 to 2024 and the carrying amount at December 31, 2024. Record the impairment loss, if any, on December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) What will appear on Carla Vista's 2024 income statement with regard to this equipment? Your answer is correct. What will appear on Carla Vista's 2024 balance sheet with regard to this equipment? Assuming no further impairments or recoveries, calculate the annual depreciation expense for the years 2025 to 2027. (Round depreciation rate to 2 decimal places, e.g. 15.75 and final answers to 0 decimal places, e.g. 5,275 .)

Carla Vista Snowboarding Company, a public company, purchased equipment on January 10,2020 , for $790,000. At that time, management estimated that the equipment would have a useful life of 10 years and a residual value of $50,000. Carla Vista uses the straight-line method of depreciation and has a December 31 year end. Carla Vista tested the equipment for impairment on December 31, 2024, after recording the annual depreciation expense. It was determined that the equipment's recoverable amount was $340,000, and that the total estimated useful life would be eight years instead of 10 , with a residual value of $10,000 instead of $50,000. (a) Your answer is correct. Calculate the annual depreciation expense for the years 2020 to 2024 and the carrying amount at December 31, 2024. Record the impairment loss, if any, on December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) What will appear on Carla Vista's 2024 income statement with regard to this equipment? Your answer is correct. What will appear on Carla Vista's 2024 balance sheet with regard to this equipment? Assuming no further impairments or recoveries, calculate the annual depreciation expense for the years 2025 to 2027. (Round depreciation rate to 2 decimal places, e.g. 15.75 and final answers to 0 decimal places, e.g. 5,275 .) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started