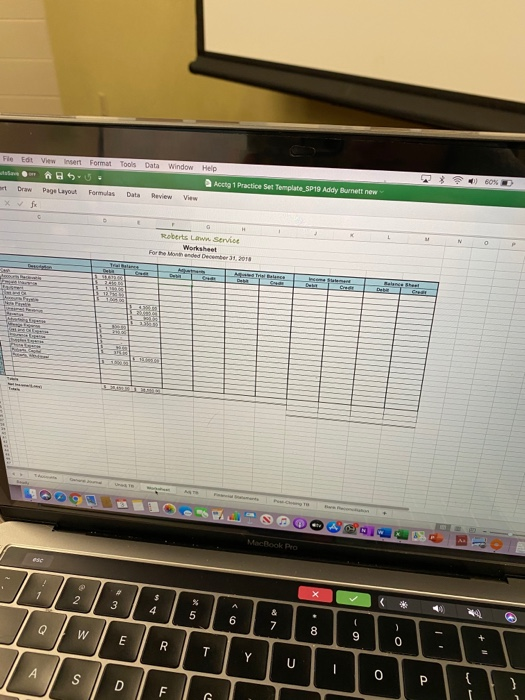

I need help creating an accounting worksheet using the template and information provided.

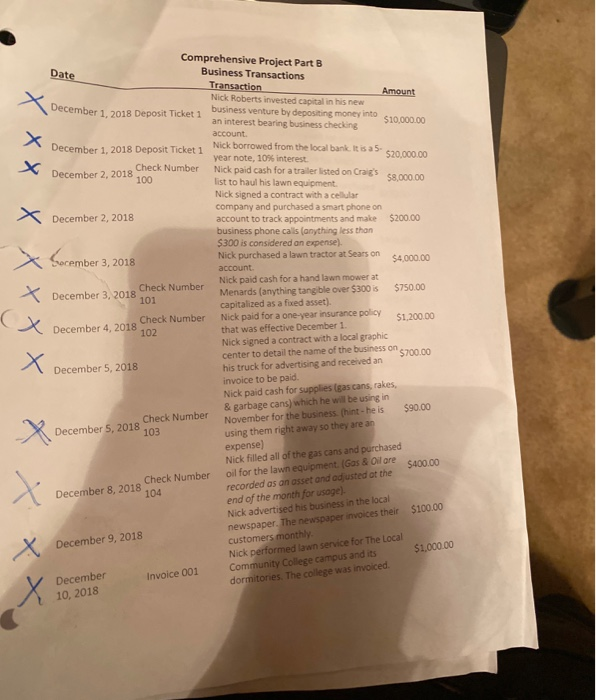

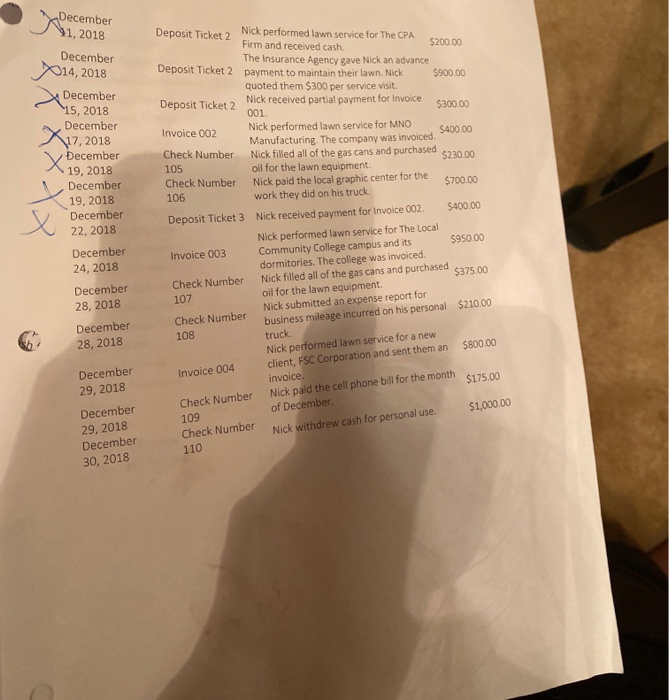

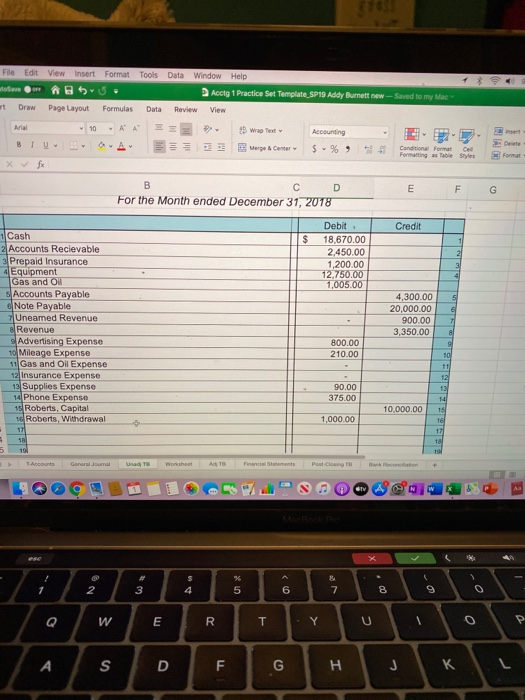

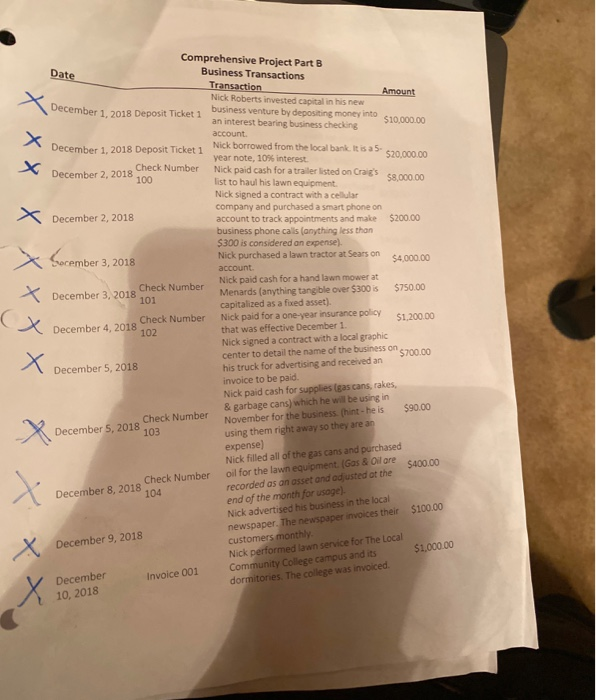

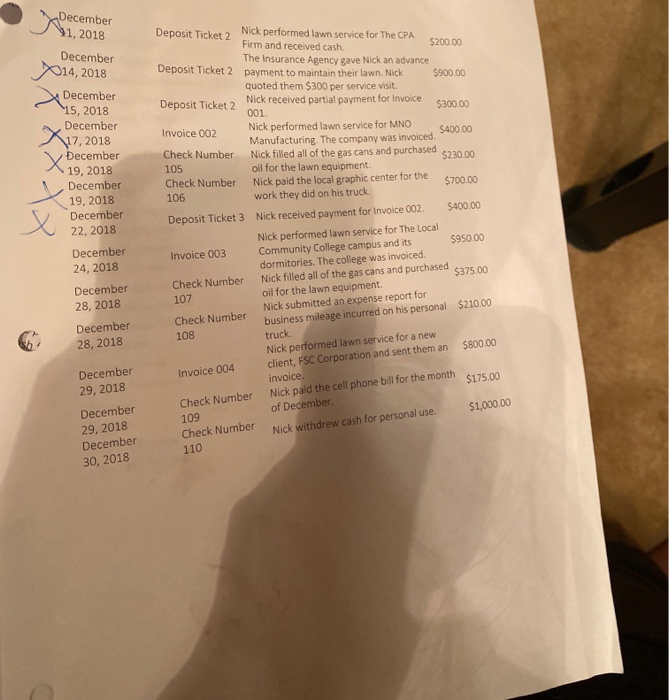

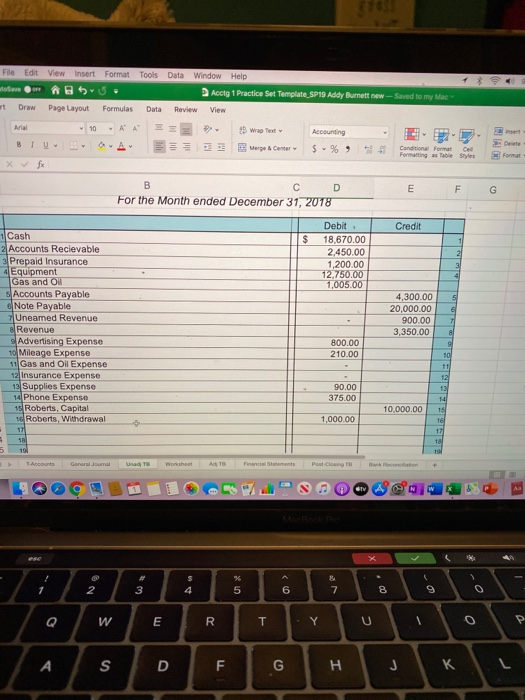

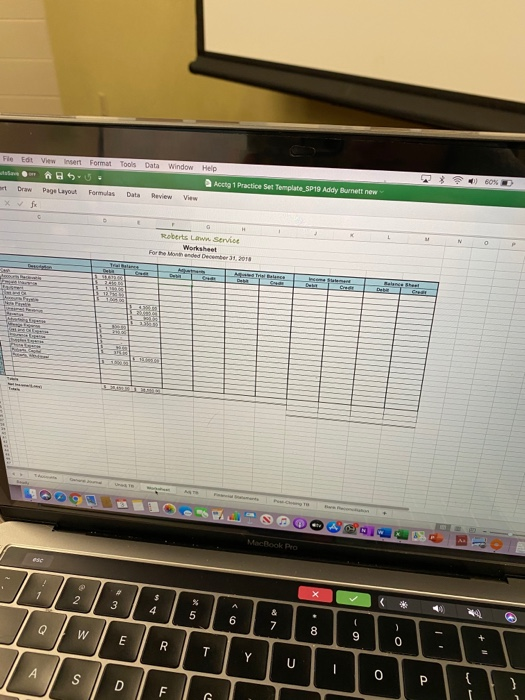

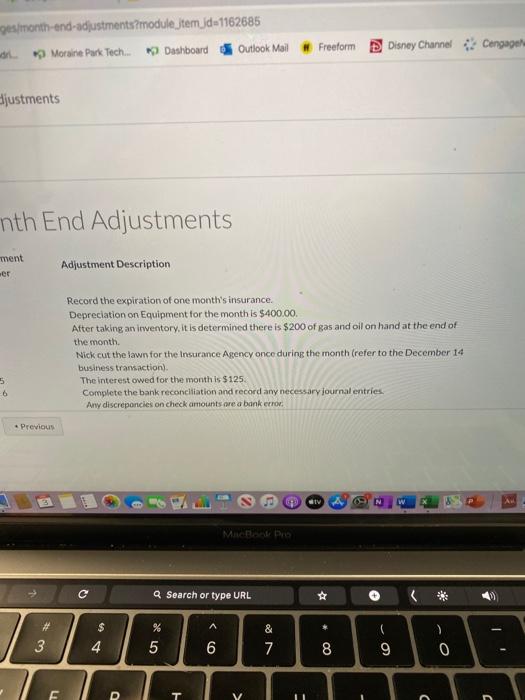

Comprehensive Project PartB Date Business Transactions Transaction Nick Roberts invested capital in his new business venture by depositing money into an interest bearing business checking X Amount December 1 2018 Deposit Ticket 1 $10,000.00 account Nick borrowed from the local bank. It is a 5- December 1, 2018 Deposit Ticket 1 year note, 10% interest Nick paid cash for a trailer listed on Craig's list to haul his lawn equipment. Nick signed a contract with a cellular company and purchased a smart phone on account to track appointments and make business phone calls (anything less than $300 is considered an expense). Nick purchased a lawn tractor at Sears on account Nick paid cash for a hand lawn mower at Menards (anything tangible over $300 is capitalized as a fixed asset). Nick paid for a one-year insurance policy that was effective December 1 Nick signed a contract with a local graphic center to detail the name of the business on his truck for advertising and received an invoice to be paid Nick paid cash for supplies (gas cans, rakes, & garbage cans) which he will be using in November for the business. (hint-he is using them right away so they are an expense Nick filled all of the gas cans and purchased oil for the lawn equipment. (Gas & Oil are recorded as an asset and adjusted ot the end of the month for usage) Nick advertised his business in the local newspaper. The newspaper invoices their customers monthly Nick performed lawn service for The Local Community College campus and its dormitories. The college was invoiced $20,000.00 Check Number December 2, 2018 100 $8,000.00 December 2, 2018 $200.00 bocember 3, 2018 $4,000.00 Check Number December 3, 2018 101 $750.00 (X Check Number $1,200.00 December 4, 2018 102 $700.00 December 5, 2018 $90.00 X Check Number December 5, 2018 103 $400.00 Check Number December 8, 2018 104 $100.00 December 9, 2018 $1,000.00 December 10, 2018 Invoice 001 X December 1, 2018 Deposit Ticket 2 Nick performed lawn service for The CPA Firm and received cash. December $200.00 014, 2018 The Insurance Agency gave Nick an advance Deposit Ticket 2 payment to maintain their lawn. Nick quoted them $300 per service visit. Nick received partial payment for Invoice 001 $900.00 December Deposit Ticket 2 15, 2018 $300.00 December 17, 2018 Nick performed lawn service for MNO Manufacturing. The company was invoiced Nick filled all of the gas cans and purchased oil for the lawn equipment. Nick paid the local graphic center for the work they did on his truck. Invoice 002 $400.00 December 19, 2018 December 19, 2018 December 22, 2018 Check Number 105 $230.00 Check Number $700.00 106 Nick received payment for Invoice 002. $400.00 Deposit Ticket 3 Nick performed lawn service for The Local Community Colllege campus and its dormitories. The college was invoiced. Nick filled all of the gas cans and purchased oil for the lawn equipment. Nick submitted an expense report for business mileage incurred on his personal $210.00 truck Nick performed lawn service for a new client, FSC Corporation and sent them an invoice Nick paid the cell phone bill for the month of December December 24, 2018 $950.00 Invoice 003 Check Number 107 $375.00 December 28, 2018 Check Number December 108 28, 2018 $800.00 December Invoice 004 29, 2018 $175.00 Check Number 109 Check Number 110 December $1,000.00 29, 2018 December Nick withdrew cash for personal use. 30, 2018 File Edit View Insert Format Tools Data Window Help toae Acctg 1 Practice Set Template SP19 Addy Burnett new-Saved to my Mac rt Draw Page Layout Formulas Data Review View Arial A A 10 bwrap Text insert Accounting Delete 8IU A E Merge &Center $ . 6 Conditional Format Formatting as Table Styles Cell Format x f C E G For the Month ended December 31, 2018 Debit Credit 1 Cash 2 Accounts Recievable 3 Prepaid Insurance 4 Equipment Gas and Oil SAccounts Payable G Note Payable 7Uneamed Revenue 8 Revenue S Advertising Expense 10 Mileage Expense 11 Gas and Oil Expense 12 Insurance Expense 13 Supplies Expense 14 Phone Expense 15 Roberts, Capital 16 Roberts, Withdrawal 171 18,670.00 2,450.00 1,200.00 12,750.00 1,005.00 1 21 3 4,300.00 20,000.00 900.00 71 3.350.00 8l 800.00 gl 210.00 10 11 12 90.00 13 375.00 14 10.000.00 15 1,000.00 16 17 18 18 5 19 19 Ad T 1-Acceunts Gonsral Journal Unad Ti Worksheat Financial Statements Post Cloaing TB Bank Reconcation tv MacRook ese & 1 2 3 6 7 4 P W E R T Y K L S F J A LO ) 60 % Data Window Help Fle Edt View Insert Format Tools Accta 1 Practice Set Template SP19 Addy Burnett new tden Review View Formulas Data ert Draw Page Layout f X e Raberts Laww Service Worksheet For the Month anded December 31, 30 Relance Sheet Deb Mat M Tr Belence Debi Tal lan Deb nom Saemen Cre ecv 1.199 13-M Thm Fe 2T Isnc Ege the thans Ts P C MacBook Pro #se X 2 3 5 6 7 Q W E T Y U P S F G + O CO