Answered step by step

Verified Expert Solution

Question

1 Approved Answer

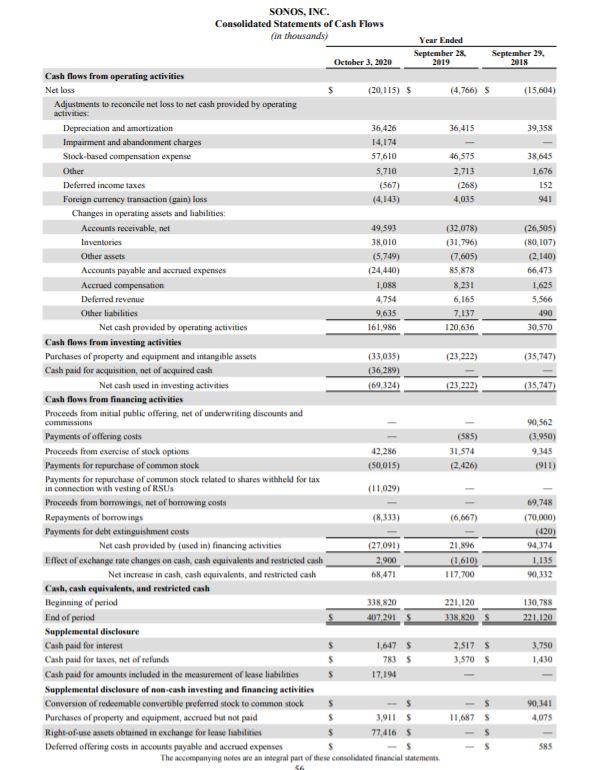

I need help creating an analysis for Sonos' statement of cash flows. Anything that could be beneficial would help me so much! SONOS, INC. Consolidated

I need help creating an analysis for Sonos' statement of cash flows. Anything that could be beneficial would help me so much!

SONOS, INC. Consolidated Statements of Cash Flows (in thousands) Year Ended September 28 September 29, October 3, 2020 2019 2018 Cash flows from operating activities Net loss (20,115) $ (4.766) S (15,604) Adjustments to recomeile net boss to net cash provided by operating activities Depreciation and amortization 36,426 36.415 39,358 Impairment and abandonment charges 14,174 Stock-based compensation expense 57,610 46,575 38,645 Other 5,710 2,713 1,676 Deferred income taxes (567) (268) 152 Foreign currency transaction (gain) loss (4.143 4,035 941 Changes in operating assets and liabilities: Accounts receivable, net 49,593 (32,078) (26,505) Inventones 38,010 (31.796) (80, 107) Other assets (5,749) (7,605) 2.140) Accounts payable and accrued expenses (24,440) 85,878 66,473 Accrued compensation 1,088 8.231 1.625 Deferred revenue 4,754 6,165 5,566 Other liabilities 9,635 7,137 490 Net cash provided by operating activities 161,986 120 636 30,570 Cash flows from investing netivities Purchases of property and equipment and intangible assets (33,035) (23.222) (35,747) Cash paid for acquisition, net of acquired cash (36,289) Net cash used in investing activities (69,324) (23232) (35,747) Cash flows from financing activities Proceeds from initial public offering, net of underwriting discounts and commissions 90,562 Payments of offering costs (585) (3.950) Proceeds from exercise of stock options 42,286 31,574 9,345 Payments for repurchase of common stock (50,015) (2.426) (911) Payments for repurchase of common stock related to shares withheld for tax (11.029) Proceeds from borrowings, net of borrowing costs 69,748 Repayments of borrowings (8,333) (6,667) (70,000) Payments for det extinguishment costs (420 Net cash provided by used in) financing activities (27.091) 21,896 94.374 Effect of exchange rate changes on cash, cash equivalents and restricted cash 2.900 (1 610) 1,135 Net increase in cash, cash equivalents, and restricted cash 68,471 117,700 90,332 Cash, cash equivalents, and restricted cash Beginning of period 338,820 221, 120 130,788 End of period 407, 2915 138.820 S 221.120 Supplemental disclosure Cash paid for interest 1617 2,517 3.750 Cash paid for taxes, net of refunds 783 3,570 S 1,430 Cash paid for amounts included in the measurement of lease liabilities 17,194 Supplemental disclosure of non-eash investing and financing activities Conversion of redeemable convertible preferred stock to common stock $ 90,141 Purchases of property and equipment, accrued but not paid 3,911 11,687 4075 Right-of-use amets obtained in exchange for lease lihilities $ 77,4165 Deferred offering costs in accounts payable and accrued expenses 585 The accompanying notes are an integral part of these consolidated financial statements. s SONOS, INC. Consolidated Statements of Cash Flows (in thousands) Year Ended September 28 September 29, October 3, 2020 2019 2018 Cash flows from operating activities Net loss (20,115) $ (4.766) S (15,604) Adjustments to recomeile net boss to net cash provided by operating activities Depreciation and amortization 36,426 36.415 39,358 Impairment and abandonment charges 14,174 Stock-based compensation expense 57,610 46,575 38,645 Other 5,710 2,713 1,676 Deferred income taxes (567) (268) 152 Foreign currency transaction (gain) loss (4.143 4,035 941 Changes in operating assets and liabilities: Accounts receivable, net 49,593 (32,078) (26,505) Inventones 38,010 (31.796) (80, 107) Other assets (5,749) (7,605) 2.140) Accounts payable and accrued expenses (24,440) 85,878 66,473 Accrued compensation 1,088 8.231 1.625 Deferred revenue 4,754 6,165 5,566 Other liabilities 9,635 7,137 490 Net cash provided by operating activities 161,986 120 636 30,570 Cash flows from investing netivities Purchases of property and equipment and intangible assets (33,035) (23.222) (35,747) Cash paid for acquisition, net of acquired cash (36,289) Net cash used in investing activities (69,324) (23232) (35,747) Cash flows from financing activities Proceeds from initial public offering, net of underwriting discounts and commissions 90,562 Payments of offering costs (585) (3.950) Proceeds from exercise of stock options 42,286 31,574 9,345 Payments for repurchase of common stock (50,015) (2.426) (911) Payments for repurchase of common stock related to shares withheld for tax (11.029) Proceeds from borrowings, net of borrowing costs 69,748 Repayments of borrowings (8,333) (6,667) (70,000) Payments for det extinguishment costs (420 Net cash provided by used in) financing activities (27.091) 21,896 94.374 Effect of exchange rate changes on cash, cash equivalents and restricted cash 2.900 (1 610) 1,135 Net increase in cash, cash equivalents, and restricted cash 68,471 117,700 90,332 Cash, cash equivalents, and restricted cash Beginning of period 338,820 221, 120 130,788 End of period 407, 2915 138.820 S 221.120 Supplemental disclosure Cash paid for interest 1617 2,517 3.750 Cash paid for taxes, net of refunds 783 3,570 S 1,430 Cash paid for amounts included in the measurement of lease liabilities 17,194 Supplemental disclosure of non-eash investing and financing activities Conversion of redeemable convertible preferred stock to common stock $ 90,141 Purchases of property and equipment, accrued but not paid 3,911 11,687 4075 Right-of-use amets obtained in exchange for lease lihilities $ 77,4165 Deferred offering costs in accounts payable and accrued expenses 585 The accompanying notes are an integral part of these consolidated financial statements. sStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started