Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help creating an excel spreadsheet to calculate the income statement starting with the initial investment and including depreciation for all three (3) projects

I need help creating an excel spreadsheet to calculate the income statement starting with the initial investment and including depreciation for all three (3) projects

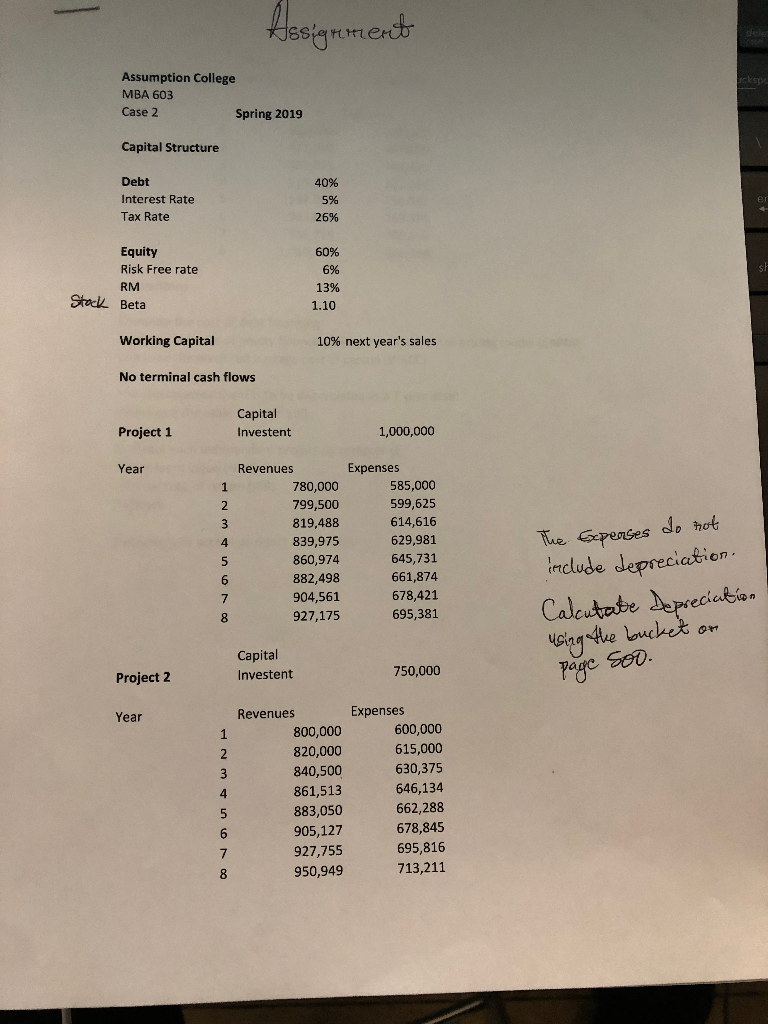

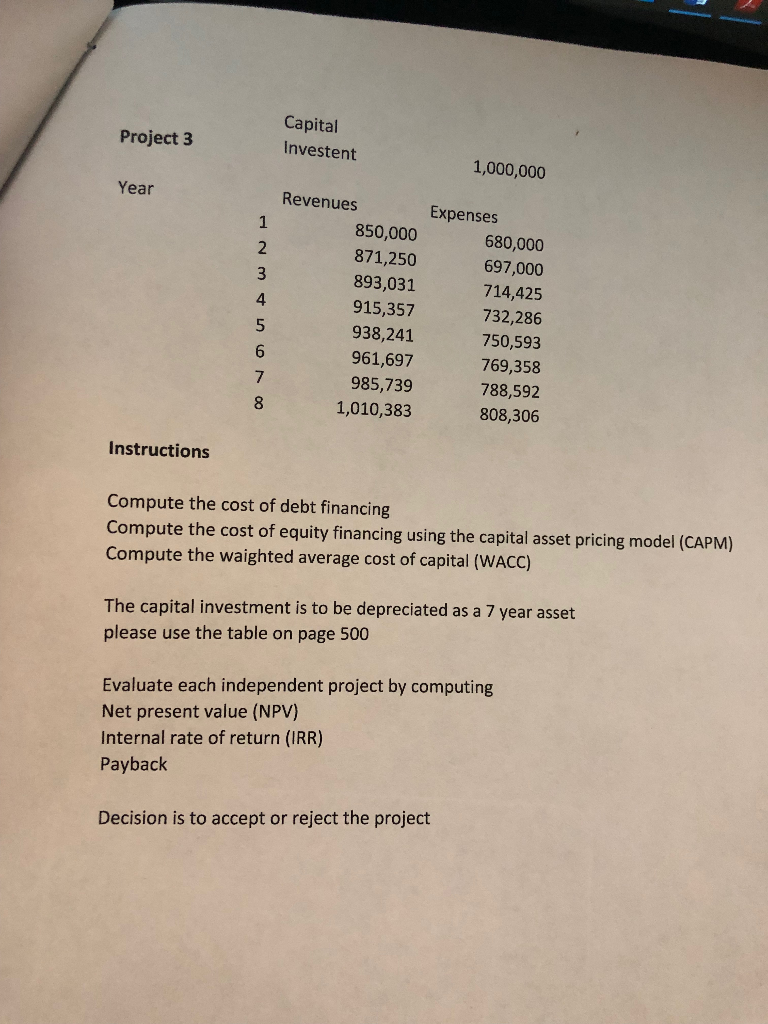

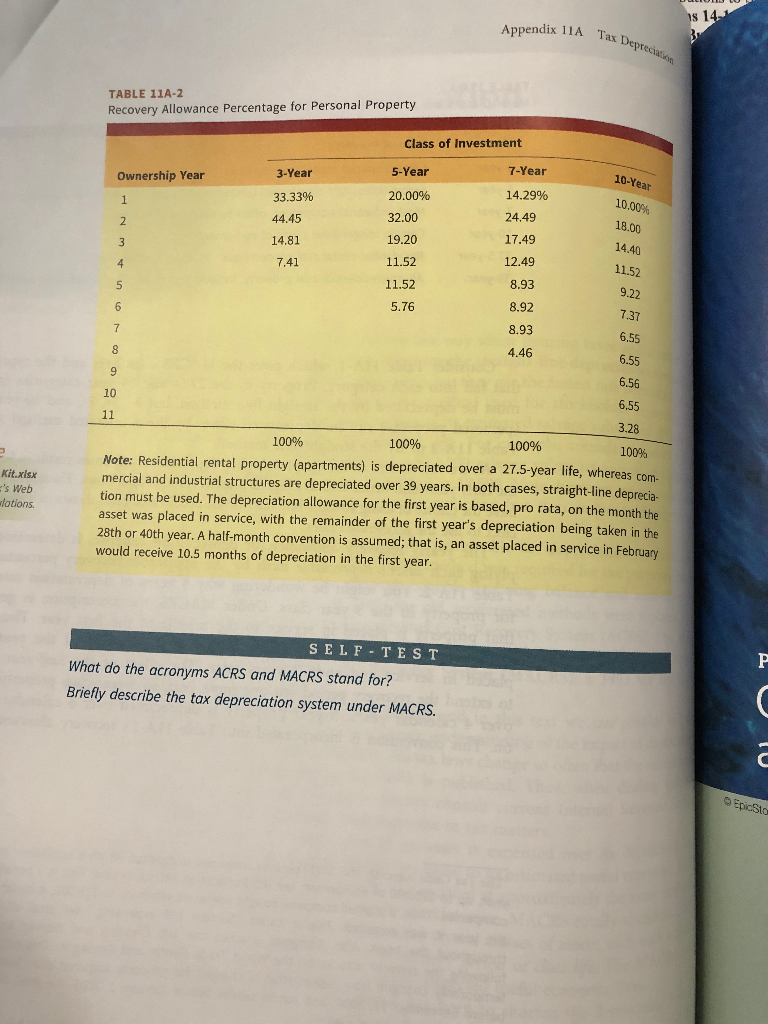

Assumption College MBA 603 Case 2 Spring 2019 Capital Structure Debt Interest Rate Tax Rate 40% 5% 26% Equity Risk Free rate RM 60% 6% 13% 1.10 Stocl Beta Working Capital 0% next year's sales No terminal cash flows Capital Investent Project 1 1,000,000 Year Revenues Expenses 780,000 799,500 819,488 839,975 860,974 882,498 904,561 927,175 585,000 599,625 614,616 629,981 645,731 661,874 678,421 695,381 4 nclude depreciation Capital Investent 750,000 Project 2 Revenues Expenses Year 800,000 820,000 840,500 861,513 883,050 905,127 927,755 950,949 600,000 615,000 630,375 646,134 662,288 678,845 695,816 713,211 4 Capital Investent Project 3 1,000,000 Year Revenues Expenses 850,000 871,250 680,000 697,000 893,031 915,357 938,241 714,425 4 732,286 6 7 961,697 750,593 769,358 985,739 1,010,383 788,592 808,306 Instructions Compute the cost of debt financing Compute the cost of equity financing using the capital asset pricing model (CAPM) Compute the waighted average cost of capital (WACC) The capital investment is to be depreciated as a 7 year asset please use the table on page 500 Evaluate each independent project by computing Net present value (NPV) Internal rate of return (IRR) Payback Decision is to accept or reject the project Appendix 11A Tax TABLE 11A-2 Recovery Allowance Percentage for Personal Property Class of Investment 5-Year 20,00% 32.00 19.20 11.52 11.52 5.76 7-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 3-Year 33.33% 44.45 14.81 7.41 Ownership Year 2 10 100% 100% 100% 100% Note: Residential rental property (apartments) is depreciated over a 27.5-year life, whereas com- mercial and industrial structures are depreciated over 39 years. In both cases, straight-line deprecia- tion must be used. The depreciation allowance for the first year is based, pro rata, on the month the asset was placed in service, with the remainder of the first year's depreciation being taken in the 28th or 40th year. A half-month convention is assumed, that is, an asset placed in service in February would receive 10.5 months of depreciation in the first year. 's Web S ELF TES T What do the acronyms ACRS and MACRS stand for? Briefly describe the tax depreciation system under MACRS. EpicSto Assumption College MBA 603 Case 2 Spring 2019 Capital Structure Debt Interest Rate Tax Rate 40% 5% 26% Equity Risk Free rate RM 60% 6% 13% 1.10 Stocl Beta Working Capital 0% next year's sales No terminal cash flows Capital Investent Project 1 1,000,000 Year Revenues Expenses 780,000 799,500 819,488 839,975 860,974 882,498 904,561 927,175 585,000 599,625 614,616 629,981 645,731 661,874 678,421 695,381 4 nclude depreciation Capital Investent 750,000 Project 2 Revenues Expenses Year 800,000 820,000 840,500 861,513 883,050 905,127 927,755 950,949 600,000 615,000 630,375 646,134 662,288 678,845 695,816 713,211 4 Capital Investent Project 3 1,000,000 Year Revenues Expenses 850,000 871,250 680,000 697,000 893,031 915,357 938,241 714,425 4 732,286 6 7 961,697 750,593 769,358 985,739 1,010,383 788,592 808,306 Instructions Compute the cost of debt financing Compute the cost of equity financing using the capital asset pricing model (CAPM) Compute the waighted average cost of capital (WACC) The capital investment is to be depreciated as a 7 year asset please use the table on page 500 Evaluate each independent project by computing Net present value (NPV) Internal rate of return (IRR) Payback Decision is to accept or reject the project Appendix 11A Tax TABLE 11A-2 Recovery Allowance Percentage for Personal Property Class of Investment 5-Year 20,00% 32.00 19.20 11.52 11.52 5.76 7-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 3-Year 33.33% 44.45 14.81 7.41 Ownership Year 2 10 100% 100% 100% 100% Note: Residential rental property (apartments) is depreciated over a 27.5-year life, whereas com- mercial and industrial structures are depreciated over 39 years. In both cases, straight-line deprecia- tion must be used. The depreciation allowance for the first year is based, pro rata, on the month the asset was placed in service, with the remainder of the first year's depreciation being taken in the 28th or 40th year. A half-month convention is assumed, that is, an asset placed in service in February would receive 10.5 months of depreciation in the first year. 's Web S ELF TES T What do the acronyms ACRS and MACRS stand for? Briefly describe the tax depreciation system under MACRS. EpicStoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started