Answered step by step

Verified Expert Solution

Question

1 Approved Answer

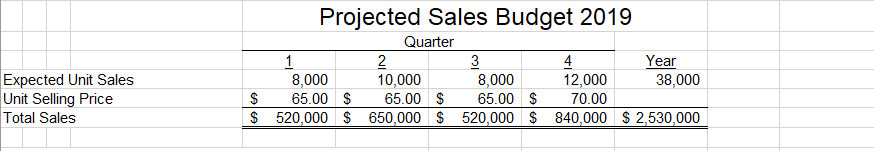

I need help developing a manufacturing budget using an Excel spreadsheet I need help developing a manufacturing budget using an Excel spreadsheet Projected Sales Budget

I need help developing a manufacturing budget using an Excel spreadsheet

I need help developing a manufacturing budget using an Excel spreadsheet

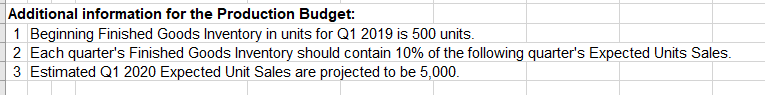

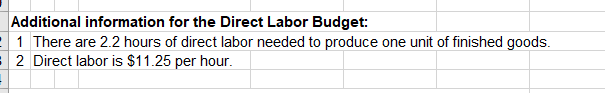

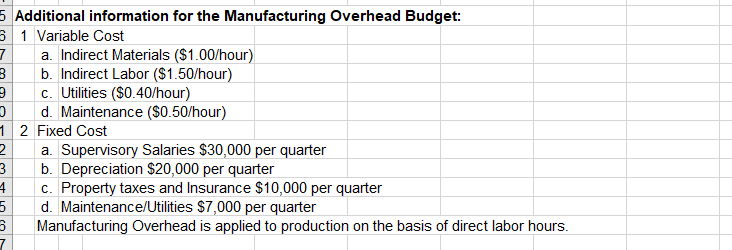

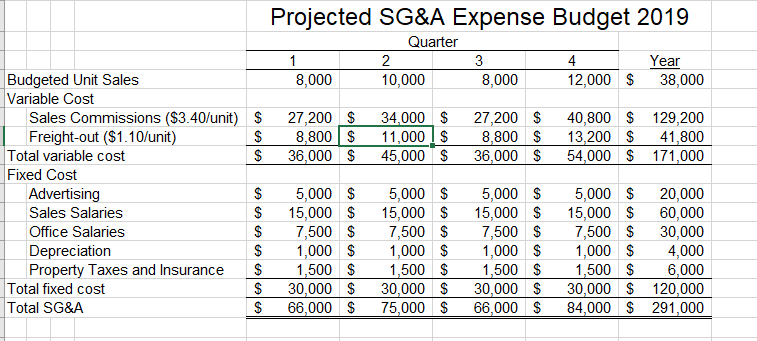

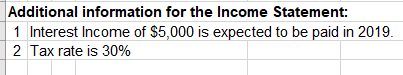

Projected Sales Budget 2019 Quarter 2 10,000 3 4 1 Year Expected Unit Sales 8,000 65.00 S65.00 S65.00 S70.00 8,000 2000 38,000 Total Sales Additional information for the Production Budget: 1 Beginning Finished Goods Inventory in units for Q1 2019 is 500 units 2 Each quarter's Finished Goods Inventory should contain 10% of the following quarter's Expected Units Sales 3 Estimated Q1 2020 Expected Unit Sales are projected to be 5,000 Additional information for the Direct Labor Budget 1 There are 2.2 hours of direct labor needed to produce one unit of finished goods 2 Direct labor is $11.25 per hour 5 Additional information for the Manufacturing Overhead Budget: 61 Variable Cost 7 a Indirect Materials ($1.00/hour) 3 b. Indirect Labor ($1.50/hour) 9c. Utilities ($0.40/hour) d. Maintenance ($0.50/hour) 2 Fixed Cost 2 a. Supervisory Salaries $30,000 per quarter 3 b. Depreciation $20,000 per quarter C. Property taxes and Insurance $10,000 per quarter 5 d. Maintenance/Utilities $7,000 per quarter Manufacturing Overhead is applied to production on the basis of direct labor hours. Projected SG&A Expense Budget 2019 Quarter 2 10,000 3 4 12,000 S 38,000 Year Budgeted Unit Sales Variable Cost 8,000 8,000 Sales Commissions ($3.40/unit) S 27,200 S 34000 S 27,200 40,800 S 129,200 Freight-out (S1.10/unit) S 8.800 S 11,000S 8,800 13.200 S 41,800 S 36,000 45,000 36,000 54,000 171,000 S 5,000 $5,000 S 5,000 $ 5,000 S 20,000 S 7,500 S 7,500 S 7,500 $ 7,500 S 30,000 Total variable cost Fixed Cost Advertising Sales Salaries Office Salaries Depreciation Property Taxes and Insurance 1500 S1500 S 1500 S1500 S6,000 S 15,000 $ 15,000 15,000 $ 15,000 S 60,000 S 1,000 $ 1,000 S 1,000 $ 1,000 S 4,000 $ 30,00030,000 30,000 $30,000 120,000 Total fixed cost Total SG&A S 66,000 75,000 66,000 Additional information for the Income Statement: 1 Interest Income of $5,000 is expected to be paid in 2019 2 Tax rate is 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started