Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help entering this if formula into an excel sheet. My pretaxable income is 192,249.67 Pre-tax income is over: But not over: Tax is:

I need help entering this if formula into an excel sheet. My pretaxable income is 192,249.67

I need help entering this if formula into an excel sheet. My pretaxable income is 192,249.67

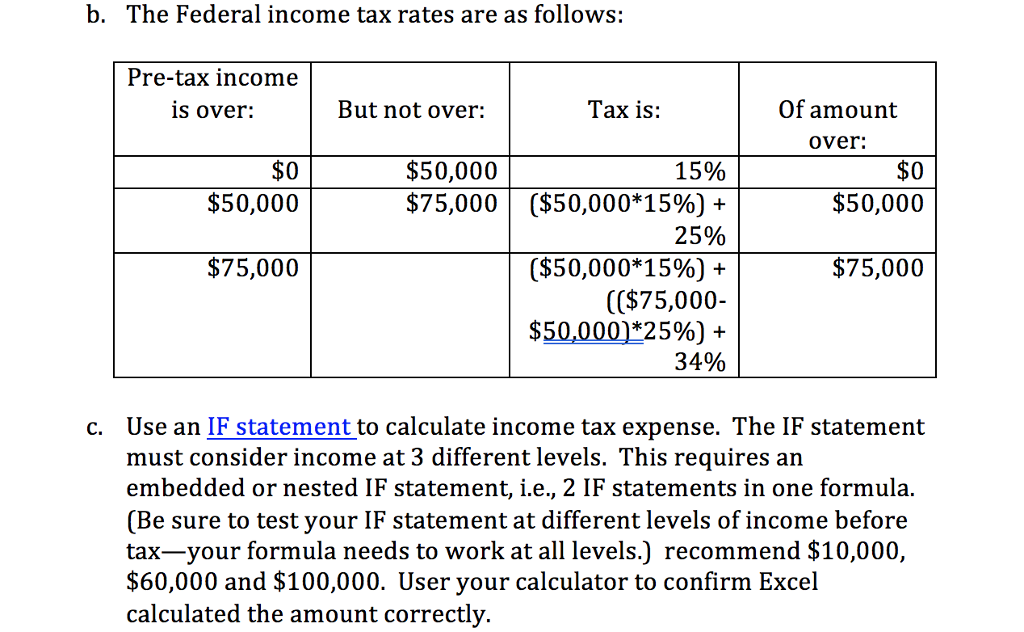

Pre-tax income is over: But not over: Tax is: Of amount over: $0 -$50,000 15% $0 $50,000 $75,000 ($50,000*15%) + 25% $50,000 $75,000 ($50,000*15%) + (($75,000-$50,000)*25%) + 34% $75,000 Use an IF statement to calculate income tax expense. The IF statement must consider income at 3 different levels. This requires an embedded or nested IF statement, i.e., 2 IF statements in one formula.

b. The Federal income tax rates are as follows Pre-tax income is over: But not over: Tax is: Of amount over: $50,000 $75,000 15% $50,000 ($50,000*1596) $50,000 25% ($50,000*15%) + (($75,000- $50,000 *25%) + 34% $75,000 $75,000 Use an IF statement to calculate income tax expense. The IF statement must consider income at 3 different levels. This requires an embedded or nested IF statement, i.e., 2 IF statements in one formula. (Be sure to test your IF statement at different levels of income before tax-your formula needs to work at all levels.) recommend $10,000, $60,000 and $100,000. User your calculator to confirm Excel calculated the amount correctly. cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started