I NEED HELP FILLING IN THE BLANK BOXES. I KNOW IVE ANSWERED SOME (THE GREEN) BUT THE PROGRAM SAYS THE BLANKS ARE WRONG. PLEASE JUST INPUT THE NUMBERS THAT GO IN THE BLANK BOXES. thanks.

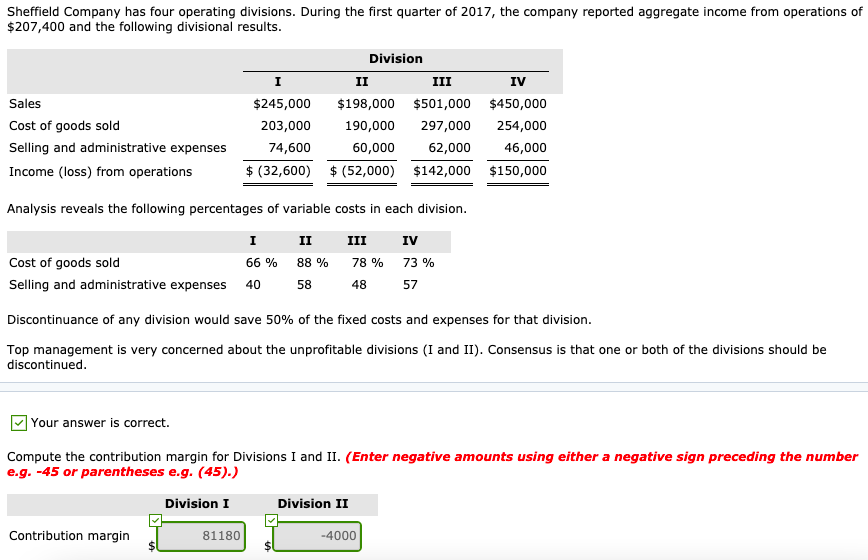

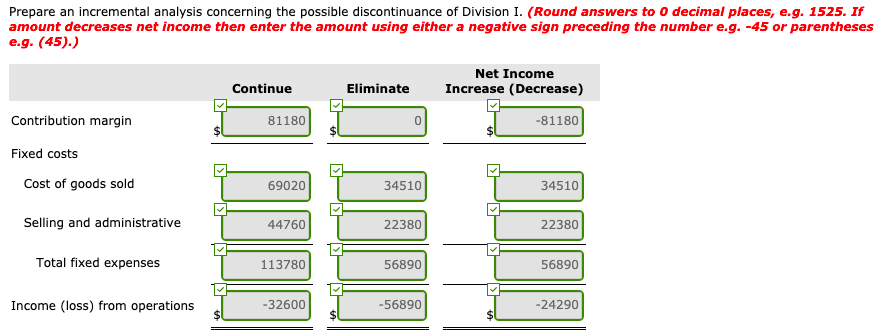

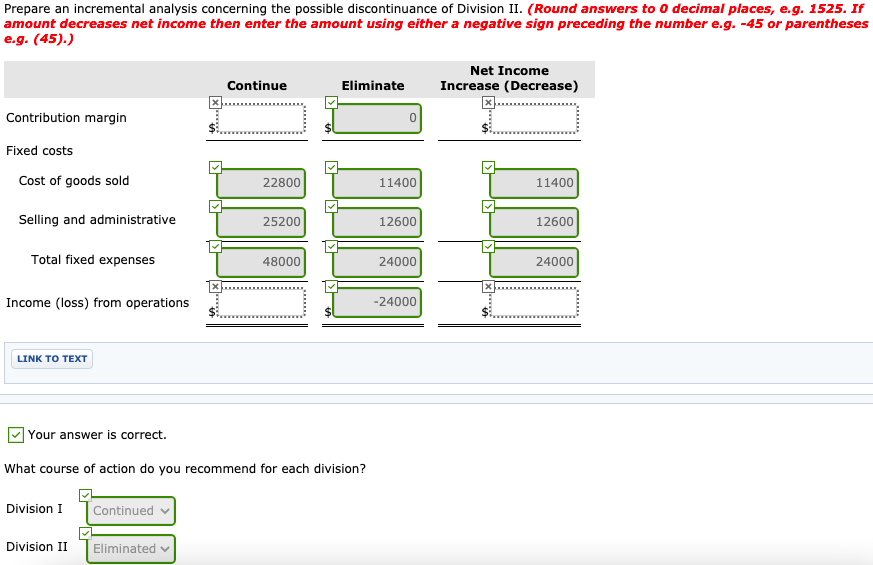

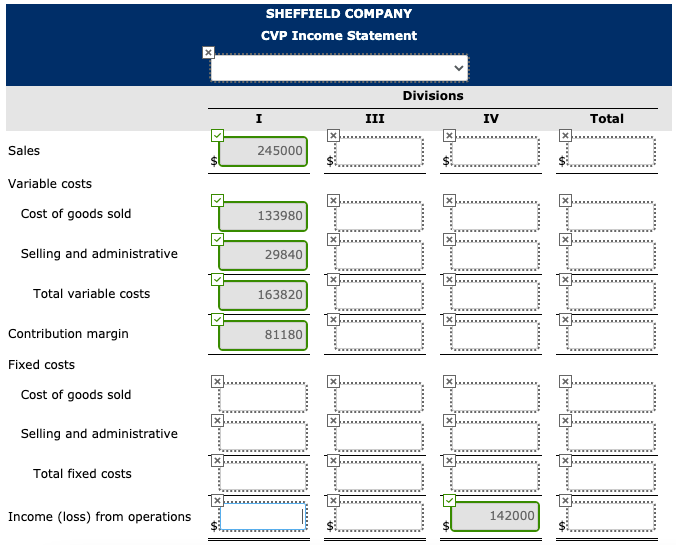

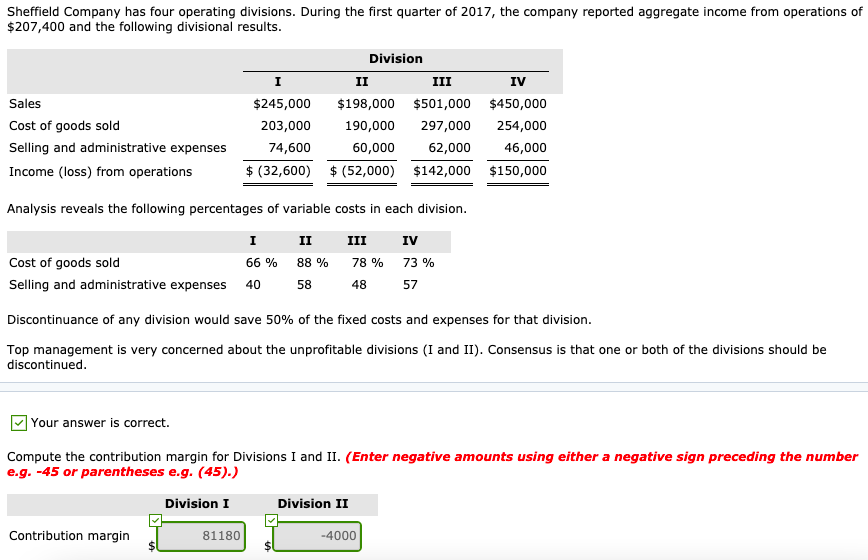

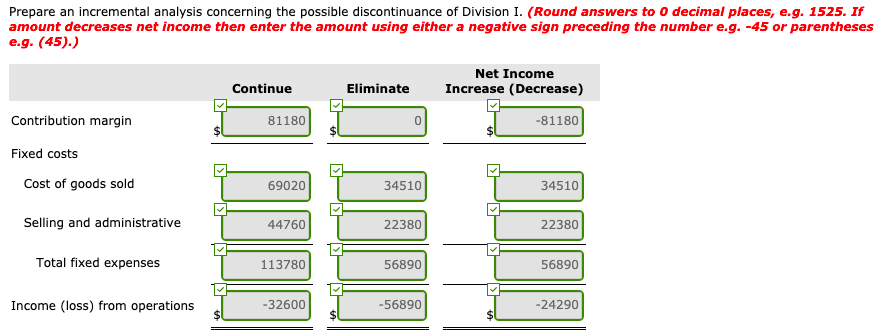

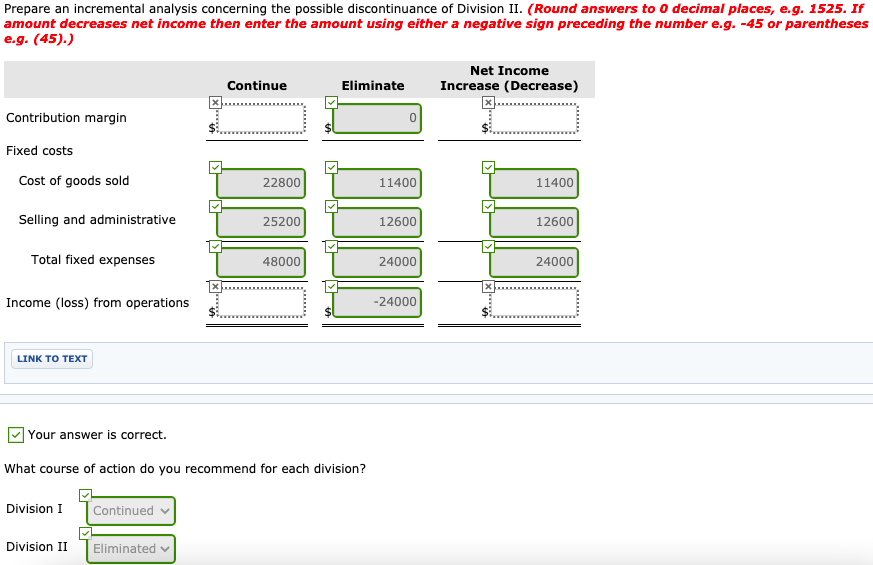

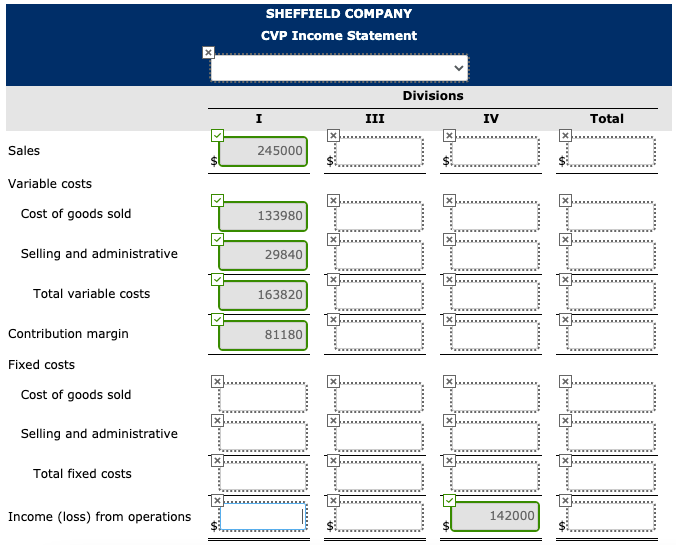

Sheffield Company has four operating divisions. During the first quarter of 2017, the company reported aggregate income from operations of $207,400 and the following divisional results. Sales Cost of goods sold Selling and administrative expenses Income (loss) from operations Division I II III IV $245,000 $198,000 $501,000 $450,000 203,000 190,000 297,000 254,000 74,600 60,000 62,000 46,000 $ (32,600) $ (52,000) $142,000 $150,000 Analysis reveals the following percentages of variable costs in each division. I II III IV 66 % 88 % 78 % 73 % Cost of goods sold Selling and administrative expenses 40 58 48 57 Discontinuance of any division would save 50% of the fixed costs and expenses for that division. Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be discontinued. Your answer is correct. Compute the contribution margin for Divisions I and II. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Division I Division II Contribution margin 81180 -4000 Prepare an incremental analysis concerning the possible discontinuance of Division I. (Round answers to 0 decimal places, e.g. 1525. If amount decreases net income then enter the amount using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Continue Eliminate Net Income Increase (Decrease) Contribution margin 81180 -81180 Fixed costs Cost of goods sold 69020 34510 34510 Selling and administrative 44760 22380 22380 Total fixed expenses 113780 56890 56890 Income (loss) from operations -32600 -56890 -24290 Prepare an incremental analysis concerning the possible discontinuance of Division II. (Round answers to 0 decimal places, e.g. 1525. If amount decreases net income then enter the amount using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Continue Eliminate Net Income Increase (Decrease) Contribution margin Fixed costs Cost of goods sold 22800 11400 11400 > Selling and administrative 25200 12600 12600 Total fixed expenses 48000 24000 24000 Income (loss) from operations - -24000 LINK TO TEXT Your answer is correct. What course of action do you recommend for each division? Division I Continued Division II Eliminated SHEFFIELD COMPANY CVP Income Statement Divisions I III IV Total Sales 245000 Variable costs Cost of goods sold 133980 Selling and administrative 29840 Total variable costs 163820 81180 Contribution margin Fixed costs Cost of goods sold TTITUITI DIT LIIT TIT Selling and administrative Total fixed costs Income (loss) from operations 142000