Answered step by step

Verified Expert Solution

Question

1 Approved Answer

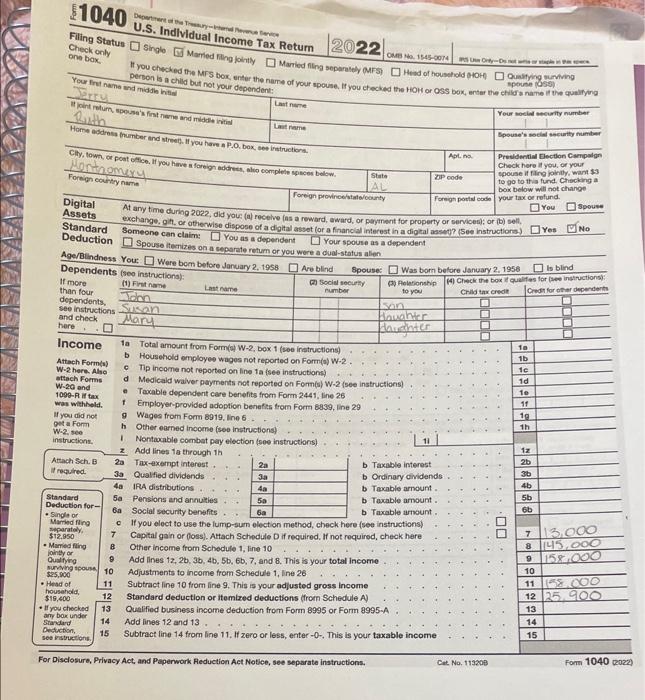

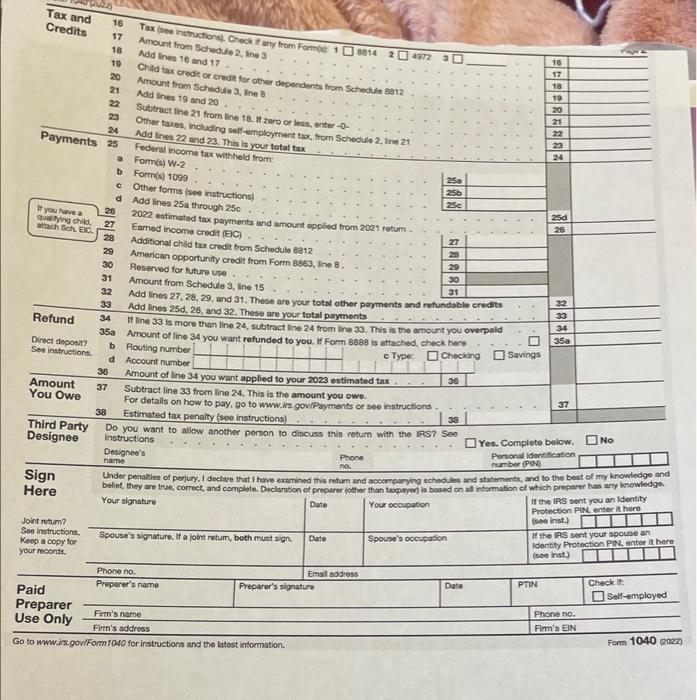

i need help filling out a 1040 tax form Jerry is married to Ruth and live in Montgomery Alabama. They have three kids together; John

i need help filling out a 1040 tax form

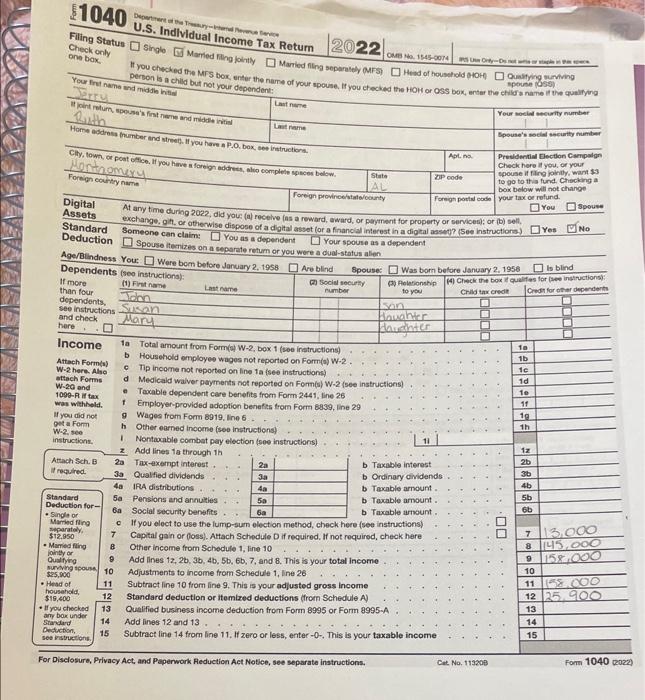

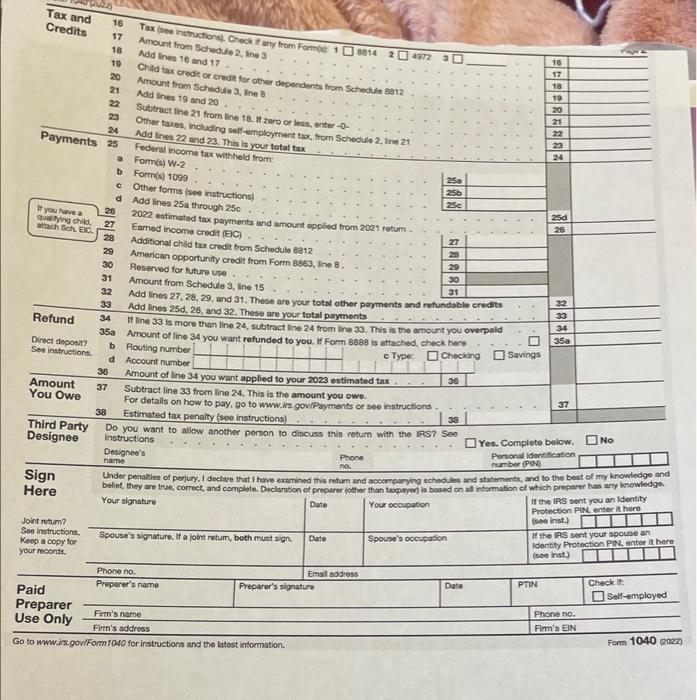

Jerry is married to Ruth and live in Montgomery Alabama. They have three kids together; John 23 , Susan 16 and Mary 3. Jofin ow owns his own mechanic shop and chooses while Ruth is a stay at home mother. Jerry's business net income came to $145,000. Ruth has been offered a position at her church that would be full time in nature and would pay her $30,000. However this job would not start until January of 2023. For the year 2022, John was a part time student at the University of Alabama while living in Huntsville. John's total cost of living was $25,000 for the year. However he has a job at a local movie theater which showed gross income for the year of $15,000. Upon Susan's 16th birthday, Jerry decided to sale his 1955 Chevrolet Belair, which he has owned for more than 12 years. The funds which he received from this sale, he would use to buy Susan's birthday present (a 2023 Chevrolet Camaro). In 2011, Jerry bought the car for $22,000 and was able to sell it this year for $35,000. Mary goes to daycare during the day, which cost the family $6,000 a year. Use the attached tax documents along with a typed statement to explain the current family position and how different transactions may affect the tax liability in the future. person is a chilld but not your dependent: Your frem nome and midth have Standard Someone can ctaime You as a dependent assot for a financolol interest in a diopal Your spouse as a dependent Deduction Spouse fltenizes on a coparate retum or you were a dual-status alien Age/Bindness You: Were bom betore January 2, 1958 Ave blind Spouse: Was bom betore January 2, 1956 is bind d Medicald waver poyments not reported on Forn(s) W-2 (see instructions) - Texable dependent care benefits from Form 2441, line 25 1. Employer-provided adoption benefest from Form 8939, ine 29 g Wages from Form 8919, Ine 6 . h Other earned inoome (seo instructions) 1 Nontacable combet pay election (soe instuctions) z. Add lines 1a through in Athach Sch. B 23 Tax-exempt interost . Itroqured, 33 Qualfied dividends \begin{tabular}{|l|l|} \hline 2a & \\ \hline 3a & \\ \hline 4a & \\ \hline 5a & \\ \hline 6a & \\ \hline \end{tabular} b Taxable interest b Ordinary aididends b Trexable anoum. b Taxable amount. b Taxable antount. - Muinod fing o It you eloct to use the lump-sum olection method, check here (see instructions) - Mumed atho B Other income from Schodule 1, line 10 lowiltion 9 Add lines 12,26,3b,4b,5b,6b,7, and 8 , This is your total income sunning soouna 10 Adjustments to income from Schedule 1, ine 26 - Head of 4 Hesti of househeld, $19,400 - H1 rou checked 13 Qualfied business incorne deduction from Form 8995 or Form 8995A. sary bok cundier 14 Add ines 12 and 13 . oly Subtract line 14 from line 11. If zero or less, enter -0. This is your taxable income For Disclosure, Privacy Act, and Paperwork Aeduction Act Notice, see separate instructions. \begin{tabular}{|c|c|} \hline 10 & \\ \hline 1b & \\ \hline 1c & \\ \hline 1d & \\ \hline 10 & \\ \hline 11 & \\ \hline 10 & \\ \hline 1h & \\ \hline 12 & \\ \hline 2b & \\ \hline 3b & \\ \hline 4b & \\ \hline 5b & \\ \hline 6b & \\ \hline 7 & 13,000 \\ \hline 8 & 145,000 \\ \hline 9 & 158,000 \\ \hline 10 & \\ \hline 11 & 168,000 \\ \hline 12 & 25,900 \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline & \\ \hline \end{tabular} Payments 24 Add lines 22 and 23 This is your totat tax, from Sohedule 2. Ine 21 a Form(s) W-2. b Form(s) 1099 e Other forms (see instructions) Hyou have 26 . 2002 lines 25 a through 25c quityhg child, 27 . Eamed incomed tax payments and amount opplied from 2021 return Additionol child tax credit (EIC) American opportunity credit from Form 8863 30 Reserved for tuture use 31 Amount from Schedule 3, line 15 38 Do you want to allow another person to discuss this retum with the IAS? Seo Wyes. Complete below. No Designee's Personal identification Here beliet, they are true, correct, and complote. Declaration of preparer (other than tappryof) is based on all informabion of which preperer has any knowledge. Go to wwwirs gowlFomm 1040 for instructions and the latest intormation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started