Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help filling out a schedule c tax form. Comprehensive Problem 3-1 Gordon Temper is a single taxpayer (birthdate July 1, 1985 and Social

i need help filling out a schedule c tax form.

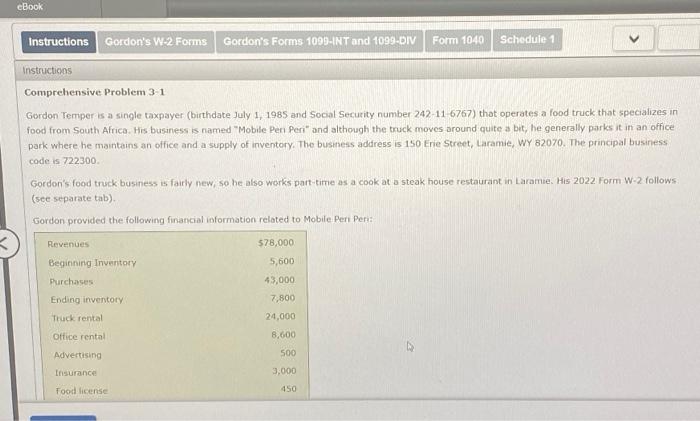

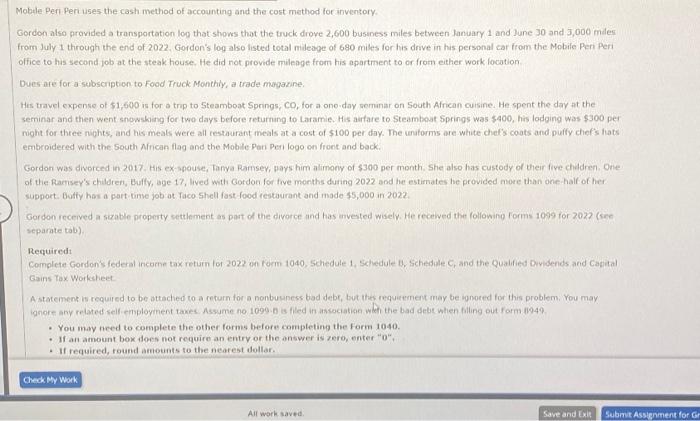

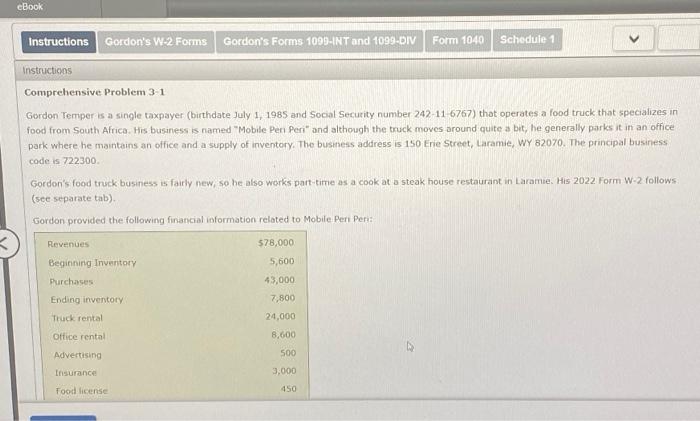

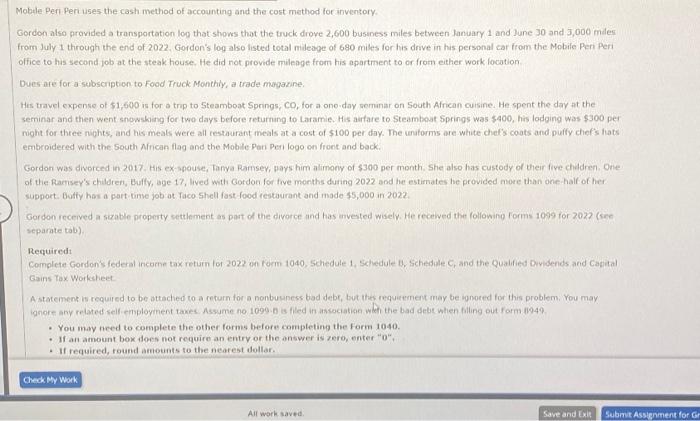

Comprehensive Problem 3-1 Gordon Temper is a single taxpayer (birthdate July 1, 1985 and Social Security number 242-11 6767 ) that operates a food truck that specializes in food from South Africa. His business is named "Mobile Pen Peri" and although the truck moves oround quite a bit, he generally parks it in an office park where he mantains an office and a supply of inventory. The busthess address is 150 Erie Street, Laramie, WY 82070 . The principal business code is 722300 Gordon's food truck business is fairly new, so he also works part-time as a cook at a steak house restaurant in Laramie. His 2022 . Form W-2 follow5 (see separate tab). Moble Peri. Peri uses the cash method of accounting and the cost mathod for inventory. Gordon atso provided a transportation lop that shows that the fruck drove 2,600 busaness miles between lanuary 1 and June 30 and 3,000 mdes from July 1 through the end of 2022. Gordon's log also listed total maleage of 690 miles for his drive in his personal car from the Mobile Peri Peri office to his second job at the steak house. He did not provide mileage from his apartment to or from either work focation. Dues are for a subscription to Food Truck Monthily, a trade mogarine. His travel expense of 51,600 is for a trip to 5 teamboat Springs, CO, for a one-day werminar on South African cuisine. He spent the day at the seminar and then went snowsking for two days before returning to Laramie. His aurfare to Steamboat \$prings was s400, his lodging was \$300 per might for three nights, and his meals were all restaurant meals at a cost of $100 per day. The untormis are white chef's coats and puify chef's hats embroidered with the South African flag and the Mobile Pori Peri logo on front and back. Gordon was divorced in 2017. His ex-sgouse, Tarya Rarnsev, pays him alimony of $300 per month, She also has custody of their five chadren, Orie of the Rarmsey's children, tuffy, bge 17, lived with Gordon for fre months durng 2022 and he estimates he provided nore than one-half of her support. butry has a part time job at faco Shell fast food restaurant and made 95,000 in 2022. Gordon recerved a sizable property settement as part of the divorce and has anvested wiselv. He received the following Forms 1009 for 302 ? (sire separate trab) Requiredi Complete Gordon's federal incorne tax return for 2022 on Form 1040 , Schedule 1 , Schedule 0, Schedile C, and the Qualified Duridends and Cagatal Gains Tax Worksheet Astatement is required to be attached to a return for a nonbuaness bad debt, but thes requitement may be ignoeded for this problem. You may ignore any related selfiemployment taxes. Assume no 1099 is is fled in associatiag weh the bad debt when falling out form il049. - You mary need to complete the other formis before completing the form 1040. - If ant amount box dees not require an entry or the answer is rero, enter "o", - If required, roumd amotints to the nearest dollar. Comprehensive Problem 3-1 Gordon Temper is a single taxpayer (birthdate July 1, 1985 and Social Security number 242-11 6767 ) that operates a food truck that specializes in food from South Africa. His business is named "Mobile Pen Peri" and although the truck moves oround quite a bit, he generally parks it in an office park where he mantains an office and a supply of inventory. The busthess address is 150 Erie Street, Laramie, WY 82070 . The principal business code is 722300 Gordon's food truck business is fairly new, so he also works part-time as a cook at a steak house restaurant in Laramie. His 2022 . Form W-2 follow5 (see separate tab). Moble Peri. Peri uses the cash method of accounting and the cost mathod for inventory. Gordon atso provided a transportation lop that shows that the fruck drove 2,600 busaness miles between lanuary 1 and June 30 and 3,000 mdes from July 1 through the end of 2022. Gordon's log also listed total maleage of 690 miles for his drive in his personal car from the Mobile Peri Peri office to his second job at the steak house. He did not provide mileage from his apartment to or from either work focation. Dues are for a subscription to Food Truck Monthily, a trade mogarine. His travel expense of 51,600 is for a trip to 5 teamboat Springs, CO, for a one-day werminar on South African cuisine. He spent the day at the seminar and then went snowsking for two days before returning to Laramie. His aurfare to Steamboat \$prings was s400, his lodging was \$300 per might for three nights, and his meals were all restaurant meals at a cost of $100 per day. The untormis are white chef's coats and puify chef's hats embroidered with the South African flag and the Mobile Pori Peri logo on front and back. Gordon was divorced in 2017. His ex-sgouse, Tarya Rarnsev, pays him alimony of $300 per month, She also has custody of their five chadren, Orie of the Rarmsey's children, tuffy, bge 17, lived with Gordon for fre months durng 2022 and he estimates he provided nore than one-half of her support. butry has a part time job at faco Shell fast food restaurant and made 95,000 in 2022. Gordon recerved a sizable property settement as part of the divorce and has anvested wiselv. He received the following Forms 1009 for 302 ? (sire separate trab) Requiredi Complete Gordon's federal incorne tax return for 2022 on Form 1040 , Schedule 1 , Schedule 0, Schedile C, and the Qualified Duridends and Cagatal Gains Tax Worksheet Astatement is required to be attached to a return for a nonbuaness bad debt, but thes requitement may be ignoeded for this problem. You may ignore any related selfiemployment taxes. Assume no 1099 is is fled in associatiag weh the bad debt when falling out form il049. - You mary need to complete the other formis before completing the form 1040. - If ant amount box dees not require an entry or the answer is rero, enter "o", - If required, roumd amotints to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started