Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help filling out Form 2220 with the informatjon below- I need parts 1-4. Thank you! Given the result in Fart improve Rho's benefit

I need help filling out Form 2220 with the informatjon below- I need parts 1-4.

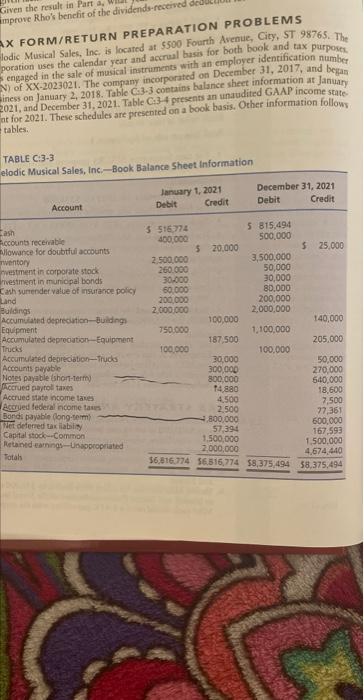

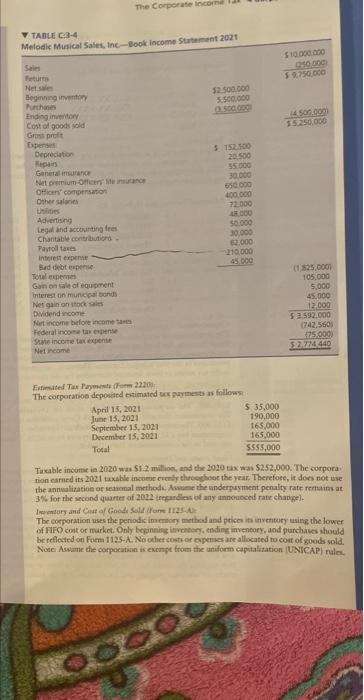

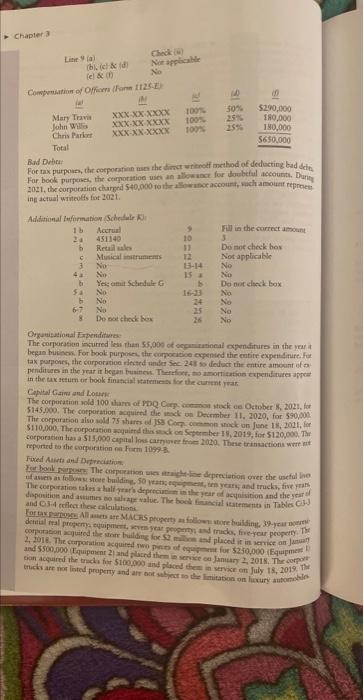

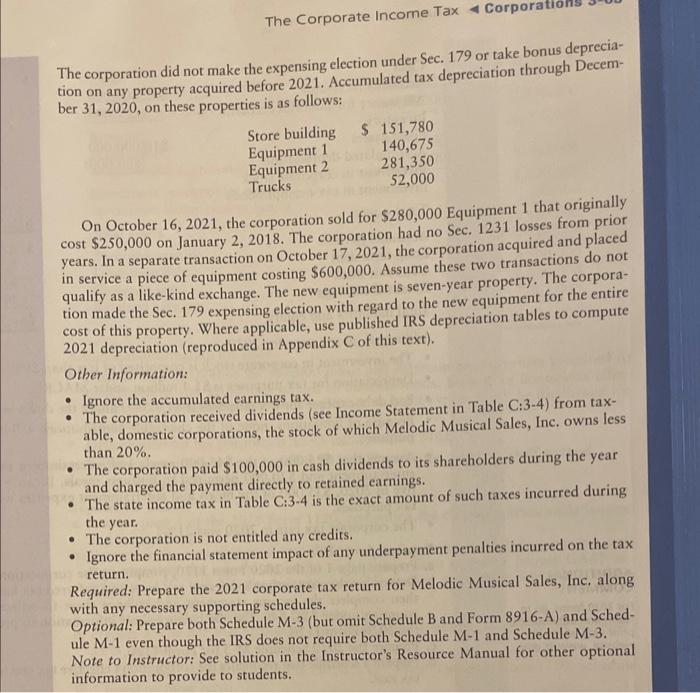

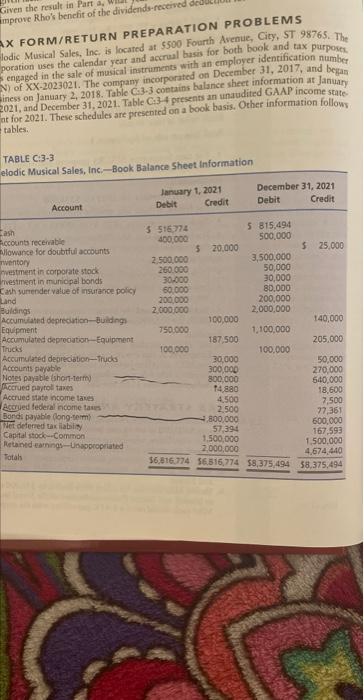

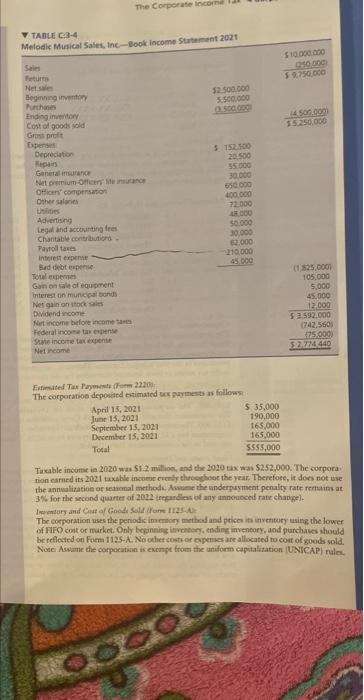

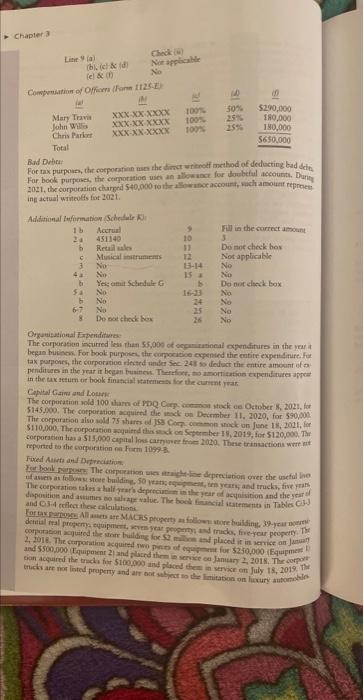

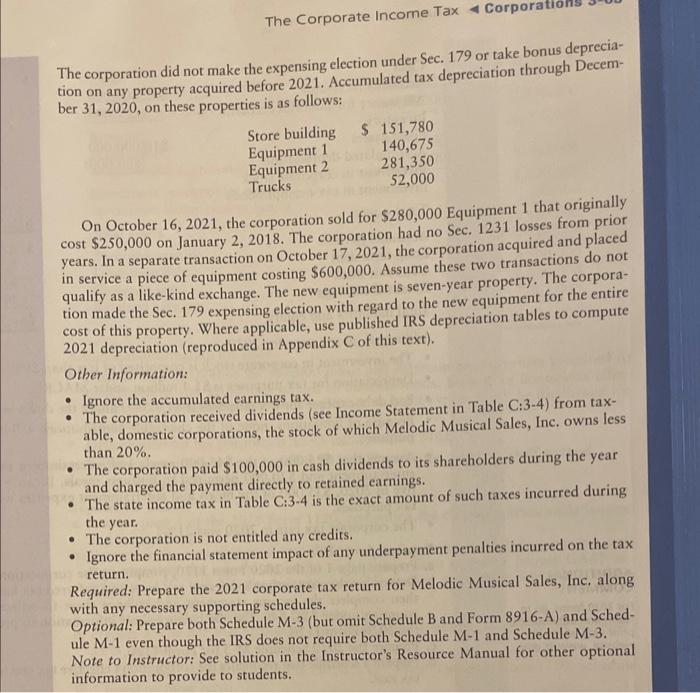

Given the result in Fart improve Rho's benefit of the dividends-recerved A FORN/RETURN PREPARATION PROBLEMS lodic Musical Sales, Inc, is located at 5500 Fourth Avenue, City, ST 98765. The poration uses the calendar year and accral basis for both book and tax parposes. engaged in the sale of musical instruments with an employer identification number N) of XX-2023021. The company incorporated on December 31, 2017, and began iness on January 2,2018 . Table C.3.3 contains balance shect information at January 2021, and Decernber 31, 2021. Table Ca3 4 presents an unaudited GAAP income stateat for 2021. These schedules are presented on a book basis. Other information followy tables: TABLE C:3-3 Einimated Tat Poymente furm 22d0in Taxable incutre ia 2020 was 51.2 millioc, and the 2020 twa mai 5252.000. The corpora: rion earned its 2021 uxable incuecue erentr throechooc the year. Therefoer, it docs not use the annwalization of seamonal methods. Asune the anderpusment penalty rate rethatins at. 3\%. for the sccond quarter of 2022 (regardleas of any annouoced rate change). The corporation uses the penodic imemiony method and prices its inventury using the lower of FIFO coit or murket, Only bopining invonerf, esding invencory, and purctases should be retlested on Foen 1195-A. No ocher costeor eqpenses are alliocated to cont of soods sold. Noec A swame the corpocation is exarapt from the undorm eapitalitation [UNJCAP] fales. For book purjeries, the cerporation usen an alles ance for dobbeful accounth. Dunth. ing actual writevifs fot 201. Aadnti Oy ramisatinnal Fapenifitwhic: in the tax actum tor book finational ifatimien fice the clorent yath. Capibal Cians and bostrer. reported 80 the corpuration no Furm 10%9 ? Fived Aleafa art Brifincistrum. The ceepuration takis a half srat a depricionin in ahe year of actinisioior and theycar al. The corporation did not make the expensing election under Sec. 179 or take bonus depreciation on any property acquired before 2021. Accumulated tax depreciation through December 31,2020 , on these properties is as follows: On October 16, 2021, the corporation sold for $280,000 Equipment 1 that originally cost $250,000 on January 2, 2018. The corporation had no Sec. 1231 losses from prior years. In a separate transaction on October 17,2021 , the corporation acquired and placed in service a piece of equipment costing $600,000. Assume these two transactions do not qualify as a like-kind exchange. The new equipment is seven-year property. The corporation made the Sec. 179 expensing election with regard to the new equipment for the entire cost of this property. Where applicable, use published IRS depreciation tables to compute 2021 depreciation (reproduced in Appendix C of this text). Other Information: - Ignore the accumulated earnings tax. - The corporation received dividends (see Income Statement in Table C:3-4) from taxable, domestic corporations, the stock of which Melodic Musical Sales, Inc. owns less than 20%. - The corporation paid $100,000 in cash dividends to its shareholders during the year and charged the payment directly to retained earnings. - The state income tax in Table C:3-4 is the exact amount of such taxes incurred during the year. - The corporation is not entitled any credits. - Ignore the financial statement impact of any underpayment penalties incurred on the tax return. Required: Prepare the 2021 corporate tax return for Melodic Musical Sales, Inc, along with any necessary supporting schedules. Optional: Prepare both Schedule M-3 (but omit Schedule B and Form 8916-A) and Schedule M-1 even though the IRS does not require both Schedule M-1 and Schedule M-3. Note to Instructor: See solution in the Instructor's Resource Manual for other optional information to provide to students. Given the result in Fart improve Rho's benefit of the dividends-recerved A FORN/RETURN PREPARATION PROBLEMS lodic Musical Sales, Inc, is located at 5500 Fourth Avenue, City, ST 98765. The poration uses the calendar year and accral basis for both book and tax parposes. engaged in the sale of musical instruments with an employer identification number N) of XX-2023021. The company incorporated on December 31, 2017, and began iness on January 2,2018 . Table C.3.3 contains balance shect information at January 2021, and Decernber 31, 2021. Table Ca3 4 presents an unaudited GAAP income stateat for 2021. These schedules are presented on a book basis. Other information followy tables: TABLE C:3-3 Einimated Tat Poymente furm 22d0in Taxable incutre ia 2020 was 51.2 millioc, and the 2020 twa mai 5252.000. The corpora: rion earned its 2021 uxable incuecue erentr throechooc the year. Therefoer, it docs not use the annwalization of seamonal methods. Asune the anderpusment penalty rate rethatins at. 3\%. for the sccond quarter of 2022 (regardleas of any annouoced rate change). The corporation uses the penodic imemiony method and prices its inventury using the lower of FIFO coit or murket, Only bopining invonerf, esding invencory, and purctases should be retlested on Foen 1195-A. No ocher costeor eqpenses are alliocated to cont of soods sold. Noec A swame the corpocation is exarapt from the undorm eapitalitation [UNJCAP] fales. For book purjeries, the cerporation usen an alles ance for dobbeful accounth. Dunth. ing actual writevifs fot 201. Aadnti Oy ramisatinnal Fapenifitwhic: in the tax actum tor book finational ifatimien fice the clorent yath. Capibal Cians and bostrer. reported 80 the corpuration no Furm 10%9 ? Fived Aleafa art Brifincistrum. The ceepuration takis a half srat a depricionin in ahe year of actinisioior and theycar al. The corporation did not make the expensing election under Sec. 179 or take bonus depreciation on any property acquired before 2021. Accumulated tax depreciation through December 31,2020 , on these properties is as follows: On October 16, 2021, the corporation sold for $280,000 Equipment 1 that originally cost $250,000 on January 2, 2018. The corporation had no Sec. 1231 losses from prior years. In a separate transaction on October 17,2021 , the corporation acquired and placed in service a piece of equipment costing $600,000. Assume these two transactions do not qualify as a like-kind exchange. The new equipment is seven-year property. The corporation made the Sec. 179 expensing election with regard to the new equipment for the entire cost of this property. Where applicable, use published IRS depreciation tables to compute 2021 depreciation (reproduced in Appendix C of this text). Other Information: - Ignore the accumulated earnings tax. - The corporation received dividends (see Income Statement in Table C:3-4) from taxable, domestic corporations, the stock of which Melodic Musical Sales, Inc. owns less than 20%. - The corporation paid $100,000 in cash dividends to its shareholders during the year and charged the payment directly to retained earnings. - The state income tax in Table C:3-4 is the exact amount of such taxes incurred during the year. - The corporation is not entitled any credits. - Ignore the financial statement impact of any underpayment penalties incurred on the tax return. Required: Prepare the 2021 corporate tax return for Melodic Musical Sales, Inc, along with any necessary supporting schedules. Optional: Prepare both Schedule M-3 (but omit Schedule B and Form 8916-A) and Schedule M-1 even though the IRS does not require both Schedule M-1 and Schedule M-3. Note to Instructor: See solution in the Instructor's Resource Manual for other optional information to provide to students Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started