I need help filling out Schedule C FORM

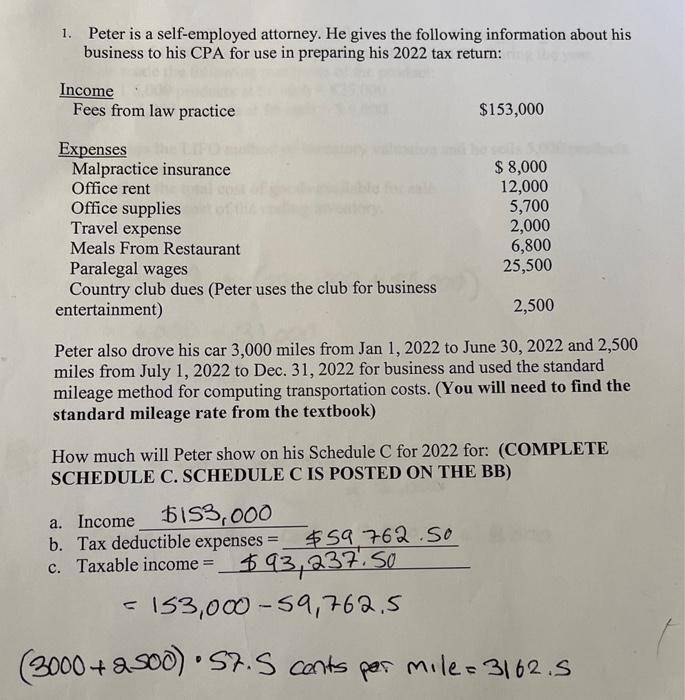

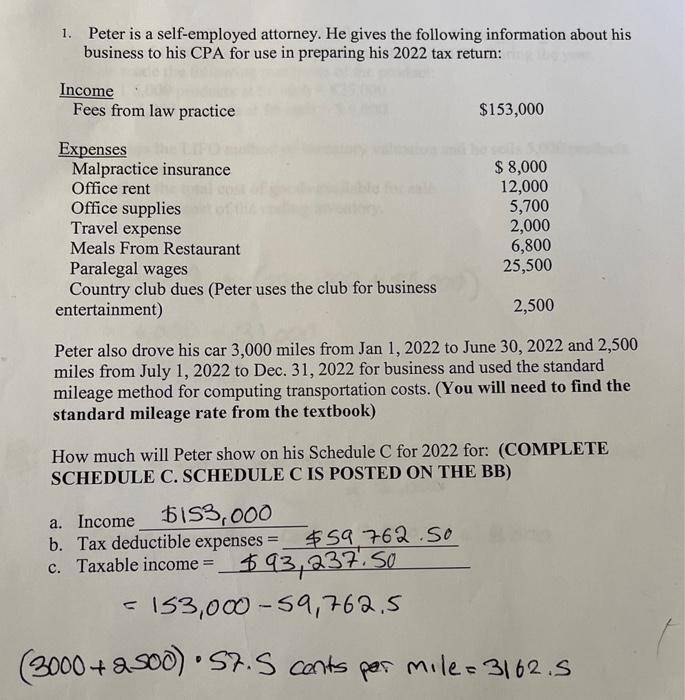

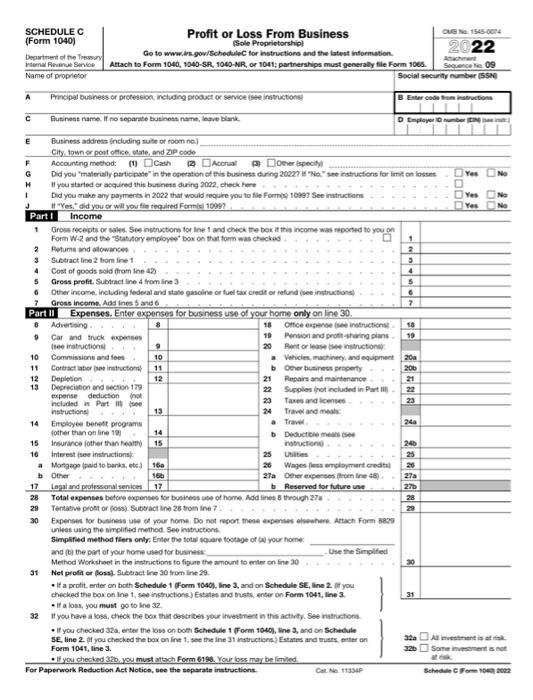

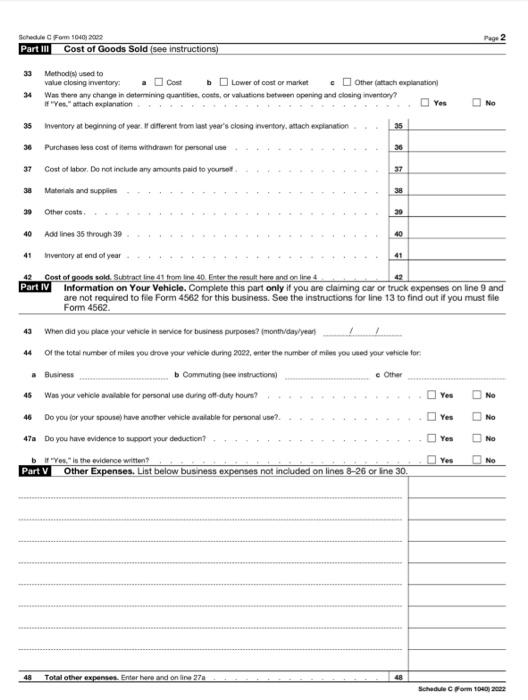

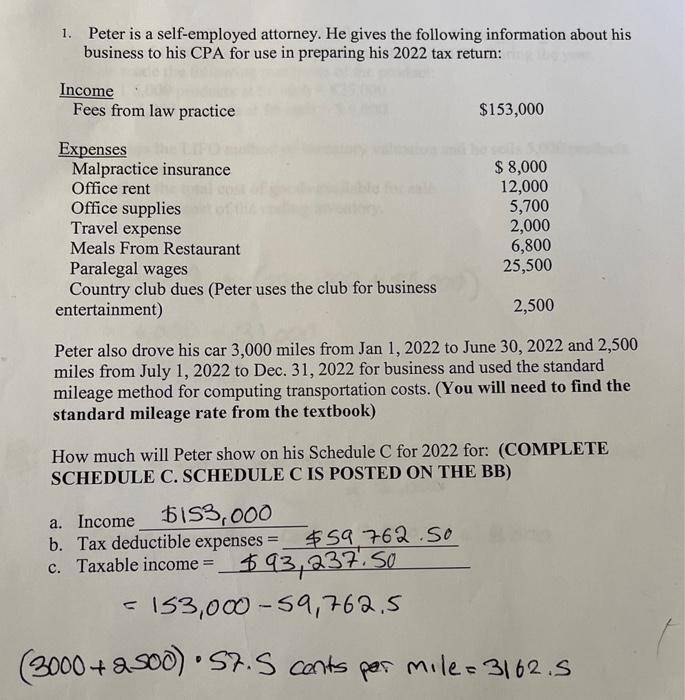

1. Peter is a self-employed attorney. He gives the following information about his business to his CPA for use in preparing his 2022 tax return: Peter also drove his car 3,000 miles from Jan 1, 2022 to June 30,2022 and 2,500 miles from July 1, 2022 to Dec. 31, 2022 for business and used the standard mileage method for computing transportation costs. (You will need to find the standard mileage rate from the textbook) How much will Peter show on his Schedule C for 2022 for: (COMPLETE SCHEDULE C. SCHEDULE C IS POSTED ON THE BB) a. Income 5153,000 b. Tax deductible expenses =$59,762.50 c. Taxable income =$93,237.50 =153,00059,762,5 000+8500)57.5 conts per mile =3162.5 1 Gross recepts or sales. See instrutions for lne 1 and check the bex it this income was reponed to you on Form W.2 and the "Statutory empiopee" bok on that form was checked 2 Petume and alowinces 3 Subtract line 2 bom ine 1 Cost of goods sold from ine 42 Gress proft. Subtract ine 4 from ine 3 Other income, including ledeal and state gasoline on fuel tax credit or nefund (see inutructions) 7 Gress income. Add ines 5 and 6 Part II Expenses. Enter expenses for business use of your home only on line 30 . 32 If you have a loss, theck the box that oescribes yeur itwestinert in this acticty. See inathetons. - If you checked 32a, enter the loss on both schedule 1 form 1040i, line 3 , and on Schedule sE, line 2. (if you checked the bex on ine 1, soe the ine 31 instruetiens, Eotates and mats, enter on Form 1041, line 3 . - If you checked 326 , you must athch Form 6198 . Your bss may be limited For Paperwork Peduetion Act Notice, see the separate instructions. Cat No t1334p Schedine from noes awes Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to fle Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562 . 43 When did you place your vehicle in service for business purposes? (month/dayyyear) 44 Of the tetal number of miles you drove your vetice during 2022, enter the number at mies you used your vehicle for: a Business b Cammuting imee instructansi e Other 45. Was your vehicle avalabie for personal use during off-duty houns? Yes No 46 Do you for your spovse) have another vehicle avalable for personal use?. . . ............... . . . Yes 47a Do you have evidence to support your deduction? Yes No b if "Yos," is the evidence witten? Yes No