Answered step by step

Verified Expert Solution

Question

1 Approved Answer

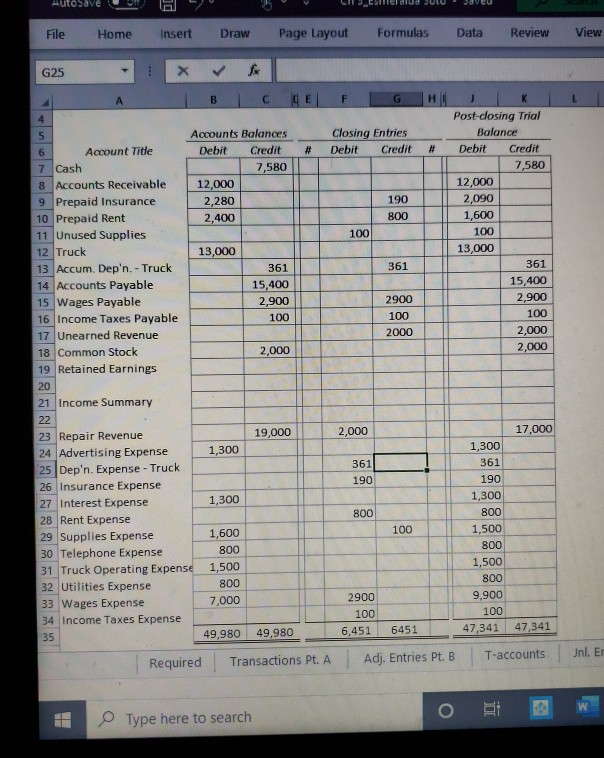

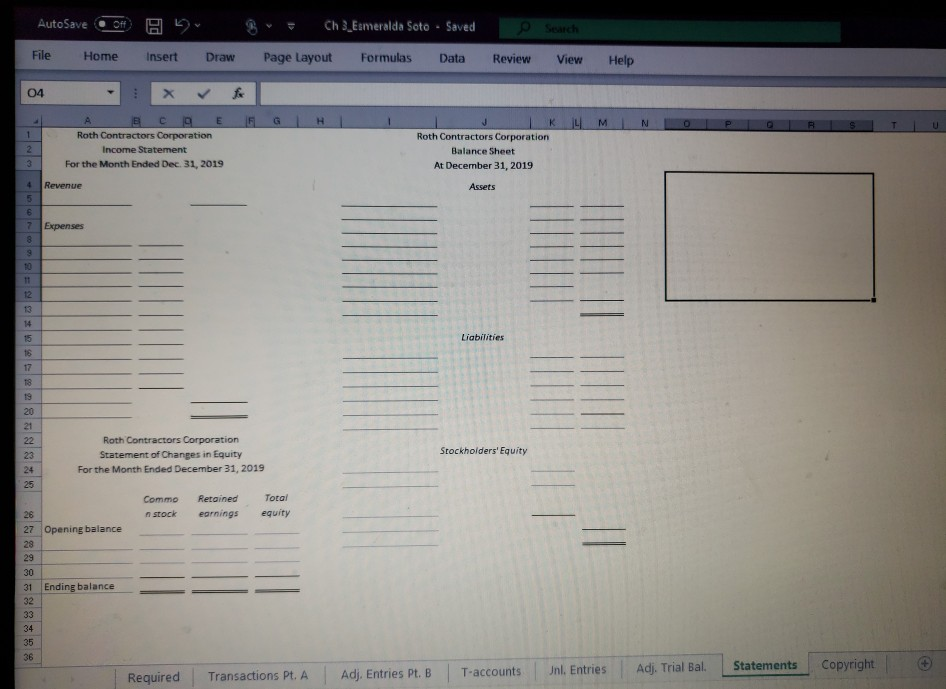

I need help filling out the income statement. The last picture. e Search AutoSave File Home B insert 8 Draw C Page Layout Esmeralda

I need help filling out the income statement. The last picture.

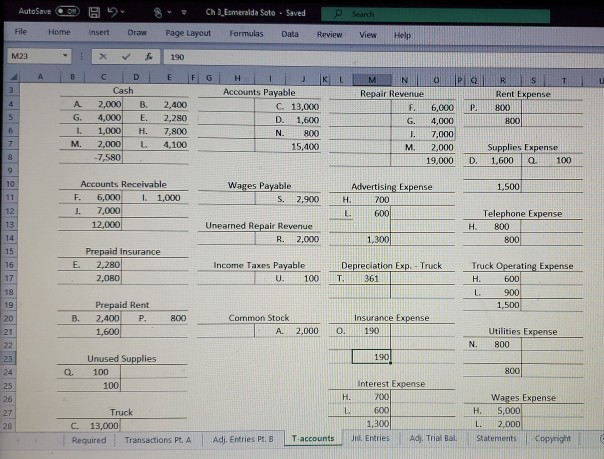

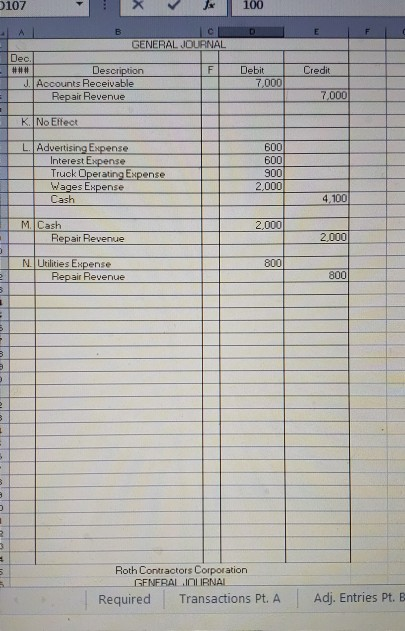

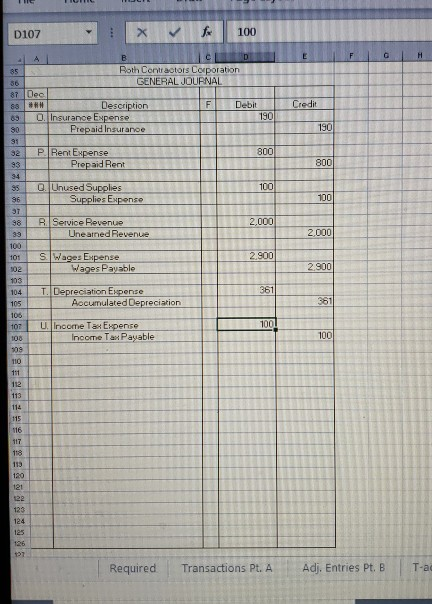

e Search AutoSave " File Home B insert 8 Draw C Page Layout Esmeralda Sate Formulas saved Data Review View |M23 x v | 190 4ABC DIENG HILDKLMNOPQRISTI Cash Accounts Payable Repair Revenue Rent Expenses A , B 2.4O0 C 13, F. 6.000 P RO .00 E 2.25 D. 1,6) 4,OOD T ET BOXO 1. 17 N 900 3,DEO ML 1 154) M 2 ,000 Supplies Expense 7550. 19,COOL 1,6CD | 0 100 1.500 Accounts Receivable E. B,CKo 1,CAD 1. 7, 12,000 Wages Payable 2,9CK Advertising Expense T O o Unearned Repair Revenue R, 2C% 2 Telephone Expense . BZAD 1 ,3COLLEGE E Prepaid Insurance 30 28 Income Taxes Payable Depreciation Exp. - Truck U1OTI 31 Truck Operating Expense H 600 . On | 1500 B, Prepaid Rent 2,400 P. 60 4 Common Stock A. 2,000. Insurance Expense 190 Utilities Expense | Unused Supplies 01 . 100 Interest Ex H. Wages Expense SOOD ? DDD Truck c 13,Cop Required Transactions Pt. A 3 ) Adj. Entries Pt. B Jn Entries Ad. Trial Bal Statements Copyright 107 x V x 100 GENERAL JOURNAL Dec. ### Description F JAccounts Receivable Repair Revenue Credit Debit 7,000 7.000 KINo Elect T L Advertising Expense Interest Expense Truck Operating Expense Wages Expense Cash 600 600 900 2,000 4.100 M. Cash Repair Revenue 2.000 2 1 .000 800 N. Utilities Expense Repair Revenue 800 Roth Contractors Corporation GENERAL JOURNAL Required Transactions Pt. Adj. Entries Pt. E D107 100 POH CD Roth Contractors Corporation GENERAL JOURNAL 87 Dec 88 Description Debit 890. Insurance Expenso 180 80 P repaid Insurance Credit 130 32 P. Rent Expense Prepaid Rent 9128 Q.Unused Supplies Supplies Expense 98 39 R Service Revenue Uneamed Revenue 2.000 101 S Wages Expense Wages Payablo 2.900 BA 104 T. Depreciation Expense Accumulated Depreciation 105 107U 1001 Income Tax Expense Income Tax Payable Required Transactions Pt. A Adj. Entries Pt. B T-a AutoSave 9 3 Eerdrud ULU VEU File Home Insert Draw Page Layout Formulas Data Review View G25 B C E F G H L Closing Entries Debit Credit # # Accounts Balances Debit Credit 7,580 12,000 2,280 2,400 I K Post-closing Trial Balance Debit Credit 7,580 12,000 2,090 1,600 100 13,000 190 800 13,000 Account Title 7 Cash 8 Accounts Receivable 9 Prepaid Insurance 10 Prepaid Rent 11 Unused Supplies 12 Truck 13 Accum. Dep'n. - Truck 14 Accounts Payable 15 Wages Payable 16 Income Taxes Payable 17 Unearned Revenue 18 Common Stock 19 Retained Earnings 361 361 361 15,400 2,900 100 2900 100 2000 15,400 2.900 100 2,000 2,000 2,000 19,000 2,000 17,000 1,300 361 190 21 Income Summary 22 23 Repair Revenue 24 Advertising Expense 25 Dep'n. Expense - Truck 26 Insurance Expense 27 Interest Expense 28 Rent Expense 29 Supplies Expense 30 Telephone Expense 31 Truck Operating Expense 32 Utilities Expense 33 Wages Expense 34 Income Taxes Expense 1,300 361 190 1,300 800 1,500 1,300 800 100 800 1,600 800 1,500 800 7,000 2900 100 6,451 1,500 800 9,900 100 47,341 47,341 49,980 49,980 6451 Required Transactions Pt. A Adj. Entries Pt. B T-accounts Unl. Er O Type here to search L e Search AutoSave Of File Home A Insert B Ch 3_Esmeralda Soto - Saved P age Layout Formulas Data Draw Review View Help 04 : X for L M N O P R S T U Roth Contractors Corporation Income Statement For the Month Ended Dec 31, 2019 J K Roth Contractors Corporation Balance Sheet At December 31, 2019 Revenue Assets Expenses Roth Contractors Corporation Statement of Changes in Equity For the Month Ended December 31, 2019 Stockholders' Equity Commo n stock Retained earnings Total equity 27 Opening balance 31 Endine balance Required Transactions Pt. A Adj, Entries Pt. B T-accounts Uni Entries Adj. Trial Bal Statements CopyrightStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started